The Fed Chair speaks, and the market jumps. But why?

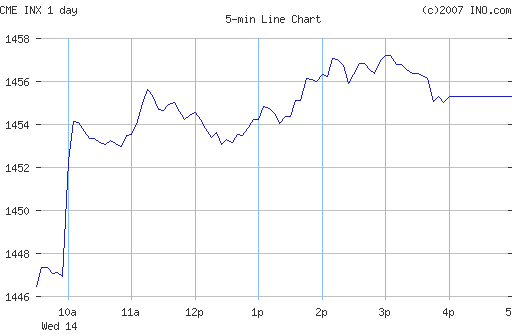

Impressive to watch the S&P500 yesterday the minute the

latest statement from Fed Chair Ben Bernanke was released:

|

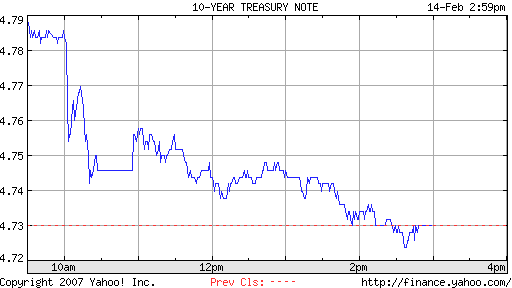

The rally in stocks was joined by bonds:

|

Here’s how

Marketbeat explained it all:

The sharp upward turn [in stocks] seems to reflect surprise that Mr. Bernanke was as dovish as he was, after more-hawkish comments last week from other talking Feds.

The message remains the same– look in the testimony, and one will find all the boilerplate language about how the “core inflation rate remains somewhat elevated” and how it will be some time “before we can be confident that underlying inflation is moderating as anticipated.” But somehow, he’s just not bringing the hammer down the way others were last week.

|

For the record, let’s take the complete quotes, straight from

the horse’s mouth:

Inflation pressures appear to have abated somewhat following a run-up during the first half of 2006. Overall inflation has fallen, in large part as a result of declines in the price of crude oil. Readings on core inflation– that is, inflation excluding the prices of food and energy– have improved modestly in recent months. Nevertheless, the core inflation rate remains somewhat elevated.

Bernanke later elaborated with:

there are some indications that inflation pressures are beginning to diminish. The monthly data are noisy, however, and it will consequently be some time before we can be confident that underlying inflation is moderating as anticipated. Recent declines in overall inflation have primarily reflected lower prices for crude oil, which have fed through to the prices of gasoline, heating oil, and other energy products used by consumers. After moving higher in the first half of 2006, core consumer price inflation has also edged lower recently, reflecting a relatively broad-based deceleration in the prices of core goods.

Before you dismiss any part of Bernanke’s statement as “boilerplate”, there’s one very important detail worth mentioning– everything he said happens to be true. Headline inflation has come down, core inflation has improved modestly and, most important of all, core inflation remains higher than the Fed is going to tolerate.

|

Bernanke sees some hope that we’re going to see further improvements in the core inflation figures, and I agree that’s the most likely outcome. But Bernanke did not express certainty that it will, and reminded us all that:

in the statement accompanying last month’s policy decision, the FOMC again indicated that its predominant policy concern is the risk that inflation will fail to ease as expected and that it is prepared to take action to address inflation risks if developments warrant.

My sentiments are with Bonddad— I don’t see a whole lot of news in this. Indeed, I used last month’s version of the above graph to support my view that the Fed is unlikely to change the target rate soon. I remain convinced that the Fed is not going to lower rates until one of two things happen– either we see further improvement in the core inflation numbers, or the prospects for real output growth deteriorate significantly. As long as the status quo prevails– core inflation higher than the Fed would like, and output growth slower than normal– the Fed is going to keep rates where they are.

Marketbeat may be right as to what the market’s reaction means. But let me offer another possibility– it may be that more and

more people are coming to share the respect for Bernanke’s judgment that I have had for twenty years. The quality of economic analysis communicated in his

latest statement is as good as you’ll find anywhere. The story is much as it’s been: inflation is higher than we’d like, and output growth is going to be slower than we’d like. But Bernanke sees the outlook for both a little more favorably than he did six months ago.

And if that’s what Bernanke thinks, that just may be right.

Technorati Tags: macroeconomics,

Bernanke,

Federal Reserve,

inflation

“Marketbeat may be right as to what the market’s reaction means. But let me offer another possibility– it may be that more and more people are coming to share the respect for Bernanke’s judgment that I have had for twenty years.

The quality of economic analysis communicated in his latest statement is as good as you’ll find anywhere.”

I’m not sure what you mean here. If Bernanke was offering an unbiased economic analysis, his statements should not move the market that much.

If anything, this jump implies that the Fed’s language is still rather fickle and unpredictable. This is unavoidable to a certain extent, but perhaps they could do better at communicating their intention.

Guest, I’m suggesting that Bernanke may be playing the role of a very influential market analyst here. But I agree with you that the magnitude of the market response is surprising.

Median CPI looks a little scary. Do you have a quick read on why the median and core lines are diverging?

Stuart, I believe the median CPI is currently tracking owner’s equivalent rent, which Dave Altig notes can rise when energy prices are falling, and which may be interacting in complicated ways with the housing downturn. None of which are reasons to dismiss the median CPI.

The read that last week’s Fed speakers were hawkish seems to me to have been backed into. Looking at the bond market’s response, and cherry-picking to gather up some hawkish sounding headlines, one can arrive at the notion that Poole was more hawkish than on prior occassions, but it still requires heavy effort at looking the other way. Last week, Poole said the Fed could stay on hold for a long time, that rates looked appropriate, that the Fed would not be in a hurry to change its economic assessment – all very “on hold” talk. Ignore that, dig out the obligatory “but we’ll hike if inflation doesn’t come down” and note that yields rose, and you can trumpet hawkishness. Pianalto was pretty stern, but nobody else was.

There is a tendency, I think, to ignore issues of event risk and liquidity when watching prices wiggle after a Fed statement. Lots of accounts have things they very much intend to do, but at the same time, they recognize they could be very sorry for doing them if the Fed Chairman says something explosive. Heck, they could be sorry if the Fed Chairman says nothing particularly important, but some glory-hawg gets on the wire and says, ‘did you notice all the hawkish/dovish stuff the Chairman said?” So big accounts often wait until the event is better understood, then go to work. If they intended to sell bonds, they sell. If they intended to buy, they buy. Just so long as the Fed Chairman (jobs data, CPI, retail sales, G7 statement) doesn’t screw things up for them. Then the pundits come along, point at the change in prices, and find some element in the Fed Chairman’s text (jobs data, CPI, …) to blame for the price move.

If you can read the English language, and are willing to look at complete sentences and context, you can understand whether Ben Bernanke is worried about inflation (not so much), growth (not so much), sub-prime lenders (well maybe), and so forth. Reading market journalism is likely to mislead more than clarify in these cases.

I do see inflation pressures still in the economy but high FED interest rates are causing the inflation not controlling it. If the FED were to lower interest rates then inflation pressures would ease.

It appears that commodities are also recognizing inflation pressures.

Excellent point, kharris.

I am flattered you agreed with my sentiments regarding Bernanke’s statement.

Thanks for mentioning it.

I suppose it’s a semantic issue, but, do we really need “further improvement” in core inflation, or simply a confirmation of the improvement that has already occurred? If you measure it on a quaterly basis, the annualized core inflation rate was 3.6% in Q2, 2.7% in Q3, and 1.4% in Q4. If it stays at 1.4%, I would hope (and expect) that the Fed cuts rates, rather than leaving the real federal funds rate at almost 4%. (There’s nothing magic about the quaterly measure, but there’s nothing magic about the annual measure either.)

Great line, I love it: “Before you dismiss any part of Bernanke’s statement as “boilerplate”, there’s one very important detail worth mentioning– everything he said happens to be true.”

Love the graph; speaks volumes.

Prof. Hamilton,

You say you think inflation will moderate. I wonder, do you think we will avoid the fate of the hangover of every major war in American history and not have a concomitant major inflationary period?

I know this war doesn’t feel “major” to anyone; but it sure is expensive.

“I believe the median CPI is currently tracking owner’s equivalent rent.”

I have trouble with the asymmetric treatment of CPI components by Bernanke and the Fed.

1) OER is increasing after decelerating for a few years. I did not hear anyone saying that the move down in OER was anamolous when it was going down during the housing boom.

2) The BLS subtracts household energy from OER that shows up as a positive when energy is falling. Again, noone was pointing out the energy price increases were keeping down the housing component of CPI when it was working the other way.

3) Bernanke pointed to energy prices falling and how it will help pressure core CPI down. When they were going up, the story was energy prices were not going to flow through into core.

Maybe they just want to manage inflation expectations but it seems to me that they do not care about inflation unless it really gets out of hand.

Aaron, in my opinion the inflations that one typically sees historically during wars were caused not by the military expenditures but by the monetary expansions that accompanied them.

js, yes there are problems with OER, but what’s the alternative? I do not advocate throwing it out, either when going up or down. If we do have inflation under control, I expect to see stabilization in OER along with the other components. I plotted the median CPI here precisely because I think it’s worth paying attention to.

Good point, knzn. I’m referring here to the year-over-year numbers.

Aaron,

Throughout history most wars were followed by deflation. This is because most governments used inflation to pay for wars and then returned the currency to its previous exchange rate to maintain the confidence of the citizens. This was a serious problem after the Civil War.

But under our fiat currency inflation is a problem because the central bank attempts to use the money supply to counter the necessary adjustments to the economy after a war.

Consider FDRs confiscation of gold and debasement of the currency from $20 to $35. This debasement could have been worked off in the 1950s but the FED continued to increase the supply of dollars under Breton Woods causing the French to call our bluff. After this Nixon abandoned any pretense of a stable currency for political reasons (he wanted to get elected and actually healing the monetary errors would have required a serious recession).

Professor,

I commend you for pointing out the median CPI. Too many commentators ignore it because it does not jive with the Fed’s assertions that underlying inflaiton is moderating.

My point is not that OER is faulty. I am arguing that there is a tendency to overlook faults in OER when it was helping keep the inflaiton rate down and complaining when it is causing CPI to go up. Same with energy prices. Ignore them when they were pressuring overall cpi UP BUT now they are a great help in keeping inflation down. What is up with that?