U.S. gasoline prices are again moving quickly up. Some of the politicians who are looking for a scapegoat might do well to look in a mirror.

|

After holding fairly steady since November, U.S. gasoline prices started rising quickly in March and are up 40 cents a gallon over the last six weeks. What gives?

Crude oil costs are by far the most important determinant of retail gasoline prices, and crude has exhibited about the same 20% increase as gasoline over this period. I hope to discuss the causes of the resurgence in crude oil prices in a later post, but let me just say at this point that I don’t believe there’s much that anybody in the U.S. could do to change the price of crude oil over the near term.

But it also appears that U.S. gasoline prices may have received an extra boost from some factors that are uniquely American. Certainly there is the seasonal component to which we’ve grown accustomed, as the refineries gear up for the summer driving season and the transition from winter to summer fuel requirements. The National Association of Convenience Stores argues that this has become a much more dramatic annual phenomenon since the reformulated gasoline requirements took effect in 2000. And in a memo put out this February, the Department of Energy warned that the problems were likely to be particularly severe this spring:

In 2005, a number of petroleum companies announced their intent to remove methyl tertiary-butyl ether (MTBE) from their gasoline in 2006. Companies’ decisions to eliminate MTBE have been driven by State bans due to water contamination concerns, continuing liability exposure from adding MTBE to gasoline, and perceived potential for increased liability exposure due to the elimination of the oxygen content requirement for reformulated gasoline (RFG) included in the Energy Policy Act of 2005….

The rapid switch from MTBE to ethanol could have several impacts on the market that serve to increase the potential for supply dislocations and subsequent price volatility on a local basis. These impacts stem mainly from:

- Net loss of gasoline production capacity

- Tight ethanol market, limited in the short-run by ethanol-production capacity and transportation capability to move increased volumes to areas of demand

- Limited resources and permitting issues hampering gasoline suppliers abilities to quickly get terminal facilities in place to store and blend ethanol

- Loss of import supply sources that cannot deliver MTBE-free product, or that cannot produce the high-quality blendstock needed to combine with ethanol

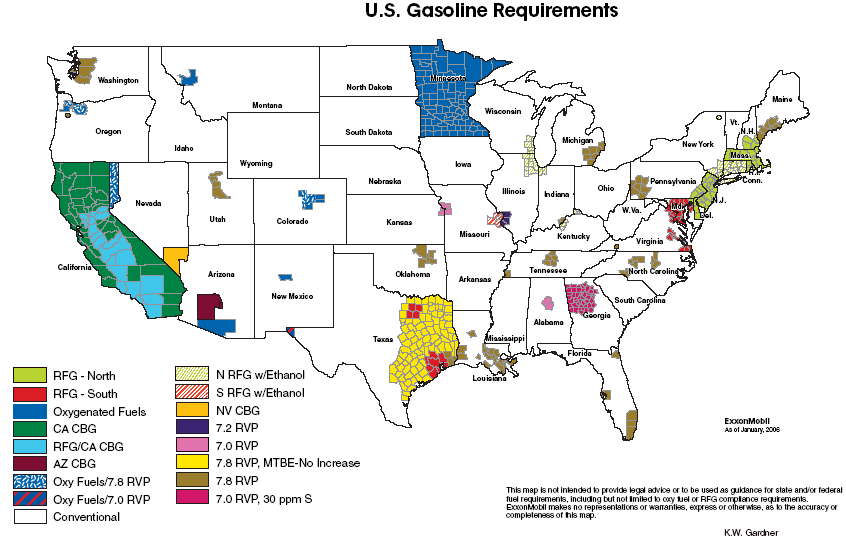

These legislative changes threw new disruptions into the process of gasoline refining and distribution, while the Energy Policy Act of 2005 failed to resolve the patchwork of conflicting fuel standards. Each color on the map below indicates that a different type of fuel is required by law to be sold in that county, requiring specialized facilities for producing and delivering that special fuel type, and producing a particular burden on the system in trying to cope with the transition from MTBE to ethanol.

Have geographic imbalances between types of crude available and the particular refineries capable of receiving that crude and refining it into the locally mandated fuel played a role in this spring’s adjustment problems? One indication that they may have comes from a story I saw noted by the Oil Drum and carried in Montana’s Billings Gazette and Colorado’s Rocky Mountain News, but that I have seen little discussed elsewhere. If you look, for example, at the price that Plains All America Pipeline has offered to pay for crude oil at different locations, a grade like North Dakota’s Williston Basin Sweet was selling for a $6 discount relative to West Texas Intermediate one year ago. Today, the discount stands at $19 a barrel, and reached as much as $26 last month, when producers were practically giving Williston Sweet away at $30 a barrel.

The Rocky Mountain News noted this contributing factor:

Colorado’s only two refineries, which are in Commerce City, are buying just 30,000 barrels of crude per day from producers, two-thirds less than its typical purchase of 90,000 barrels a day. That’s because one of the refinery units caught fire in December and had to shut down temporarily.

The refineries also went offline for scheduled maintenance earlier this year. They are expected to restart at full capacity before the end of March.

I would be curious if any readers have more light to shed on this. But my current reading is that the issue of inadequate refining capacity and matching refining capabilities with specific local needs, although not the biggest factor in gasoline prices, is the one thing that Congress could actually do something to improve, and one thing that Congress actually made worse with the Energy Policy Act of 2005.

So whom do you think that the politicians are going to blame? I’m betting it’s not going to be themselves.

|

Technorati Tags: gas prices,

gasoline prices,

Energy Policy Act of 2005,

refining

The fuel formulation issue seems like it should have been the easiest to solve. That seems like a textbook example for regulation of interstate commerce. They require high oxygen/low oxygen fuels and hot climate/cold climate fuels. Combining these two requirements should result in at most four formulations.

Cheney and his energy task force spent five years on his energy plan. The fact that this simple and most basic issue was not addressed makes me wonder if it was intentional and that there is some business motivation like limiting interstate competition and protecting regional monopolies.

I’m going to say, as a chemist, that map doesn’t look scary at all. What is not shown is how dynamic a refinery can or cannot be, how “on the fly” a changeover can be made from one region’s fuel to another. Certainly, if the difference is additives, one should be able to push a button and get a differnt fuel out the tap.

Agreed; the map isn’t scary. Honestly, there’s minor variations between a lot of these – so minor that one gas formulation could easily satisfy multiple requirements here. For instance, essentially all of the markets that specify just the RVP of the gas could be served by one high RVP formulation, right? i.e. 7.8 RVP gas satisfies the 7.0 RVP requirement, doesn’t it?

For 20 or so years refining has been a very poor business with returns so low that the industry contracted. Yes, greater environment regulations played a very minor role in this but the impact was insignificant. So now we have a shortage of refining capacity and refining margins, profits are starting to improve and with a lag we will see some expansion of refining capacity. However, this will be limited by the widespread knowledge in the industry that Venequela, and other OPEC suppliers are also building facilities so they can capture the upstream value added.

But the overwhelming bulk of he refining “problem” reflects the extremely cyclical nature of the oil industry and the way free markets almost always overshoot and undershoot. The role of government in creating these problems has been marginal at best.

iran has a problem so does the usa both goverments are bad our problem is exxon and mobil they would have to move up 8 or 9 notchies to reach the good name thief fruad if they could attain these upgrades it would an improvement most of these companys have a real sick need and will never be full they do not understand anything but over priceing to wake then up do not buy thier product there are other companys who sell gas and oil buy from them james

Catching my eye: morning A through Z

Here’s what’s caught my eye this morning:

The Euston Manifesto that Norm Geras posted about last week is beginning to draw some attention from the Left Blogosphere. TBogg mocks it. Duncan Black proclaims it wankery. I’ve said i…

Spencer, in my earlier analysis of the refining question, I suggested that at least two more refineries, in Yuma, Arizona, and Santa Fe Springs, California, would have been in operation today if there had not been so much litigation. And are you disputing that the transition from MTBE to ethanol is making an additional contribution in the current situation?

On April 12, the Wall Street Journal’s Fialka ran an interesting and detailed story that dovetails well with your post. Not sure if this link works, but here goes: link (“Gas Prices to Jump this Summer”).

Good post, as usual.

JDH, the link you provided on Santa Fe Springs says

“All ultimately allowed the old refinery, infamous in its day for having the worst environmental record in the region, to reopen with modern pollution controls.”

We know that deal later broke down in the courts, but how do we (casual readers who I assume have not dug into “the deal” made for those modern controls) know if that is good or bad?

I hope we aren’t reopening plants with the worst environmental record in a region, and a few new controls slapped on, in order to … what, shave a few cents off local prices?

I’m afraid your 08:17 AM groups a lot of things together, and the lack of discrimination in “environmental concerns” is worrying.

Yes, I am disputing your conclusion.

For example, the original request for one of the refineries in AZ asked for exemptions to the pollution control rules. the request was rejected on that basis, but approved with the pollution controls.

The oil company decided to sit on the request for 5 years before resumitting it. After resumiting it they got rapid approval for exactly the same conditions as five years earlier.

so the reaon the Az refinery was not built 5 years ago was the oil company decision not to accept to the regulations they later accepted.

I would say this delay in the refinery was the oil company, not the government.

I’m just replying off the top of my head and did not recheck the original source. so do not hold me to the details, but the gist of my comments are correct.

P.S. I sugget you go to the DEA and look at the data they have on refining margins. From early 1980 to about 2000 refinging margins did not change. During this period the refining industry underwent a massive contraction as Valero bought up numerous small firms they were going under because of the excess capacity in the industry.

I suppose this comment falls into the category of “common good” versus “personal good:” Not picking on JDH, but would JDH take part in a lawsuit against an oil company planning to build a refinery in his neighborhood?

I suspect the answer would be yes. Yes, I realize this is just stating the NIMBY issue. But I grew up adjacent the El Segundo refineries South Los Angeles and frequently was in the vicininty of the Torrance refineries.

All I can say is ugh. An externality of refineries is the loss of value in the surrounding property.

We need refineries. But I can’t but imagine that a large part of the problem in building new refineries is that we regulated the way in which refineries are built (and operate) but don’t regulate the price of that which comes out of them. Hence the classic race to the bottom. The winner is the one who can play dirtiest. Grandfathering and already invested capital make for an unlevel playing field.

China

Has

Its

Needs

As well.

eia.doe.gov’s data only go through Feb. 2006 when the retail price was $2.28 a gallon. It’s interesting that the refinery margin had dropped below 10% of this retail price while the crude oil component was 54%. Yep – let’s blame the world market for crude oil!

Gas is cheap. There wouldn’t be so many vehicles on the road if it were expensive.

Gas is cheap. We’d see more scooters and mopeds on the road if it were expensive.

(I did see two Vespas on Saturday, and one moped today, but that’s compared to a zillion cars.)

We’d see more scooters…

Or not, because of the danger factor.

Commodities are rising across the board, from oil to metals to meats to grains. The price increases are originating in the futures market, of course, but appear to be a general inflation rather than commodity specific. The press releases cite various causes for the increases, depending on which day of the week it is and which major brokerage is feeding the reporters. Mostly, it boils down to a claim that the cause is increasing demand from China, whether the underlying data support the assertion or not. Pension funds, mutual funds, exchange traded funds, hedge funds, individual speculators, etc. have been pooring money into commodities at an unprecedented rate, resulting in an ever increasing upward spiral of prices. Kind of like a game of musical chairs. Where and when it stops, only a few insiders really know. Although I think there is an increased demand for commodities and prices should be elevated, the current rate of increase in prices as well as the absolute price levels don’t seem remotely justifiable.

The recent run up in natural gas prices and subsequent 50 % collapse in a few short months suggests to me that the commodity markets are under manipulation and/or speculative momentum. Prices have taken on a life of their own and are only partially the result of increased demand and constrained supply.

If there is a message, it may well be that the market does not believe the government inflation numbers and that the Fed is going to monetize the extraordinary national debt through inflation. The markets seem to be betting that Dr. Ben and company do not have the resolve, or power, to control the underlyng inflation that has already taken hold.

Thanks for another good post!

The primary reason that refining is a bottleneck at this point is because none have been built in the past 3 decades.

The knee-jerk reaction is to come to the energy industry’s defense and state that this is because of environmental regulations. I disagree with this assessment.

Building a new refinery is not like drilling ANWR; there are a handful of brownfield areas that are ideal for development, with locals more than willing to host a refinery for the jobs it provides.

No, the reason such facilities weren’t built is one or more of the following:

1) because they would be poor investments,

2) becuase the industry wasn’t in a financial position to invest, or

3) because the industry didn’t *want* to deal with making the facilities meet environmental standards.

I work in a newly constructed power plant, and you know what? It’s the same sort of thing: Selling your project to locals and complying with regulations are good citizenship. Why the hell are we giving the refining industry a free pass?

Wow, gas is averaging $2.95 up here in Orange County … $3.00 isn’t looking that far away.

Odo: Take a drive to San Diego. Prices vary of course. But the nearest station to my house is $3.15 for the cheapest stuff.

PS: Just be sure to fill up BEFORE you visit.

You must live in a nice area ;-), as I assume real estate values underlying the gas stations are the largest factor in local variation.

According to GasBuddy the average for the whole San Diego area is $2.968 (at this moment):

http://www.sandiegogasprices.com/

A few comments in response to anon’s points about possible manipulation in the commodities markets:

As I noted a few days ago, the natural gas price changes this past autumn and winter reflected anticipated shortages which did not materialize due to one of the warmest winters on record. In England, where temperatures were colder, gas prices did spike to levels consistent with what the markets were forecasting in the fall. This looks to me like efficient price discovery in a market with a tight supply/demand margin and intrinsically unpredictable weather.

As far as the idea that pension funds and others are rushing into commodities, while this may be happening to some extent it is still recognized as a risky investment for something like a pension fund. And even if investors are moving into commodities, they don’t have to take a long position; unlike in stocks, it is as easy to make money when commodities fall in price as when they rise. If and when investors become convinced that markets are overpriced they can easily bet on prices to drop. Commodity markets also have a tie to reality via spot market prices, which will tend to keep commodity future prices from getting too far away from fundamentals of supply and demand. All these reasons make it hard to justify current commodity prices as purely a speculative bubble.

As for the claim that commodities prices reflect anticipated inflation, JDH has offered evidence against that a few times, e.g.:

https://econbrowser.com/archives/2006/02/gold_and_inflat.html

Nice piece.

I wouldn’t underestimate the impact of the MTBE mess on the potential for higher gasoline prices. Removing MTBE from the market creates incremental demand for about 2 billion gallons of oxygenate, which can’t be filled by ethanol yet and the ethanol produced is all in the wrong places and extremely expensive to transport (rail is the favored mode and to transport 2 billion gallons of ethanol during a season you need something like three years’ additional production of rail tank cars).

Anyway, it’s going to be an incredible mess this summer and it’s way too late to avoid the mess, too.

But prices are even higher in Canada, which doesn’t have an MTBE transition. Is this an obvious disproof of the MTBE/ethanol consensus?

THEY ARE ALL CROOKS. I’m Sorry but when i hear 300 billion to the good in a quarter pure profit from Exxon/mobil, that says it’s going in there pockets. They are probably going over seas and telling the buddy connection, raise prices, so they can come back here and cry about how they need to increase prices. To me it sounds like a violation of the clayton act. The system is rigged. The rich get richer and the rest of us get poorer. Must be tough to get a 444 million dollar retirement pension for being a CEO. They Cry this and that, but it’s all B.S. and always will be. Cause they can do whatever and we can’t do jack.

Canada gas prices are about the same as us. I believe it’s about .95 cent’s per liter. And it takes 2.78 liters to make a US Gallon. So that would make it around 2.641 per gallon.

Canada Ranges From .949 to 1.249 per liter so that would be about 2.638 to 3.472 per Us Gallon.

OOOOPS. my mistake. I take back what i said about canada, I was wrong. It takes 3.78 liters to make a Us Gallon. So the range of .949 to 1.249 would be like paying 3.587 to 4.721 Guess I won’t take the Alcan Highway trip for a while.

Workers of the world!

Who doesn’t hate the oil companies? They’re easy to hate: Exxon Mobil has become the largest company in the Fortune 1000 (at least partially on the basis of rising gas prices), the retired CEO got an unthinkably large retirement package&m…

Gas Prices

We Americans seem to think that it’s our right to always have cheap and plentiful gas. You may have noticed, the price is going up. And as always, we don’t ask ourselves why, we look for scapegoats and quick fixes….

The Canadian Dollar is worth somewhere in the range of .8-.9 to the US dollar over the last year. This, and the fact that the taxes are much higher on the Canadian gas leads me to believe that the base price is about the same.

3 dollars a gallon for gas is incredibly cheap….

Hell, we would be more then happy to pay 4 dollars a gallon…..Here in the Netherlands we are currently paying 7 dollars a gallon…..

We in Europe see it as total comedy when the Americans complain about gas prices!!!

Here’s an online resource for MTBE issues: http://www.mtbelitigationinfo.com/

MTBE removal from market has of course added to the rise in price.coz ethanol is less efficient.It gives lesser energy output than MTBE.Its transportation cost is high and supply is low-so of course u can expect the price to go up.

And you are not to blame the oil industry. They are just following what the federal government asked to do. The law had that anyone who spills gasoline-with or without MTBE-had to pay for the clean up.Otherwise it would go for a MTBE LITIGATION . May be efforts should be put up to find a better substitute to MTBE. Now, with the present situation of the oil companies facing lawsuits, – who does the government and people expect to take up the research to find a substitute better than ethanol???????

Those who dont know anything about MTBE, go check out the site http://www.mtbelitigationinfo.com and gather some info on MTBE.

GET back to my blog http://mtbe.theblog.cc.

Well discuss on anything and everything related to MTBE