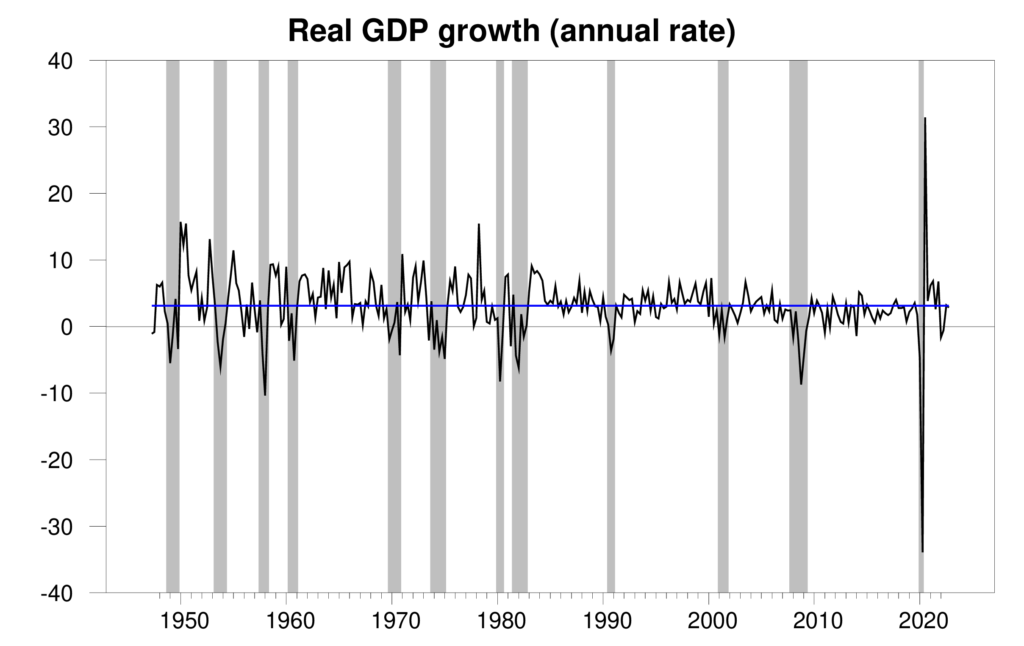

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.9% annual rate in the third quarter. That makes two quarters in a row with values close to the historical average, a welcome relief from the modestly negative growth rates with which we started last year.

Real GDP growth at an annual rate, 1947:Q2-2022:Q4, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

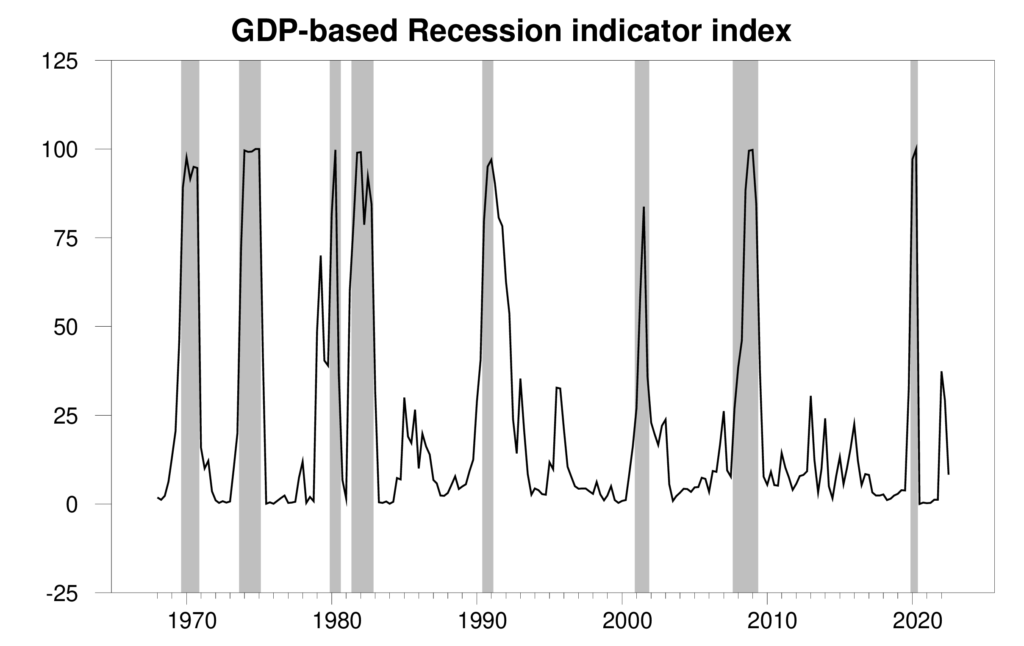

The new data caused the Econbrowser recession indicator index to ease down to 8.3%, undoing the caution signal from the two previous quarters. This is an assessment of the situation of the economy in the previous quarter (namely 2022:Q3). Although some observers thought the U.S. might have entered a recession last year, the facts didn’t end up supporting their pessimism.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q3 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

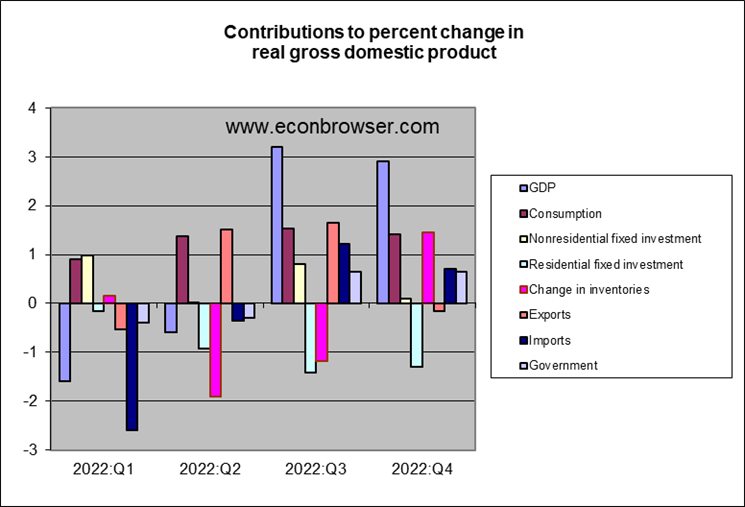

Notwithstanding, all is not well with the housing sector, which is ground zero for the Fed’s war on inflation. Drops in construction of new homes subtracted an average of 1.2% from the annual GDP growth rate over each of the last three quarters. The Fed’s hikes in interest rates are defintely holding back growth.

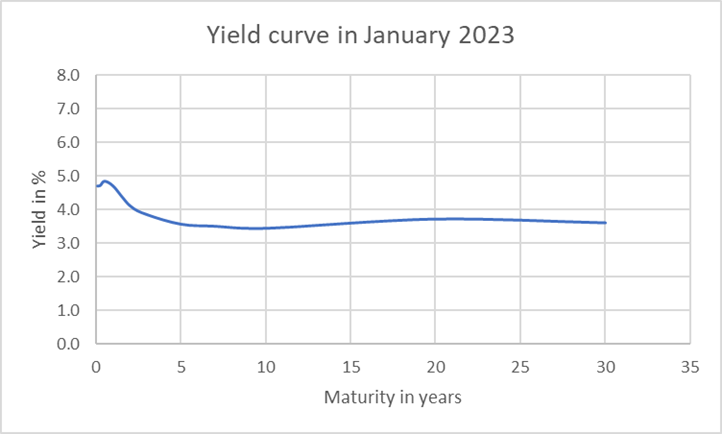

The yield curve says the market is betting on one or two additional modest hikes from the Fed, but by the end of the year it will have reversed course and be bringing rates down.

One immediate threat to the economy is the debt ceiling. Treasury puts the end of its ability to avoid default in June. Treasury’s ability to make this estimate with sufficient accuracy is limited.

In comments to the “tank” post, pgl linkedto a chart of what amounts to real government discretionary spending. Here’s the same seriesa as a share of GDP:

https://fred.stlouisfed.org/graph/?g=ZeWV

Government discretionary spending is at the lowest share of GDP since WWII. This is what House Republicans insist has to be cut, under threat of default.

The Federal, state, county, and municipal expenditures component would of GDP be 44%.

What is the impact of the low labor participation rates on funding SS, Medicare, etc.?

Here’s the ratio you seem to have in mind. It ran at 41% in 2021, 43% in 2020. In 2022, it averaged 34% as Covid spending fell and GDP grew.

https://fred.stlouisfed.org/graph/?g=ZfC2

I see you provided no source for this claim. Macroduck did. Not only was this ratio = 34% in 2022 but that is sort of the norm.

So pray tell – who do tell lies that are easily rebutted?

That is something different. US GDP is gonna be trade boosted reversing the 2022 the first half of the year as exports out pace imports.

“That is something different.”

What is different from what? No idea what you’re saying.

I think he meant export led growth. If so – it is a nice rebuttal to Princeton Steve telling us any fall in the trade deficit = HARD RESET. Yea Stevie is that dumb.

import balance surge was why GDP was negative last year in the first half. With excess inventory from the surge, ordering has collapsed and indeed the trade deficit shrinks yry causing export driven growth to surge. Its all accounting in the end. By summer inventory should be getting under control and “normal operations” should then pre-crisis its impact.

a caution on the linked fred ratio.

from about 1952 up to the 1970, the pentagon was spending 7% or so of gdp. result of cold war/korean war/berlin wall angst and the 1947 national security act.

following the increase in entitlement from aging population drawing new social security benefits, the advance of the great society spending and overall rapid growth of gdp, while pentagin had to yield market share…

note there are still think tanks, heritage i recall, that come out regularly claiming “if usa don’t spend 7% of gdp, the western world will be defeated”…..

Yep, spending has shifted more toward non-discretionary accounts. However, non-discretionary accounts often have their own funding. Social Security lends to the Treasury, not the other way around. So when discussing spending, we should separate discretionary and non-discretionary accounts.

When it comes to total government spending as a share of GDP, here’s how the U.S. stacks up against other countries:

https://tradingeconomics.com/country-list/

The U.S. is not a big spender. (Note also the sharp drop between 2021 and 2022 as Covid support wound down.)

As can be seen in the FRED link, the decline in discretionary spending as a share of GDP resumed around 1990 and has continued, on trend, to a new post-WWII low in recent years. That’s well after the post-WWII/Vietnam wind-down in military spending.

An historically low discretionary spending/GDP ratio is a target of House Republicans’ hostage demands. Some also want to cut Scocial Security spending, withou offering a plan for doing so.

Any demand for reduced spending predicated on the claim that government in the U.S. spends “too much” by some objective standard needs to identify that standard, because a comparison to our own history or to peer countries doesn’t support the claim.

Counting non-discretionary spending with its own funding a part of “government” spending is a bit of a disinformation scheme. It is a huge poverty and health insurance system that is run semi-autonomously under government regulation. I see less difference between SS/Medicare and private life insurance than between SS/Medicare and military spending. One of the frauds that GOP has been trying to perpetuate for decades is the privatizing of SS/Medicare to make government “smaller”. Sure it would look smaller to the morons who vote for them, but only via an accounting gimmick.

https://fred.stlouisfed.org/graph/?g=R62c#:~:text=U.S.%20Bureau%20of%20Economic%20Analysis%2C%20Real%20government%20consumption,Product%20%28GDPC1%29%20Source%3A%20U.S.%20Bureau%20of%20Economic%20Analysis

FRED provides this interesting graph of real defense spending as well defense spending/GDP. The latter passed 5% as a result of our invasion of Iraq under Bush43. Under Obama, this ratio fell below 4%. But of course big spending Trump let defense spending soar again. Under Biden, defense spending is coming back down.

I understand Lawrence Kudlow is calling Biden a despot for noting Republicans plan to balance the budget by cutting Social Security and Medicare. Kudlow actually tried to peddle the Republicans would never cut these two programs. Maybe someone should ask Kudlow the Klown how Republicans plan to balance the budget without such cuts. I guess Kudlow thinks going back to Reagan’s tax cuts for the rich and more defense spending will magically lead to a balanced budget. He is indeed a Klown.

years ago p. Krugman said usa is a large insurance company with an army….

still true?

Am I the only one that sees this favorable FDP read as a cause for the Fed to raise rates 50 bp next week?

my preference is .5% next week. shaded by being retired and sensitive to inflation as are my age group.

but i also see that gdp is about where the fed wants it and the pce pre-read is not high.

i feel is a weaker dollar at the moment may not be bad for the us or the world.

pce comes out, tomorrow?

if pce index is low i bet .25%.

“all is not well with the housing sector, which is ground zero for the Fed’s war on inflation. Drops in construction of new homes subtracted an average of 1.2% from the annual GDP growth rate over each of the last three quarters. The Fed’s hikes in interest rates are definitely holding back growth.”

Maybe holding back growth but not causing a recession is the FED’s soft landing plan. Let’s hope they take the good news on inflation and start lowering interest rates.

I worry that the full effect of rate hikes has not been seen yet. It’s a long process from someone eyeing a piece of land for development until its buildings have been finished. For those who are in the intermediate steps there is always a strong incentive to continue and take a small loss rather than stopping and take a bigger loss. So current housing activities are likely to slow even if rate hikes stopped. Furthermore. the Fed selling of bonds will as far as I know continue even if they stop hiking rates. That would put a strain on mortgage rates keeping them high or even pushing them higher.

“Notwithstanding, all is not well with the housing sector, which is ground zero for the Fed’s war on inflation. Drops in construction of new homes subtracted an average of 1.2% from the annual GDP growth rate over each of the last three quarters. The Fed’s hikes in interest rates are defintely holding back growth.”

Housing costs are going up because there is a shortage houses and apartments. So the Fed keeps raising interest rates to reduce the construction of houses and apartments. That’ll fix it for sure!

Real GDP received a substantial boost from the big swing factors of inventories and trade. Final sales to domestic purchasers, total and private, grew rather slowly in Q4:

https://fred.stlouisfed.org/graph/?g=ZfCV

Final domestic sales are a sort of “core” GDP measure. When they wander far below trend, it’s reason for worry.

i’m late getting to this because the GDP source data file was empty earlier today…

note that December’s construction, trade in services, and non-durables factory inventory data have yet to be reported or formally estimated, and that the BEA assumed a $12.5 billion increase in exports of services, a $1.8 billion increase in imports of services, a $7.4 billion decrease in residential construction, a $3.2 billion increase in non-residential construction, a $1.2 billion increase in public construction, and a $0.2 billion decrease in nondurable manufacturing inventories for December before they estimated the 4th quarter’s output (see the Key source data and assumptions (xls) for more details)

the three December construction spending figures will be published Wednesday, invariably with revisions to October & November, so those revisions to prior months need to be figured in when computing the revised change for December..

Menzie – I was preparing my federal taxes the other day and I had read an article about Wal-Mart increasing their minimum wage to $14. All the GOP talks about is dismantling Social Security/other programs and cutting taxes for the wealthy when they get in office. And – all we get from the media is this GOP-driven narrative that we have to do something about the “really big” deficit.

But – aren’t there other solutions besides cutting programs? For example, raise the minimum wage from $7,25 to $14 – and -one – decrease dependence on means-tested govt food and housing assistance and -two- generate more in income tax revenue? (another would be reverse the Trump tax cuts for billionaires – but – geez – McConnell and Manchin don’t want to reverse their signature legislative achievement,)

Also – read another article in Bloomberg about the lack of workers – IMO – a simple commonsense solution would be to re-install commonsense intl. migration reform and boost from current 250K to back what it was before Trump admin of 900K to 1M.

For my day job – I look at Wisconsin’s population – in 2010 – it was predicted that by 2020 – we would pass 6M people – we are in 2022 at around 5.8 and unless we have a large intl migration into WI – we probably will not reach 6M by 2030. BTW – the fastest growing age group are those 65+. To me – this doesn’t bode well for the WI economy. .

@ James

This is a Hamilton post, they don’t normally cross-over into each other’s threads, you might replicate this comment in the next thread.

Real Private Residential Fixed Investment (PRFIC1)

https://fred.stlouisfed.org/series/PRFIC1

We had a post pandemic boom in residential investment. That has completely disappeared pushing inflation adjusted residential investment back to 2015 levels.

One would hope the FED lowers interest rates in 2023,

https://fred.stlouisfed.org/series/EXPGSC1

Real Exports of Goods and Services

We had a post pandemic increase in both exports and imports. Real exports continued to rise in 2022 as real imports sort of leveled off.

The rise in real exports is what drove the fall in the trade deficit, which is completely contrary to the HARD RESET nonsense we had to endure from Princeton Steve and his fellow RECESSION CHEERLEADERS. Then again Princeton Steve knows nothing about international macroeconomics.

https://www.bea.gov/news/2023/personal-income-and-outlays-december-2022

Personal Income and Outlays, December 2022

Good news and bad news:

“Personal income increased $49.5 billion (0.2 percent) in December, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $49.2 billion (0.3 percent) and personal consumption expenditures (PCE) decreased $41.6 billion (0.2 percent). The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 9). Real DPI increased 0.2 percent in December and Real PCE decreased 0.3 percent; goods decreased 0.9 percent and services were unchanged (tables 5 and 7).”

In other words, inflation is low but consumer demand may be heading down.

The Fed hasn’t stopped growth now…and it didn’t have much success stimulating growth ten years ago. But I will refrain from saying that the Fed has failed, like I said repeatedly back then.

This time I’ll only say that the Fed’s credibility is at stake…

Jonny boy pretending he is now an expert in macroeconomics reminds me of a conversation between Ray Fair and James Tobin back in 1980. Fair had this little model that suggested that Volcker’s tight monetary policy would have little impact on investment demand. Tobin generally liked Fair but on that day he turned on him saying his little empirical model was “misspecified”. And of course anyone who knows anything knows Volcker’s tight monetary policy did crush the US economy by not only lowering investment demand but also net exports.

Of course Dr. Hamilton properly knows that the high interest rates today have lowered residential investment. I guess Jonny boy forgot to READ the entire post before making a jerk out of himself (as usual). As far as the economy after the Great Recession, all the talk was about the US economy being in a liquidity trap. I guess Jonny boy never heard of that either.

As far as the economy after the Great Recession, it took 10 years for unemployment to return to Great Recession its pre-recession low, despite year of ZIRP and QT. But banksters’ saw record profits and the stock market returned to its pre-recession highs within a fraction of that time…which ultimately seems to be what Fed policy was all about back then.

As for the Fed’s tight money policy now, 10 year treasuries are only a half a percent above where they were a year ago, when the housing market was going gangbusters, so it’s hard to blame the Fed for the woes of the housing market. But the mysterious part, which pgl has yet to comprehend, is why the mortgage spread adds 75% to the 10 year treasury…that’s where the problem lies, begging for an explanation and a solution.

‘As far as the economy after the Great Recession, it took 10 years for unemployment to return to Great Recession its pre-recession low’

Ever wonder why Jonny boy never provides data to go along with his word salad? Let’s see:

https://fred.stlouisfed.org/series/UNRATE/

Unemployment rate = 5% in December 2007. Unemployment rate = 5% as of September 2015. Huh – less than 8 years not 10 years.

OK Jonny edit that to be 8 years if you wish but your gibberish still has NOTHING to do with basic macoeconomics. Which is fine as you never bothered to learn macroeconomics or anything else except jumping up and down on a soap box.

“As for the Fed’s tight money policy now, 10 year treasuries are only a half a percent above where they were a year ago, when the housing market was going gangbusters, so it’s hard to blame the Fed for the woes of the housing market.”

Tight money had nothing to do with the downturn in the housing market? Gee Jonny boy – you have just won the Grand Prize for the dumbest statement ever made.

’10 year treasuries are only a half a percent above where they were a year ago’

https://fred.stlouisfed.org/series/DGS10/

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity

3.49% minus 1.85% is 0.5% in Jonny boy’s world? Come on dude – please take remedial 1st grade arithmetic. GEESH!

An interesting discussion about the effectiveness of aggregate demand management policies from a grown up:

https://www.rochester.edu/newscenter/monetary-policy-vs-fiscal-policy-which-is-more-effective-at-stimulating-the-economy-507112/

Can fiscal policy and monetary policy be at odds with each other?

That can happen when the Fed lowers interest rates, while Congress is concerned about adding to the national debt.

Yes. We saw fiscal and monetary policy at odds in the wake of the Great Recession. The initial response—both in 2008 under the Bush administration and then in 2009 under the Obama administration—was fiscal stimulus. The Bush administration facilitated tax cuts through Congress and the Obama administration increased spending. But the recession proved deeper and more protracted than most economists expected. In response to that persistence, the Federal Reserve kept interest rates extraordinarily low, and called desperately for more fiscal stimulus. Instead, Congress cut back on spending. What we saw was Congress and the Fed moving in opposite directions—and an example of politics playing its role in fiscal policy. Why did Congress cut spending? Because as elected officials they were very concerned about the perceived fear among voters that increased spending would run up the deficit and lead to higher debt.

A much more accurate discussion of policies following the Great Recession than we will ever get from little Jonny boy. Of course the Bank of England also cut interest rates back then even as David Cameron was imposing fiscal austerity, And it seems Jonny boy has said over and over that Cameron’s insane decision to cut government spending during a weak economy was a good thing. Yea – Jonny boy never got basic macroeconomics.

One has to wonder if Jonny boy even remotely got the simple point Narayana Kocherlakota made about fiscal austerity (in the US as well as in the UK) undermining the efforts of the FED and the BoJ. I had to shake my head in utter disbelief that anyone would admit that both Central Banks kept interest rates at zero and then blame these Central Banks for aggregate demand not being stronger. Seriously?

Of course the real problem Jonny boy has is that he has consistently endorsed Cameron’s fiscal austerity. I mean come on – can anyone be THAT STUPID? Well yea – Jonny boy is indeed THAT STUPID!

Kevin Drum also noted the drop in real consumer spending last month but suggested in general such spending is above trend. Fortunately FRED tracks this:

https://fred.stlouisfed.org/series/PCEC96

Real Personal Consumption Expenditures (PCEC96)

Thanks to Kevin and FRED for making me feel a wee bit less worried.

There was no drop. The same as 2021 and 2018 most of the economy shut down after the 16th and did not go up to Christmas. This same “hiccup” will reverse in January and be completely whipped out. Get used to it.

Current market pricing is for a 25 basis point Fed hike next week, another 25 in March. Starting in May, it’s about 60/40 for an end to hikes.

Ten year yields are down from early November, increasing curve inversion. More hikes will probably push the inversion further. I’m happy that recession concerns have abated somewhat, but both the Fed and Congress still represent risks to growth, as does the rest ofthe world.

“Current market pricing is for a 25 basis point Fed hike next week, another 25 in March. Starting in May, it’s about 60/40 for an end to hikes.”

What annoys me the most is how Powell spent the last two years lecturing us like slow children over and over about how the Fed decisions were carefully driven by the data each month.

But what has occurred is that they arbitrarily decided many months ago that the Federal Funds Rate must get to 5% and 5% it will be, come hell or high water, and the heck with the data.