Taking a break from recession talk, I discuss some aspects of the progress of economic integration highlighted in a paper by Bergin and Glick presented at a SCCIE–JIMF conference on Financial and Commercial Integrations.

There is a tendency to think that the progress of globalization — often defined as increasing financial and trade flows — is always forward. The container ship [sub.req.], the Internet, just-in-time inventory management [sub.req.] are perceived to have driven transportation and transactions costs ever downward so that prices of similar goods should have their prices more and more equalized.

That is why the results in Bergin and Glick‘s paper are so surprising. They focus on price dispersion of highly disaggregate goods (e.g., a white business shirt, or a liter of peanut or corn oil). Measuring price dispersion as the square of deviations of prices expressed in a common currency, as reported in country-pairs, they find:

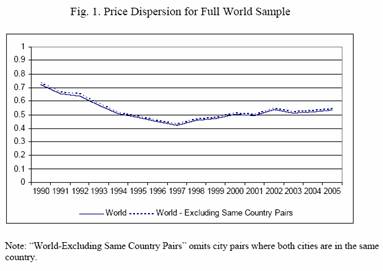

“[T]here appears to be a general U-shaped pattern with price dispersion first falling and then rising in recent years, a pattern

which is remarkably robust across country groupings and commodity groups. This time variation is difficult to explain in terms of the trade friction explanatory variables common in the literature, as these tend not to vary much over time or have not risen in recent years.”

This pattern is displayed in Figure 1. Price dispersion is measured as the square of deviations between prices of disaggregate goods (e.g., white business shirt, 1 liter bottle of peanut or corn oil) expressed in a common currency in city-pairs (Sourced from EIU). The series is the average across all the goods measured. Note that price dispersion troughs in 1997 and starts rising thereafter.

To those of us who are accustomed to thinking about the process of globalization as the inexorable march of greater and greater trade and capital flows leading to convergence of prices, this is a surprising finding. And certainly, the trough point of 1997 does not fit into some story of increased security costs post-9/11 driving up transportation costs. How can this reversal be explained?

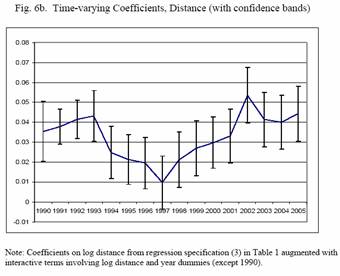

One way to look at this issue is to try to empirically model the determinants of price dispersion across city-pairs. Bergin and Glick use log distance, other geographic attributes, exchange rate volatility, and financial crisis dummies (in a specification that is reminiscent of “gravity models”). Below in Figure 6b from the paper is the estimated coefficient on log distance year-by-year.

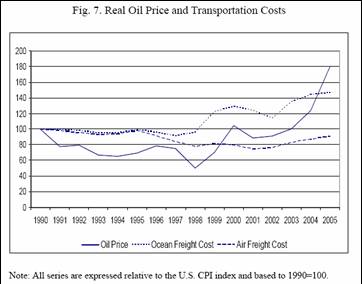

The results indicate that log distance seems to have a declining impact on price dispersion until 1997, and thereafter rises. Bergin and Glick have an ingenious explanation for this pattern. They observe that oil prices feed (roughly) into transportation costs, and that oil prices reached a trough in 1997. As oil prices have risen, goods markets have become more insulated, exactly because transport costs have risen.

I have several observations drawn from the results in their paper. First, we should not expect that goods markets will monotonically become more integrated; to the extent that transportation and transactions costs vary over time (think about what would happen if we actually did inspect all the cargo that came into the U.S.), price dispersion might not consistently fall. Second, the increasing trade flows and price convergence witnessed in the latter part of the 1990’s might not have all been attributable to better technologies (the Internet, lower cost telecommunications), but also partly due to a fortuitous convergence of accelerating technological progress and low oil prices. If oil prices remain high (at least high relative to prices in 1998), then we may see a deceleration in what many have characterized as “globalization” (and relatedly, perhaps a diminishment of worries about disinflation exported from China [sub.req.]).

Technorati Tags: price dispersion, oil prices, distance, globalization

i think you mean getting bigger not geting bigger

charts: yes, thanks. fixed.

I don’t have a reference off hand but I recall that container shipping is so inexpensive wrt energy usage that the cost to transport goods by truck from Long Beach to Chicago is vastly more than the cost from (some Chinese port) to Long Beach.

Another potential reason for the “up-tick” could be that: When a particular Good becomes commoditized, it becomes finacially important to innovate or to increase the Brand Value.

This might conceivably lead to lower costs in the “home” market, e.g. Volvo is considered a Blue Collar car in Sweden while it’s an upscale car in the US – thus alloweing Volvo to charge a premium in the US.

Yet another possible reason could be currency fluctuations: Due to the decrease in the US dollar, Volvo is now forced to charge less in Euros for their cars in the US, thus making their cars cheaper in the US than in Sweden.

Menzie, What’s your take on these two explanations?

camille roy: I believe it is true that trans-pacific container shipping costs are probably relatively low compared to cross-land shipping; this is probably why trans-Pacific trade is slightly higher than standard gravity models predict. That being said, I think these types of models do explain a high proportion of variation in price dispersion, despite omission of such details.

bellanson: While some of the goods are “branded”, most are not. Hence, I don’t think that the aggregate, cross-good, cross-country uptick identified in the data can be ascribed to the phenomenon you mention. In addition, many city-pairs are involved, not just those involving the source country and other countries.

On the other hand, the exchange rate volatility hypothesis seems like a plausible explanation. However, if you refer to the paper, you’ll see that this is one of the regressors they included in their many robustness tests. Exchange rate volatility matters for price dispersion, but the trends identified in the post still remain after including that variable.

Doesn’t the ’97 trough also roughly coincide with the start of a long of increased liquidity in some key countries?

Certainly oil prices have been an effect of boom times in those countries. Probably shirt prices too, no?

Inflation being everywhere and always a monetary phonomenon, and all that.

We all know that one of the reasons that prices were going down is because more and more items were being manufactured in countries with a big labor cost differential (e.g. China, India, etc.). My theory (and I know I’m not original) is that in these countries, with the new wave of manufacturing increases the has been an increase of job sources in industries that pay higher salaries than farm jobs where most of the people worked. And also factories have to compete against each other for that labor (i.e. salaries increase). Add that to the fact that these new higher salaries allows these workers to start purchasing the same things they are manufacturing adding to the demand of these products. The increase on labor cost and increase of the demand are for me a big part of the reason of the costs of manufactured products. 1997 could have been a turning point, but I think that these trend will continue, no matter what the cost of oil is. And also means that there is a limit on the number of jobs that can be outsourced to other countries.