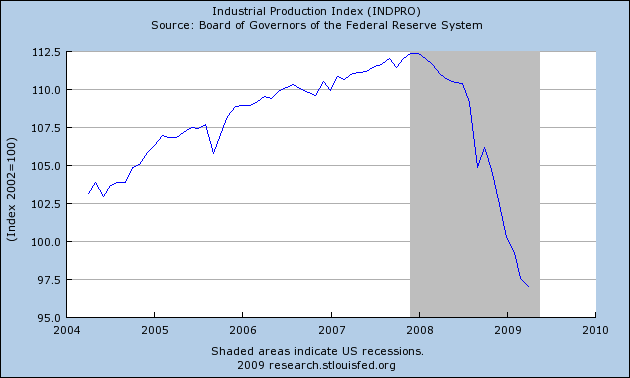

The Federal Reserve reported Friday that its index of industrial production fell another 0.5% in April, after having fallen 1.7% in March. Some analysts took comfort in the fact that at least the rate of decrease has slowed. But any decrease means we’re producing less than we did the previous month, and recovery requires growth, not a slower rate of decline.

|

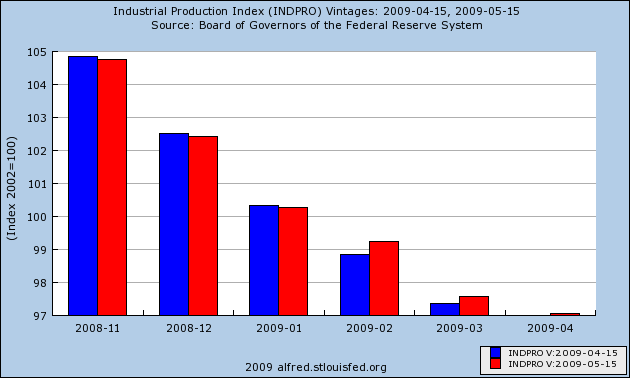

On the other hand, the levels for February and March were revised up from their earlier reported values, which is a positive development.

|

Those back revisions gave a boost the ADS Business Conditions Index. But I’m waiting for the backcast value of the index that is able to employ all 6 indicators (indicated by the leftmost vertical line in the second diagram below) to rise above -1% before interpreting this as an unambiguously favorable signal.

|

Meanwhile, across the pond euro-zone GDP fell 2.5% during 2009:Q1. Unlike the American convention, which would quote such numbers at an annual rate, the European number represents the actual quarterly loss, or a -10% annual growth rate. That is a staggering rate of decline, though not as bad as the 3.8% drop within the quarter experienced by Germany or the 11.2% quarterly drop in both Slovakia and Latvia.

Finally, let me mention here that Marc Wildi and Michel Philipp of Zurich University are also getting into the business of real-time business cycle dating algorithms.

Technorati Tags:

recession,

macroeconomics,

economics

JDH wrote:

any decrease means we’re producing less than we did the previous month, and recovery requires growth, not a slower rate of decline.

Professor,

Thank you for your straight forward honesty. Good post!

There were a couple things that led me to believe the April number would be worse than it than it was. Retail sales have been falling faster than consumer goods production the last two months. For Feb & Mar, retail sales less gasoline fell about 1.4% and consumer goods production fell just .3%. But maybe the difference can be explained by a greater fall in imports?

The other odd thing is that the rate of decline rail traffic YoY has been increasing over the last 5-6 weeks. Year to date, the decline is 18%, about inline with the drop in trade, but 50% greater than the fall in industrial production.

For the 4-week moving average is down 22% YoY, for the last week it was 25%, and these declines are broad-based. So it seems odd that the decline in industrial production is decelerating.

Rail stats:

http://railfax.transmatch.com/

Something else I meant to add. The explanation to the dichotomy between the trend in rail traffic and production could lie in inventories. The conventional wisdom is that this quarter will be the one where producers get their inventories in line with sales.

But the inventory/sales figure didn’t change between Feb and Mar:

http://www.census.gov/mtis/www/mtis_current.html

And perhaps it’s actually worsening again?

Though the explanation may lie elsewhere.

Bob_in_MA has interesting comments.

One might be tempted to conclude a slight uptick in price inflation, unreported, but felt by the consumer through the pump. By then it is too late to adjust by the retail distributor. I noticed an uptick in long bonds after the government debt sale, but it quickly settled down. As if the initial shock is still settling, each sector trying to adjust the elasticity of their network.

Good points on the discrepancy between falls IP and rail traffic, Bob.

This mess has only just begun, and will not appreciably ameliorate until household debt gets chopped by at least one-third; that is what marked the bottom of the last depression.

Love the title. I can’t wait until we get as enlightened here as Europe is so we can experience that type of decline next time. If we could just get Congress to stay in session without recess, we could speed up the transition. Surely we can turn the current exodus from NY and CA into a nationwide exodus. We certainly seem to be on the right path.

This could just be another blip on the charts in the long run but, the unfunded liabilities represented by medicare and social security etc. overhangs everything going on today. The futures so bright, I probably don’t need shades.

Speaking of the Federal Reserve check out this youtube of my congressman Rep. Alan Grayson questioning Federal Reserve Inspector General Coleman.

http://www.youtube.com/watch?v=PXlxBeAvsB8

And they say we need more auditors? No, we need the existing auditors to actually do their jobs.

I wanted to alert you, on the off-chance it hadn’t come to your attention, to the piece by Robert C. Allen posted at VOX EU on why the Industrial Revolution took place in England. His answer (in short): cheap energy (coal) and expensive labor (after effects of the Plague and some other causes.) I am not an economist, but I think it dovetails well with your recent paper on the 2006-8 oil shock’s relationship to the current crisis and other work of yours I’ve seen. It can be found at: http://www.voxeu.org/index.php?q=node/3570.

Wow! Those first two graphs look like REALLY bad news!

You know, until you look at the y-axis…