The IMF’s April 2007 World Economic Outlook has been released — or at least part of it. One chapter, entitled Exchange Rates and the adjustment of External Imbalances [pdf], deals with a subject close to my heart.

There is much that is familiar in the chapter, although this in no way reduces its relevance. However, one new aspect is the recognition that traditional estimates of price elasticities for trade flows might be biased downward. The implication of this finding is as follows:

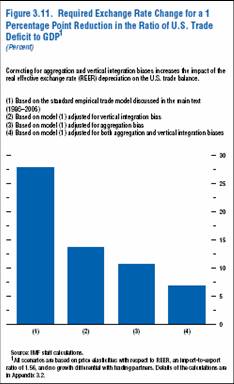

How much would the U.S. dollar need to decline in the long run to reduce the current account deficit? Typical estimates from the standard econometric models of the U.S. economy suggest that narrowing the ratio of current account deficit to GDP by percentage point would require a real depreciation ranging from 10 percent to 20 percent. The evidence on trade elasticities presented in this chapter is consistent with estimates at the lower end of this range. Incorporating estimates that correct for either aggregation or vertical integration biases into a partial equilibrium analysis of trade adjustment suggests that a real depreciation of between 10 percent and 5 percent is needed to lower the trade deficit by percent of GDP. Using elasticities that correct for both biases brings the

required real dollar depreciation down to below 10 percent (Figure 3.11).

The two modifications made by the authors include accounting for aggregation bias (the fact that examining aggregated trade flows instead of disaggregated trade flows may bias downward estimated price elasticities) and accounting for trade in intermediate products used in exports — namely vertical specialization.

I discussed the importance of this aspect in the context of implausibly high estimated income elasticities in traditional econometric specifications in “Long term prospects for U.S. net exports” (Jan. 2006) and “Measuring the import component of U.S. exports” (June 2006). The former post recounted more extensive results reported in this working paper [pdf].

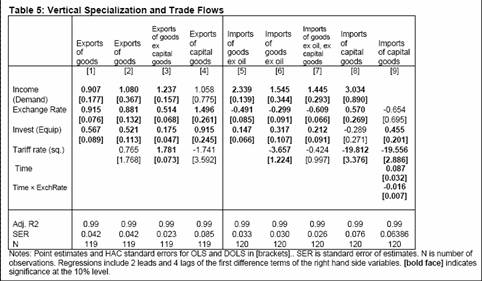

In that paper, I found that examining separate components of imports typically — although not always — yielded higher price elasticity estimates than when using aggregated data (imports are where the low price elasticities are usually found). This is shown in Table 5 from the paper.

Table 5 from M. Chinn, “Supply Capacity, Vertical Specialization and Tariff Rates: The Implications for Aggregate U.S. Trade Flow Equations,” mimeo (September 2005) [pdf]

The IMF staff has undertaken a more extensive analysis (see in particular Appendix 3.2 to the chapter, authored by Alessandro Rebucci, starting on page 108). The implications of these alternative estimation methods/specification are summarized in Figure 3.11 from the chapter.

Fig 3.11 from IMF, World Economic Outlook (April 2007), Chapter 3 [pdf]

In a partial equilibrium setting, instead of the 28 percent depreciation needed to induce a 1 percentage point improvement in the trade balance to GDP ratio, only about a 15 percent depreciation is required once on takes into account vertical specialization in the manner the WEO authors do. Accounting for both aggregation bias and vertical specialization leads to an even more striking result — only 7 percent depreciation is required. This is good news to the extent that we cannot hope for too much initiative from the present Administration for fiscal retrenchment to aid in the process of global rebalancing (after all, the White House apparently does not believe in any role for fiscal policy in affecting the current account balance).

Technorati Tags: capital goods,

trade deficit,

trade elasticities ,

expenditure switching,

vertical specialization,

aggregation bias

Am I reading this right? This is advocating debasing savings accounts and money market funds by 10-20% in order to theoretically generate more exports?

DickF: The post can be read in two ways. The first way is positive — a statement about what the trade elasticities are. The second is normative — given a recognition of these new estimates, what would be the necessary depreciation given a belief that the trade deficit was too large. Whether this leads to a debasement of savings and money market accounts — well this depends upon the “theoretical world” you live in. If you happen hold your assets in USD but consume a wholely foreign-produced consumption bundle (i.e., you don’t consume any American made goods), then the answer is that a 20% dollar depreciation will lead to a 20% “debasement”. Since the import to GDP ratio for the U.S. is about 15% or so, the “debasement” is substantially less.

I have a lot of trouble with such analysis that does not take into account where the domestic goods to replace the imports are going to come from. For a domestic good to replace an import the import price must increase to the level that it becomes profitable for a domestic producer to manufacture the good — excuse me for ignoring services.

Take shoes for example. What would have to happen to the price of shoes before a domestic manufacturer would appear to displace an Asian shoe producer. I suspect it is a lot more then what is build into these economic models.

spencer: For some goods where the U.S. has no comparative advantage, the price elasticity of imports might indeed be low. But for differentiated goods, say machine tools, one might imagine domestic suppliers supplanting foreign if the relative price moves in a sufficiently favorable manner. Also, as prices rise, consumption of machine tools (or even shoes) might decline. Keeping in mind that imports are the excess of quantity demanded over domestic quantity of supplied, then exchange rate changes can still have an impact even when there are no domestic suppliers.

DickF

Countries do this all the time. For example, the British pound once stood at $4.85 (it’s now just below $2.00).

If they do it in a hurry, they impose exchange controls to prevent a panic (Malaysia, 1998).

If they do it gently, no one much notices (for an economy like the US, where the external sector is not large).

You get some feed through to the domestic inflation rate, but that depends on the ability of importers to hold prices up, as the dollar falls.

It’s probably an American thing that you think currencies don’t do this sort of thing, but look at the US dollar after 1985 (The Plaza Agreement)– it fell by more than is being talked about here.

Menzie, Currency devaluation certainly is the debasement of US dollar held savings. The impact may not be immediate in terms of US consumer prices, except in gas and other imported items. But anyone visiting Europe will notice his being poorer.

: Menzie Chinn said :

domestic suppliers supplanting foreign if the relative price moves in a sufficiently favorable manner

That is exactly my problem. How much do prices have to move before domestic suppliers emerge?

I suspect it is a lot more then this paper implies.

In general over the last quarter century we have seen that exchange rate movements seem to have a smaller and smaller impact on import prices.

jaim klein: Yes, that’s what I said in my comment. So if you receive your income (wage or capital) in USD, but live in the euro area, then indeed your accounts have been “debased”. But for the rest of us — like those living in Wisconsin — well, we see less of that effect. But, as I have said many times, the effect is there (which is why one shouldn’t see the stabilization of the dollar-measured net foreign asset position of the US with complete equanamity).

Anonymous: The specifications estimated in the WEO chapter and in my paper are quasi-reduced form equations, combining the exchange rate pass-through equation and the import quantity/import price equation. The attenuation of the import price pass through should be reflected in the parameter estimates of the quasi-reduced form expressions estimated. By the way, for more discussion of exchange rate pass through, see the links and Figure 2 in this post, as well as in this paper by Gopinath et al., presented at a recent NBER IFM conference I co-organized.

Valuethinker,

Of course governments debase the currency all the time. This has been one of their favorite tricks since mankind began to use money.

Now whether the debasement is rapid or slow you still lose wealth. In the 1980s (in general terms) it took around $10 to buy a $1 item in 1970. That is a huge loss of wealth. Did you see your income increase 10 times from 1970 to 1980 (assuming you are old enough to have had an income in 1970)? Well, the average man did not see his income increase 10 fold.

You also need to understand that prices do not rise all at once when the currency is debased. You may see a huge increase in the price of oil long before you see the increase in a hamburger.

But regardless the debasement of the currency only profits those who control the distribution of the currency. They get to spend a dollar for a dollar. But the debasement of the currency leads to more than simply a loss in the value of the dollar. It causes businesses problems with controlling costs and it adds burden to production. All of that destroys wealth that would have been created without the debasement.