A big challenge for Mexico and the rest of us.

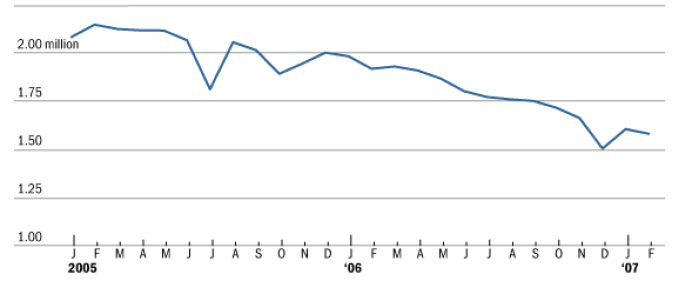

The Wall Street Journal reported today that production from Mexico’s Cantarell oil field fell by 20% between January 2006 and February 2007.

|

The Journal notes that nearly a quarter of the world’s oil currently comes from only 20 individual fields, of which Cantarell had been the second biggest:

Two decades ago, about a dozen fields produced more than a million barrels a day. Now there are only four, one of which is Cantarell. The future of two others, discovered more than 50 years ago, remains in question. Some analysts speculate Saudi Arabia’s Ghawar, the biggest field by far, could begin a gradual decline within a decade or so. Another, Kuwait’s Burgan, is showing signs of maturity. In November of 2005, Kuwait Oil Co. lowered its estimate of the field’s sustainable production level to 1.7 million barrels a day from 1.9 million a day.

The Journal chose surprisingly cautious language in that statement about Ghawar. As Econbrowser readers are well aware, some analysts in fact speculate that Ghawar’s decline has already begun. It’s interesting that if you click on the WSJ online link to see data on aging oil fields, it leads to a table that estimates Ghawar productive capacity will fall by 11% between 2007 and 2010.

Ghawar in immediate decline raises such frightening possibilities, it seems the WSJ is afraid to float it even with the qualifier “some analysts speculate”, and even when their own data suggest that’s what we should be anticipating.

Technorati Tags: oil prices,

peak oil,

Mexico,

Cantarell,

Ghawar

What do you think about the argument given in the WSJ that smaller, more efficient, oil fields will replace the larger ones and the decline will not be as bad?

eh, how does the WSJ justify the highly counterintuitive idea that smaller oil fields will be more efficient? Historically, it’s been more efficient to get oil from places where it’s abundant, which is large fields.

Peak Oil is often misrepresented as the theory that the world is running out of oil. It’s not: It’s the theory that the world is running out of cheap oil. Even if a bunch of small fields can slow the decline from the depleting giants, they aren’t going to do it at a comparable cost.

How reliable is the private industry in reported “proven” reserves (cheap, expensive, deep, shallow, BIG, small)? Didn’t Shell can an executive or 2 in the past on this business? Given the seismic technology shouldn’t we be able to determine right down to the teaspoon how much is in the ground? How much is recoverable at what price might be slightly more difficult…but then engineering is so much easier than economics, right boys?

If you consider under sea oil then the deeper reserves are obviously not going to be economically exstractable on a small scale.

The remaining land based oil is often highly insecure and risky and probably needs a massive military presence to justify the cost of extraction

Reading the WSJ is not likely to give you the answers if you want to find them.

http://www.netcastdaily.com/1experts/2004/exp012404.ram

I would modify Peak Oil from even that, Pianoguy: the Peak Oil that matters is the theory that demand will grow faster than we can grow supply. The point of divergence in these two growth rates, I would suggest, not only exists, but is soon (if not already passed).

Many analysts are still running around modelling growth (either implicitly or explicitly) on the West; but everyone knows it’s really the East that matters now.

Reading the recent threads on oil and housing has been great fun. The comments are like the blind men describing an elephant. Some were great experts on the ridges on the trunk. Others were deeply learned about the feet.

And some – the ravers and nutters – just shouted about how big the creature was and how terrible the stuff that came out smelled.

Go for it, guys! Not a single comment so far will make anyone a dime but they are all fun!

But where is PhD Electrician? Is he hiding in the bundu with only his equations for comfort?

Go for it, guys! Not a single comment so far will make anyone a dime but they are all fun!

Well, maybe some will learn to save a few dimes…

Small Investor Chronicles

Aaron Krowne: “the Peak Oil that matters is the theory that demand will grow faster than we can grow supply.”

Literally, IIRC, Peak Oil means the point of maximum global oil production rate.

Demand and supply depend on price. So you can say that demand of oil at $25/barrel has already outstripped supply of oil at $25/barrel. But not at $100/barrel…

What I am pretty sure is, we have already passed peak spare production capacity. From now on, I do not think that we will be seeing those 3 MBd of iddling wells in Arabia, waiting for the price to go a bit up, any more. It is going to be full throttle until the end. Like ’60s Texas.

Aaron Krowne: “the Peak Oil that matters is the theory that demand will grow faster than we can grow supply.” If you’re going to define it that way, you’ll have to be more precise as to what you mean by “supply” and “demand”. As long as there is no price ceiling and the market is functioning properly, the quantity demanded cannot grow faster than the quantity supplied.

knzn,

It can. Inventories can decline. Even hitting zero inventories does not necessarily end it, as back orders can pile up.

Actually all you have done is simply give a working definition of how we know when “the market is functioning properly.” Such markets go to or stay near equilibrium, which means that supply equals demand, but not all markets do that, even ones with flexible prices, or may not do so very quickly. There are quite a lot of lags in production and also in demand, along with quite a few other peculiarities, in the oil industry, even though crude prices are flexible.

Yikes! 100 million poor people within walking distance of our southern border. That might be more of a problem than an oil field running dry.

Barkley Rosser,

I assume that inventory holders are sufficiently rational, well-informed, well-financed, and profit-motivated that they won’t be running down inventories dramatically at a time when prices are expected to rise rapidly (as they surely would be in any scenario where “demand” is growing “faster than we can grow supply”). If anything, a permanent strain on oil production capacity would lead to hoarding and cause (by your definition) demand to fall short of supply: inventory holders would destroy demand by raising their selling prices in anticipation of even higher prices in the future. I don’t see how inventories can be a big deal in the final story; it has to be about prices and about the quantities produced (which should approximately match the quantities consumed).