The dollar is on the decline…more or less. Will this cause the long awaited adjustment?

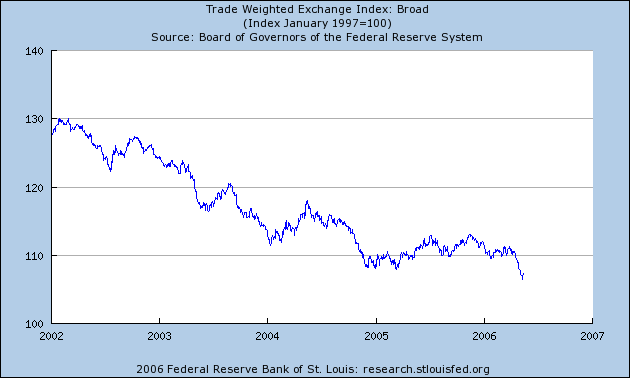

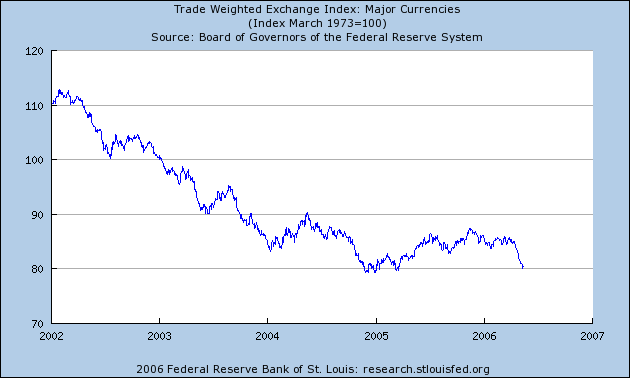

The dollar has been declining at a rapid clip, both against a broad basket of currencies, as well as against a narrow basket of major currencies.

Figure 1: Fed Broad Index of Dollar Value. Source: St. Louis Fed.

Figure 2: Fed Major Index of Dollar Value. Source: St. Louis Fed.

Some forecasts have the dollar depreciating somewhat over the next year. Deutsche Bank (5/11) forecasts 1.32 USD/EUR and 97 JPY/USD in twelve months time.

Much of the discussion has focused on how expectations regarding interest rates in the rest of the world have risen relative to those for the US Fed Funds rate. But it’s important to remember that dollar depreciation is in and of itself not sufficient to achieve a substantial reduction on the trade deficit. To the extent that the dollar decline reflects accelerating growth abroad, the dollar’s value merely reflects expectations of growth trends and monetary policy in the future. In other words, the dollar’s value is endogenous with respect to monetary and fiscal policies, and it doesn’t make sense to talk about movements in it in addition to those policies.

One exception to this general point pertains to the behavior of the risk premium associated with dollar denominated assets. As I noted in the previous post, the argument that central bank reserve diversification has important effects is tantamount to allowing for an exchange risk premium effect (a premium for holding a specific currency). While we have plenty of models for explaining the exchange risk premium, few of them have much empirical success, at least in terms of being linked to observable fundamentals. In other words, the exchange risk premium seems to appear almost exogenously. In these particular instances, the dollar decline might be considered an adjunct to monetary and fiscal policies.

So, one of the things to watch is how much of a discussion there is about two things when observing the dollar’s decline: (1) how much focus there is on incipient funding needs on the part of the Federal government; (2) how much the depreciation is correlated with talk of reserve diversification or decline in dollar accumulation by PBoC, the other East Asian central banks, and the petroleum exporting states.

(By the way, a weaker dollar arising from this channel might facilitate adjustment to a smaller trade deficit. But it also worsens the terms of trade — that is it increases how many bundles of American goods it takes to get a single bundle of foreign goods).

Technorati Tags: dollar depreciation,

reserve accumulation,

risk premium

Would not a slowdown in housing price appreciation go some way toward correcting the trade deficit? Fewer cash-out refis, less pocket money, less consumer spending growth. Less consumer spending growth at any given marginal propensity to import should mean slower growth in the trade gap. In a slightly bigger stretch, if factory activity continues to expand the way recent data suggest, we will have growth in the sector that is best able to export. Dollar slide or no dollar slide, though it would not be a surprise to hear from factory managers that some of the recent strength in activity is due to the dollar.

Will dollar depreciation bring about trade balance readjustment?

Looking at the problem one-dimensionally, we should conclude that it will. After, all, it has in the past. But I suggest that the past is not prelude to what is to come.

If commodities and energy become increasingly scarce, then the dollar buys less. To that mix we add that we are the consumer of last resort up to our eyeballs in debt and that China and the developing nations are not ready to be consumersthey are our feeding tubes, export machines. And if and when they think they are ready, the rising price of raw materials will push the goodies further and further away.

We are chasing dreams here, fireflies in the morning light. Look ten or twenty years out and frame the world not how we have always known it but what it is becoming. Construct a model based on at least modest assumptions of growing scarcity, on cheap and abundant labor, now see if depreciation will rectify the trade imbalance.

If the Fed does pause, the selloff continues. Maybe the Fed wants to tank the dollar.

So far, alot of older bonds are getting dumped on the market and the dollar is pulling back.

Who is buying these bonds? Outside of central banks and emerging markets, There is no secondary market that I know of.

And no one in their right mind would go near these older bonds, unless they were severely discounted.

As stated, a pause or halt will tank the dollar further, but in effect the resulting bond market selloff would raise rates much farther than the Fed ever could. But they already know that.

If you tank the dollar and in effect the bond market, could you not retire alot of older debt with freshly printed and devalued dollars?

Which leads us back to the issuer of the bonds. With a lack of secondary market, one can only speculate that these bonds are getting sopped up by the issuer either directly or through proxies.

And congress wants to label China as a currency manipulator?? Hell, we wrote the damm book and are still the best at this game.

Natter,

Fed folks have said for years that they don’t care all that much about the dollar. They have said for years that the trade deficit results from differential growth and savings rates between the US and its trading partners. Greenspan once told Congress that the dollar is a good gauge of whether we are driving the current account deficit through borrowing to spend, or foriegners are driving it through demand for our assets, which demotes the dollar to a barometer, rather than a policy tool. Fed folk have spent the last two years arranging to keep inflation tame, a goal that would be undercut by intentionally weakening the dollar. Why would we not take them at their word?

A,

As Barry Ritholtz sez, keep repeating after me, the price of everything is going up, but there is no inflation…

Your right the Fed has arranged things very nicely…. I will weigh in on these arrangements this weekend… and no, never take a central banker at his word…

The Nattering Naybob

Note that everything which is dollar denominated — Gold, Oil, Metals, etc — has risen dramatically.