Once more unto the breach.

As some of you will know, my main area of research is in empirical exchange rate modeling (see Meese and Chinn (1995) and Cheung et al. (2005)). In a recently completed a paper to be presented at conference at the HKIMR, Ron Alquist and I have conducted another exercise. Specifically:

We examine the relative predictive power of the sticky price monetary model, uncovered interest parity, and a transformation of the net exports to net foreign assets variable. In addition to bringing a new approach (utilizing our measure of external imbalance suggested by Gourinchas and Rey) and data spanning a more recent period to bear, we implement the Clark and West (forthcoming) procedure for testing the significance of out-of-sample forecasts. The interest rate parity relation holds better at long horizons and the net exports/net foreign assets variable does well in predicting exchange rates at short horizons in-sample. In out-of-sample forecasts, we find evidence that uncovered interest parity outperforms a random walk at long horizons and that the measure of external imbalance does well at short horizons, although we cannot duplicate the findings of Gourinchas and Rey.

There are two innovations in the paper. The first is to see if we can outperform a random walk using a recently proposed approach (based on the net exports/net foreign assets variable). The second is to use a procedure that properly takes into account the fact that most predictions are based on estimated models. The results of the out-of-sample comparison are reported in the table below.

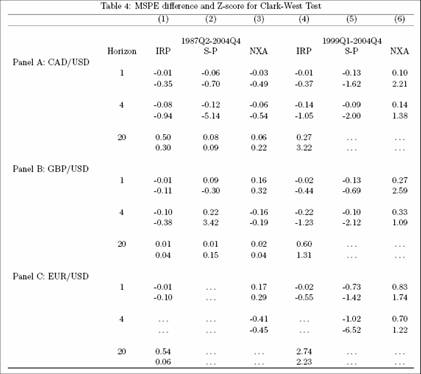

Table 4 from Alquist and Chinn (2006). Notes: IRP: Interest parity model; S-P: Sticky price monetary model; NXA: Transformed net exports to net foreign assets model. The first entry is the Clark-West test statistic times 100. The entry underneath is the z-score for the null hypothesis

of no difference between the random walk and the linear alternative. For the interest rate parity forecasts, the z-score is the Diebold-Mariano (1995) test statistic. In some cases, 20-quarter ahead forecasts omitted because the Clark-West procedure requires the forecast sample be greater than two times the forecast horizon.

From the paper:

At most horizons, the interest rate parity model does as well as the random walk. During the 1999q1-2004q4 sample, forecasts based on the interest parity relationship significantly outperform the random walk at the 20-quarter horizon for the Canadian dollar and the euro, although the result does not hold over the longer sample, 1987q2-2004q4. At shorter horizons, the interest rate parity forecast does less well than the random walk forecast. The result is consistent with Cheung et al. (2005a,b), even though we omit the yen, a currency for which interest rate parity substantially outperformed a random walk.

The sticky price monetary model outperforms the random walk in 4-quarter ahead forecasts during 1987q2-2004q4 for the pound, but significantly worse for the Canadian dollar. In the most recent 1999-2004 period, it does worse, and significantly so, at one year horizons. The finding is consistent with Cheung et al. (2005a) and (2005b), who point out that the papers in which the sticky-price monetary model outperform the random walk in out-of-sample forecasts usually involve a cointegrating vector estimated over the entire sample, as in MacDonald and Taylor (1994). Our test is more stringent. We estimate the cointegrating vector over a rolling window rather than the entire sample, making the forecasts true ex-ante predictions.

We find favorable support for the use of the measure of external imbalance, particularly when we estimate the cointegrating vector over the longer sample. In the second subsample, it outperforms the random walk at short horizons for the Canadian dollar and the pound at 5 and 10 % level significance level. The results are less favorable at long horizons and not particularly positive for the euro.

It should be noted, however, that the Gourinchas-Rey approach is primarily one that implies predictability of the effective value of the dollar, where the weights are asset and liability based. In this sense, we are not really testing fully the G-R approach.

Technorati Tags: exchange rate,

dollar,

out of sample prediction,

net foreign assets,

interest rate parity,

Pierre-Olivier Gourinchas, and

Helene Rey.

Congratulations!

It does make sense that different models at different time horizons might be necessary in order to at least match the random walk in forecasting.