Those whose political philosophy is to try to opt for the lesser of two evils may have a hard time choosing their dog in the fight between Senate Democrats and Republicans over gasoline taxes.

Senator Robert Menendez (D-NJ) last week introduced the

Menendez Federal Gas Tax Holiday Amendment which would suspend the federal gas tax for 60 days to “help reduce the cost of gas and diesel for consumers, thereby providing $100 million dollars per day in relief directly to Americans.”

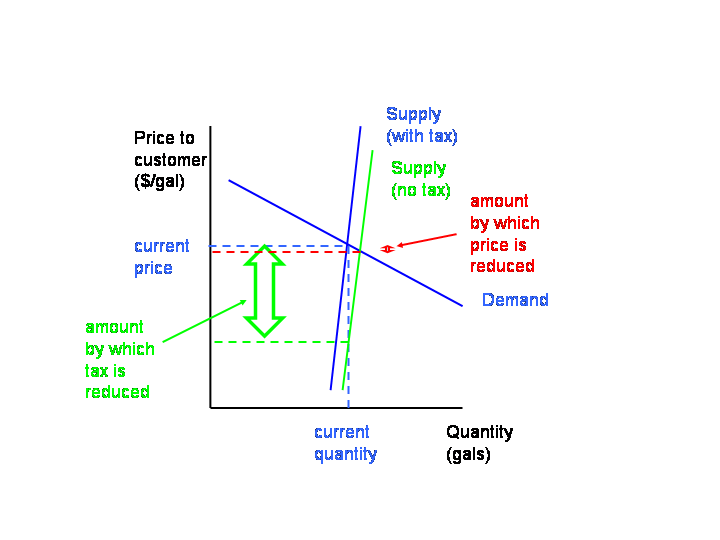

Let me begin with a diagram that will be very familiar to anyone who has taken an introductory economics course (or if you prefer the verbal version with no picture, see Arnold Kling). The vertical axis reflects the price the customer pays– the supplier gets this amount minus any tax. The blue supply and demand curves reflect the market outcome under the current arrangement in which there is a tax. I’ve drawn the supply curve as being rather steep, meaning the price that producers receive has little short-run effect on their willingness or ability to bring a greater quantity of gasoline to the market. The intersection of the blue curves determines the current price, say $3.00 a gallon.

Now, if we eliminated the 18 cents federal gas tax, the customers’ behavior, as a function of the price paid at the pump, would of course be the same. The supplier, however, now receives the full $3.00 the customer pays for the gallon, rather than the $2.82. Anyone who previously was willing to sell a given quantity for $3.00 per gallon should now be willing to sell the same amount for $2.82. The result is that the supply curve should shift down by the amount of the tax cut, in this case, shift down by 18 cents to the new green supply curve.

But, a lower price would mean an increase in quantity demanded (as the economy moves along the blue demand curve), and, unless those customers are to be rationed, the resulting equilibrium is where the green supply curve intersects the blue demand curve. As I’ve drawn the curves (with a very steep supply curve), the result would be essentially no drop in price and a big increase in oil company profits.

If the senators believe that something other than this would be the outcome, then they must have in mind that the supply curve is not as steep as I’ve drawn it, but instead much flatter. Let’s consider what sorts of mechanisms might result in a bigger response of supply to the added profitability of sales that the tax cut produces.

One possibility is that they believe that refiners are in fact quite capable of increasing refinery output, and would willingly do so if it were just a little more profitable. But I know this can’t be the senators’ thinking because, if they believed that, they’d be aghast at the idea of a windfall profits tax.

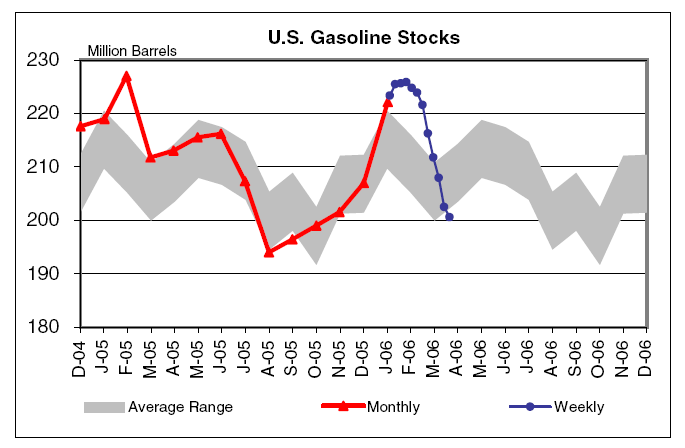

A second possibility is that the temporary nature of the tax cut provides a particular incentive to sell gasoline now rather than in the fall, so that perhaps we could get more supply to the market by drawing down inventories. It’s true that inventories of crude oil are currently abundant. However, as the picture below from the Energy Information Administration shows, gasoline stocks are a very different matter. Now, there may be some subtleties in interpreting just what the incredibly low current values of gasoline stocks may signify. But does anyone honestly believe that our senators have made a careful investigation of these issues and concluded that current gasoline inventories are way to high and can and should be drawn down even further?

A third possibility is that the higher profitability to gasoline sellers would be an added incentive to import gasoline from abroad, though if it were Congress’s intention to provide such incentives, one might think they would have started by doing something about the 54 cent per gallon tariff on imported ethanol that they have imposed. And, if the net effect of diverting gasoline from Europe to the U.S. is that the U.S. Congress forces Europeans to pay even more for their gasoline in order for us to consume even more, I could imagine some people in Europe might be a bit disgusted with us.

And more than a few Americans might be disgusted with us as well.

If the effort actually is successful in reducing the price Americans pay for gasoline, it would do so by increasing imports, worsening the trade deficit, and undermining fuel conservation efforts.

So that brings me to the Republicans’ Gas Price Relief and Rebate Act (press release

here, and text here). This is an amendment to the Supplemental Appropriations Bill, cosponsored by Senators Pete Domenici (R-NM), Ted Stevens (R-AK) and Chuck Grassley (R-IA). The Republicans propose to cut through the fog and simply hand each taxpayer an extra $100 when they file their 2006 tax returns, to help pay for gas or whatever. This bizarre proposal raises in stark terms another rather glaring issue for either the Democrat or the Republican plans– whose money is it that is supposed to pay for these nice gifts to the taxpayer-voters?

To be sure, both the Democrats and the Republicans purport to have an answer to this obvious question. Menendez’ amendment claims it would be “funded by repealing three unnecessary tax breaks currently enjoyed by oil and gas companies, and also eliminating royalty relief and other production incentives enacted last year as part of the Energy Bill”, while Domenici’s press release talks more vaguely about repealing “tax incentives for oil companies.” This is a favorite game played by the politicians, to pretend that measure X is to be paid for with tax Y. But this is always a complete fantasy. The only kind of money the government collects is green. It all goes into a big pot called revenues, and all comes out in an even bigger fountain called spending. Pretending that revenues Y (and none of the other revenues) pay for program X (and none of the other spending) is simply a ruse to try to convince voters of the worthiness of raising revenue through Y or the relative affordability of spending on X.

If Democrats or Republicans have any proposals for raising additional revenue, either through Y, or Z, or any other means, let’s put them on the table on their own right. Even if we pile up everything anyone has suggested for revenue, with no additional spending and no new other tax cuts, deficits will be increasing as far as one can see into the future. There can be no question that, in the current environment, the fiscal source of a marginal dollar of spending on X or new tax giveaway is more government borrowing.

You have to admire the way Mish carries this to its logical conclusion:

How can anyone possibly think that “free money” can be given away with no repercussions? What planet are our senators and congressman from anyway? Isn’t the national debt big enough already? If not, why stop at $100? Heck, why not give every citizen in the country $100,000?

I see no alternative but to call these energy proposals for what they are: a blatant effort to bribe the voters, based on the assumption that the voters are too stupid to recognize that they themselves will foot the bill for the bribe, with interest.

Come to think of it, that also seems to be Congress’s plan for dealing with Medicare and Social Security.

Technorati Tags: gas prices,

gasoline prices,

gas tax

I agree with your stance on the gasoline tax break, unsurprisingly as I’d want the gas tax raised to $5 per gallon.

You haven’t put numerical estimates of what would actually happen into your discussion.

In my opinion, a tax holiday of 18 cents for 60 days would cut US gasoline prices by close to 18 cents and result in only a tiny increase in gasoline imports. US gasoline demand is very inelastic, so the extra demand generated by prices that are $2.80 instead of $2.98 for two months would be tiny, probably around 0.1% of the roughly 550 million gallons of demand in those 60 days, or of the order of half a million gallons. Most of that could come from stocks. A hundred thousand gallons from domestic stocks, 0.3 million from international stocks and 0.1 million from increased production (both domestic and international) would then do. An extra cent per gallon for US spot whole sale prices should be enough to incentivise that, and the impact on the trade deficit would be around 30-40 million Dollars.

I agree with your concluding sentence, but I think that the increase in gasoline consumption, imports and the trade deficit will be minor, while the price impact for the consumer will be very visible and obvious.

I agree with Heiko.

In particular, I think it is misleading that you show demand as being more elastic (less steep) than supply. In the short run (which is the timeframe of the proposals under discussion), demand is surely as inelastic as supply.

As an intro econ prof, can I please ask you folks to refer to an increase in the quantity demanded (not an increase in demand) when the price of gasoline drops?

Heiko, how can the U.S. obtain 0.3 million gallons from international stocks without that meaning an increase in imports?

EclectEcon, thanks, I’ve corrected that.

Excellent. When the Democrats talk about tax breaks for consumers of energy – they should be asked two things: (1) why are you promoting breaks that will benefit mostly suppliers; and (2) how will you pay for them, that is, what taxes will have to be raised? Of course, we can ask the same questions of Republicans except for one thing. Republicans must believe there is some sort of magic money tree given their propensity to raise deficits without concern.

i think the amusing thing in national politics is that while markets, and even free markets, are championed nonstop … when something like this comes along there is sudden unanimity as everyone looks to government. this is obvious, a banal observation perhaps … but i can’t help making it.

i guess i expected some people to show this kind of cognitive dissonance, but to see everyone caught up in it is shocking.

really nobody on the national scene has said “these are the prices, it’s up to you, the consumer, to decide what you do about them.”

i think maybe maybe the political “free markets” sound-bite has a somewhat more confused meaning than i thought.

Agreed. Politicians are pandering.

We’d be better off if politicians would not do this. But we’d also be a lot better off if the power centers who create the terms of the debate would not pander. E.g. take a look at the WSJ opinion page. Or TCS, which you reference. These organizations don’t pander? They are fact based? I don’t think so. I find them to be ideologues as well, particularly when it comes to an honest debate about the concept of limits and exponential growth.

This is the problem in my mind. Social security. Medicare. These are embedded in an ideological environment in which an honest discussion about limits cannot take place. Because people don’t want to hear about limits. They want to listen to Julian Simon pontificate about the unbounded bounty that human ingenuity will produce.

Until humans accept limits, until I see honest discussions of the real implications of economics, which I think should be a subset of biology (in an ecological economics sense), I don’t see much progress. Until we reach those limits.

The problem is much broader than pandering politicians. They are just an easy target. Everyone wants something for nothing and the WSJ opinion page and the cornucopians of the world are more than happy to ensure an honest dialog doesn’t take place.

i’d say “pragmatism” rather than “limits” just because it isn’t limits across the board. we’ll probably have higher bandwidth in 10 years … but more expensive energy

Odo: I agree in general.

But limits must be discussed. Economics is about limits. It would not exist as a study if not for limits. We’d all be in nirvana and limits, as a concept, would not exist.

Science itself, is the study of limits. Some people miss that. They think of science as the study of unbounded opportunity. But science at its core is about limits. The speed of light is a limit. The laws of thermodynamics are limits. Experimental physicists are really searchers for limits, set by nature.

In the political and economic realm, a discussion of limits will show that some quantities are relatively unlimited.

The key problem, as I see it, is that there is a large segment of the intellectual community, particularly in the libertarian and conservative community, that is not willing to discuss limits. It is off limits, to play on words. Why? Because it is counter to their sales pitch. They are selling a concept, or social organization, and to make that sale it is important for them to ensure that discussions of limits are kept off the table. Their arguments, their entire success, in fact, is based upon unbounded growth.

Look at the health care debate. Kling, who JDH references, is coming out with a book that discusses choice as an important means to control health care costs. Great. I’m with that. But here’s the problem. I’ve looked a bit at this issue, at medicare, and most of the expenses seem to be consumed by a small percentage of the people. Enormous expenses.

Solving the health care problem will, in the end, require telling someone “sorry, there is noone to pay for this procedure.” That is the complain free-market folks use to argue that, for example, Canadian health care is bad. Lines. Limits. Time delays.

Yet, other than efficiency, limits are the only solution. Saying no.

So while I agree with your general point, I think in fact there still needs to be a serious discussion of limits. And hopefully some adults will stand up to engage in it.

My take is that an increase in gasoline taxes does seem warranted. The US government expends quite a bit of resources and human lives to maintain the global oil infrastructure for the use of US citizens and businesses. I think it far for gasoline to support part of that cost. And global warming is starting to look to me like a real and expensive externality of fossil fuel burning.

T. R. Elliot, you wrote:

This is the problem in my mind. Social security. Medicare. These are embedded in an ideological environment in which an honest discussion about limits cannot take place. Because people don’t want to hear about limits. They want to listen to Julian Simon pontificate about the unbounded bounty that human ingenuity will produce.

I doubt Julian Simon claimed that human ingenuity was so unbounded that we couldn’t squander it all. Besides he has been dead for some years and is currently unable to pontificate. I think his point wasn’t so much that we have or don’t have limits, but rather that it was a terrible idea to artificially set limits. For example, there’s no point in artificially restricting human fertility in the developed world or regulating the consumption of most resources.

Karl: I concur that Julian Simon did not believe in the regulation of resources and that, all things considered, one has to have a good reason to do so. It all comes down to who chooses. Some remote person or organization–or me. And I’d always rather choose me.

That’s the upside of the libertarian argument. I support it. The down side is the tragedy of the commons. I really believe Julian Simon did not believe in it–the tragedy of the commons, in other words. The way Simon spoke, he truly believed that the human mind was a font of unlimited plenitude. I see no other way to interpret his statements. He believed that ideas are not limited by any physical constraint, and that ideas will always overcome any physical limits.

Though Simon is dead and no longer pontificating, I believe that this central idea is at the heart of the debate. Are there limits? Julian Simon and the many who follow in his footsteps do not talk about limits. E.g. when it comes to energy, they hold out this carrot: as energy prices increase, the market will discover another cornucopia just beyond the rainbow.

Maybe. Maybe not. They argue through weak analogy, a few historical examples.

Limits is the key issue. There is no cornucopia. There is no unbounded exponential growth. Julian Simon did not believe this. And it makes a great sales pitch.

So going back to JDH’s original post. Americans believe they have a right to cheap energy. And there are hordes of people in positions of powereconomists, politicians, pontificatorssupporting that belief. They are all to blame, not just the politicians who are acting out one small part of this larger drama.

What will happen if we reduce gasoline taxes?

It’s always dangerous to disagree with the brilliant and insightful combination of James Hamilton and Arnold Kling. But here goes. Both of them propose that the market price for gasoline will not fall substantially if the federal government eliminates …

Maybe. Maybe not. They argue through weak analogy, a few historical examples.

I don’t know if 5000 years of history really qualifies as a ‘few historical examples,’ but set that to one side. Energy is unusual as commodities go in the totally stupifying amount of it that is out there. There is as much energy as we are going to need for a very long time in the solar constant, or the atmosphere (esp. at high altitudes), or the ocean (temperature gradients), or the geology (ditto), or in the various solutions of U-235 in both the geology and in the ocean. let alone in all of them combined. Our infrastructure is wildly inefficient on every level (only 15% of every barrel of oil that is made into gas is translated directly into tires pushing on roads). I’m not even going to bother talking about coal. And of course fifty years or so from now — almost everyone in the business has a lower estimate, but let’s be conservative — fusion will be coming along.

I understand totally that there is a transition issue and that it will be difficult. But that’s all it is: a transition issue. Energy costs per joule have been declining for a very long time, and as bumpy as the next few decades might be, once they are cleared it is very hard to see any reason why the long-term trend should stop. Ever. (The fusion I am assuming as being fifty years out is far from the best possible form of the process.)

And given enough energy there really aren’t any commodity problems that aren’t soluble. Of course that doesn’t mean we won’t have problems, but they won’t come from running out of stuff, unless you count as a case running out of intelligence.

If you were to argue that we have reached “Peak IQ” and are trending down I would be hard put to disagree.

Fred: 5,000 years is a drop in ocean from the perspective of evolution and a particular species. That is one of the reaons that I say, in a loose sense, that economics is a social science–as JDH agrees–and more generally, social sciences are part of biology.

In that 5,000 years, there are only a handful of energy transitions. What? Five. Ten at most?

Any investor knows: past performance is not a guarantee of future results. I take that to heart when I consider issues.

With respect to the universe and energy, I agree. I’m currently reading the scientific american 1970 edition on energy, to see what they have say. Freeman Dyson discusses your perspective, with which I agree, in the sense that there is a lot of energy in the universe and that we use it inefficiently.

But those generalities have to be quanitified. Or we just play the game of “things will probably turn out well, because they have in the past.”

Fusion is very very unlikely to happen. Uranium is a very limited resource. Unless breeder technology can be developed, Uranium will have the same problems as oil. Prices, in fact, have been jumping along with other commodities. China is grabbing uranium.

I’ve long studied science, philosophy, the history ideas, etc. I’m aware of the mistakes made by Kelvin when he announced that the future of science is the fifth digit. Then a revolution occurred. But I’m also congnizant that humans, in the realm of physics, have reached some hard limits. Theoretical physics, for example, may become speculative philosophy because the energies required (e.g. colliders the size of the solar system) will be required to answer their questions.

Efficiency, as I mentioned earlier, is one solution, and nanotechnology as an example can buy us something.

But the fact of the matter is: there are limits. Medicare will die because we cannot afford to provide the best health care money can provide to the growing elderly population. That is THE problem. We can’t afford it. And it won’t happen. That is a limit.

Price itself, I believe (I’m thinking off the top of my head here) is itself a measure or metric of limits in operation.

As Sheldon Schultz, a professor of physics I had at UCSD always drilled into us: you can’t get something for nothing. What’s the price you pay.

There are limits. It’s a matter of how we operate within them. And unfortunately the american electorate has been told that cheap energy is a right, that there are no limits when it comes to energy. This miseducation will make it more difficult to implement sensible policy.

In a more general sense, the politicians are simply acting out roles that have been defined for them by the larger architecture of ideas within society, pressures that I think are created by the inability of those within the free market community to honestly talk about limits.

Like I said. Nobody wants to talk about limits. It’s not a marketable idea. We’re too obsessed by the unbounded. Yet families, communities, societies, eco-systems, etc are just as defined by limits.

It’s a tiny increase rather than no increase at all.

My main point was that the 18 cent will be very noticeable at the pump (say by looking at the differential between the average US price and the average Canadian price), and the import increase will be so tiny, because of demand inelasticity, that it’ll be hardly noticeable virtually no matter how you mine the data.

I agree with your general point, but we don’t do ourselves any favours by talking about these effects on imports or gasoline conservation (or what terrible things it’ll do to European gasoline prices), when this specific measure will have negligible effects, aside from setting the wrong example, costing the US taxpayer some money and temporarily lowering US gasoline prices by 18 cents.

Fusion is very very unlikely to happen.

What, never? Nonsense. Anyway the Joint European Torus reached break-even — better than breakeven — years ago. That’s done. The function of ITER is to find the right design and materials to keep break-even going long enough to make a practical reactor. In many industries that not even be considered research, but development, though of course that would be over-optimistic here. While you can never be sure of anything, not many people think something is going to bite us on the tail at this late date.

(Note one of the easy-to-miss benefits of doing work in energy physics in this day and age: you get to run humongous simulations. In fifty years — not that I think this will be necessary — you’ll have so many cycles at your disposal that you’ll be able to force the machines to design themselves if you want.)

Uranium is a very limited resource. Unless breeder technology can be developed, Uranium will have the same problems as oil.

This is a common assertion but like many of the species completely wrong. It is true that the amount of uranium in the world at the current price level is limited. But the cost of fuel in the nuclear power cycle, specifically the cost of extraction, is nugatory. You can increase the cost of extraction by a factor of a hundred — especially at current energy prices — and still make money. If the industry has to go to granite to get its uranium atoms it won’t even notice. If it has to, it can go to seawater. See for instance: http://www.americanenergyindependence.com/uranium.html.

Health care is a more complicated case, and here I think you might well be right.

T.R. Winners will continue to see opportunities and provide solutions. Winners see health provision as an opportunity, retirement planning as an opportunity, energy and transportation needs as an opportunity. While losers sit around and lament the challenges, opportunists will capitalize. They’ll do it during an economic boom and during a recession. Some people will suffer as they have throughout history, others will benefit as they have throughout history. Hanging out with the people who believe they can make things better is a much more fun way to spend your LIMITED time than worrying with those who think they can’t.

Fred:

I’m aware of ITER. But there are no practical plans or path for fusion to provide viable energy in the next, what, fifty years. The joke in the fusion community is that fusion energy is always 50 years away. The same joke exists in the breeder reactor community. The fact that I don’t currently see them as viable energy sources right now doesn’t mean we shouldn’t pursue them. But I’m not going to replace reality with wishful thinking. The wishful thinkers believed fusion would be a reality by the year 2,000. It isn’t.

There is a lot of uranium. One lesson I learned from Youngquist’s Geodestinies is that Uranium, unlike some other metals or fossil fuels, is not located in high densities in a few places and then rare elsewhere. It’s spatial distribution function is less sharp (perhaps a way to say it). So supplies will never drop off sharply. The supply/demand relationship will be smoother.

That said, there are practical, economic, and political complications to even going forward with simple fission power. Economic includes the rising price of uranium, the disposal of waste (civilization is 10,000 years old, fissile products last a hundred times that).

I don’t believe fusion will happen by 2050 in any practical sense. I’m not sure about breeders in that time period. And I think scaling up nuclear will happen but will also prove to be very expensive. A limit of sorts.

Rick: “Winners” and “losers” don’t see like the right words. I think “manic” and “depressive” are more appropriate to what you are describing. And I’m not arguing for either.

My experience has taught me that (a) the consistent winners are those who understand the resources they have to draw upon and then use them wisely, as well as (b) there are not a few winners who are just plain lucky. But you prove my point well in agreeing that time itself, for a particular person, is limited.

The point I’m making though is that the politicians themselves are operating in an environment in which a discussion of limits is not possible. You are right. It’s more fun to hang out with manics. The depressives are–well depressing. Though hanging out with manics is also depressing, because at some point manics do something stupid.

I’m not arguing for a lack of idealism, nor optimism. I’m saying there needs to be an honest debate about the real tradeoffs that exist. I had this debate (in email) with Stephen Moore maybe two years ago when he wrote an article on oil prices. He responded, based on no facts, that oil would be back to $30 soon. He told me to go read Julian Simon. He’s now at the WSJ opinion page creating more nonsense and oil is over $70.

What I’m saying is that people like Stephen Moore are also part of the problem. Not just the politicians who are pandering in an environment created by manic thinkers trying to sell their particular programs (e.g. free markets). I’m not against free markets–I’m against the manic thinkers unwilling to look at cost benefit analysis.

I see your point now, Heiko. I agree with you that if consumers pretty much ignore the price, my concern about the demand effects would not have much bite.

From the EIA figures, U.S. gasoline use in Sept.-Oct. 2005 was about 10 million gallons less than it had been in Sept.-Oct.2004, or 20 times as big as the effect you analyze. I see the potential for an even bigger impact on the quantity demanded in the current situation, as people are more likely to view the current prices as a permanent signal.

In my opinion, Congressional moves like the ones we’re discussing have the potential to have an important effect on demand, in part by setting a very different psychology and expectations. This is one of the reasons that I’m upset about these proposals. But I agree, if the Congressional actions have only negligible consequences for demand, there would be less reason to criticize them.

amusing that you talk about health care while i’m off at kaiser getting my stitches checked …

i think the pragmatic thing is to understand the many technologies we have, and look for opportunites within them. we can certainly also fund r&d, but it is not pragmatic to count technology chickens before they are hatched.

it’s sad that the single best (low cost and available) technology set, improved efficiency, is so resolutely ignored in the national conversation as people repeat the “alternative fuels” chant.

from a pragmatic engineering standpoint efficiency is here, and doesn’t need to be hatched. unfortunately talking about efficiency leads people to think about lifestyle changes as well … a political dead zone.

so we pretend that “alternative fuels” will be hatched to save us.

ok, maybe that is slightly unfair – hybrids are catching another lift on the political front. i still see them behind “alternative fuels” in the concersation though.

Demand would rise in the last weeks of the taxholiday. I will fill my car if i know that gas will be 18 cents more expensive next week.

I would suggest that the interaction of the various incentives and disincentives in the tax system make it impossible to project actual changes in demand and supply when changing one variable. For example, having given SUV and light truck owners a tax break to buy their vehicles, we hope that higher fuel taxes will make them change their minds and buy smaller cars; but wait, we will now take off the gas tax, but only for a while, so maybe they don’t have to change after all. Meanwhile we will encourage corn growers by subsidizing ethanol, except that now it doesn’t need to be used because of transportation and refining bottlenecks. Does this remind anyone of Soviet style five year industrial plans? Can we expect the results to be any better?

“Voter Bribery” is right. That is all these politicians are doing. I would love the tax break but what happens after 60 days? It goes right back to where it was. We need real solutions and we need them fast.

Sammy: Unfortunately there is no real solution, particularly no fast solution. To the merit of the current administration, they’ve been honest in saying that there are no short-term solutions, though they are also trying to appear to be doing something. For better or worse, the political process sometimes requires (a) doing something that needs to be done or (b) looking like you are doing something in order to let off some pressure or steam. And I’m serious about point B. Though from what I’ve gathered, people are calling those proposing the $100 rebate and telling them it’s pandering. So that is good.

But there really is nothing the government can do short term (next few months) or middle term (next few years) in my thinking.

The only way the govt should intervene is if they truly think some form of collusion or manipulation is taking place in the oil biz (I doubt it but you never know). The other reason: if the gov thinks it can change behaviors or smooth out the transition to higher energy prices. I think we might have had that chance twenty years ago. It’s not clear that chance exists any longer. And a final intervention that could prove useful, one I’ve mentioned here long ago: rationing through some form of credit that can be traded.

I think what the govt could do immediately, if anything, is to follow the advice of Richard Smalley: race the tax on gas a nickel and apply directly to R&D to explore alternatives, nanotechnology, superconductivity, etc.

And perhaps, on a more local level, an attempt to put into place alternative transportion schemes, whether that be ride sharing or otherwise. But that should really be performed at the state level if at all possible. That’s all we need is a subway system in Kansas that isn’t used and only exists because the federal funds were divied up.

In summary, I’m in agreement by and large with JDH on this issue. Let the market work the issue right now.

An Economic Analysis of Gas-Pricing Policies

James Hamilton, the Econbrowser, has a very succint and superb analysis of proposals to help consumers deal with the rising gasoline prices. Anyone who has studied the rudime…

While this was an insightful discussion, I think J.H. greatly underestimates the steepness of the short-term real-world demand curve for gas. A steeper demand curve would better model the actual situation which is that demand doesn’t change much in energy (especially gasoline). Thus I think most of the tax cut would indeed get passed on to consumers, having the desired effect.

But it’d still be stupid, because the whole point is that making the long-term adjustment to lower gas consumption will be painful. One cannot avoid the pain and also reach the goal. In fact, the pain can only be offset to the future, when it occurs at probably some premium to its present value…

Short term solutions will only make the situation worse in the long run.

We need long term answers including greater domestic drilling and exploration and more alternative sources such as nuclear and ethanol. None of these is a magic bullet but taken together they offer some hope.

Shakes head. Sighs.

I think JDH is being more than a bit unfair when he characterizes these two proposals as representing their two party’s positions with regard to energy issues. Menendez is a minor player, a senator for only a few months, most likely you have never heard of, who proposed an amendment that has absolutely no support from other Democratic senators and absolutely no chance of even being considered. On the other hand, the Republican proposal is co-sponsored by veteran senators and committee chairmen Domenici, Stevens and Grassley and endorsed by Majority Leader Frist who controls the senate’s agenda. It is intellectually dishonest to suggest that Menendez represents the Democratic position when Democrats have fought for CAFE standards, efficiency standards, alternative energy research, and energy conservation programs and been thwarted at every turn by the Republicans.

Joseph: Let’s face it. The republicans have largely been in cahoots with the cornucopians who give me such heartburn sometimes. Many of the pundits and talking heads, e.g. the reference to Kling and his article above, areat bestgoing to do the Fox news type fair and balanced thingin other words, totally imbalanced. My opinions often get people riled up, but I look at things like the following: Stephen Moore now runs the WSJ opinion page. I see people like him as part of the problem. Now, are the pundits who are trying to make a name for themselves writing for sources such as TCS, WSJ, or Fox going to give us a proper perspective, e.g. tell us that in fact the Stephen Moore’s of the world might be a bit confused, that in fact we may be facing an energy crisis. I don’t think so. Not if you want to write articles for the WSJ opinion page. It’s a little club if you ask me. And they are part of the problem, creating an environment in which unreality goes unchallenged. Moore spews nonsense sometimes. I suspect people are simply afraid to call him on it. That’s why I said earlier we need more adults. They are in short supply.

Gasoline Update: Politicians Pander Over Events They Cannot Control

Lynne Kiesling An update from others who have been writing about gasoline prices while I have not: Jim Hamilton at EconBrowser about political pandering over gasoline taxes (there’s a shocker …). Tim Haab and John Whitehead are on a roll…

I hope you’re right, Joseph. But the Republican plan is so loopy, I could easily imagine the Menendez proposal gaining traction.

Actually, in today’s news it turns out that Frist is backing off on his proposal because of negative reaction — oops, just the part where he was going to finance it with reductions in oil company tax subsidies. The part about the $100 is still there — with no revenue offsets. The negative reaction was from the oil companies. Is there any clearer sign how far in the bag the Republicans are to the oil lobbyists?

You can see the official Democratic proposal at Senate Minority Leader Harry Reid’s site. He wants to remove the oil tax subsidies from Cheney’s pork laden energy bill from last year. Seems like a reasonable thing to do in light of record oil profits. It would also remove distortional incentives from the market.

Oh, now it gets even better as Frist furiously tries to tap dance to the tune of the oil lobby. Frist’s new plan is to pay for the rebates by opening ANWR to drilling. Even if this were approved tomorrow we wouldn’t see a dime of revenue for at least 5 or 10 years.

Joseph, removing some of the subsidies from the Energy Policy Act of 2005 was also proposed by the President last week. This is another example of why I resist claims by any politicians that “program X will be paid for by reducing the Policy Act subsidies,” because, some reduction in the subsidies is going to happen regardless of whether we implement X, and we need all that, and a good deal more, just to make progress on the existing deficit.

I absolutely agree that the subsidies need to be removed regardless, but I’m not so sure more than token changes will be made after seeing Frist’s disgraceful fawning performance yesterday.

But where was the President last year when his egregious energy bill was passed? Oh, yeah, his approval ratings weren’t in the toilet just yet, so he didn’t care. That bill was the output of Cheney’s secret energy task force which was written by the oil and coal lobbyists. They had been fighting to get their dream bill passed since 2001 and it must really hurt now that the Republicans realize that they might be forced to backtrack ever so slightly.

Joseph: Give the republicans some slack. They’re busy with important stuff right now:

Sen. Lamar Alexander (R-Tenn.) introduced a resolution yesterday calling for “The Star-Spangled Banner” and other traditional patriotic compositions to be recited or sung solely in English.

The resolution states that the national anthem, the Pledge of Allegiance and other “statements or songs that symbolize the unity of the nation ? should be recited or sung in English, the common language of the United States.”

Senate Majority Leader Bill Frist (R-Tenn.) co-sponsored the bill, as did Senate Majority Whip Mitch McConnell (R-Ky.) and Sens. Johnny Isakson (R-Ga.), Pat Roberts (R-Kan.), Jim Bunning (R-Ky.) and Ted Stevens (R-Alaska).

Now, isn’t it interesting that Bush has a reputation for singing the national anthem with Spanish speakers in that dreaded language of Spanish (which, by the way, as languages go, is a lot more sensible from a pronunciation perspective than that mongrol English that is taking over the world).

There is a word for what is going on. It starts with Cluster.

Congressman Mark Kennedy (R-MN) has now also endorsed a proposal similar to that from Menendez.

Good point T.R. Shouldn’t we just be glad someone wants to recite or sing our national anthem regardless of the language chosen?

America became a nation because we couldn’t stand the tea tax or the stamp tax. We fought King George because he was a tyrranist only interested in taking out of our pockets what we worked hard to put into it. Now it is 2006, and our own “brothers” are acting as King George of old. Here in California this greed, this malicious attempt to skim for oneself a life of ease off of the skin of others less fortunate has spread; gas is the highest in the nation. Rent has more than quadrupled. Housing prices are unfathomable to an honest person. Movie tickets are $10 a show. Who wants this arrogant tyrrany to spread nationwide? And what about the farmer who must now give way to bio-tech farmers? The list goes on, my friends. We are living in pre-revolution Russia amongst the Bourgios. And NO, I am not communist. I believe in what our founding fathers gave us. When in the course of human events it becomes necessary… when a long train of abuses and userpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their DUTY…

Let’s stick to our unaliable rights, as John Locke wrote them. “Life, Liberty, Property.” The pursuit of hapiness is nothing without these three being untampered with. Anyone with me?

Well, we are getting a bit off track, but here is Bush and pop star Jon Secada singing the National Anthem in Spanish at his first inauguration. Today, with his approval ratings sinking, he’s suddenly thinks this is unamerican.

It just goes to show that with mid-term elections just around the corner we are entering silly season. Politicians will say and do anything that they think will get them re-elected. Let’s just hope they can’t do too much harm before November.

Yeah, we’re running into the weeds a bit, but the additional examples of pandering are pertinent to one theme of this post.

Dan Bednarz brings up a point I’ve raised in this thread in the following energy bulletin:

Precautionary Priciple

in which he states

In the first three chapters of Kevin Phillips? new book, American Theocracy, he indicts the federal government for failing to forthrightly inform the public about our energy situation. Philips writes, ?The political establishment?s reluctance to acquaint the American electorate with this dilemma involves three particularly glaring problems:

(1) unwillingness to speak of the present oil crisis in the full context of geological, economic, and military history;

(2) failure to understand the past vulnerability of great but idiosyncratic national energy cultures [like England relying on coal] losing their familiar footing; and

(3) refusal to discuss the evidence of oil-field depletions and insufficient new discoveries that shows petroleum production moving toward an inflammatory worldwide shortage??

I believe he is right to draw these conclusions. But governments, especially large ones, are not unitary rational actors.

This goes back to my point that the pontificators who bring economic arguments, education, and backgrounds to their roles as pundits and leaders of media and think tanks have a responsibility to honestly discuss energy. I find most of them unable to do it unless backed into a corner when they are clearly shown to be wrong. I think they fear that a single step in the direction of discussing limits is a full-fledged surrender to the forces of dystopia, negativism, and birkenstocks.

Markets should be allowed to operate as freely as possible, but neither they nor the government can do magic. Which is odd: many of them claim to be economically literate–in other words scientists, yet are unable or unwilling to discuss limits.

That’s when they become theologians, advocates, and politicians.

We have freedom of speech for Senators too! Unfortunately, they too often use it to prove their insincerity and ignorance.

Remember when George McGovern was running for president in 1972, he promised, if elected, to send eveyone a $1,000 government check in the mail (GCITM). He was rightly and robustly ridiculed for that campaign puffery.

The only good thing I can say about the Republican proposal for a gas GCITM is that it an order of magnitude smaller than McGovern’s proposal.

As to uranium supplies, the rather sudden expansion of new nuclear projects has created a bit of a run on existing uranium supplies. There are PLENTY of ore bodies known and awaiting exploitation – they just needed someone willing to lay down money on the table (probably not “demand”) to make them worthy of investment. We quit exploring for uranium decades ago and have a rather large backlog of resources for a heavy metal.

WHY OIL TAXES SHOULD GO UP, NOW DOWN

We spill some coffee at Josh’s place. The tantalizing thing about the oil biz (via Andrew Samwick) is the elasticity of supply. In other words, the percentage change in quantity supplied in response to a one percent change in price….

Example of federal dollars at work:

Railroad to Nowhere

Hence my desire that transporation issues be handled as locally as possible. Otherwise we pork-portation, not trans-portation.

Well quite a response to this one. I live close enough to work and school that I can walk, and do. The increasing price of gas doesn’t affect me that much, although it may eventually free up some parking spaces on campus 😉

And I don’t really need the money (my student loan rates are even below current bond yields), but I can imagine a few folks who could use a federally sponsored credit card payment ;). The interest rate’s bound to be lower than what they push on college students around here!