Thinking about what happens to interest rates when foreign capital inflows slow

In Suskind’s The Price of Loyalty, Paul O’Neill attributes to Dick Cheney the statement that “Deficits don’t matter. Reagan proved that.”

Given that the US government has been, and is running for the foreseeable future (see here), large deficits against a backdrop of low household savings without nary a budge in long term interest rates, one might think that Vice President Cheney’s conclusion is correct (although it must be said that he denies having made this remark). A variety of studies suggest that debt and deficits matter, but these effects have been masked by the tendency of foreign monetary authorities and individuals to save U.S. Treasuries. (Note that there is some evidence that long term rates are now finally rising despite this effect of capital inflows.)

A recent (2/17) Deutschebank study finds a significant role for current budget deficit and the current government debt stock (as a share of GDP). When log Asian foreign exchange reserves are included, the model predicts the current long term interest rate within 30 bp (as opposed to 130 for the standard model).

Similar results are obtained in Chinn and Frankel (2005), and Warnock and Warnock (2005). In the first instance, the debt-to-GDP ratio expected two years ahead has a positive and statistically significant coefficient; a model excluding foreign official intervention overpredicts the US long term rate by about 200 bp. When official purchases are included, the coefficient on this variable is negative and statistically significant. In the second instance, Warnock and Warnock’s study uses the deficit-to-GDP ratio, the fed funds rate (and so addresses the “conundrum”), and more refined and up-to-date asset data. They find that excess capital inflows account for about 105 bp of the deviation of long term interest rates from the predicted value from a baseline model.

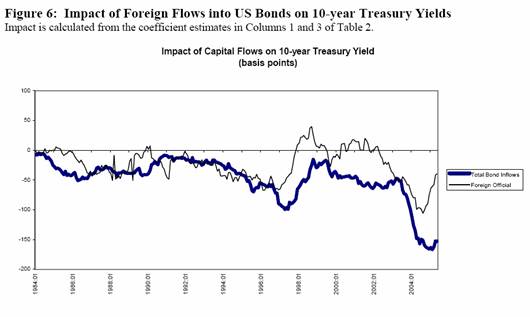

Source: Warnock and Warnock (2005).

(The dark line is the deviation due to all capital inflows, while the narrow line is that attributable to official capital inflows.) All this suggests that if there is a cessation of above average capital inflow, if combined with chronic and incipient budget deficits, will lead to a substantial increase in long term interest rates. Of course, this effect may be masked in the immediate future by an economic slowdown or recession that depresses private demand for credit.

Technorati Tags: budget deficits,

long term interest rates

conundrum

Here’s how to resolve this: Go back in time, and run a parallel US government without deficits.

Then see what happens to interest rates in that scenario.

I’ll wait, while you compile your results (and if you can go back in time to conduct this experiment, I shouldn’t have to wait very long).

I remember the Ronald RayGuns years. It seems to me that they cooked up a scheme to increase the money supply by eliminating the Federal oversight on Federally supplied loans for residential and multi-family construction. Savings and Loans were given complete discretion in making Federally insured loans without any pesky Federal bureaucrat making sure of the credit quality.

Many of our finest bankers took up the program with gusto. Charles Keating, one of the Bush boys, David Paul, etc. The result was one of the largest Federal liabilities in our nations history and the Resolution Trust Corporation.

It would seem to me that budget deficits come in different varieties, making an apples/apples comparison difficult. Recession or depression spending has a different effect and timing as does a war deficit. Deficits that occur while the Federal Reserve is hawkish have a different effect than when the Fed is accomadative. Deficits that occur from a base of a balanced budget probably have a different effect than a deficit that increases from a record cumulative deficit base. Deficits that occur when Foreign competitors have an overriding need to recycle massive quantities of dollars without buying goods and services from their competitors probably has a different effect than when the home team limits the rate of destruction of the domestic economy.

One of the problems I have, is isolating the 10 year yield from the capital cost of the good to be acquired through borrowing. Does a house at $400K at 5 % cost more or less than a house that costs $ 200K at 7.5 % interest. And how did the price of the same house get from 200 to 400 $K in the first place. And what if problems, like inflation, arose and it became adviseable to increase the interest rate ? What happens to the price of the $ 400K house ?

So many variables, such a small sample space. Thanks for your blog.

Thanks to all for the comments. I agree that it is hard to compare budget deficits, since sometimes they are accompanied by lots of contingent liabilities (this is what I guess STARK is getting at referring to the S&L debacle). In addition, it isn’t just the level of the budget deficit but also the persistence that matters.

Several Points:

The budget deficit (revenues – spending) does not drive the economy. Rather, the economy drives the deficit, especially revenue. Tax revenues soared during the expansions of the 80’s and 90’s due to rising employment and incomes. My point is that if the economy grows deficits take care of themselves. If the economy does not grow the debt and deficit become bigger problems.

The real problem with the current deficit is that we are getting nothing in return. We are spending huge $$ on the war overseas and social services at home (healthcare and homeland security.) If the money was being spent on infrastructure – roads, energy grids, railroads…, the economy would be better today and we would have something to show for it besides just debt.

It’s all money well spent.

No country or person wants to contemplate what this

feels like:

We’ll just make more deals you can’t refuse.

http://video.google.com/videoplay?docid=-485152666214457252&q=a10

Barry,

What you are saying is that more regulation of S&L’s would have resulted in less people qualifying for loans and higher rates for those who did qualify, and that more regs would have protected the owners of S&Ls from losing their equity. I agree. But whether or not the g’ment should have allowed low income people get mortgages, poor people reneging on their mortgages was not a major factor in the S&L meltdown.

Consider your points regarding interest rates vs. home prices (which I agree with.) Interest rates do influence home prices, esp. over a few years. Interest rates immediately determine mortgage values. If an S&L loans out $100k at 8%, they have an asset worth $100. If rates go to 10%, than value of this asset drops to $80 or less. This is what happened to the S&L’s when the fed raised rates sharply in 90-91. Not only were their assets wiped out, but they were no longer able to borrow at rates low enough to meet obligations, so they became insolvent.

The collapse was not caused by the generous social programs of the 80’s, but by poor government policy in the early 90’s. Remember the main job of the fed is to maintain liquidity in the markets. At the time of a financial crises they should have been increasing the money supply, not restricting it.

The S&L meltdown did not cost taxpayers money, and would not have cost depositors money even with no bailout, as S&L assets far outweighed deposits. The administration’s decision to bailout cost tax payer money, but who did we bailout? Not the S&L’s who went under anyway. Not depositors who would have been paid anyway. We essentially bailed out the big banks who had made loans to the S&L’s and would not have been repaid in the absence of a bailout.

In short if we had maintained the laissez – faire stance of the 80’s:

The Fed remained neutral, losses would have been much lower. Had the Admin. done nothing the losses would have remained in the private sector.

I agree that if the fed had remained neutral in the late 90’s and early 00’s home prices would have remained lower and inflation less a long term risk. And yes there is a difference between low home values / high rates and high values / low rates. High current prices mean higher risk of loss and lower long term return (whether you pay 200 or 400 today, the value in twenty years will not be affected,)

It seems to me all these problems are the result of government intervention, not the absence of regulation.

Actually Rich what drove the entire S&L example you are talking about was the removal of Reg. Q.

Under regulation Q when rates rose the flow of capital to housing was cut off — it was a form of nonprice rationing. Without req q the morgage market switched to a free market pricing system that extremely few expected. And what we found out was that the demand elasticities were such that it took much, much, much higher prices to dampen demand then anybody expected. So prices soared. But this had massive impacts on S&L balance sheets because the system was set up on the assumption that rates would not soar.

So the S&L problem in the early 1980s was created by the removal of regulation q, not by new government interference.

The big mistake we all commit is to give the government free hands in allowing her to exceed the real nation’s expenditure; this will add the yearly burden on the nation. is there any law to check on the deficit, and make it impossible for any government to pass it with strict and stringent rules..

DOES ANY ONE KNOWS WHAT DEFICIT MEANS: IT IS INDIRECT TAXATION PAID DIRECTLY BY THE NEXT GENERATION, VERY SIMPLE. THE QUESTION IS TO BE ASKED WHO HAS THE AUTHORITY TO SPEND THE SWEATOF NEXT GENERATION?

IF ANY GOVRENMENT DARE TO RASE THE TAX AS THEY DO NOW ON DEFICIT, DO U THINK THEY WILL BE REELLECTED BY PEOPLE? WHAT WILL BE YR REACTION IF U HAVE ADDED TAX EACH YEAR TO THE VALUE OF THE DEFICIT? MIND U 5% DEFICIT EQUAL MORE THAN 5% TAX IF U WANTS TO COVER THE DEFICIT BY TAXATION?

When our government says our growth rate is 3% but they never tie that with the DEFICIT OF 5% WHY?

Our Main stream media also part of this crime never publicly comes and says honestly that we r in fact in the red and our growth rate is Minus 2%, Do u hear this from the media?

Do u know what is yr debt?

Please see National debt clock, I will advice those who has heart problems to avoid it:

http://www.toptips.com/debtclock.html

It was nearly $5 billions for only one Min, and total gorenment debt is reached above $8.3Trillions, this $8.3 trillion is the total amount of dollars owed to all the holders of US government debt instruments. Excluded from this total debt are all of the federal governments other liabilities, which total another $38 trillion, please read economic suicide:

http://news.goldseek.com/JamesTurk/1142438460.php

Do you hear from Media that yr deficit is adding to yr debt daily and it reached over $ 8.3 trillions, and the nation could not raise enough $$$$$$$$$$ to full fill the deficit thirst last month from abroad, the total of 119.7 Billion were needed last month USA could not raise this

can any one help what a hell is going on ?

can we have a law to stop this crime before