The autumn of 2010 is in some ways a replay of what we saw last spring. Is what we saw then a guide to what’s going to happen next?

Last spring the yield on 10-year Greek sovereign debt spiked up 600 basis points as concerns rose about the country’s ability and willingness to meet future interest payments. After a significant bailout from other European countries and the IMF, yields settled back down. They crept back up this summer, fell in September and early October, and are now back up almost to the peaks reached at the height of the crisis.

|

The concern last spring was that problems in Greece could spill over into other European countries such as Ireland and Portugal. Their long-term sovereign debt yields were up 100 and 200 basis points on the Greece concerns last spring, but have shot up much more than that over the last month.

|

|

As Paul Krugman notes, the really scary thing is that Spain and Italy, which were relatively untouched by the fears last spring, have also seen dramatic moves up in their apparent risk premia.

|

|

Thus we’re seeing last spring’s sovereign debt concerns being replayed in slower motion but on a broader scale than the first time around. There’s another interesting parallel with last spring’s concerns. The developments in Europe have coincided with efforts by China to raise interest rates and tighten credit. And just as we saw last spring, the decline in China’s stock market has been as big as that for European equities.

|

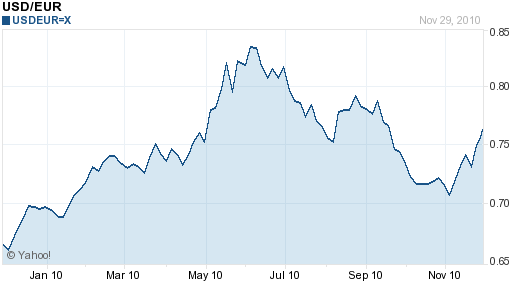

If this is deja vu all over again, what might we expect next? What happened last spring was a flight to the dollar as a seemingly safe refuge. And there’s been some appreciation of the dollar with the latest events as well, with more to come if history repeats itself.

|

But this is a slower-moving and broader wave than the first one. And tsunamis pack much more power than a simple crashing breaker.

It seems as if we lurch from crisis to crisis. First the US has debt problems, then the EU has bigger debt problems. The dollar weakens, the dollar strengthens.

Is there any question that the EU will get this sorted out through a debt re-fi and austerity?

As soon as the EU gets their problem ‘under control’ CNBC and the WSJ will point out that California and other debt ridden states have big debt issues coming due and then the dollar will tank, rinse and repeat.

TJ, I couldn’t agree more. The current debt status for many US states (but California and New York in particular) are just as bad if not worse than some of the EU member countries. What happens when they default?

Hmmm …

Backwards, every time crude oil punches above $80 the peanut butter hits the fan. Eurozone countries are vulnerable because of the cross- border currency peg and the resulting debt overhang(s).

The PIIGS are also energy hogs, being as underwater from an energy standpoint as they are from an credit standpoint.

China is vulnerable because its energy sector is bloated and miserably inefficient, even worse than the US’s and far worse than Europe.

China is also in the pre- pre- pre- stage of out and out hyper- inflation. Yup, this will cause stox will fall ..

Professor,

You forgot to mention that several economists (including Nourriel Roubini) were putting the UK and the US in the same basket as PIIGS in the Spring.

Of course, these economists have stopped talking about the UK and the US altogether as they start looking like total fools with record low yields both in the US and the UK (record low yields in Canada, Sweden, Japan and Denmark also). You will notice that all these countries have their own floating non convertible currency. I dare also including France and Germany as countries having their own floating non convertible currency given their political clout over the ECB (people forget that Germany and France have a very high debt-to-GDP ratio, but the market knows well that these countries ARE the EURO).

you forget to mention north korean: Feb 26 torpedo frigate, November artillery; therefore, the risk off trade and flight to Dolllar, Treasurities, gold could be much more stronger

TJ: “Is there any question that the EU will get this sorted out through a debt re-fi and austerity?”

There is, indeed, a very serious question about this. Krugman expressed it niceley in his post: http://krugman.blogs.nytimes.com/2010/11/29/not-waving-but-drowning/

It is probably stupid for Ireland or Spain or Greece to try to make good on their debt in its entirety – some of it will need to be forgiven.

I also wonder what will happen when state debts come to the fore and there is simultaneously serious concern about a euro break up. There would be precious little supply of safe haven assets globally (Switzerland is too small to make any difference). The strategy of deny and delay used up to now appears to be coming to its deserved end. It will be a beauty contest among pigs.

http://imperialeconomics.blogspot.com/2010/10/chinas-gdp-per-capita-global-gdp-and.html

http://imperialeconomics.blogspot.com/2010/11/chinese-demographics-and-china-crash.html

http://imperialeconomics.blogspot.com/2010/07/chinas-oil-consumption-and-imports.html

China’s money supply has been growing at 20-25% yoy and at one point at 75-100% annualized, while fixed investment is nearly half of GDP. China has created the greatest credit-induced fixed investment bubble as a share of GDP in world history.

Moreover, see the links above to see that China’s GDP per capita trajectory mathematically (and thermodynamically) cannot continue. Also, China is facing the onset of a secular demographic drag that has occurred in Japan since the early ’90s and the US since the early ’00s.

Now a net importer of coal, oil, and food, China is at a similar place as were Germany and Japan in the 1930s in terms of growing foreign resource dependence in order to keep their industrial machine going.

China is on a collision course with Peak Oil, population overshoot, and the imperial US military. China will soon learn, as did Germany and Japan, that she cannot be a superpower but rather must submit to being a cheap labor colony and open up her financial system to be plundered by the western rentier bankster syndicate; refuse, and crash and be forced to turn inward as has occurred every 60 years or so since the late 18th century (White Lotus Rebellion, Opium Wars, Boxer Rebellion, and Mao).

China is due yet another era of social upheaval, a falling out with the West, and another turn inward.

You can’t separate speculation from capitalism. Meet our Frankenstein.

I am afraid that other european countries will eventually be affected by the crisis that greece is experiencing. I hope that wont happen because asiann developing countries will be hurt much as well, because much of those relies on europe.

Just like when america cripples last year almost all of the asian developing countries are hurt badly too

In a car wreck ,still breathing and kicking ? rush to attend those whom do not move, they are the ones in danger.

Very sorry it is going to be dry counties,but it may assist to sober up.

The IMF figures telling (world bank quarterly external debts statistics)

The largest external debts as of 2Q 2010 are hold by the following countries (in US millions) :

http://ddp-ext.worldbank.org/ext/ddpreports/ViewSharedReport?REPORT_ID=13532&REQUEST_TYPE=VIEW

USA 13 984 097

UK 8 980 793 ( to be compared to a GDP estimate)

Ger 4 712 791

Fr 4 698 162

Neth 2 231 668

SP 2 165 945

Then going from a general outlook,let us gradually go to the particularities,as provided for, by BIS P8

External position of Banks in all currencies vis a vis all sectors (in billions usd).Please go along the tables,take a breath at P67 and check the pulse of the Vatican.

http://www.bis.org/statistics/provbstats.pdf#page=7

UK 5228.7 (in economists parlance, one may notice a little stickiness in the outstanding amounts)

USA 3335.9

Germ 2730.6

Fr 2302.4

Once finished, for the exclusive use of the proponents of the “Margaritas ante porcos”,mathematicians will enjoy to know the relationship is bijective.

Go to “A preliminary report on the sources of Ireland banking crisis” and check the pulse of Anglo Irish bank P31 P32 (suggest not to spend too much time on the loans to deposits ratios as they consolidate interbanks and customers deposits P34).It may be worth remembering,an Irish bank was a regular customer of the ECB for a daily emergency O/N borrowing of around 100 billions euros.

As the British say the proof is in the pudding:

Bloomberg

‘Good Neighbors’

British Taxpayers `Knee Deep’ in Ireland After Bank Bailouts

By Jon Menon and Gavin Finch – Nov 1

British banks have the world’s biggest “exposure” to Ireland, totaling more than $222 billion at the end of the first quarter, according to the Bank for International Settlements. Britain is implementing the biggest public expenditure cuts since the end of World War II following taxpayer-funded bailouts of its banks.

I have noticed, that money changers in some countries in the Eastern side of Europe, are no longer quoting the GBP.

state debts are not like EU member state debts because 1) Chapter 9 exists in the US bankruptcy court and 2) The US wants to print more dollars, and bailing out the states will be a great way to fight the devaluation battle against the EU/Yuan.

Fine but according to K Rogoff,C Reinhard “This time is different”

Whether or not domestic or foreign, the public debts matter.They are all driving to the same end ie default if not remedied. Conclusion that are defying the most popular beliefs.

PPCM:

You are in deep trouble if you are reading Roggoff and Reinhard to learn more about monetary and fiscal operations.

Back in the Spring, Roggoff was among the economists -notably with Roubini and Sachs-claiming the US and the UK were the next in line after the PIGS… they have dropped this story altogether since then given record low yields on both US and UK debt.

I had the chance to question Roggoff about the most heavily indebted country in the world -Japan-that pays 2% on its 30 year bond. His answer was that the market for Japanese bonds is irrational, and has been for the last 15 years. Next step is to called the Japanese themselves crazy and irrationale I guess. I noticed that you “forgot” to talk about Japan in your post.

Yes, this time is truely different -and I know that Roggoff meant this title to be sarcastic- for countries that are not on gold-standard or on a curency peg. I would encourage Roggoff to learn more about the operationnal realities of a country with its own floating non convertible currency.

JDH, do you have any charts that show the distribution of state/soveriegn debt distribution within the banking system? It would be interesting to see who is going to take the hit.

One ‘rescue’ scenario would be for the central banks to buy the souring securities of states and pigs. In return, balanced budget requirements would impose across the board spending cuts if the ceiling is breached.

Another option is to let the creditors take more of the hit then they did during the mortgage backed crisis.

ppcm,

If I understand your post at 12:22am correctly, it supports what I see as the core problem.

The GFC was, and is being, caused by too much dependence on growth from lending. The concept of an ‘investor nation’, or of the viability of a service-based economy, is flawed systemically.

Put simply, the demand for capital is limited by the ease in which it can be created, and so, foreign investment has less value to a nation’s development and/or prosperity, than domestic investment.

Liquidity is therefore following the path of least resistance so to speak, and what we are witnessing is a type of flooding on the debtor’s end of the path, which, as resistance to the excess liquidity builds, the path splits and partly loops back and returns to its source, as it did in a large way in the period leading up to the crisis in 2007, especially in the US and in the UK.

But there is a more serious problem at the source of the liquidity. This due to many factors, but essentially, nations like the US and the UK, are not just dependent on excessive lending, but on gains from foreign sources and unsustainable domestic debt, and those sources are either tapped out, or emboldened and justifiably so (G-20), in efforts to protect their economies from further exploitation.

And so, the lending nations are at the center of the GFC, not the PIIGS and etc. This central flaw has merely been ignored and hidden by stimulus funds.

Thanks for your comments

QC

K Rogoff C Reinhard “This time is different”

It is not to be read as a theory but statistical references to countries indebtness on a time frame.One may as well, read the title as “The same causes produce the same effects”

Are all the parameters the same? Are and were all policies the same?. Obviously, a closed loop where the treasury sells TBS to the Fed may last longer on flows,not on a foreign exchange.

K Rogoff C Reinhard are prompt to write in the same study, foreign exchange depreciation is a default.

Rayllove

Fully concur with your analysis.

I would add:

When a country is outsourcing its production function. The net result is exporting 75% of the domestic salaries (rule of thumb. salaries are representing 75% of the total revenue).It is exporting as well the multiplier tax effects.

When substituting capital (for capital gains), against labor,the dividends and capital gains are far from matching the net loss of above.Risks concentration is higher and counter cycles more punitive.

Incorrect ppcm, public debts do not matter as you think, nor do the piggs. The fact you think they matter means you have been duped. Their “yields” aren’t rising because of “public debts”.

It is all in the private debts. Literally, all of it. The fact the last deflationary wave was so weak, probably has made several speculators overly decadent, means little. The next one to come, oh about the time the 3rd quarter of 2011 will probably be much stronger

Today was a pretty good day for economic news…

http://imperialeconomics.blogspot.com/2010/12/us-real-private-gdp-real-private-final.html

Please see the link above for real private GDP and real final sales after oil consumption as a percentage of private GDP.

Real private GDP (GDP less total gov’t) and final sales (less gov’t and inventories) less oil consumption, i.e., private investment and consumption, continues to contract, making the US, EU, and Japanese (two-thirds of the global economy) private sector vulnerable to an “exogenous shock” 🙂 from accelerating price inflation in China, India, Canada, and Australia.

With oil consumption at 6-7% of private final sales, the top 20% of US households must grow their personal consumption expenditures 7-8% yoy just to overcome the inertia of the price of oil consumption on private final sales.

Thus, the US private sector cannot grow with the price of oil above $60-$65/bbl.

“The current debt status for many US states (but California and New York in particular) are just as bad if not worse than some of the EU member countries. What happens when they default?”

I can’t speak to NY, but California’s constitution puts debt repayment second only to the state’s K-12 education obligations in priority. Higher than Medicaid payments; higher than payments to the UC system; higher than paychecks to state employees. The state easily has sufficient revenue to meet K-12 and the debt obligations. Absent a constitutional amendment, it is impossible that California will default on its debt.

hello,

looking at the euro peirpheral countries’yield asbolute level, we have greece 12%, ireland 9% and portugal 7%, with a current money rate around 1%. With a money rate at 3%, the equivalent yield would be respectively 14%, 11% and 9%. This situation is similar to 1999: at that time those long rates were for Argentina and Russia, when money rate was around 3%. This situation is the compelling deja vu (with a tremendously deteriorated economic conditions),

regards

Things will get more clear with Irish budget vote next Tuesday.