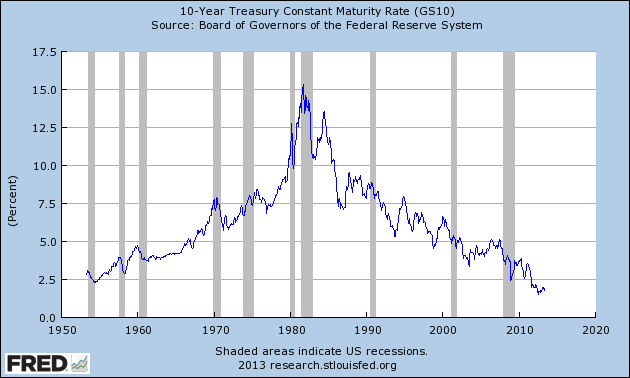

The yield on 10-year U.S. Treasury securities averaged 1.8% during 2012, the lowest levels in 60 years. But that episode may now be behind us.

|

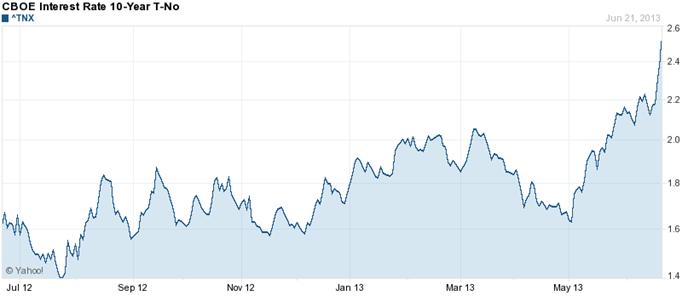

The yield closed Friday above 2.5%, with half the gain from last year’s levels coming during the last week alone.

|

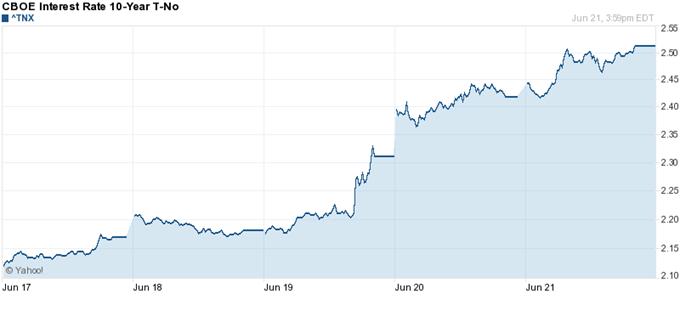

About 10 basis points of the increase came in two sharp jumps on Wednesday. The first began around 2:00 p.m. EDT with the release of the minutes of the latest FOMC meeting, and the second around 2:42 p.m.

|

That second jump on Wednesday appears to coincide with the statement by Fed Chair Ben Bernanke in a press conference that Fed bond purchases might end when the unemployment rate reaches 7%:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year; and if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7 percent, with solid economic growth supporting further job gains, a substantial improvement from the 8.1 percent unemployment rate that prevailed when the Committee announced this program.

As Bernanke emphasized, the forecasts of FOMC members anticipate that the unemployment rate might be 7.2-7.3% by the fourth quarter of this year. The Survey of Professional Forecasters expects unemployment to still be at 7.2% by the second quarter of 2014. Bill McBride provides a careful analysis of when the Fed’s stated objectives for GDP, unemployment, and inflation are likely to be attained, and concludes

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy. (September tapering is less likely, but not impossible– but the pickup would have to be significant).

If anything, the Fed statements seem to push back the date of tapering. The baseline assumption in my paper with Greenlaw, Hooper and Mishkin written in February was that Fed purchases would continue at their current pace through the end of 2013. For a while, I had been thinking the Fed could move earlier than that. But based on the latest FOMC statements, it looks like it could well be even later.

Of course, if the economy does pick up more quickly than many are forecasting, tapering could begin earlier. But, as I noted last week, those are the same conditions under which interest rates would likely rise even if the Fed does not change its bond purchases.

Mention by the Fed of a 7% unemployment figure seems mainly to be conveying that the Fed has actively and concretely discussed the conditions under which the bond-buying will end. If you assumed they never would, then I guess this comes as news.

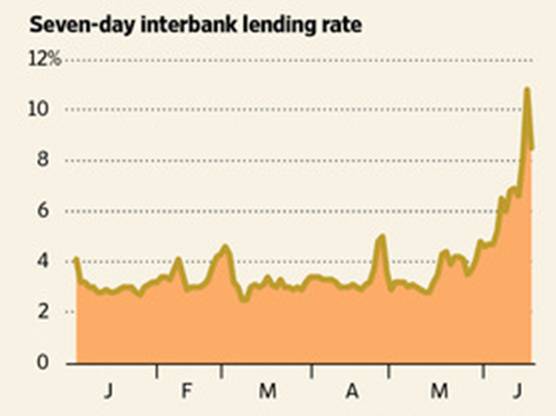

But it’s interesting to note from the last figure above that another 20 basis points came on Thursday and Friday. You can’t attribute this to revised anticipations that the economy is going to strengthen even sooner than the Fed is predicting. In fact, the news coming Wednesday night U.S. east coast time and Thursday morning in Asia was rather troubling. Interest rates on the Chinese interbank market have been rising sharply in conjunction with rising rates in the U.S. and a weakening Chinese economy.

|

Part of what has been going on in China is complicated schemes under which enterprises borrow dollars cheap in the U.S. in order to finance loans in China. The prospect of rising U.S. rates seems to have produced a major shock for Chinese markets, the implications of which echoed back across the world on Thursday and Friday.

Interestingly, the borrowing side of the Chinese carry trade is based on low short-term U.S. rates, and the Fed is trying hard to communicate that increases in the short-term rate are even farther away than any tapering of its long-term bond purchases. But the mechanics of the carry trade as described by Izabella Kaminska sound rather bubbly, in which the players have convinced themselves that they’ll be smart enough to get out before everyone else. In that kind of environment, announcements like those Wednesday from the Fed can end up being a major event.

The Fed of course would like to see credit extension go to sectors like the U.S. housing market, and this certainly has been happening as well. But events outside the U.S. last week make it clear that managing the unconventional policy tools on which the Fed has recently been relying can be a tricky business, both going in and coming out.

Which seems all the more reason that, when the U.S. unemployment rate does get down to 7%, the Fed would like to be out of the business of buying long-term securities to the tune of $85 B a month.

The question at the moment is how long it is going to take before that happens.

Senator Cutting who introduced a bill including 100% backed banking, government issuance of money, and paying of of private non-investment = money creating- debts in 1935 died in a plane crash. The bill did not go through. Instead, Watered down Banking Act was introduced. The cause of Great Depression survived then- will it now?

http://www.levyinstitute.org/pubs/wp/76.pdf

BTW, introduction of such a plan or similar could be a reason Gold bull market ends this time- but its so major change (separation of money creation and lending functions) that it won’t happen very soon. Some reasonable size wars may prolong the agony of banking and CBs quite substantially. Otherwise, it should have happened already now with QE proving to be just another smoke screen from bankers as “saving economy” by saving bankers and ruining economy.

Apart from my views that unemployment has an effective demand constraint at 7% and that China is intelligently positioning itself ahead of the curve while the rest of the world continues to destabilize (high rates stabilize, low rates destabilize, the trick is to find the balance), I have another comment:

Capital is much less grounded in communities than it was in the past. My grandfather was president of Santa Fe railroad until 1966. He was conservative in his investing. He had the mind-set to invest in communities for long-term development.

Since the 70’s capital is much less grounded in communities, and much more likely to jump for self-centered reasons, even when it means turning your back on the long-term development of your community. Even Japanese capital is leaving Japan.

Capital has become “flighty and capricious” and bubbly as noted in the article above. A talk of tapering QE back in the 50’s would not have had such an over-reaction. Capital would have taken it more in stride and kept more to their long-term development goals. However, now capital is much more impersonal, more “self-centered & self-interested” as promoted by Friedman.

Investors act more like children now on average. It is more difficult to take candy away from a child than an adult. Barry Ritholtz even has a post called “Taper Tantrum reaction”.

http://www.ritholtz.com/blog/2013/06/taper-tantrum-reaction/

The immature behavior of investors is a dynamic that will complicate unwinding of QE globally.

Tim Duy’s take concentrate’s on St. Louis Fed President Bullard’s comments suggesting that a data driven target of 7% is a fig leaf and that the Fed is really thinking about a date driven end to QE. It’s just that the Fed would prefer to tell themselves some bedtime stories, so they mouth the words “data driven” timing.

But Bernanke’s rather clumsy handling of “tapering” could leave us with the worst of all possible worlds; a world in which we get higher interest rates because of a date driven target coupled with slipping into a recession because of those higher rates. So unemployment ends up being well above 7% even though QE ends.

At this point the Fed has very little credibility. It has proven that it cannot even achieve a 2% inflation but yet we’re supposed to believe 1979 is just around the corner. And the Fed rather has (rather bizarrely) focused on the unemployment rate as the appropriate trigger rather than other measures of economic slack, such as employment to population ratios.

The US economy surged in May. The Philly Fed is the confirmation that led to the selloff’s second leg. The ISM and IP both lagged by a month so I suspect those confirmations are coming next month. My guess unemployment will be 6.5-7.0% by the 4th quarter, especially after the BLS’s hedonics are revised higher.

The Boomers are starting to push capital out of bonds………finally. This means markets will have to adjust or hope for a slowdown(which I doubt they overly want either).

I think after QE exit, liquidity can increase significantly from moving from excess reserve nearly 1.8TrnUSD into lending and investment activity. Now everyone expect rate normalization around 2015 and long term bond yield and real rate increase sharply.

The problem of no timeline of QE is that money will sit at excess reserve on Fed balance and people are happy with long term and TIPS bond investments. If people change to understand QE exit plan, the will adjust their investment and portfolio. Surely, under rate normalization or higher expected return from risk free rate, fund managers and banks must shift their portfolio into higher risky assets like start to lend and investment for banks and more overweight in equities from fund managers and they must reduce less risky investment like deposit on fed balance for banks or Bond funds and gold investment for portfolio managers.

I think Fed is happy with 1% real rate for 10year TIPS bonds after rate hike; therefore, real rate at 0.55% is quite overdone during before QE exit. I think market are panic on what they know on QE exit and when they realize that all cash from selling all assets get no return, they will move back to market but I think equities will be only choice from investment not bond or commodities.

The problem is that most economists concern on economy will not strong enough after QE exit. I think QE3 have little impact on economy because 75% of QE is parking on excess reserve on Fed balance. If the QE exit plan cause rising return on investment and banks start to lend and investment, the liquidity will increase more than QE. This is what Fed want and we will see if banks are willing to lend and invest, we could see stronger economy in 2014 and 2015.

For emerging market, I think they can sustain economy with lower growth trend. China is on property bubble and overinvestment temporary and if they can rebalance economy effectively, they will survive. I think they still have monetary and fiscal policies that can stimulate economy but they are careful on policy action. That is good news to contain problem. At some pont, PBOC will lower Reserve requirement ratio at 20% that is too high to improve liquidity in banking system after they are successful to tackle shadowed banking growth.

I think emerging market stocks will be good spot during rate normalization with high beta assets and underweight position from global investors.

Professor: If decreasing volatility was attributable to QE, then doesn’t the reverse apply? Aren’t the markets likely to be more volatile as support is decreased?

Another thing: Many people seem to be making the assumption that the economy will continue to improve which should help equities. But a recent report from the FRBSF is less sanguine.

So, what if the economy stalls? Then the higher long-term rate will hurt housing and growth and we could see investors pile back into USTS.

Isn’t that possible, or would it take a crisis (like China) to push investors back into bonds?

Keep in mind you are looking at 10-year rates. Which means their value depends on where short rates and inflation and other parameters over the next 10 year’s. A move from 1.8 to 2.5 seems massive but actually reflects a compounding over most of those ten years of a fairly minor calibration of expectations. Markets continue to signal deep pessimism.

Um, what does this mean?

http://www.cnbc.com/id/100836919

@steven, re BIS estimate of private sector capital losses on bond holdings if rates rise 3pps.

I’m not sure it means a huge lot, as I doubt rates will rise that much. At least it would require an extremely tighter Fed policy, which seems unlikely anytime soon. People often point out that these aren’t the 70s. These aren’t the nineties either, or even the aughties, when underlying, sustainable investment demand (hypothetically stripping away the bubble) might not have been strong enough to support 3.25% short rates.

People have been pointing to the same potential problem for Japan for some two decades now.

Correction: The FOMC did not release minutes Wednesday at 200PM. It issued the statement which it has chosen to release at the conclusion of its two day meeting. At 230PM Bernanke began his press conference and the rest his history.

The minutes of this meeting will be released in several week. I forget the exact scheduling but I believe the minutes and the participants discussion will be available three weeks for the date of the meeting.

It will make for interesting reading this time.

Interest rates are spiraling higher because investors and traders and other market participants are unwinding trades established since November 2008 when the Federal Reserve first announced that it would purchase agency debt and agency MBS securities. That is one very crowded position and has portfolios long credit and a host of other risky assets. Spreads of every ilk have narrowed to Treasuries as any yield was good yield. Investors are sensing that the gig will be up sooner rather than later and are heading for the exits en masse.

It will not be pretty and the orgy of regulation and the forceful pruning of the dealer community (by the crisis) will mean fewer players bidding for bonds. In addition those bidding have allocated less capital to the game so look for air pockets as rates rise.

Unwinding trades? Hardly. The 10 year was over 4% in early 11. That trade began then. IMO, it was a foreign move from the Euro mess.

This move is all Abe-patting.

Professor, thanks for sound analysis once again.

Bernanke relying on a figure of 7% unemployment is a joke. The unemployment rate has been falling even though the employment rate is stagnant. He is making decisions on numbers that are changing because of the classification of the unemployed. That shouldn’t give us a very warm fuzzy.

Edward, Your analysis is spot on but have you considered that capital has become “flighty and capricious” because governments have become flighty and capricious? Investment would be grounded in communities if the investment environment was more stable. When the FED changes interest rate targets on a whim investment will do the same.

Tom –

The last time someone told me not to worry about a bubble in a major asset class, the world as we knew it ended.

Are we sure that rising interest rates won’t take the financial markets down with it?

How would that impact China’s economy? cf

How China Can Avoid A Meltdown

To the Rage.

Mortgage bonds have melted. Corporate bonds have melted. Callable agency spreads have blown out. Retail is bailing out of high yield funds. Utility stocks have sharply corrected. Vol is exploding.

The fact is that real investors are exiting trades which worked for years.

You might want to look at the yield curve for confirmation. The sweet spot on the curve was the 5 year and 7 year point. Those who have not exited those trades will soon be seeking advice on career change

What has happened to Obama?, not sure what he will be remembered for, I think we are looking at another Jimmy Carter.

I’m afraid I have a mental picture now, of Snowden running, while being pursued by journos, CIA, NSA etc, with the Benny Hill music in the background.

That Obama is some piece of work. At least Nixon had the decency to look iffy.

John, all trades work and then not work. You overblow the yield curve and notice those trades are still going on, just not at the level, which is hardly meaningful.

“Tom –

The last time someone told me not to worry about a bubble in a major asset class, the world as we knew it ended.

Are we sure that rising interest rates won’t take the financial markets down with it?”

Steve, you do know the “bubble” in those asset classes” was built in the 99-01 time period don’t you? Mercy child, look at leverage. I don’t see any big leverage in any asset market right now, outside consumer loan markets, but that is typical when you have intense capital inflight.

Higher long term rates steepen the yield curve which gives financial firms better margins and debt servicing. One of the reason for the bad “financial” performance since early 2011 is because of the collapsing long term rates.

@Steven – My point isn’t that everything’s hunky dory, but that exercises in measuring the effects of a 3pp rise in short rates miss the point. We have an economy with a 2% long-term growth rate, and nobody in power thinking the least bit seriously about what could be done to increase that rate, other than one-offs subject to withdrawal drag, ie fiscal and monetary stimulus. In such conditions a 3pp increase in short rates is ludicrous. What do you see making it happen, if not a very aggressively tightening Fed? Strongly accelerating growth and demand for credit (so strong as to overwhelm trillions of excess reserves)? If only that were in the offing, we would happily suffer the capital losses on long-dated Treasurys. It’s obviously not in the offing. So quit throwing around red herrings and get to the point.

Rage wrote:

John, all trades work and then not work. You overblow the yield curve and notice those trades are still going on, just not at the level, which is hardly meaningful.

I dont get that at all. It is very difficult to overestimate the importance of the yield curve. It is one of the primary tools money managers and traders enlist when they decide what to buy or sell.

So how can one pay “overblown” attention to it?

Please illuminate me.

Further to Tom’s point, the CBO now estimates a $6.2T cumulative production shortfall from potential gdp due to this recession before production closes back to potential. This is the cost of austerity, a loss of real production, not one time losses by one side in a financial swap.

A superb CNBC analysis of the tax and economic issues and how low interest rates fed into to ongoing discussions at the G8 Summit. Fascinating CNBC discussion:

http://video.cnbc.com/gallery/?video=3000176933&play=1

benamery21-

The CBO is NEVER right about anything. Don’t cite them.

Jesus Christ, operating at the helm of the Economy of God, Ephesians 1:10, terminated Liberalism, and its Banker regime, by enabling the bond vigilantes to call the Interest Rate on the US Ten Year Note, ^TNX, higher to 2.01%, on May 24, 2013. This “extinction event” killed the Creature from Jekyll Island, that is the US Fed. God’s Son did what Ron Paul could not do; he ended the US Fed.

And now, continuing on, Jesus Christ buried Liberalism, putting its Milton Freidman Free To Choose Floating Currency System, in the grave, on July 5, 2013, by first enabling the bond traders to call the Interest Rate on the US Ten Year Note, ^TNX, higher to 2.72%; of note, the 10 30 US Sovereign Debt Yield Curve, $TNX:$TYX, steepend sharply, as is seen in the Steepner ETF, STPP, steepening, better said, blasting vertically higher; and secondly by enabling the currency traders to call the US Dollar, $USD, higher to 84.71, and to sell invididual currencies; those sinking included the Indian Rupe, ICN, -1.2%, Emerging Market currencies, CEW, -1.4%, the Swedish Krona, -FXS, 1.5%, the Euro, FXE, -1.5%, and the British Pound Sterling, FXB -2.4%.

Friday July 5, 2013, was Black Friday for credit, as the bond vigilantes conducted ongoing sluagher in the credit markets. And Friday July 5, 2013, was Black Friday for currencies worldwide as the currency traders continued their successful currency war of competitive currency devaluation on the world central banks.

Marc to Market writes in Zero Hedge The Dollar Index made new three year highs before the weekend and after the employment data (and has been rising from an April 2011 low of 73). Although it is flirting with the top of its Bollinger Band, there is no compelling sign that the move is exhausted. It has rallied over 5% off the low on June 19, when it recorded a key upside reversal. Our next target is the downtrend line drawn off 2009 and 2010 highs and comes in near 86.00. This environment is not good for the dollar-bloc, which had been the market’s darlings for much of the post-Lehman period. Both the Canadian and Australian dollar recorded new lows for the year last week and the adjustment is not over.

Beginning in May 2013, Jesus Christ, as steward, acting in the administration plan of God, for the fullness and completion of every age, dispensed debt deflation to destroy first credit, AGG, and second Major World Currencies, DBV, as well as Emerging Market Currencies, CEW, terminating peoples trust in the elected officials, and world central bank monetary policies of investment choice and their credit schemes, such as, free trade agreements, financial deregulation, leveraged buyouts, nation investment, currency carry trade investing, securitization of debt, financialization of stocks and ETFs, dollarization, and Forward Guidance.

EU Observer writes Portugal and Greece highlight eurozone fragility. Soon out of the PIGS, that is Portugal, Italy, Greece, and Spain, banking and nation state insolvency, Jesus Christ is going to cause a stroke to one of mankind’s seven institutions, specifically, the head of Finance, Commerce, and Trade. This is known as Financial Apocalypse, that is a global credit bust and financial system breakdown, as foretold by John the Revelator in Revelation 13:3-4. Yet surprisingly, economic capability will recover, this will come through Regionalism, replacing Crony Capitalism, European Socialism, and Greek Socialism, as well as Russian Communism and Chinese Communism, Revelation 13:1-4.

With Liberalism, both terminated and buried, people will come to trust in Authoritariaism’s regional governance, and economic policies of diktat and their debt servitude schemes, such as, regional framework agreements, bank deposits bailins, new taxes, privatizations, capital controls, and austerity measures.

Libertarians and Austrian Economists abhored Liberalism’s Interventionism; they will abhore even more Authoritarianism’s Regionalism.