The CBO released The Cyclically Adjusted and Standardized Budget Measures last Thursday.

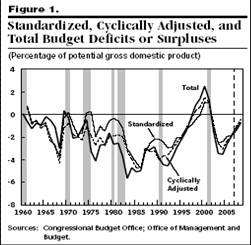

As I teach my undergraduate students, the more appropriate measure of fiscal stimulus is not the budget deficit, which is an endogenous variable, but rather the cyclically adjusted budget deficit. In this regard, Figure 1 from the report appears to give reason for celebration.

Figure 1 from CBO, The Cyclically Adjusted and Standardized Budget Measures, February 2007.

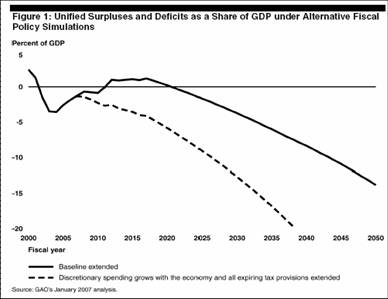

However, as I have stressed on numerous occasions, and as the CBO makes clear itself in its publication, the “current law” baseline presented does not take into account likely legislative actions. For instance, if discretionary spending is assumed to grow with nominal GDP (which is more likely, from historical precedents) rather than with CPI, and the 2001 and 2003 tax cuts are made permanent (as the President has budgeted), then a more alarming picture is obtained:

Figure 1 from GAO, The Nation’s Long-Term Fiscal Outlook January 2007 Update — The Bottom Line: Federal Fiscal Policy Remains Unsustainable, GAO-07-510R (January 2007).

What drives this outcome? The usual suspects are there (and don’t forget the figurative “magic asterisk” that makes expenditures for Operation Iraqi Freedom drop to $50 billion in FY 2009…). However, Greg Mankiw’s recent laudatory post on the operation of Medicare Part D spurs me to quote this point:

Spending on the major federal health programs (i.e., Medicare and Medicaid) represents a much larger and faster growing problem. In fact, the federal government’s obligations for Medicare Part D alone exceed the unfunded obligations for Social Security. (emphasis added) (p. 3)

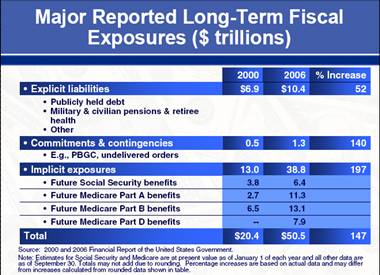

In other words, those who were concerned about the Nation’s fiscal outlook were not so much worried about the implementation and cost-effectiveness of the program (although from previous implementation episodes such as the absence of a pre-9/11 alert, post-Katrina rescue/recovery/rebuilding, the post-invasion stabilization program of Operation Iraqi Freedom, and administration of medical care for returning veterans, such concerns would be understandable), but rather the fiscal burden associated with starting a massive, new entitlement program, even as the Administration sought to adjust Social Security. A reminder of exactly how enormous this burden the Administration and Congress saddled us with is provided by Chart 1 from Comptroller General David Walker’s presentation on fiscal challenges.

Chart 1 from David Walker, Saving Our Future Requires Tough Choices Today, Fiscal Wake-Up Tour, Forum Club of the Palm Beaches, West Palm Beach, Florida, GAO-07-500CG (February 21, 2007).

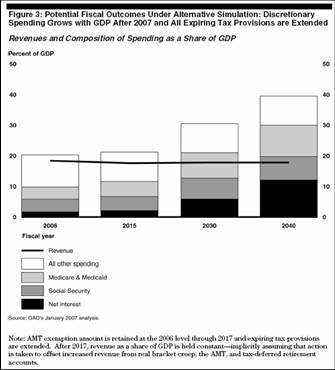

Figure 3 from the GAO report presents the composition of outlays under the assumptions indicated.

Figure 3 from GAO, The Nation’s Long-Term Fiscal Outlook January 2007 Update — The Bottom Line: Federal Fiscal Policy Remains Unsustainable, GAO-07-510R (January 2007).

One additional statement from the GAO report sticks in my mind:

These figures also show that waiting makes the size of the problem worse. For example, even under GAO’s “Baseline extended” scenario-under which revenues rise to about 20 percent of GDP and discretionary spending falls to below 6 percent of GDP-waiting until 2040 to close the gap would require drastic change. Taxes as a share of GDP would have to increase by about 40 percent or total spending cut by almost a third in order to balance the budget in that year. Sudden, drastic changes of either kind — and revenues at such a level — are outside post-World War II historical experience in this country.

This suggests that if we had not embarked upon this fiscal experiment of running the Nation’s coffers dry, we would not be facing such dire fiscal straits.

Technorati Tags: Iraq, budget deficits,

denial,

cyclically adjusted budget surplus.

Menzie wrote:

if discretionary spending is assumed to grow with nominal GDP (which is more likely, from historical precedents) rather than with CPI, and the 2001 and 2003 tax cuts are made permanent (as the President has budgeted), then a more alarming picture is obtained

This of course includes one huge assumption: producers continue to produce at essentially the same rate (GDP remains the same) no matter the tax and regulatory structure.

Imagine, if you will, how your lifestyle would change if your taxes increased by 40% as the GAO indicates must happen to pay for Medicare Part D. Obviously simply increasing taxes will never solve the problem and will actually make the problem worse.

This morning on the Wall Street Journal’s morning program they reported that 1 in 6 Americans is on welfare. (here is a link to an online article if you are interested http://www.contracostatimes.com/mld/cctimes/news/nation/16786127.htm )If you have a family of five how do you feel about taking on another mouth to feed? We cannot solve the welfare crisis by simply substituting one welfare program for another and pretending it makes a difference.

Government does not produce, it confiscates and consumes. The only, answer to an economic crisis is to release producers. Any other action will simply make conditions worse. If your economy has one house but your economy demands two, you cannot satisfy that need by simply taxing the one fortunate home owner. You only satisfy the need by building another house!

So should the tax reductions be made permanent?

Something has happened to your printing and most of your text is too small to read.

Spencer: Thanks for catching that. I’ve fixed it now.

“So should the tax reductions be made permanent?”

A reminder of exactly how enormous this burden the Administration and Congress saddled us with is provided by Chart 1.

Let’s see. The fiscal hole is so big because the republicans spent like drunken sailors at the same time they cut revenues. Oviously we should make the tax cuts permanent because the deficit is so large. Not only do huge fiscal deficits not matter, big deficits are actually good for us.

DickF: Apparently in your world, the net return on expenditures on courts, police, defense, R&D (remember the agricultural research stations), the patent office, etc., is zero. If that’s your view, you’re certainly welcome to it. It seems to fly in the face of empirical evidence.

zinc: I can’t tell if you’re being ironic or not. But if you think big budget deficits are good, it’s too bad you weren’t around for Weimar Germany ca. 1920s.

Wow, nearly one in six on public assistance. What happened to shame and sense of pride? Ridiculous, that socialism has displaced extended family and church as our safety net.

In today’s San Diego Union-Buffoon, the paper highlighted a mother of two going to Hamilton College, while on public assistance. She was studying theater, and hoped to be a teacher. There are several things wrong with this picture. Where’s her husband? If she’s ‘in need,’ what in the world is she doing at Hamilton? Go to SUNY, CUNY, etc. Who’s taking care of her kids while she studies? Why in the world study theater if one needs to provide for two children post-graduation?

Quit trying to save stupid people from themselves, federal and state governments.

Menzi wrote:

DickF: Apparently in your world, the net return on expenditures on courts, police, defense, R&D (remember the agricultural research stations), the patent office, etc., is zero.

Menzie,

There is a net return on government spending on enforcement of contracts. This includes the protection of person and property. The people empower government to protect the individual from coercion and theft. This will include police, courts, national defense, establishing measurement standards, and enforcing direct contracts. Taxes should only be used to support the government’s ability to enforce contracts, because any other use of government power violates property rights.

Government’s coercive power should not be used to take the property of one individual to give it to another. Government funding of R&D is a waste of resources because there is no control on the expenditure, no market control, no cost control. Such expenditures are actually justified as funding research with results that cannot be cost justified in the marketplace.

The greatest waste of money can be seen at the Department of Commerce – the biggest cash cow in our country. Billions of dollars are confiscated from taxpayers then passed out to the biggest and most profitable businesses in our country to buy favors for various politicians.

What must be understood is that for our government to best function we should have the comman man in positions of authority. It is the common many who understands violations of property rights and so it is the common man who can prevent government from violating property rights. While the common man functions best in this role because he is a common man he is not the best to engage in business activities. Congress does not know best how to pass FASB regulations or what R&D is most promising. They only know what they like.

But when government is run by professional politicians we see the masters of deception and extortion craft laws to allow them to use the powers of government to their advantage. Government follows the Willie Sutton rule: rob banks because that is where the money is. Crooks enter professional politics because that is where the money is, and they can even write the laws.

Government has an important function in our society. Without it we would have chaos, but because the government is vested with the collective power of coercion of the people, it must be tightly controlled or it evolves into the totalitarian state.

One in six on welfare proves my case.

Sorry this is so long. It is one of my passions.

I will not normally write so much.

To jg:

I think such cases explain the fact that there is still some (perverted) notion that the “American dream” is not so delusional as many of us think. By the same token, it explains why so many people from other countries want to emigrate here. One can live beyond one’s means.

Now, I agree that the woman’s case, at least as you describe it, is practically criminal–maybe it can count as some species of white-collar crime. But I suspect that some economists would argue that maintaining some version of the “American dream” is (like the British royal family) ultimately an economic benefit to the nation as a whole. Some notion of “American dream” is like high “consumer confidence”.

–From a skeptic and libertarian trying hard (and prob not successfully) to play devil’s advocate–and generate a little more discussion of Mommy Shakespeare.

To DickF:

If there’s one convincing point in the writings of Hobbes, it is that there are no “property rights” outside of govt. (What is a “right” in a state of nature?) So, at least according to Hobbes, and those who follow his reasoning, your separation of “govt” and “property rights” is faulty. This is rather serious: no govt, no property rights. You can’t have your cake and eat it too–though this is precisely what Locke thought. You want the govt to protect you, you must undergo the risk that it will rob you. As Adam Smith pointed out, govt is quite a good thing if you’re rich; if you’re penniless, pray for civil war and state of nature.

ws,

On this I do not agree with Hobbes but with Samuel Rutherford, Locke, Adam Smith, and the writers of the Declaration of Independence.

The writers of the Declaration reflecting Rutherford stated it as: “…all men are endowed by their creator with certain unalienable Rights…” Locke appealed to natural law giving man the right to protect “life, liberty, and estate” (property). Smith stated it as “life, liberty, and the pursuit of property.”

I do not believe that rights eminate from government but from natural law as created by God. The government is an institution created by man to enforce rights. The government does not create rights. Understand that government does not exist separate from man so it cannot endow anything.

DickF

One can cite God, Creator, Natural Law, or anything else (Zooba-Zooba-Looba-Looba, for instance) as the author, origin, or benefactor of “rights”. I can say that I have a “right” to life as conferred by God. But what does that matter when you’ve got the barrel of the gun pressed against my forehead? Similarly, what did it matter to the slaves that the Creator (if not the Founders) had endowed all creatures with “inalienable” rights? Hmm…maybe they’re not so inalienable, even when bestowed by God or Zooba-Zooba-Looba-Looba. Maybe it’s more important to be able to EXERCISE a right than to be able to cite an “inalienable” or “natural” one. So, I much prefer to have a CIVIL right–the force of the govt backing me–than one of those inalienable, GOD-given, NATURAL-law ones. To put it into more economical terms I’ll pose this question: what are the worthwhile “rights”? Only the ones you can cash in on. A “property right” you can cash in on is one that is established and protected by the govt. Try appealing to your “property right” (however inalienable or natural or divine) when the would-be thief has little or no reason to fear punishment (when no govt exists). Thus the looting we see, even in this country, whenever people see there is little likelihood of detection–when govt is, for all practical purposes, non-existent.

None of this alters the fact that you can continue to insist that there are “inalienable rights” from God or any other source. But that does not mean you are likely to preserve your property when the would-be thief has no reason to fear ENFORCEMENT of your “right” to property. In other words, at least according to Hobbes, a right is only really worthwhile if you’ve got a govt to enforce it. So, in the looting situation, your right is worthless. Thus, as Hobbes at least reasoned, a property right is just a way of saying “the govt will harm you if you take his land”. And if there is no govt–state of nature–to assert a property right is just a way of saying: “I’ve got no gun to deter you from taking my land: please don’t.” In a state of nature, in a jungle far from civilization and govts, which would you prefer, a good weapon or the right to life, liberty, and happiness? If I meet you in the jungle, I hope you will have chosen the latter.

This is why Hobbes was a philosopher, and Locke a mere Whig propagandist–if not Shaftesbury’s poodle. (As for Bentham, he seems to have been something of a Hobbesian: indeed, most of the points made in Anarchical Fallacies are expositions of Hobbes’s aphoristic formulations in Leviathan.)

To Econbrowsers: Sorry for the rambling and let me cease before hijacking “fiscal stimulus” even further.

To DickF: thanks for engaging.

ws,

I agree, it is a good interchange. I thank you.

Yes, one does have a choice of living by the law of the jungle or the law of civilization. What is the difference? The law of civilization reasons from a position of morality while the law of the jungle reasons from a position of force and power.

Hobbes makes a leap of faith in believing that the survival of the fittest will result in a just society. This reasoning from force makes self-sacrifice foolishness and justifies totalitarian rule, rule by the strong man. The accumulation of power becomes the highest good and democracy becomes an impediment. Efficiency replaces liberty and expediency trumps freedom and central planning overwhelms the market and a monarchy is preferred over a republic.

Menzie,

Sorry to stray so far. I will stay on topic.