What can one read from asset responses to “news”

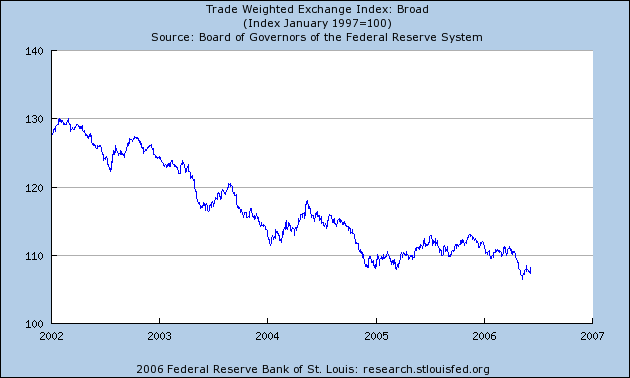

Several commentators have weighed in on the path of the dollar’s value over the next few months. Brad Delong wonders about the possibility of sharp declines, and Brad Setser has a slightly different interpretation of the hiatus in dollar depreciation in 2005. Earlier on, Macroblog wondered if the safe-haven hypothesis insulates the dollar from sharp disruptions. For perspective, here’s the dollar’s value over the past five years.

Figure 1: Broad trade weighted dollar value. Source: Federal Reserve Board via St. Louis Fed; accessed 7 June 06.

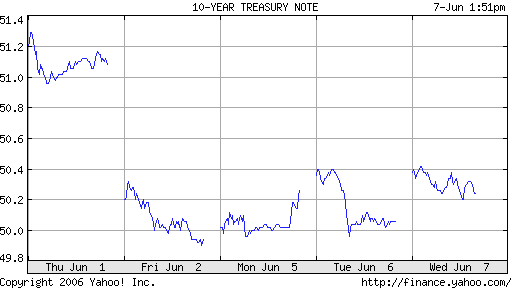

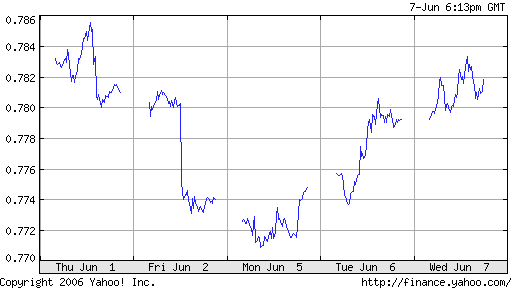

I think it’s useful to consider what is going on with the dollar in light of recent turmoil in the U.S. equity and bond markets. Over the last few weeks the dollar had stabilized after a substantial decline. In the wake of Bernanke’s comments regarding vigilance against inflation, the following happened: (1) expectations regarding the Fed Funds rate moved toward ascribing a higher probability to further tightening (according to the Cleveland Fed’s measures) (Figure 2); (2) the long term (ten year) bond yield rose (Figure 3); and (3) the dollar rose slightly (Figure 4 and 5).

Figure 2: Implied probablities for Fed Funds rates. Source: Federal Reserve Bank of Cleveland, via Macroblog.

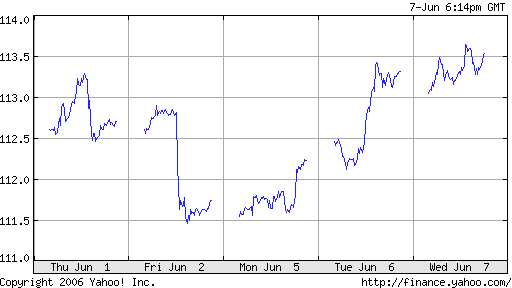

Figure 3: Daily long term bond yields. Source: Finance.Yahoo.

Figure 4: Daily Euro/US Dollar exchange rate. Source: Finance.Yahoo.

Figure 5: Daily Yen/US Dollar exchange rate. Source: Finance.Yahoo.

How to interpret this? The exchange rate is the present discounted value of the stream of fundamentals into the infinite future (ruling out bubbles). Bernanke’s comments were taken as indications that short rates had to rise in the future for more than previously expected — hence the “news” was in the revision to expectations such that monetary policy was expected to be tighter than had been anticipated prior to the announcement). The dollar appreciates instantaneously in response the news (the revision to all the expected M-tildes into the future). The math for the present value model of the exchange rate is below.

In the context of the math above, Bernanke’s speech induced a revision downward in the future path of M-tilde (the fundamentals), i.e., the stock of U.S. money supply relative to income, relative to the rest-of-the-world. At home, this manifests itself in a higher interest rates at long maturities (which depresses equity prices because these are themselves the present discounted value of future dividends, where the discount rate depends on the interest rate). For the exchange rate, s instantaneously declines (the dollar appreciates).

This might seem obvious to many, but the interesting thing (to me) is that without the support of contractionary monetary policy, the secular path of the dollar’s value would be downward. Why the difference between 2005 and now? There is of course the point that Brad Setser highlighted — foreign central bank acquisition of U.S. Treasury securities and Agencies (which is important in a “portfolio balance” world). But I would also highlight the well-defined expectation that Fed Funds rates would continue to rise over 2005 which supported the dollar. The weakness of the dollar in early 2006 roughly coincided with the widely perceived increasing probability of a “pause” in interest rate increases. The recent comments by Bernanke promised a temporary reprieve in dollar weakness. But once market expectations fully incorporate the higher probability of tightening at the next FOMC meeting, the dollar should then again resume its secular decline. Faster growth in the euro area and Japan should only reinforce that trend. From Bloomberg:

“The dollar will still be challenged in recording significant sustained gains because even if the Fed goes in June that brings it one step closer to the end” of its rate increases, said Alex Beuzelin, an analyst at currency-trading company Ruesch International Inc. in Washington.”

So, in my opinion, “Fasten your seatbelts. It’s going to be a bumpy ride ” — or at least bumpier than many anticipate.

Technorati Tags: exchange rate,

dollar,

news,

interest rate expectations,

rational expectations,

Fed Funds Rate,

Ben Bernanke,

If the yield on the long term 30 year treasury

is equal to the cumulative short term yields,

starting with the Fed funds rate,currently 5%

and prospectivel;y 5 1/4 %,how do you explain

the actual yield curve? Do foreign purchases

explain it?

Menzie:

Thanks for unpacking some of the reasoning behind daily adjustments to dollar exchange rates. Have you done any similar calculations for the dynamics of an unwinding carry trade?

Specifically, if the BOJ actually manages to start raising rates, and housing-dependent US GDP for Q2 comes in weaker than expected leading to a Fed pause how does the resulting “narrowing” of the spread between policy rates in yen and dollars work out?

I have my intuitions about it, but it would be interesting to see an experienced international economist work the math 😉

For what it is worth, it appears that the Russians are unloading dollars out of their reserve holdings. This has been reported by Brad Setser and the Fin Times.

I can also add a personal note on this. My wife is in Moscow now and told me yesterday that the exchange rate was wildly oscillating, being changed up and down as one watched at exchange windows, but mostly going down hard.

wilfred lumer: The expectations hypothesis of the term structure (EHTS) says that the long term rate is the average of the expected short term rates from now until the corresponding end-date of the long maturity bond plus a term premium. That risk premium could include liquidity effects (how thick is the market at that maturity) and risk premium, which might (or might not — nobody knows for sure) incorporate the effects of uncertainty in returns (as well as “the appetite for risk”). Since the expected future rates and the risk premium are unobservable, almost any term structure can be rationalized depending on your view of expectations. Only by imposing structure (i.e., making more assumptions) can one test whether the EHTS makes sense. In my post, I implicitly held constant the term premium, while assuming the expected near short rates rose. The assumption of constant term premium might be wrong as “the rush for safety” hit today — but I think that is a fairly transitory phenomenon.

STS: The logic I laid out is a rational expectations – no exchange risk premium framework. In steady state (i.e., where market expectations are unbiased), the joint hypothesis of unbiased expectations and uncovered interest parity holds, and the carry trade cannot be profitable in a systematic fashion. Well, as we know, the carry trade is, at various times and for various currencies, very profitable. Hence, the model I laid out is not very useful for answering that question. Departing from the model, I would say that the narrowing spread makes typically makes the ex post profitability of the carry trade lower; combined with lower risk appetite, I would expect a decline in the carry trade.

Barkley Rosser: Interesting observation. I think the gyrations in asset prices are hard to interpret because there are, over any given time period, many bits of “news” coming out. I focused in on monetary policy news in a monetary model (where stocks of bonds do not matter, and hence reserve diversification doesn’t matter), but clearly when we’re talking about hundreds of billions of dollars, portfolio balance effects might matter. That bit of news should have weakened the dollar. Of course, the decreased “risk appetite” works in the opposite direction, which might explain this.

Menzie wrote “future for than previously”…

“far more than” or “for more than”?

Higher rates to stop inflation may only exacerbate the coming credit crunch.

Stormy: Thanks for catching my typos. “future more than” is what it should read.

Will correct.

Menzie,

I know we disagree on the degree to which China’s exports are based upon Western companies situated there, but how would you respond to the following from the People’s Daily?

“China’s actual foreign direct investment(FDI) in 2005 amounted to 72.4 billion U.S. dollars, up 19.42 percent over that of 2004, the revised statistics released by the Ministry of Commerce showed here Thursday.

“The newly revised figure is upward by 12 billion dollars over that announced by the ministry in January, which excludes the FDI received by the sectors of banking, insurance and securities.

“The new figure reflects one important information of China’s FDI that the sector of service has become an important field to attract foreign investors, said Ma Xiuhong, vice commerce minister, at a news conference.

“Ma said that in 2005 the FDI received by the sector of banking, insurance and securities has reached 11.8 billion U.S. dollars, which indicates that China’s modern service sector has become more and more open.

“After its first release of FDI in January, the ministry will take a later revise on the figures to rank in the FDI of the financial sector.

“Statistics show that in the first four months of 2006, a total of 12,639 foreign-funded companies were set up in China, with the FDI up 5.7 percent to 18.48 billion dollars over the same period of last year.

“Ma said that the foreign-funded companies in China have accounted for 57.3 percent of China’s overall export in 2005 and they took a share of 87.89 percent of the total high-tech products export.

“Accounting for only 3 percent of China’s overall companies, the foreign-funded companies have taken up 28.5 percent of the country’s total industrial added value and 20.5 percent of the tax revenue, Ma said. ”

The “57% figure” has been consistently the figure mentioned, even by Roache. In short, the developed nations are using China as an export machine to their home countries. (Off-shoring, export of jobs, etc.)

What is happening is that slowly but surely the U.S. in particular has lost its export base. Those companies are now abroad, leveraging cheap labor to sell goods back to the states, which is slowly but surely going “bankrupt.” U.S. policy, both the Fed’s and the White House’s/Congress/s have encouraged this process in the name of globalization.

There are powerful interests within the states that support a strong dollar and a fixed yuan–especially those companies now in China or in other developing nations.

I would suggest that the Fed is now in a shrinking box with little room to manoeuver. Despite all its efforts, it cannot keep the dollar strong nor inflation at bay. As the dollar weakens, inflation will rise. Everything has been done in the U.S. to make credit cheap and available. The coming energy crunch will exascerbate the problem.

In short, globalization has been mishandled, to say the least.

Oops, sorry. Link to the above citation is:

http://english.people.com.cn/200606/09/eng20060609_272420.html

stormy — thanks for highlighting the revised fdi numbers. i would have missed them otherwise. Ma’s numbers don’t strike as inconsistent with roach — say 50% of China’s industrial value added is in the export sctor and 50% of that comes from foreign funded companies. their total contribution to industrial value added would be 25%. am i missing something?

Stormy: Thanks for the extensive comments; unfortunately, I don’t recall disagreeing on the issue of there being lots of U.S. FDI in China, and that lots of it is devoted to exporting. Rather, my disagreement (if I recall correctly) is with the premise that the rise of China necessarily means (1) measurable downward pressure on aggregate U.S. price levels, and (2) that this means in the long run that U.S. employment declines. Outsourcing of some jobs to China might — or might not — result in a net decline in total employment; it depends upon whether the resulting lower cost of inputs and final goods leads to greater employment elsewhere in the economy. And in any case, what we should be concerned with is the overall impact on the economy (consumption, output, employment, consumer surplus as well as producer surplus, etc.).

None of this denies that we should be concerned about the dislocation to workers in these sectors; my personal opinion is that more, not less, trade adjustment assistance is called for.

Menzie,

I apologize for the distortion–and appreciate the correction.