Or, why I have to explain to my Money and Banking students that discretionary counter-cyclical fiscal policy is “off the table”.

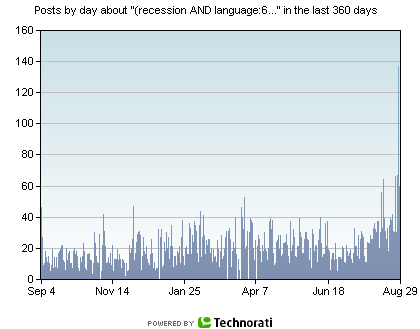

As the discussion of a slowdown, or a recession, becomes more pronounced (see Figure 1 below), it might be useful to think about how the choices made about fiscal policy over the past five years have reduced our choice set.

Figure 1:Word count for “recession” from Technorati, all weblogs “with some authority”, August 29.

Previously, I’ve noted that if (i) growth proceeds at the rate the CBO projects, (ii) discretionary spending grows at the rate of inflation (rather than at the rate of nominal GDP, which it has over the past five years), (iii) the tax cuts of 2001 and 2003 are not extended, (iv) no further fixes to the Alternative Minimum Tax cut are implemented, and (v) spending in Iraq and other theaters of operation remain grow at the rate of inflation, then the deficit to GDP ratio will stabilize at 2 percentage points of GDP for a few years; then as the tax cuts “sunset” in FY2010-2011, the deficit shrinks. Drop (iii), and the deficit stays a constant share of GDP, and the debt-to-GDP ratio continues its rise.

But if there is a slowdown, then what happens to the budget deficit? Well, let’s assume a moderate slowdown, so real GDP grows 0 percent grom 2006 to 2007, but resumes its pre-recession growth rate thereafter. Further assume that the elasticity of real tax revenues with respect to real GDP is unity. And finally, to be conservative in assessing effects, assume that transfer outlays (unemployment insurance, AFDC, etc.) all stay unchanged relative to CBO baseline. Then one gets the following picture.

Figure 2: Federal Budget Surplus to GDP ratio (blue), CBO baseline (red), baseline adjusted for AMT fixes, tax cut extension (green) and recession (w/o tax fixes), fiscal years. Sources: CBO, The Budget and Economic Outlook: An Update, (August 2006), CBO, “Uncertainty of CBO’s Projections of the Budget Deficit or Surplus Under Current Policies,” in The Uncertainty of Budget Projections: A Discussion of Data and Methods March 2006, CBO, Historical Budget Statistics, January 2006, and author’s calculations.

The red line is the CBO baseline, the green line is the CBO baseline incorporating fixes for the AMT and extension of the 2001 and 2003 tax cuts, and the black line is the recession case (w/o fixing the AMT and w/o extending the tax cuts). What the figure suggests is that if the economy goes into a slowdown (no negative growth assumed in this scenario!), we may find ourselves with a deteriorating fiscal position that constrains our ability to implement to, say, increase the length of time unemployment insurance benefits can be paid out, or to give tax relief. The deterioration may not look that bad, relative to FY 2004, but it is harder to sell bonds in a period when the stock of government debt is much bigger holding all else constant, and when we might — or might not — be able to “rely upon the kindness of strangers”, especially if Treasury Secretary Paulson is able to convince the Chinese to allow more rapid Renminbi appreciation.

So after spending a couple lectures explaining the potential uses of fiscal policy to counter recessionary influences, including a portfolio balance definition of crowding out, I’ll then tell them about how the fiscal policy of the last five years has made it difficult to use discretionary fiscal policy.

Technorati Tags: recession, budget deficits

fiscal policy, and

tax cuts

i wonder though what might have happened during the post sep11 period and during the period in which the dot com bubble burst if there had been no fiscal stimuli….perhaps the recession would not have been as short and as shallow and we might have truly flirted with japanes style deflation…..maybe the bush folk did the right thing for the wron reasons. jjj

Is there no notion of peak oil around here? This whole IF recession is a moot point. We’ve been in a recession for a year or two when you take into account REAL inflation subtracted from GDP. Since inflation is around 8% as we speak, and it has been trending up from 4 or so for several years, it’s extremely clear that we are being lied to. There hasn’t been growth for years b/c all the stats have been skewed.

We should be questioning all gov’t numbers especially when Alan Greenspan said he didn’t trust all the govt numbers. Yet we continue to just talk about if’s and when’s. Let’s start a real discussion on how statistics have been manipulated and we are not measuring this country in the same manner as done merely 15 years ago.

The geological trainwreck known as Peak Oil will hit this world and create the ultimate financial tsunami in this country. Rome, the greatest civilzation of their time was ruined from the inside out and it took over 400 years to recover. Are we so arrogant to think it CAN’T happen to us?

Actually this blog was where some interesting data was posted recently that is highly suggestive of Peak Oil, IIRC:

http://br.endernet.org/~akrowne/econ/charts/saudi_peak.jpg

Give prof Chinn credit; one can’t analyze all factors together and expect to understand them clearly.

Makes it difficult? That seems to be overstating the case. Why not extend Figure 2 in this post back to 1980?

The deficit (as a % of GDP) in 2004 was 3.6%. In 2003 it was 3.5%. (Source: OMB).

However, in 1993 it was 3.9%. In 1983 it was 6.0%.

These are not statistics to brag about, but clearly there’s a lot of room for fiscal policy.

You seem to be making a political argument, not a public finance argument.

I have to agree with RD, there is room for counter-cyclical fiscal policy, Japan was able to do it quite well for many years, if I remember correctly running deficits as high as 10% of GDP, and thereby pushing public debt well over 100% of GDP. That doesn’t mean that counter-cyclical Keynesian fiscal stimulus is the right answer, but it is possible.

RD and Nathan,

Well, the other kicker in here, alluded to elliptically by Prof. Chinn, is that a) the US savings rate is much lower now than in those

earlier periods, meaning we must borrow from abroad to finance it, and b) our current deficit and more dramatically, our net foreign indebtedness, are both much higher as percents of GDP than they were back then, especially the net foreign indebtedness (there were some pretty big current account deficits over the last couple of decades).

The combo of these two means that we are much more dependent on the “kindness of strangers” now than back then. We are already borrowing huge amounts, and they may be less willing to increase that substantially and suddenly than they were in the past.

RD and Nathan: Thanks for the comments. I have plotted the deficit to GDP ratio in previous posts. See here and for a discussion of the full employment budget balance here. Context is important; in particular, the stock of government debt outstanding, and the trajectory of debt, given entitlement spending, means that 2007 is not a replay of 1983.

jjj: Remember that the original tax cut proposal did not include the $300 per taxpayer payment; this was added in response to criticisms — valid in my view — that the original tax cut proposal was too skewed toward high income households. Even if one thought the 2001 tax cut was well thought out, the 2003 fails on the counter-cyclical policy grounds.

Barkley Rosser: Thanks – yes, you’ve stated it better than I did.

I still think you are overstating the case by claiming “fiscal policy is off the table.”

The stock of debt argument does not work here. The Federal debt held by the public as a % of GDP in 1983 was 33.1%. In 2005 the statistic is 37.4%. These are comparable numbers in historical terms.

Yes, entitlements represent a serious long-term challenge. But one can use that challenge to oppose any tax cut or spending increase by simply claiming we have serious long-term budget problems. Estate tax repeal proponents adopt a similar tactic by claiming CBO underforecasts receipts, so factoring in those ‘new’ receipts, estate tax repeal pays for itself (of course, if such receipts exist, they could finance any tax/spending policy). Entitlement reform is an issue of government spending, unless one believes that government spending and taxation should rise dramatically to ahistorical levels in the coming decades.

Finally, claiming the $300 credit, which was not originally a Bush policy, as a major element of the 2001 tax cut is misleading. According to the official revenue estimate, the credit had a tax expenditure of less than $40 billion. In contrast, the 2001 tax cut reduced taxes by $1.4 trillion over ten years.

To recover from the 2000 recession, the Bush Administration took a bipartisan approach – stimulating both supply side and demand side.

By cutting taxes, they followed Milton Friedman’s advice. By engaging in deficit spending, they followed John Maynard Keynes’.

Of course, when you’re middle of the road, you get hit from both sides.

Having followed Professor Chinn’s postings, I would be hard put to imagine ANY Bush action that would meet her approval. I would posit that reduction in total government spending be the option of choice to deal with an economic downturn but the Professor prefaces her outlook by bemoaning the difficulty of INCREASING government spending in the future. In other words, any constraint on government spending increases is bad.

I would think that a recession is almost always, by definition, “a deteriorating fiscal position” so there is some circularity in the argument.

What a shame that we live in a country where the voters seem SO disinterested in raising income and gasoline taxes. Why can’t they be “tax-and-spend-OPM” academics like Professor Chinn?

BTW, didn’t Clinton and Gingrich do away with AFDC?

Menzie,

Economic entities always interact. An assumption that the CBO growth projection of 3% will continue if the tax cuts are not extended is highly questionable. If the tax cuts are not extended, the same can be said for discretionary spending. And it is important to note that the weakness will manifest itself long before the cuts sunset as investors anticipate an economic slow down.

I assume that what you mean by no more fixes to the Alternative Minimum Tax is that you will hold the AMT at its current level. Once again because of the automatic tax increase from inflation the AMT would have a significant dampening effect on other elements forcing more and more of the middle class to pay higher taxes.

Your assumption as the tax cuts sunset in FY2010-2011, the deficit shrinks is only true in a world where tax cuts have no economic affect. We do not live in such a world.

The deficit has been shrinking much faster than any projections forecast because of economic growth, but economic growth can be halted in its tracks by restrictive fiscal and tax policy.

Finally, I am not sure what you mean by a deteriorating fiscal position but I assume you mean a weakening economy. To say that this will constrain our ability to implement tax cuts is to get the dynamic exactly backward. The strength or weakness of the economy is dependent on tax policy; to make tax policy dependent on the economy is to court disaster. Keynes made this perfectly clear in his analogy of the business man who continued to raise his price in the face of declining sales.

Because of faulty assumptions I am not sure the graph says anything useful.

Joseph,

Milton Friedman is not a supply sider. He is a monetarist.

Dick,

Not anymore. He has recently come out in favor of inflation targeting for the post-Greenspan era. Did so at a conference in June or thereabouts while in the company of William Poole, president of the St. Louis Fed, that bastion of the old-timey monetarism.

Heck, even Uncle Miltie has noticed that V1 went blooey in the mid-80s, and pretty much all central banks have been targeting interest rates ever since. The question is on what basis to do that.

Fiscal policy will have to change to reflect the realities of the world if recession kicks in.

Which means a political sea change. So yes, this IS very political, indeed.

Dick,

Grant you that! I was thinking Laffer maybe? Any better examples of supply side economists? Names escape me at the moment. Funny, I don’t remember anyone profiled in “The Worldly Philosophers” being called a supply sider.

I’m waiting for someone to accuse me of being a “Hooverite” for suggesting cutting government spending when government revenues decline.

That said, increased spending on defense does look increasingly like a necessity in the future. That “peace dividend” couldn’t last forever.

Joseph,

With this: “I’m waiting for someone to accuse me of being a “Hooverite” for suggesting cutting government spending when government revenues decline.”– check your History books to how wrong that would be.

“Counter-cyclical fiscal stimulus” ?? Will we never be rid of dread Keynes and his GT of E,I,&M?

Anyone care to countenance the idea that that work was not one of “Economics”, but a work of agitprop that would still make ol’ Bernays proud?

Barkley is wrong about Milton Friedman.

I quote from his communication to Greg Mankiw (posted on Greg’s blog):

“Nothing that I have observed in recent decades has led me to change my mind about the desirability of a monetary rule which simply increased the quantity of money at a fixed rate month after month, year after year. That rule would get rid of the mistakes and that is probably about all you could expect to get from a monetary system.

Even better would be to abolish the Fed and mandate the Treasury to keep highpowered money at a constant numerical level.”

Joseph,

Robert Mundell probably has the best good supply side ideas today. He is now one of the primary advisors to China, and their growth has come, in large part, from following his advice especially on monetary policy. You can read most of his work at this site. http://www.robertmundell.net/

For those interested check out this site for a debate between Mundell and Friedman. http://www.irpp.org/po/archive/may01/friedman.pdf

Reuven Brenner is also a great supply side economist.

There are others with differing levels of consistency, if you are interested in more I can list them, but Mundell and Brenner will give you a lot to chew on.

Thanks Rich. I listened to an recent interview with Friedman http://www.econtalk.org/archives/2006/08/milton_friedman.html just yesterday where he stated that he has always wanted to get rid of the FED and replace it with a mechanical system that would increase the money supply by a fixed rate. He suggested 4%. If you want to see an economic disaster….

A year, or so, ago Friedman did admit that his monetarism was flawed, but, after listening to his interview, he really has not changed.

Joseph,

Just for the record Hoover increased taxes rather than cutting them. He was a disaster, certainly not a supply sider.

Dick,

“Fiscal position” refers to the state of the budget, rather than the state of the economy. The rest of your comments seem to take an untenable “tax cuts pay for themselves” position. At marginal rates that obtain in the US, and that would obtain if tax cuts passed as temporary were allowed to expire, there is no evidence that tax cuts come anywhere close to paying for themselves. Tax hikes raise revenue except in extreme cases.

Deficits shrunk faster than projected in several years after the Clinton tax hikes, too. This might be taken by those of broad mind as evidence that there are things far more powerful than changes in tax rates in determining output growth and resultant short-term changes in revenue grwowth. In the present case, this year’s increase in revenues still leaves us with a substantial structural deficit that is to say, a deficit that cannot be cured by growth.

The claim that the strength of the economy is dependent on tax policy is true, but in a limited way. Tax policy is a far bigger issue from a microeconomic perspective, at US tax rates, than from a macro perspective. Claims that have been made since the Reagan era for the overwhelming importance of small changes in tax rates have simply not been supported by the facts. Claiming that we court disaster by returning to pre-cut tax rates ignores the fact that we enjoyed a lengthy period of good growth under just those tax rates.

RD,

There was a good bit of effort aimed at figuring out how much of the tax credit in the 2001 tax package was quickly spent. As I recall, the share was substantial. That is more than can reasonably be said for the broader tax cut. Since, as a Keynesian matter, getting the money spent is overwhelmingly important, it is probably not wise to dismiss the rebates as trivial. Magnitudes matter, but we can do better than to simply stop at pointing out that $40 bln is smaller than $1.4 trillion. In addition, comparing a 1-time rebate when demands was flagging to a ten-year revenue reduction over a period that is still only half-way done rather masks relevant magnitudes. That $40 bln you ascribe to the rebate comes to about 29% of the first year’s share of that $140 trillion, and it arrived earlier than other bits, which were handled through reduced withholding and periodic tax payments, as well as refunds the next year. NBER puts the end of the recession in November 2001. As a fiscal stimulus, that rebate looks pretty well timed.

“Nothing that I have observed in recent decades has led me to change my mind about the desirability of a monetary rule which simply increased the quantity of money at a fixed rate month after month, year after year. That rule would get rid of the mistakes and that is probably about all you could expect to get from a monetary system.”

This sounds dangerously too easy and then hearing that 4% growth in MS is his target is insane.

The entire financial system that we have developed depends on growth. We live in a finite world and growth has limits. We can’t simply keep expanding without limits. Limits to growth was written over 30 years ago and has been updated. It’s worth a read for those of you who may have come across it while in college.

Our financial issues may become trivial compared to the geological contraints that we were blessed with when the Earth was formed. Contrary to what our President tells us, The American way of life IS negotiable and thermodynamics are not. Nature always wins.

kharris —

140 trillion? Wow – I take it all back. There is no room for fiscal policy now.

Just kidding.

Good point on the first year effect. And I agree that the rebate was very well-timed. I just wanted to make it clear that it was just one part of the demand-side targeted 2001 cut. The argument remains as to whether the 2003 cut was more effective as fiscal policy (my intitial reaction is yes, but I am not entirely convinced yet).

Thanks to kharris for setting the record straight. I’ll let those comments speak for themselves.

As for the Milton Friedman as monetarist/supply sider debate, I’ll leave others to fight that out.

I think it would be useful for people to read the CBO documents that are linked to the post, just to see how CBO does its forecasts. In previous posts, I’ve discussed the implications of allowing for dynamic effects.

One point I’d like to mention. To paraphrase Nixon, “we are all supply-siders now.” Pretty much all mainstream economists believe that there is a supply side response to marginal returns to factors of production (labor, capital). The question is the size of those returns. One dividing line is between those who believe tax cuts pay for themselves, and on the other side, those who don’t. I think that most mainstream economists, and the people in the Office of Tax Analysis at Treasury, line up on the that latter side, given the discussion about the recent Treasury study.

Finally, so I am not accused of being a partisan hack, let me highly recommend that people read following book, so commenters can fix concepts in their minds (like fiscal position, endogeneity, etc.): Greg Mankiw, Macroeconomics, Worth Publishing. I think you will find a balanced, albeit mainstream, interpretation of supply side, demand side there. (Of course, if you don’t believe in mainstream, it won’t be of help to you.)

Rich,

Well, it looks more complicated than you say. I have looked at the full letter you quote. Your quote comes at the conclusion as a sort of ideal. So, yes, I suppose we can say that Uncle Miltie is really still, fundamentally, a monetarist.

But then most of the letter is devoted to praising “inflation targeting” and particularly the policies of both Alan Greenspan and Donald Brash of New Zealand. Both of them in practice targeted interest rates, and Greenspan openly opposed rigid inflation targeting. Several other countries that Friedman praises have officially targeted inflation, while focusing on fixing interbank interest rates as the short term policy target, including Britain. None of these countries that he praises have targeted money supply in any way shape or form at all during the last 20 years, the period for which he praises their policy making.

So, I suppose one can have it either way: ideally still a monetarist, in practice an interest rate manipulating inflation targeter.

kharris and Menzie,

I have read most of the criticisms of the Laffer Curve and the case for and against tax cuts paying for themselves. It is not possible to understand every variable in the real world so historical analysis has very limited use. Also the effects of such things as tax cuts are greater than the immediate macro or micro effects. What I mean is that there is an effect on such things as the entrepreneural spirit that cannot be easily quantized. Economics is a behavioral science.

Looking at the tax cuts of the 1920s, the 1960s, the 1980s, and now the 2000s convinces me that tax cuts do reduce impediments to prosperity.

I realize that most here are demand side Keynesians who place consumption ahead of production and see macroeconomics as a different animal from the sum of all micro elements. All I can say is that if you have two apples for sale, giving consumers twice as much money doesn’t change the fact that there are still only two apples for sale, even if there is a multiplier effect. But giving consumers twice as much money does change how much is bid for those two apples. So you must determine for yourself if demand stimulation is better than removing impediments to production.

To clarify whether tax cuts pay for themselves (a strange illogical construction since taxes can only be collected from production, so the real question should be do taxes pay for themselves) consider that the first Bush tax cuts were more demand side than supply side. There was almost no economic change due to this first cut. But the second tax cut, engineered by Bill Thomas in the House, was a much stronger supply side tax cut. The result was that the economy began to grow almost immediately, even before the second cuts were actually implemented as suppliers began to place orders in response to their improved forecasts. Consider that all tax cuts are not created equal.

I hope this post has made some of you reconsider your preconceived ideas about supply side and demand side economics.

Professor,

“Finally, so I am not accused of being a partisan hack….”

No, you’re not THAT bad! But to prove it, would you share with us one economic action or position of the Bush Administration that is, in your estimation, worthy of praise or commendation?

Dick,

In 1980 you could make a plausible argument that cutting the top marginal rate from 70% to 50% might pay for itself if that 50% rate is closer to the Mirrlees revenue maximizing point than the 70% rate. I think just about everyone would agree that the 1964 tax cut lowered generated more revenue than it cost. But no one today believes we are anywhere near the revenue maximizing rate, which necessarily means a tax cut widens the deficit.

Joseph: OK, here’s a list. My service in government ran from June 2000 to June 2001, and hence includes the first five months of the Bush Administration. During that time, (i) the USG began a dialog to enourage financial sector and governance reform in Japan. Other items in the Bush Administration economic program I supported include (ii) the push for the Doha Development Round, (iii) efforts to encourage the Chinese to allow more rapid appreciation in the RMB, (iv) refusal to impose trade sanctions on Chinese imports above and beyond those allowed by the Safeguards agreed to in the process of Chinese accession to WTO, and (v) the inital funding levels and set up of the Millenium Challenge Corporation.

“But no one today believes we are anywhere near the revenue maximizing rate, which necessarily means a tax cut widens the deficit.

2slugbaits,

We are well above the tax rates that would maximize revenue. Look at the fall in the deficit over the past months, much greater than any forecasts. But you must look not simply at the tax rate but at the impact of the tax targets.

Our current tax system is a spoils system in the worst way. Additionally, many seem to find comfort in the fact that the bottom 50% of wage earners pay virtually no taxes at all. Add to that the rhetoric about “tax cuts for the rich” (of course tax cuts are for the rich; they are the only ones paying taxes!) and you have a system that saps the strength out of a powerfully dynamic economy.

Professor,

Vindicated. Thank you.

Dick,

“We are well above the tax rates that would maximize revenue. Look at the fall in the deficit over the past months, much greater than any forecasts.”

Uh…not quite. The revenue maximizing tax rate is a function of the relative elasticities of the income and substitution effects. When tax rates get too high, then people choose leisure over working for that marginal dollar. The effect on the supply side is to shift the aggregate supply curve to the left. The effect on the revenue side is to shrink tax revenues. But most empirical studies estimate the top revenue maximizing tax rate as something in the neighborhood of 60%. The last time I checked we were nowhere near that range.

As to the lower deficit, I think you’re confusing supply side economics with ordinary cyclical effects.

Dick,

Please allow me to disagree with your notion that people under the 50% level don’t pay taxes. Indeed, the payroll/social security and related taxes are, I believe, the largest single sources of federal revenue. Yes I know the money is in escrow for the beneficiaries… wink nod. But In reality it all goes into one pot, at least for the present, and is used as any other federal revenue, to pay uncle sam’s bills.

Also, when one calculates the revenue realized by the feds from the taxes applied to the additional gdp that occurred after the tax cuts, the additional revenues do not equal or exceed the revenue lost from the original tax cuts. Tax cuts don’t pay for themselves and the L curve only relates to reality at the extreme where marginal rates are confiscatory…way above 60% in many cases,