Well, not quite. But I find it interesting to see how much revenue the government loses by giving tax breaks to certain groups in the energy arena.

Unsurprisingly, oil and gas producers are projected to do well in the 2006-10 period. While unconventional fuel producers also do well, interestingly the current plans (as of March 31) seem to show declining “tax expenditures” for unconventional fuel producers in the out years. See these excerpts from Table 1, pages 30-32 of Estimates Of Federal Tax Expenditures For Fiscal Years 2006-2010, JCS-2-06 (April 25, 2006):

Excerpt from Table 1 of Estimates Of Federal Tax Expenditures For Fiscal Years 2006-2010, JCS-2-06 (April 25, 2006), pages 30-32.

Since this table is not very clear, here is a Download file for the PDF file of the relevant pages.

In brief, for the 2006-2010 period, going to corporations for (i) expensing exploration and development of oil, natural gas and other fuels, $5.6 billion; (ii) excess of percentage of cost depletion, 5.3 billion; (iii) tax credit for unconventional fuel production, $8.8 billion; and tax credit for production from renewable resources, $29.4 billion. Going to households for (i) tax credit for purchases of new and existing qualified energy efficient homes, $0.6 billion; tax credit for purchases of energy efficient appliances, $0.2 billion; and (iii) tax credit for purchases of alternative technology vehicles, $0.8 billion.

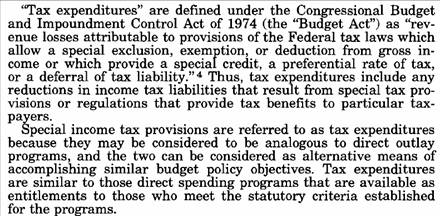

By the way, here is a formal definition of a “tax expenditure”:

From page 2 of Estimates Of Federal Tax Expenditures For Fiscal Years 2006-2010, JCS-2-06 (April 25, 2006).

Technorati Tags: energy conservation,

tax expenditures,

alternative energy, and

tax credits

Why is this surprising in the least?

Obviously, it would be best if the government did not have these kinds of distorting tax breaks at all, but failing that, does it not make sense to use them to encourage exploration and production of a commodity that is in such short supply?

What I find disturbing is the outsized tax expenditures for renewables. Not only are they huge by absolute measures, but if you compared them on a basis of how much credit to how much energy is produced, they would be hundreds or thousands times higher than for oil. Unit of energy for unit of energy, these credits are ridiculously high.

David

That’s a bit like arguing that government subsidies for the Internet are ridiculously high– in 1982.

With any nascent industry, to create the learning curve effects and economies of scale, you need to create that industry. Since we have a good intuition that we are going to need those alternative energy sources in the future (whether due to National Security, fears about ‘peak oil’ or the problem of global CO2 accumulation), we need to create those industries and learning effects now.

A second point with your argument is that you haven’t quantified it. I don’t know (and I presume you don’t) what the relative subsidy is.

A third problem is the presumption that subsidies to conventional energy activities actually create more oil etc. I can’t think of any reason (can you) why any economically extractible resource of oil, coal or gas in the US right now is not being pursued, other than the sheer physical limits of the industry. The US has, after all, drilled something like over 1 million bores in its history as an oil producing nation.

So the additional government subsidy may not actually be producing any more conventional energy: because that energy isn’t there to find, or the industry cannot extract it given current technology and/or constraints on production.

Having said all of the above, I am very suspicious about US government subsidies to the corn-based ethanol industry. That I suspect is the ADM lobbying effort, for which it is long famous. On enery security or carbon-neutrality grounds, I don’t think the economics stack up.

It would be better to subsidise the purchase of more efficient automobiles, if the goal was to reduce US CO2 emissions and US oil imports.

The measurement system used to generate these conclusions is at best questionable. For example, the study computes the cost of retirement plan contributions at $706 billion. This is apparently the difference between the income tax that would have been collected had deductibility not been in place. However, if these contributions were not deductible then it is likely that much of this would be expensed as wages (directly in case of 401(k) deductions.) The study explicitly states that changed behavior is not considered. I doubt that they considered the increased income tax that would be collected from individuals.

The write-off of exploration expenses needs some focus. Generally, the cost of creating an income producing asset (such as a rental building) is subject to depreciation. The advantage to the oil and gas industry is not a greater deduction, but rather an accelerated deduction. A change from expensing to depreciation status would have no effect on revenues after the period of transition. Immediate write-off might encourage reinvestment, but the real cost is the interest factor on delayed revenue.

Percentage depletion is limited to producers with under 1000 barrels per day of production. In many instances, the elimination of percentage depletion would be replaced with a deduction for cost depletion, and this is unmeasured in tax returns.

Both percentage depletion and exploration and development costs are adjusted for calculation of the alternative minimum tax with the result that in many instances there is no overall tax benefit from either of these provisions.

Finally, the study says that the exclusion of social security from income costs $125 billion. The IRS calculation of this could not possibly be right. An individual over age 65 pays no income tax if his income from sources other than social security are less than $6,400, and no part of the social security is taxable unless income + one-half of the social security exceeds $25,000. $6,400 of passive income likely reflects the income from assets on the order of $200,000. If you made more social security taxable, many of these recipients would then be able to take a medical deduction that would eliminate their tax liability, but is not reflected on current returns because they have no tax liability anyway. Farther, if they paid more income tax, those in nursing homes would require more medicaid subsidy.

Anyone that chooses to run for congress must ignore the basic financial implications of spending a few million dollars to get elected. The result of this system is that those in office are practiced at ignoring economics. The only possible use of this study is to provide sound bites for congressmen.

Bill

Why on earth, given that the oil producers are among the most profitable in the land, are we giving them any subsidy given that they are not even using their enormous current profits to increase capex spending? In other words, the oil companies, through their actions, are saying that they don’t think there is much out there that is worthwhile, so we won’t spend it. Instead, the taxpayer picks up the cost of any exploration that might prove to be less than optimal. Of course, I recognize that in the past 30 years the oil companies have been in the dumps – but given the incredible amount of money they are pulling in, I find it more than a bit absurd.

What a great business to be in – heads I win, tails you lose.

Feel free to comment and critique via some more educated economic argument – me, I’m just a simple man…. 🙂

David Strom: I agree that subsidies for alternative energy should be subjected to the same sort of benefit-cost assessment that other subsidies are subjected to. An organizing framework would incorporate the question of whether there is a market failure, such that the market is unable to produce the socially efficient level; that issue (along with the elasticities of demand and suppy, pointed out by Valuethinker). On this point, see this post on ethanol subsidies.

Bill Ellis: I agree, there are limitations of the analysis. In part, they arise from the limitations of our knowledge of the nature and strength of interactions, and is related in part to the issue of whether dynamic analysis is desireable or not. I think it is in principle, but when you actually work on government policy from the inside, you are immediately confronted by the knowledge that there is a lot of uncertainty about the strength of relationships, and that sometimes “zeroing-out” those responses is a good way to impose discipline against the more outlandish arguments that might come around (i.e., tax cuts pay for themselves — see this post on dynamic scoring).

damian: I agree it sounds absurd to be granting these tax subsidies when these firms are earning such large profits, but one could argue that that increases domestic production, replacing imports (in my view not an efficient way to expend scarce resources, but I haven’t done a systematic analysis).

Increasing domestic production is definitely important. The question is this: if the big oil companies are not doing it, in the face of these record profits, then why should we pay for it? They are voting with their capital and saying “domestic oil ain’t worth the work.”

Damian and Menzies

Increasing domestic oil production is about the silliest thing you can do.

1. oil is a phenomenally profitable industry. Always has been. Even at $10/bl, most oil companies made money.

Oil has one of the highest Returns on Equity of any sector in the S&P500, over the long term.

Why subsidise what is already a profitable industry?

2. oil is an exhaustible resource– all oil fields run out (or reach a level where production is less than 5% of peak). The *last* thing you want to do, is subsidise the extraction of US oil *ahead* of foreign oil.

At the minimum, you only want to extract US oil when there is no additional economic cost over extracting, say, Saudi oil. ie no subsidy. If other countries want to subsidise oil production, let them. Their taxpayers can bear the burden of subsidising American consumers.

More sensibly, since you know your oil is going to run out some day (the US is about the world’s 5th or 6th largest producer of oil, but it has the world’s 20th or so largest reserves), you don’t want to hurry up that process.

Better for national security, and future prosperity, to husband your national oil supply for the day you really need it.

Burn the Saudi, or the Venezualan, crude first. Certainly don’t burn it before it is at least as economic to burn it as it is to import it.

PS Damian (and Menzie)

If you are worried about oil supply interruptions, then consider the Japanese example.

Japan spends billions of dollars subsidising rice farmers. 2% of the land area of Tokyo (far and away the world’s largest city, with 30million people, and also one of the most expensive in land terms) is farm land.

Japan starved during WWII. This is a legacy of that and traditional Japanese attitudes.

Does it make sense? No. What would make sense is the Japanese build very big warehouses, and store several years worth of food. As 7th Day Adventists do in the US.

If the supply interruption lasted longer than that, Japan could find other food sources, plough back land into farmland, etc.

Instead they subsidise rice, have recurring trade wars with the Americans about it, and cost their economy lots of output.

And in the case of oil, the Japanese take precisely the opposite view. They don’t spend billions of dollars trying to synthesise oil inappropriately, rather they:

– diversify their supplies geographically and politically

– make conservation a national fetish – Japan is, I believe, the only major industrial nation that uses *less* oil than it did in 1980. It was Toyota that invented the hybrid car.

-stockpile

Now arguably food is more important than oil, so you can see the Japanese point about rice. But they behave rationally with respect to oil, and not so with respect to rice.

The US could do what Japan does with regard to oil, and be in a more secure strategic position than it is now.

This whole debate is a little silly. Don’t you see that the real point is the definition of “Tax Expenditures?” Based on this formal definition assume you have two companies, one taxed at 35% the other receiving an actual paid subsidy from the government. If there is a 1% decrease the the effective tax rate one company will be accused of receiving an additional subsidy while the other company laughs all the way to the bank.

As an aside, when oil was at $10 in the mid 1990s it was being virtually being sold at cost. The result was producers left the business. It can take as long as two years for a company to return to production.

If you actually want the price of oil to go down let the producers produce.

Actually, it is simply NOT true that oil companies are phenomenally profitable in the long run. In fact, most businesses have better profit margins than oil over any reasonable time frame.

See our recent publication, Gasbags:

http://taxpayersleague.org/NewIssues/GasBags/GASBAGS.htm

David

You are right on ROE although I am (mis?) remembering different data. Oil *services* has the highest ROE in the SP500– this I do remember quite clearly.

I would take issue with ‘most businesses’– what you have is an average, composed of a cluster of businesses with very high ROE (software, pharmaceuticals) and the rest, with very variable ROEs (automotive).

So my guess is the median would be different, and lower than, the mean.

You still don’t want to subsidise oil production.

Why not? Because oil is a finite, exhaustible resource. Therefore you don’t want to finance its exhaustion in advance of the normal market demand for it.

David,

You are exactly correct. In truth the big money hog in the oil industry is the government. They take a cut at the well, a cut at the refinery, and a huge cut at the pump. While oil companies make around 4% the government takes over 50%, then when the companies finally make a profit the government hits them with an “excess profits tax” and takes some more. Then if the government loses one penny due to tax reductions they squeal like stuck pigs; come to think of it they are stuck pigs.

If you have two energy sources: one with negative externalities (oil, coal), and the other without (wind or solar), the efficient policy is not to subsidize the one without the negative externality, because in that case the “bad” fuel will still have the externality for free, but to tax the one with the externality. Of course this might be politically impossible, so you go for the 2nd best policy of subsidizing renewables. In most cases however (certainly in the case of ethanol) the subsidy is much more than the reasonable estimates of the value of externalities, so the policy brings further distortions.

I think there is some truth in the infant undustry argument, Germany and Danmark succeeded in deceloping a wind industry cluster, and nowadays they are already gradually reducing their subsidy. With best technologies (and high gas prices) the price differential between a CCGT and wind/biomass is down to 10-20 dollars/mwh, so if the tax credit is well structured, 28 billion it will buy a lot of renewables.

Subsidizing an energy source with negative externalities is simply absurd (it happens often though). You spend taxpayers money to buy acid rain and global warming.

A big chunk of US oil production comes from marginal stripper wells. These can be very sensitive to oil prices, tax treatment, and production costs. These strippers are much more important in aggregrate to US energy supply than “alternative” solar and wind and probably always will be. So why are we “spending” 5X as much on it?

As to conservation, why not let the free market provide? If it is true that conservation is a lot of little things, then that’s what private enterprise is best at. We don’t need a big Manhattan Project to shave a few watts off a light bulb or design fluffier insulation. And if a conservation project doesn’t make sense on a pre-tax basis, why should I have my tax dollars spent on it?

I agree with Cheney that conservation is a private virtue – I strive for it although I will admit an occasional vice.