Recent data leave me significantly more bearish than I was a month ago.

But the home sales data as of yesterday looked good, you say, or at least “not unambiguously bad“? True, existing home sales rose a seasonally adjusted 3% in January, to the highest level in 7 months. Dave further notes that futures market forecasts of home prices have been becoming less bearish. But the January new home sales numbers released today by the Census Bureau do look unambiguously bad to me. Seasonally adjusted new home sales fell 16.6% in the month of January alone, enough to completely wipe out this fall’s gains and put us back below the previous low set last July.

My index of the stance of monetary policy provides a quick summary of the implications of recent monetary policy decisions for new home sales. A positive value indicates that today’s new home sales should be higher as a result of the Fed being less contractionary than the market had been anticipating, while a negative value signals that the Fed has on balance surprised the market by being more contractionary than anticipated. The Fed’s decision to stop raising rates helped bring mortgage rates down last summer, which accounts for the net stimulus recorded by this series for November and December. That stimulus is one factor that led me to predict that new home sales would rebound from the bottom reached last summer. Up until today’s release, that prediction had proven right on target.

We did indeed receive a stimulus from those mortgage drops, and I think that’s why home sales did rebound this fall. Unfortunately, according to my index, the stimulus from last summer’s drop in mortgage rates had disappeared by the beginning of February, and the index in fact is now once again back into negative territory. The green line in the figure above is the projection of where this index will head from here if the Fed behaves as currently anticipated by the fed funds futures markets. Thus, further gains in home sales from here would seem to depend on factors other than interest rates.

And those factors don’t look very favorable to me. For example: (1) As more subprime mortgages go into default fewer such loans will be extended by lenders or desired by borrowers, both of which mean lower demand for homes. (2) The employment consequences of the decline we’ve already seen in new home starts has not yet shown up, but is just about to begin. (3) Consequences of declining home construction for sales of home appliances are also just beginning to set in.

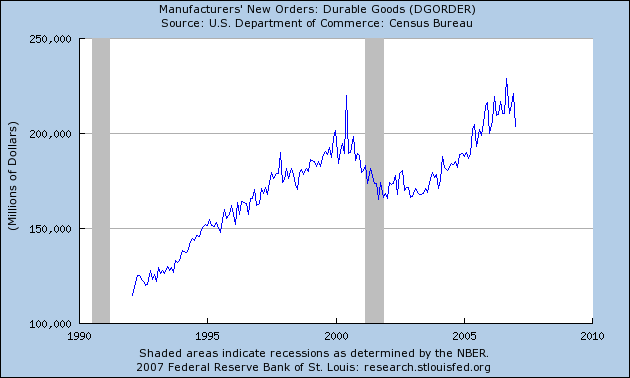

As Menzie noted yesterday, we also received several other indicators this last week that suggest that outside of housing, the U.S. economy has taken a sharp turn for the worse. Industrial production fell to a 6-month low in January, which concerns me greatly. Everybody’s talking about yesterday’s report from the Commerce Department that new orders for manufactured durable goods fell nearly 8% in January. That’s the fifth biggest decline for this series since 1992, with two of the other worst four months appearing just before the 2001 recession:

|

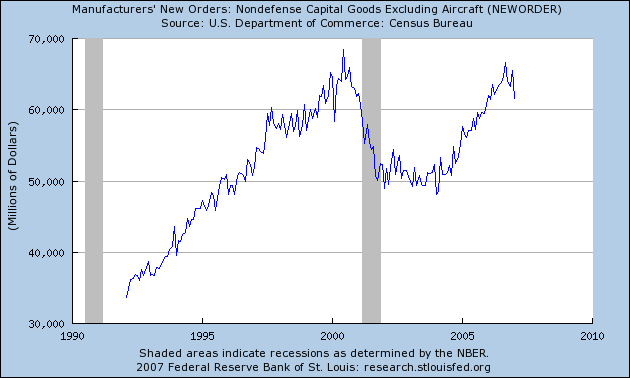

Also disturbing to both Menzie and me is the fact that new orders for nondefense capital goods (excluding aircraft) were down 6%, which is another unusually sharp drop:

|

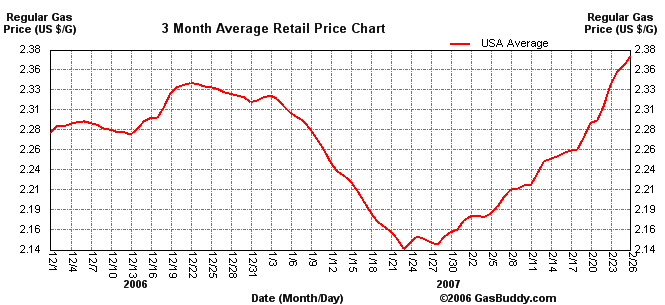

To top it all off, gasoline prices have been climbing back up. In part this is the usual seasonal result of the transition to summer fuel requirements, and in part it’s the result of the fact that crude oil prices have risen significantly over the last month. But whatever the cause, the run-up in gasoline prices is unlikely to make American consumers feel more optimistic.

|

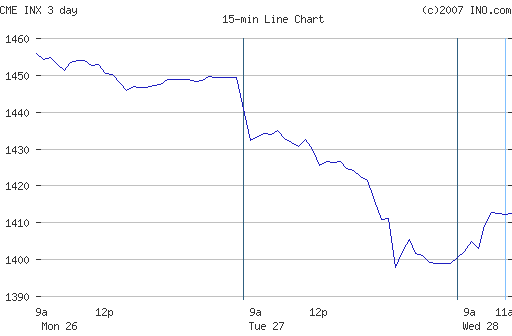

And let’s not overlook that unmistakably ursine growl from world equity markets yesterday.

|

Technorati Tags: macroeconomics,

housing,

Federal Reserve,

recession

Stagflation anyone?

Professor, I’m glad that you’re rational, fair-minded, and happy to say, ‘Time to look again.’ Fine graphs.

Keep up on this tack and we may see you posting on Roubini’s blog!

I look forward to seeing those consumer spending numbers tomorrow.

I think we need to separate two issues in housing. One is the importance of the housing sector to the overall performance of the economy. In that regard, we should pay very close attention, because consumer spending and employment have been critically tied to the housing sector in this cycle. The other is the data in the short term. New home sales data for a single month just can’t be relied upon to tell us what the future will bring. In fact, the January slide follows a December jump. Average them and you’ll find that sales haven’t wandered far from where they were in October and November. Slightly better, in fact. Weather goes a long way toward explaining the wobbles, both because weather was quite changeable from December to January and because winter in general pulls down non-seasonally adjusted sales to the point that the seasonal adjustment factors in December and January are quite large. The housing numbers from November forward are probably very badly distorted. Let’s see what March brings.

The general run of data, though, is another matter. Industrial production and core capital goods orders have both been icky (in the purely technical sense of the word) for months. Toss in ISM factory data, too. There is just no getting around the fact that the factory sector is looking poorly. Since sizable chunks of the service sector provide their services to goods producers, I will not be surprised if service sector indicators begin to slip pretty soon, too. The frequently observed divergence between the performance of the goods and services sectors may prove to be mostly the result of the goods sector leading, services lagging, just like always.

James, please be consistant. Being the good ole’ midwesterner, I pretty much use your econ outlooks as my factory output and expansion futures.

If you say bad: I cutback

If you say good: I expand

I am confused!!!!!

kh, the fundamentals in housing are bad; we have too many homes/have overbuilt. Why do I say that? One indicator is that 30% of homes for sale in San Diego are vacant. That’s neutron bomb levels.

http://piggington.com/too_many_homes_certainly_how_many_too_many

No, the slowdown is more than weather-related.

Professor, would you be willing to comment about this? Consider yesterday’s slide of 400 to 500 points of the DJIA. Everyone sat up and took notice, but it seemed to have rebounded as of today. My question is, how much of a slide would one have to have to see a catastrophic collapse of the markets? Obviously 500 points didn’t do it. However, as I read about how highly leveraged the edge funds are, has anyone estimated just what kind of drop would be needed to cause a serious implosion as the leveraged positions can’t make margin calls, leading to a good ‘ol run on the bank? 1000? 2000? 5000? I would think that someone has thought about this, but I’ve never read anything about just what this number is. Obviously, if the market is all small investors, then it would be a significantly larger number. However, as it seems that there are vastly smaller of investors controlling huge amounts of wealth, I would guess it would be a somewhat decidedly smaller number to catalyze the scenario. Any thoughts?

I think you have to be concerned about any expansion where debt-to-income ratios start at high levels and continue to rise throughout the expansion. And especially so when this debt is funneled into consumption rather than investment (do all those nice houses we built actually do anything productive?).

I think you are spot on in your analysis. The subprime (soon to be Alt-A) meltdown might provide the final blow to prevent a resurgence of the DJIA above 12.5K, thus making the possibility of a confirmation of the secular bear. It’s pretty remarkable that with today’s negative numbers, the market went up. For the moment, the carry trade continues, but we’ll see how much capital is expended to keep that going….I see exhaustion of both the consumer & private equity in our futures….

Dryfly, OK, so now I’m saying “bad”. And I’m saying the futures market shifted this month. That’s why you read us every day, right?

The real definitive Econbrowser verdict is the happy or grumpy face, which turned sour Feb 21.

And by the way, what I’m about to say in my post later today about the new GDP figures isn’t a new “good” signal– I’m just trying to set the facts straight.

Jack, that’s an interesting question, though I’m afraid that I don’t know the answer.

I notice that some effort was made to blame computers for, if not creating the sell-off, exacerbating it. Had they had the capacity to handle 4.5B shares (is there another metric, the intelligent one, that measures # of trades?) there might not even have been a drop. (So perhaps these same computers are not working all that well today as the market bounced back only 50pt –not quite the 400 yesterday.) Likewise the Chinese market losing 9% after a run up of nearly 100% in a year, may have just been some sticky data stream in the main computer.

The fundamentals are always rock solid and beyond reproach. [Buy now before the rest of the bounce back happens.]

Ok, the good news: the preliminary GDP q4 moved to 2.2% from the ‘advance’ 3.5%…on the road to my (once upon a time laughable) 0.0% prediction. One more shift like that and I will feel absolutely vindicated. This forecasting business is not a confidence builder.

jg,

Not saying the housing sector isn’t bad. Saying that one month’s data, when we have had some historically extreme weather, is not going to tell you much about changes in trend. Big differenc.

The question in my mind is, “Are these indications of a coming bear market, or are these ‘twitches’ from investors getting forcefully corrected that no, the late ’90s are NOT back.”

I can easily imagine this week’s shock to the market is due more to people realizing an eight or ten percent return really isn’t insultingly low for long term investment.

Any comments on bear versus stag-flation?

Professor,

Thanks for all the great info. Also, just wondering if you have updated the probability that we are “currently in a recession and don’t know it yet” chart?

GWG, that number is only updated every 3 months. I’ll see if I can find a good way to keep the most recent value on the Econbrowser main page.

Tighter lending standards in housing lending will blow out all other factors that might otherwise be smoothly extended to make predictions. I’m talking about something potentially exceeding a removal of 25% of buyers from the market at current prices, requiring a 30-50% additional price decline to reach the same transaction volume as last month.

JDH wrote:

The green line in the figure above is the projection of where this index will head from here if the Fed behaves as currently anticipated by the fed funds futures markets. Thus, further gains in home sales from here would seem to depend on factors other than interest rates.

Existentially if the FED takes no action isn’t that action? If the FED does not move rates yet the market demands a downward shift in rates doesn’t this push us toward recession? So in this sense doesn’t the FED have a huge impact on recover of home sales?

You’re absolutely right, anonymous, that’s the exact philosophy on which the index is constructed. In order for the index to move, there has to be a change in near-term fed funds futures prices. If these do change, the index will respond, but with a lag that’s based on the very sluggish response of new home sales to changes in interest rates. The green projection represents the base case in which there are no further changes in fed funds futures prices. But even if there are big changes in those futures prices, the path of the projected index for March would be little changed because of the lags.

Sorry JDH. Anonymous was me.

Thanks for the real informative writeup here. The analysis here is indeed factual and objective. From the charts and from the analysis, my personal take is that prudence in economic activities should be recommended for now. Preceding data will confirm the trend further.