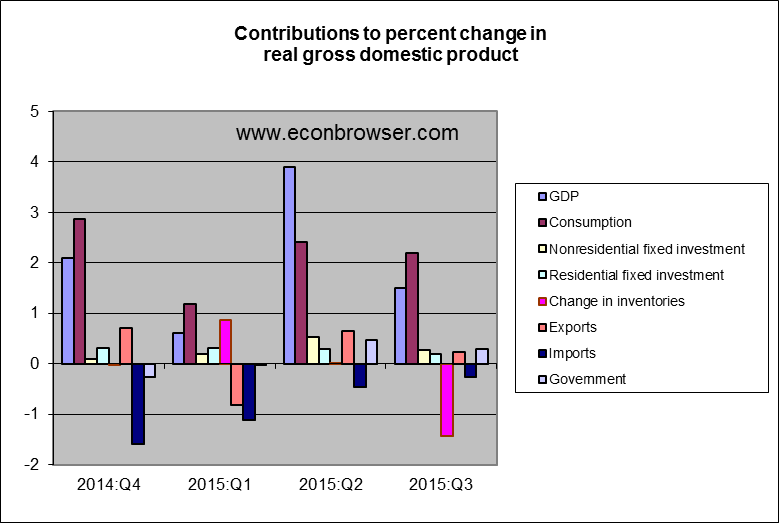

The Bureau of Economic Analysis announced yesterday that U.S. real GDP grew at a 1.5% annual rate in the third quarter. Although the headline number sounds disappointing, the underlying fundamentals look solid.

It was encouraging that housing, nonresidential investment, and the government sector all made positive contributions. The one negative was a drawdown in inventories (goods sold but not produced during the quarter). Leaving inventories out, real final sales grew at a healthy 3% annual rate.

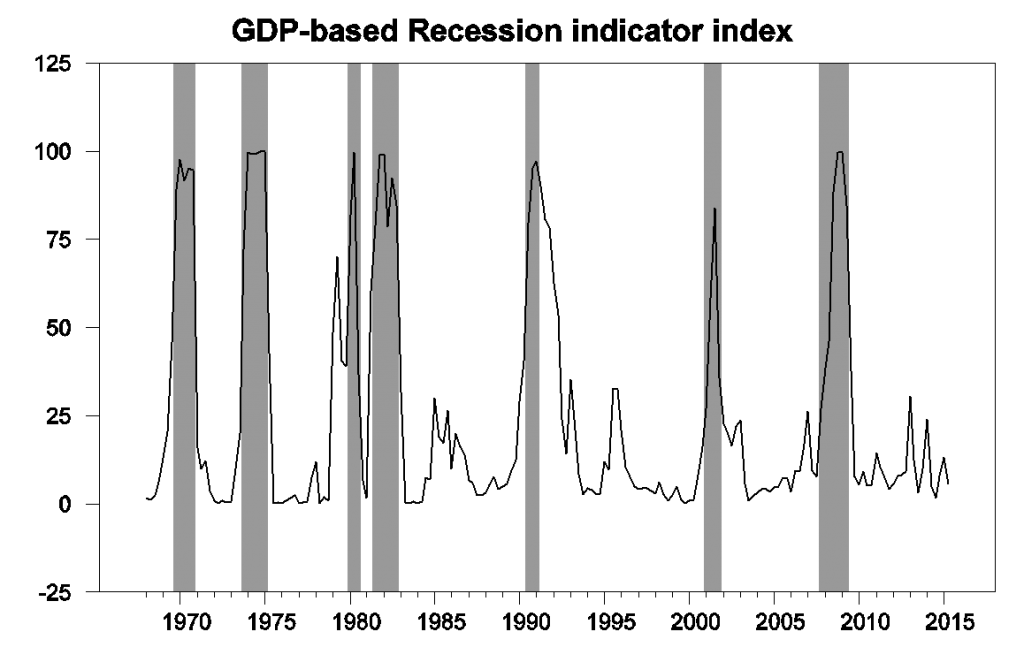

With the BEA now estimating that real GDP grew in the second quarter at a 3.9% annual rate, the latest reading for the Econbrowser Recession Indicator Index eased down to 5.6%, unambiguously signaling an ongoing economic expansion. The index uses yesterday’s data release to form a picture of where the economy stood as of the end of 2015:Q2.

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2015:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

In The General Theory (p. 104) Keynes famously said: “Consumption — to repeat the obvious — is the sole end and object of all economic activity.”

Without consumption, it is obvious from the graph that there would be no recovery at all and we would still be in a recession. Why do economist today completely ignore the essential role of consumption in our economy? Why is there no emphasis on spurring consumer demand especially when government fiscal policy is MIA. We need to follow Keynes’ advice:

“I should support at the same time all sorts of policies for increasing the propensity to consume. For it is unlikely that full employment can be maintained, whatever we may do about investment, with the existing propensity to consume.” The General Theory, p. 325.

Of course, no business will invest and hire workers without customers.

When household debt is high, a big tax cut can bring customers back.

However, customers will pay one way or another when businesses are taxed, regulated, and sued too much.

[The only two times I had food poisoning was in and around San Francisco].

“[The only two times I had food poisoning was in and around San Francisco].”

When you return please ask the server to “super size it”. A bad cold and a long recovery has made me grouchy.

Yes the rich and their little wanna-bee sock puppets come up with all kinds of elaborate contraptions to support their self-serving narrative of “serve the investor class and all shall be good”. Yet simple 5’th grade math tells us that the GDP is driven by consumption. Consumption in itself is about 70% and investments (20%) rarely occur unless consumption is increasing. Who the heck would build a new production facility if they don’t have or predict increased demand. Looking at the observable world even a 5’th grader should have the sense of logic to understand that economic activity is driven by consumption (private or government). It is a pathetic spectacle to watch those whose ideology and self-interest dictate that they must reach another conclusion.

Making consumers pay too much, because of government policies and/or lawyers, doesn’t improve consumption, but depletes saving.

We’re still in a weak recovery after the severe recession. The anemic economic growth is driven by population growth, federal borrowing, and emergency monetary policy.

We need to unleash the entrepreneurs and eliminate crony-capitalism to expand the economy. The new millionaires and billionaires will create lots of good jobs and a great deal of value to consumers.

Making consumers pay too much, because of government policies and/or lawyers, doesn’t improve consumption, but depletes saving.

Huh? Those things might reduce welfare through deadweight loss, but as one wise man noted, it takes a lot of Harberger holes to fill a recession…or words to that effect. And some government policies and a legal system with property rights vigorously defended by lawyers do contribute to growth. If you want to point a finger at non-productive actors who engage in rent seeking, then point your finger at many in finance and asset trading.

We’re still in a weak recovery after the severe recession. The anemic economic growth is driven by population growth, federal borrowing, and emergency monetary policy.

More nonsense. I would agree that demographics will hurt long run growth, but over the short run we should be seeing some disinvestment as people retire and tap into savings, which should stimulate demand. And when private sector consumption and investment are weak, government spending does not weaken the economy, it lifts it up. Have you not learned anything after all these years visiting this blog?

We need to unleash the entrepreneurs and eliminate crony-capitalism to expand the economy. The new millionaires and billionaires will create lots of good jobs and a great deal of value to consumers.

Too many of today’s millionaires and billionaires made their money the old fashioned ways…inheritance and rent-seeking. I would suggest that you read some of the current literature on economic growth (long run growth). It’s not capitalists who drive that growth, but ordinary people who innovate at the ground level. Innovation is what drives growth, not some cult of leadership personality, which is what you seem to have bought into.

I was responding to Keynes’s statement about increasing the marginal propensity to consume (MPC). You can increase the MPC and still consume the same, while reducing the marginal propensity to save.

Are you saying population growth, federal borrowing, and emergency monetary policy don’t have positive effects on growth?

Not everyone can be a successful entrepreneur and I’ve stated before many people shouldn’t be wasting their time in finance-related work.

We need to allow the entrepreneurs to do their work. When they become wealthy and have a successful firm creating tremendous value for consumers, then you can think about destroying their lives.

Peak Trader

Are you saying population growth, federal borrowing, and emergency monetary policy don’t have positive effects on growth

Okay, so you’re really saying the opposite of what it sounded like you were saying. Your initial comment suggested that you are blaming the weak and anemic recovery on federal borrowing and emergency monetary policies. BTW, I don’t think this recovery has been all that weak…not robust by any means, but given the headwinds and compared to the UK and the EU, not too shabby despite the best efforts of Tea Party types to kill an Obama recovery.

Paul,

You really need to borrow and spend more. I can’t believe you are not consuming more. You should probably also stop working to have more time to consume. After all, work does waste time producing when we could all be increasing our propensity to consume.

Ricardo For someone who constantly criticizes Keynesian economics, it’s amazing how little you actually know about it. Nowhere does Keynesian economics say that not working increases GDP. Why is it so hard for you to understand the very simple point that saving without an offsetting increase in investment reduces income? Then again, you don’t believe in the concept of aggregate demand, so that probably explains a lot. Instead you believe in voodoo Austrian economics…i.e., the kind of stuff that most people put behind them by their sophomore year.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mP3

Non-residential “investment” per capita is turning negative for the first time since Q3 2008 and Q2 2001.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mP8

The differential growth of health care “consumption” to final sales is at a rate that previously occurred in Q3 2008 and Q2 2001.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mP9

Orders and wholesale sales and inventories are recessionary.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mPb

The acceleration of money velocity to private GDP is recessionary and deflationary.

http://www.cfosurvey.org/2015q3/Q3-2015-US-KeyNumbers.pdf

CFOs anticipate a marked deceleration of revenues, earnings, and spending hereafter.

The aggregate of payroll receipts and reported wages and salaries implies that US employment is significantly overstated, and civilian employment is decelerating to ~0% YoY.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mA8

Texas (and the energy sector) is in recession.

Lookin’ good.

James,

Your recession index is great for telling us when we’re in a recession, but doesn’t do a good job of forecasting the likelihood of a recession in the next 6 months. The latter would be much more useful information.

“The latter would be much more useful information.”

That technique would work only once. Efficient Markets yakno.

How much are you paying to subscribe to this blog?

Anonymous, you’re asking the impossible from eCONomists. 🙂

https://www.businesscycle.com/

https://app.box.com/s/pke0xewatd7zvhnteefajk6tcoqone9h

https://app.box.com/s/ivzn1w3zfqln5p7rmr5c0enar18tbui1

Try ECRI. They don’t use models, but they’re not infallible, to be sure.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mPb

As to indicating when a recession is underway . . .

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2n34

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2n0D

As to whether or not the Fed will raise rates, the answer is clear.

“The future is not ours to see.”

Once a time, James predicted the future : at least 100 USD for oil per barrel forever.

(was it during the late 2007 speculator spike ?).

The year over year change in real GDP is just 2%. Moreover, the second quarter strength was largely a bounce back from the first quarter when weather related problems contributed to real GDP growth of under 1%.

Final demand looks OK,as you observed. But there is still extremely limited information suggesting the economy if breaking out of the past several years poor performance of some 2% plus real growth.

Real Final Sales, year-over-year, have been steadily trudging along for a number of quarters quite consistently in a tight, 1.5%-2.5% range.

This report came in at +2.2%, showing no surprising acceleration or deceleration. In contract, quarter-to-quarter GDP series jump all over the lot, as they’re imbalanced by inventory changes and odd mathematical annualizing effects.

http://tinyurl.com/o3h6h6x

2slugbaits-

You disagreed above that the economy is still weak. So you support the fed raising rates and unwinding QE, along with the fed govt raising taxes and aggressively cutting spending so we can rearm our weapons to fight the next recession, right?

anonymous, 2slug never said it’s a strong recovery, so reload the tools. we are still in recovery phase, and as such support should not necessarily be pulled. at some point you will no longer consider it a recovery, and at that point you should undwind your efforts. not before that time.

when baffling? by what metric?

Hint: we will NEVER EVER EVER unwind EVER.

what possible sound economic reason do you have to unwind today? you sound like peter schiff. i cannot tell you when to unwind-too many unknowns. but i can tell you it is not appropriate to unwind today and tomorrow. i can tell you it is appropriate to unwind in 6 months as accurately as i can tell you what the stock market will be in 6 months.

More oil stuff, sorry. Some articles on China oil consumption. None of them show an actual contraction in volume.

http://www.wsj.com/articles/why-chinas-thirst-for-oil-cant-lift-prices-1440574814

“SINGAPORE—Oil prices haven’t proved immune as commodities prices tumble amid jitters about China’s economy, with key global benchmarks trading around six-year lows. That is despite Chinese crude demand remaining remarkably robust.”

Note the chart within that shows what fraction of oil demand comes from China.

http://www.woodmac.com/analysis/oil-demand-China

Emphasizes that the recent pullback in construction of factories and the like is not the same as consumer usage of gasoline (which is main driver of China demand growth).

“In the first half of 2015, China’s official GDP growth came in on target at 7% year-on-year. However, with the government intervening in equity markets, devaluing the currency and slashing interest rates to support short-term growth, there is a perception that this figure is masking a sharper slowdown in the real economy.

Indeed, our China Activity Index – which has proven to be better proxy than headline GDP for commodities – reveals that the demand outlook for 2015 is looking bleak for coal, power, natural gas and diesel.

But, while demand across these commodities stalled in the first half of 2015, oil has remained resilient. So how has the demand growth momentum for oil been maintained?”

http://www.bloomberg.com/news/articles/2015-09-29/jefferies-china-s-demand-for-oil-is-totally-misunderstood-by-the-market

“Although tentative signs suggest domestic crude production is rolling over, analysts led by Laban Yu, head of Asia oil and gas equities for Jefferies, think it’s time to focus on what’s going on at the other side of the ledger on the other side of the world.

Yu’s team has grown more than a little sick of reports linking weakness in crude oil prices to softening economic data in China. There’s one big problem with this narrative, according to the analysts: [b]Chinese oil demand is actually quite robust, up 9.2 percent year-over-year, as of August.[/b]”

———————–

Look…I agree it is hard to disentangle supply and demand changes exactly, conceptually. But one thing is mathematically certain. If you believe in downward sloping demand curves and upwards facing supply curves, you have to agree that an increase in Q while price dropped, involved a supply curve shift (to more/cheaper production). You can argue that demand curve shifted up, down, stayed same behind that. But you can’t disagree that the supply curve moved.

To me this is a momentous thing. In particular when including the upward shift in OPEC volumes (which certainly seem to belie the idea that OPEC was irrelevant to previous high prices or worse that SA was running out of oil or the like, Simmons-Staniford concerns).

Also, seems to be some pretty strong results to counter the past concerns over supply scarcity (using up the cheap stuff, Hubbert curves, general peak oil in the media in mid-late 2000s, in the “peakosphere” of the Internet, and even here in this blog.

E.g. reread the 2007 post here on US peaking, titled “Peak oil in America”

https://econbrowser.com/archives/2007/05/peak_oil_in_ame

Comments within include things like “inexorable decline” “necessary consequence of the geologic reality that oil is a depletable resource– you can’t take the same oil out of the ground twice. No matter what we do, we can’t turn the clock back to 1970.” [Does anyone contest that we could not have delivered 10+ MM bpd if price had not crashed?]

Note that commenter Hal raises excellent objections to the idea that arduous efforts were expended and no more oil came out. In particular he notes the Alaskan oil that is off limits (large estimated volume), mostly because of Democratic Party, as well as East Coast drilling in analogy to NF/NS Canada fields, as well as low prices. I think events of 2010-2015 pretty much support his comments and in any case his points were not addressed at the time.]