Macroblog and Calculated Risk had some discouraging graphs yesterday.

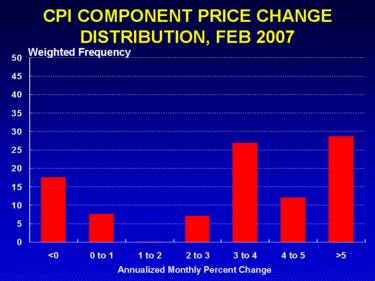

First, Dave Altig of Macroblog looks at the distribution of inflation rates across the different components of the CPI, and finds that two-thirds of the typical consumer’s budget went to items whose price increased at greater than a 3% annual rate in February:

|

If the Fed was looking for an excuse to cut rates (and I sure would be), this has to undermine the claim that we can just declare victory in the war on inflation and bring the troops home.

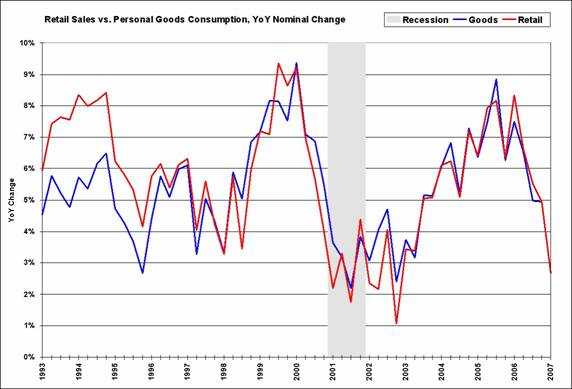

Second, Calculated Risk notes the very close historical correspondence between the growth rate of nominal retail sales (which we now know to have been disappointing for January and February) and the growth rate of nominal consumption spending on goods (which will be an important component determining the 2007:Q1 GDP growth that won’t be reported until the end of April). If the lackluster numbers of the first two months also hold for March, and if the CPI inflation numbers are any guide, we’re in for disappointing numbers for the consumption goods component of 2007:Q1 real GDP.

|

And the plunging numbers on capital goods and new home sales suggest that the 2007:Q1 investment numbers could be pretty dismal. So maybe the economy can keep chugging on consumption services alone?

Choose your poison, Ben: inflation or recession. Or perhaps you’d like a little of each?

Technorati Tags: macroeconomics,

inflation,

Federal Reserve,

retail sales

,

recession

JDH:

I am going to ask you for your opinion regarding what level of GDP growth (or contraction) over the next six quarters would be required to bring down the Median CPI to around 1.5% or the 16% Trimmed Mean CPI to just under 2%, and does the political will exist in the United States to take the pain?

Hi JDH, I see a plunge in 95-96 as well. Can you please elaborate on some of the differences and similarities between that time period and now. Thank you.

Charts,

You might be interested in reading this article from the NY Times.

If you’re not registered there, you can get a password here.

Esb, I had thought we’d already done enough to start slowing core inflation, and it hasn’t happened yet. But, given the tradeoffs and likely downturn in real output, I doubt very much that anybody at the Fed plans on hitting 1.5% within 6 quarters.

Charts, any one item, such as slowing retail sales, I think the economy could handle. It’s the combination of them all together that worries me.

Steve, thanks for that article. From my perspective, one of the key differences between 1996 and now is that ’96 didn’t have the backdrop of a dying housing market. In fact, in 1996 homebuilding was actually increasing.

This is one of the key data points that the NY Times forgot to include, in my opinion, because a recession has followed every time the housing industry has imploded like we’re seeing now.

Charts,

Did you read the second page? It does talk about the housing bust.

Beware of the slowed down productivity. If may have altered the landscape. As a chicken farmer would say, you can’t feed a rooster to much grain, or they become a vollyball.

“I doubt very much that anybody at the Fed plans on hitting 1.5% within 6 quarters”. James, while I agree with this, they better worry about inflation not hitting a core rate of 3.5% by mid-year. Times are different. Fed Policy needs to reflect that.

There’s nothing that the Fed can do; household debt to disposable income is at an all time high, and we’re seeing reduced consumption as a result, now (flat/decreasing real retail sales in February). With ARMs resetting higher and folks moving out of their low teaser rate period, the pain is increasing (14% default rate on subprime ARMs).

I expect housing starts announced tomorrow will disappoint. Auto sales hurting, housing hurting, retail sales hurting, debt at an all time high; short the market folks, ’cause we’ve got a big correction coming as soon as enough folks smell the coffee.

JG:

My prediction is that BB will have an Arthur Burns moment…”Ya’ know, we might just be able to print our way out of this mess.”

If so, SPY could rise or flatten as FXE and later FXY rise more rapidly.

In any event, BB cannot print his way out of this one. As 7 of 9 would say…”He will fail.”

Can a couple of quarters of below-trend growth reduce inflation? One would think that is dogma from listening to economists and the Fed.

The truth is consumer price inflation arises from sources insensitive to the U.S. domestic economy: healthcare, rents, education and food. Other goods (consumer goods ex-autos) sourced from China (with prices more dependent on Chinese costs than U.S. growth) have stopped subtracting as much from inflation. None of the trends in these prices would be in the least affected by temporary below-trend growth.

So I have to ask: where did this idea that inflation would abate with 2% growth come from?

David, one place you might look is this study by Stock and Watson.

ECRI said that the U.S. was helped in the nineties to achieve high growth with low inflation because of asynchronous recessions around the world and none of this productivity poppycock that Greenspan threw out. The scenario today is of synchronous global expansion.

JDH,

Thanks. I took a look at the abstract and it seems to be an empirical study of the Phillips Curve.

I have a question for you: is it possible the economics profession is overreliant on econometric models? I ask because I this problem on Wall Street. Subprime ABS investors and lenders continued to argue, until very recently, that unemployment drove subprime losses, and that therefore they were likely to be low. This conclusion was based on econometric models where unemployment showed by far the highest correlation.

What about lending standards? Well, they were positively correlated with losses — lower standards, lower losses. Of course this makes sense, as the ability to access additional re-fi credit is one way to escape foreclosure.

So the widespread use of econometric models was in good measure responsible for the subprime wipe-out, and the same will likely happen with Alt-A mortgages.

Is it possible that the short term correlation between employment and inflation is equally misunderstood?

David, certainly it is possible to be overreliant on econometric models. I’ve argued that proper statistical method involves combining the inference from a number of sources (including anecdotal and subjective judgment) and shrinking any econometric estimates towards those.

However, I must disagree with your suggestion that “the widespread use of econometric models was in good measure responsible for the subprime wipe-out”. My current prime suspects are pension funds and the GSEs.

By the way, I will be talking more about the forces behind the subprime problems in my next post, but I don’t think you’ll like it, since it will make significant use of econometrics.

Hi Jim,

I understand that the downturn in retail and consumption are likely related to the earlier warmer weather than usual in Nov-Dec. Makes sense.

If true, the implications are that the current plunge is also unique … i guess we’ll know soon enough. And you know my perspective: jobless claims are my favorite signal of the job market, and coupled with low unemployment, I’m yet to alarmed.

But the notion of weather and consumption made me wonder: has anyone done a study of the weather effect on consumption patterns. Most macro data from the government is seasonally adjusted. Maybe it is time to temperature adjust as well?

All the best,

Tim

JDH,

I read your post on multiple forecasts — quite interesting. I don’t mean to disparage econometric models, only their mis-application.

Even after the subprime spread-widening, most MBS investors continue to use loss models with the following characteristics:

-employment is the principal driver of defaults

-doc levels, debt-to-income and LTV correlations are weak

-in the absence of a recession, FICO is the dominant variable

Instead, I think the future holds the following: debt-to-income and doc levels will be most important, and FICO is relatively unimportant. The latter has already surfaced in Alt-a delinquencies.

So my point is that these models have the potential to create a great deal of financial instability as they drive leverage ratios at hedge funds and the GSE’s and provisioning levels at lenders.

–

JDH,

Thought you might be interested in these commenst by Fed Gov. Mishkin:

In interpreting these stylized facts about changes in inflation dynamics, we must first recognize that all of them are based on reduced-form relationships, and thus they are about correlations and not necessarily about true structural relationships. Because the explanatory variables in inflation regressions are themselves influenced by changes in economic conditions, changes in the underlying monetary policy regime are likely to be a source of changes in reduced-form inflation dynamics. This problem is especially acute for structural relationships involving expectations or other factors that are not directly observable and so cannot be included in reduced-form regressions. In such cases, we cannot use the reduced-form equations to disentangle the effects of such unobserved factors–which themselves may be driven by changes in monetary policy–from that of other influences.