Many publications use energy futures as proxy measures for market expectations of future energy prices. Does this procedure make sense?

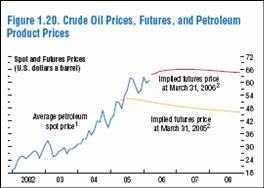

Consider the IMF’s recent World Economic Outlook, which included a figure with futures a year ago, and in March. While futures a year ago indicated some decline, the most recent reading indicate persistently high prices.

Figure 1.20 from IMF WEO, April 2006.

A relevant question is whether futures are actually good predictors of future spot oil prices. The answer is not obvious — for instance, for currencies futures aren’t good predictors. In a paper assessing energy futures, coauthored with Olivier Coibion and Michael LeBlanc, I assessed whether the gap between the futures rate and current spot rate predicts the actual change in the spot oil price. Over the 1990-2004 period, we find that at 3 month, 6 month and one year horizons, regression of actual change on predicted yields coefficients of 1.2, 0.8 and 0.9, respectively. In no case can the null hypothesis of unbiasedness be rejected.

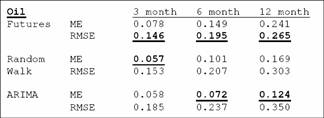

It turns out that in a horse race against a random walk and a simple time series (ARIMA) model, futures do not have the smallest mean error. This outcome is shown in the Table below.

Table 2 from Chinn, Coibion and LeBlanc (2005).

On the other hand, futures do have the smallest mean squared errors. Hence, one could do worse than using futures to assess prospects for oil prices. (See also Wu and McCallum, 2005.) On the other hand, the differences aren’t too great between the futures and a random walk (at 3 month horizon) and an ARIMA(1,1,1) — close to a random walk — at the 6 month and one year horizons, thus consistent with this post by James Hamilton on the time series characteristics of oil prices.

One caveat to this conclusion is that our results only apply to horizons of up to one year. The markets further out on the maturity spectrum are very thin, and the characteristics of these futures are unknown. (For more, see also my colleague’s posts on this subject, in the context of contango and backwardation, here and here).

Technorati Tags: oil futures, energy prices.

Professor Chin – interesting article.

As a commerical grain hedger (I’ll hedge well over 25m bu this year), my perspective on futures prices is perhaps different from that of many others.

Perhaps the reason futures prices are so often used as “indicators of future price” is that there really are no other “easy” sources of this info. IOW, futures prices are used as a proxy simply b/c they’re relatively easy to understand and “see” for those interested in price, but not necessarily involved in hedging – which IS the purpose of the markets.

From where I sit, the price is simply the sum total of knowledge on any given day – tomorrow we’ll learn something new and react accordingly. My trades are done to lock in value relative not to expectations of prices in December, but rather my overall position as it exists today and as is expected to change over time – and how I can protect my risk exposure.

And yes – I do hedge oil as well – truck freight is an important component of my business. I buy crude futures not b/c I “think” it’s going higher, but rather to protect my freight costs *if* it does go higher – I can lock in X freight costs right now and offload my fuel cost exposure to someone else. If it goes down – that’s fine too – what I lose in the futures is offset by gains in lowered freight payments.

Furthermore, when one accounts for spread action due to supply/demand concerns, “price” becomes even more “relative”. Example – N/U corn spreads are running roughly $.11. In my world, this means the market is paying holders $.11 to keep the grain *off* the market – it does NOT mean that corn is in short supply and expected to command a higher price come September delivery. Throw in basis and the equation becomes increasingly murky.

So….I wonder if the use of futures as a proxy for “future values” is simply because they’re easy to “see” for those not involved in hedging purposes?

I think we would expect forward prices not to necessarily be “good” predictors, but “unbiased” predictors.

Anyway, as someone who makes long term commodity price sensitive investments, I think of forward prices as an “opportunity price” of sorts.

I would not want to evaluate my project using a set of price assumptions below the forward curve, because I can improve my economics by locking in the forward curve – presuming the forward the market is liquid.

I would equally not want to credit my project with a set of price assumptions above the forward curve because I can capture that value indpendent of the project by going long the forward curve.

I think you’re forgetting that for storable commodities like gold or oil (which can be “stored” for free simply by leaving it in the ground) it is easy to move production from the present into the future. This means that it is impossible for the market to accurately forecast a future price rise, since any such forecast would be accompanied by changes in production schedules to eliminate the rise. Price changes in these commodities are largely random walks and it is no surprise that futures prices fail to predict accurately. It’s also unsurprising that you can find some other models that do about as well given the limited amount of data available and the large amount of noise in the price movements.

The one thing that seems clear is that predictions by so-called “experts” are even worse. Take a look at this article on oil prices from the Bank of England in February, 2006:

http://www.bankofengland.co.uk/publications/quarterlybulletin/qb060105.pdf

Pay particular attention to Chart C, which compares prices forecast from the futures market with those from various experts. At that time oil was trading at about $60. The futures market predicted that prices would rise, through the 2007 time frame. The two forecasts from the “experts”, in contrast, both predicted that the price would fall. Well, as we know, so far prices have risen. Only the market got the direction of change correct.

There are good theoretical reasons to expect futures prices to be the best available forecast of future prices. There are *no* theoretical reasons to expect “expert” predictions to be better than those from the market. Any time I read some expert’s forecast for future prices of oil, or gold, or whatever, I figure that those aren’t even worth the price of the paper they’re printed on. Most of those forecasts are designed to get publicity for the trading desk or to churn the market in order to increase commissions. If I want to know the best available information about what is going to happen to commodity prices, I only need to look at the futures market.

Hal

What you describe is termed “Trading your own position” in my business….

Don’t get me wrong – I do believe there’s a tremendous amount of information that can be gleaned from looking at prices – particularly in the deferred months – but all that is based on what we actually know today and anticipate tomorrow – it’s the day after that brings the surprises

Isn’t this what the ‘miracle’ of markets is all about? A random ‘expert’ may be better than the market, but collectively ‘experts’ can’t be better than the market. Since there is no way, or at least it’s very difficult, to know who the best ‘expert’ is, it’s best to use the market price. That’s why most people benefit by investing in index funds.

But would futures even be unbiased predictors, or just swing around unbiased positions based on swings in investor pychology?

Lord…

Considering that market participants are humans, yes, price is *highly* dependent on current psychology. The “news” matters less in actuality than how people interpret it – and how they interpret “news” varies constantly….

Menzie,

The best futures can do is react to prospective bumps ahead of time: Iran, Nigeria, etc–all the things economic pundits and traders love and watch.

But we are moving into a world where there are some big, intractable problems: Actual shortages. For a year, world production has been bumping along at approximately the same level; world demand has increased. Production and refinery capacity is tight, very tight. Markets will force conservation…but there is only so much elasticity to conservation.

In a pre-2000 world, we thought we could safely make one assumption: resources are, for all intents and purposes, infinite. (They aren’t; but the assumption permitted us to focus on the kinds of events that traders and economists traditionally use. And over half of your data points are before 2000.

If you always look backward, you are sure to stumble going forward.

Against a backdrop of rising economic imbalances, we now have two other issues. The first is energy–and ethanol is not the way. We are rapidly and frivously spending our resources and capital just before we will seriously need them.

I simply cannot understand how we can put ourselves into such jeopardy: spending our capital when we know we will need it shortly. It is like telling the fire department to have a weekend bash during a prolonged heat wave; then turning off the water supply for good measure.

The second issue is global warming; the squeeze there will be a bit later.

Menzie — You mentioned that markets are thin for periods of longer than one year. I have heard the same thing. Does this imply that say a big producer that wanted to invest in Canadian tar sands with a breakeven point of $50 couldn’t lock in $65 ($15 margins = quite good, equal to $5 a barrel production cost oil when oil was at $20 …) in the futures market? Am trying to answer the standard question “if prices are high, investment will go up” with some of the reluctance of the big oil cos to go after the really high cost (i.e. high risk) stuff in a really big way (judging from afar).

bsetser –

Your question almost answers itself. If, in general, oil producers were capable of locking in certain excess profit margins on a $65 forward curve, there wouldn’t be a $65 forward curve. It would be arbitraged down.

Jon and dis: I agree that futures are relied upon as measures of market expectations largely because of the ease of observation. But there is also a large literature that supports the use futures over say expert forecasts or surveys because they aggregate the relevant market participants’ views. The drawback is that futures are unbiased measures under the joint null hypothesis of rational expectations (in steady state) and the absence of a risk premium.

Hal: If you look at the references in the Chinn-Coibion-LeBlanc paper, you will see that the regressions we estimate are consistent with the theory of storable commodities, since the carrying cost (proxied by interest rates) are included.

bsetser: Yes, my understanding is that the market is not liquid at all. Hence, it would not be useful to hedge using the oil futures market at 5 and 7 year horizons.

Stormy: What you say may very well be right. The question I want to address here is whether “the market” or at least the futures market makes guesses that are highly correlated with what actually transpires with respect to spot oil prices.

to test whether storage is impacting futures prices pick a market which has futures but no storage. Eg electricity futures, in that market the futures price should be the unbiased expectation of the price at that time, adjusted for the time value of money.