The Oil Drum has been featuring some very interesting speculation as to the meaning of the

ongoing drop in Saudi Arabian oil production.

First, let me recap the basic facts: (1) Saudi oil production is now down more than 10% from its peak level in 2005; (2) this decline in production has followed an erratic pattern, beginning in October 2005 when oil was selling for $62 and continuing through July 2006 when oil briefly touched $75, making it difficult to see these cutbacks as an effort to stabilize oil prices; (3) the production decline coincided with a doubling in the number of oil rigs employed in Saudi Arabia since 2004 and tripling since 1999.

To this Stuart Staniford adds the observation that, when one averages the slightly conflicting estimates of Saudi production from different sources, the production decline does not appear entirely haphazard, but instead fits the pattern of an 8% annual decline rate temporarily offset by the boost in production from the Saudis’ new Haradh III project:

|

Euan Mearns responds that on previous occasions, when we would all agree that the Saudis were deliberately cutting back production in order to stabilize the price, production also followed an erratic pattern. Mearns suggests (also here) that the Saudis might well achieve this intentional production cutback by shutting down some highly productive wells and opening a larger number of smaller wells. Moreover, despite the tripling in the number of Saudi oil rigs, Mearns notes that the total number is still quite small relative to the U.S.:

|

Whether comparing these two series on the same scale is appropriate is not clear. On the one hand, the U.S. has four times the number of square kilometers as Saudi Arabia, so perhaps equal intensity drilling should mean that the U.S. would employ four times the number of rigs as Saudi Arabia. Furthermore, oil fields in different locations can have very different physical characteristics. Even so, Mearns emphasizes that, with far less area and fewer rigs, the Saudis are producing significantly more oil than the U.S., and concludes:

There is no sign of a looming productivity crisis in these data and it would appear that increasing production may be achieved quite simply by drilling more wells.

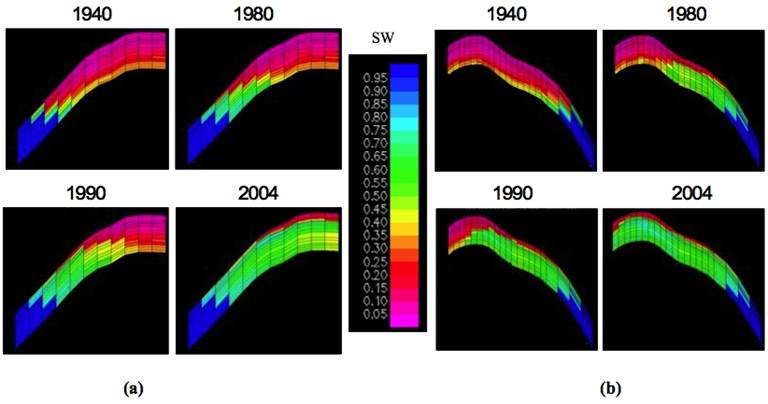

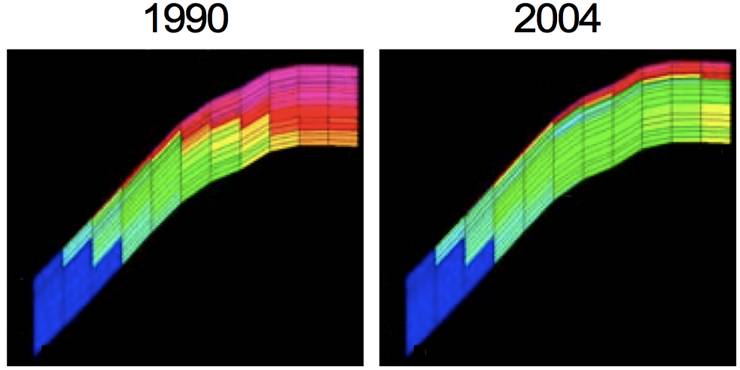

Stuart in turn has a very interesting rejoinder, based on digging through some technical reports on Saudi oil fields. The Saudis have achieved remarkable recovery rates by injecting water underneath the oil, which causes more of the oil to rise to the surface of the reservoir where it can be extracted most efficiently. The graphs below display numerical simulations of how the water content for two vertical cross-sections from the Ghawar oil field has changed over time. Red and pink sections, which made up most of the original reservoir in 1940, have less than 20% water content. The now-dominant green sections are more than 50% water.

|

Stuart argues that once production gets into the green regions, the oil yield will start to fall significantly. Extrapolating the rate of loss of the red area from the time-series trend, Stuart calculates that the red would have been all gone by the second half of 2005, exactly when the production declines began.

|

I think it would be hard to overstate how big a deal this would be if true.

Saudi Arabia produces almost a quarter of the oil globally available for export. Furthermore, nearly a third of the increase in global production by 2010 that is assumed in the EIA’s reference case forecast is supposed to come from Saudi Arabia.

Half of Saudi Arabia’s current oil production capacity comes from the

Ghawar oil field.

And what if Stuart’s speculation that Saudi production has already peaked turns out not to be the case? I turn again to

Euan Mearns,

the skeptic of Stuart’s thesis cited above:

I am in total agreement that Saudi oil production is entering a new era. In the past, over 9 million barrels per day could be achieved with relative ease. Their best assets are mature and may be in decline. In the future, much greater effort will probably be required to sustain production over 9 million barrels per day.

Elsewhere Mearns writes that he believes the peak in global oil production will occur between 2009 and 2015.

Whether or not that is so, if tensions with Iran escalate to the point that there is a significant disruption of Iranian oil production, at least that should give us some additional hard data on Saudi capabilities and intentions. As objective observers of the world scene, we’d welcome some additional data, wouldn’t we?

Technorati Tags: oil,

oil prices,

Saudi Arabia,

peak oil,

Ghawar

Some of the more “politically enlightened” players near Wall&Broad have a much different explanation for crude price movements over the past six months.

The past six months have witnesed an economic war between our “good friends” the Saudis and Iran.

In the the initial skirmish Saudi Arabia walked down the price of crude through production actions. In the counterattack Iran has walked up the price of crude by building in a higher risk premium as a result of its “British gambit” in the Shatt-al-Arab waters. The British gambit has a secondary benefit for Iran in that it reminds “the Poodle” just how unplesant it will be for the Brits to be surrounded by Shia should Bush opt for a third hot war. Don’t like 15 captives, just add a zero and contemplate how that feels.

The visit by Dick (and never was a man more appropriately named) Cheney to SA last year set the game into motion.

One question I have is how reliable and accurate are the statistics on Saudi oil production levels. We’re magnifying the data pretty heavily on that first chart. Even a small amount of noise and variance could easily swamp the patterns which Stuart claims to have found. I’ve read that one source of this kind of data derives from eyeballing loaded tankers to see how deeply they sit in the water(!). Such “measurements” have to be inherently imprecise. I’d also point out that the EIA and IEA produce independent estimates that vary by several percent each month.

Another possible interpretation of Saudi production levels is that they are trying to match their OPEC production quotas. Stuart created a graph comparing the two, here:

http://www.theoildrum.com/files/ksa_qatif_haradh_quota.png

It shows that Saudi production levels have generally tracked their quotas, with the exception of a couple of high periods, late 2002-03 for the Iraq war, and middle 2004 (some speculate that this was to help the Bush re-election effort). Since then production has returned to match the quotas quite closely.

Stuart’s graph only goes back to 2002 so it gives the illusion that this is the first time that Saudi production has fallen below quota, but if you look at this other graph of his, you see that is not the case:

http://www.theoildrum.com/files/ksa_qatif_haradh_quota.png

It shows production in 1998-99, which again is tracking quota closely, and is frequently somewhat below quota.

At this point the evidence is consistent with Saudi Arabia merely reducing their production levels from the 2004 “bulge” down to match their official OPEC quotas.

Another point is with regard to the drilling rigs. Saudi Arabia has indicated that it has a goal of expanding its excess production capacity over the next few years so that it can respond to a loss of oil production from Iran, Venezuela, or some of the other second-tier producers. This extra drilling activity makes sense as part of that program.

If tensions with Iran escalate to the point that there is a significant disruption of Iranian oil production, at least that should give us some additional hard data on Saudi capabilities and intentions. As objective observers of the world scene, we’d welcome some additional data, wouldn’t we?

You know, without the smiley face, it sometimes it isn’t always clear when you are kidding. 🙂 I had to read that paragraph twice. I guess I need to recalibrate my humor detector. Unfortunately, there are people in the Bush administration that might take that suggestion seriously.

Are you completely unaware of the military build-up the US has prepared to unleash upon Iran?

Iran exports about 3.5 million barrels of oil per day. If/when the U.S. attacks Iran, that shortfall will have to be made up somehow or it will cause an oil price shock. Therefore, at the behest of the Americans, the Saudis have cut back production so much so that, when the bombs start dropping, they will be able to release immediately an additional 3+ million barrels per day onto the world markets. To be able to do this, they had to first cut back by about a million barrels per day.

Gee, Joseph, maybe I have this backwards. I’d been using the smiley face to signal I was really serious!

Trouble is, it may be some time before I find a good excuse to bring that back.

I’m certain that a large number of you watched the tapes of the phoney, staged “attack” on the Teheran British embassy over the weekend, with a small group tossing harmless objects over the wall and then lining up for on-camera interviews…in English no less.

Should be worth a dollar or two in Brent and WTIC.

The “British gambit” plays on.

In some ways it reminded me of the staged Saddam statue event back in 2003…you know, the one with the “Iraqi” crowd wearing brand new Dockers khakis and plaid shirts who then lined up for on-camera interviews in English. (I wonder if gift bags were handed out following the interviews.)

Turned out that the statue event was another in a seeming endless series of Karl Rove ideas.

Somewhere in the Iranian government is a bright eyed boy who has learned very, very well from the master of mind control.

Thanks for keeping up on this serial thriller, Professor.

Yep, you’re right, we may embargo Iran’s oil shipments, and we’ll see how Saudi production responds.

Word spoken many months ago and on on the street today is SA is simply running out of economically producable oil. Period. The bell curve has never been so appropiate or real. If the US takes action SA can not up production to ease the worlds demand. Wont happen – er that is SA production. How do you say it? $165.0/per bbl?

JDH: Thanks for the coverage of our stories!

Courtesy of Jeff Brown, I note this interesting story, which says that Riyadh Bank (the 5th largest in Saudi Arabia) projects “Saudi oil production is expected to fall from an average 9.12 million barrels per day in 2006 to 8.44 million bpd in 2007. “

Stuart, the link you provide goes to a story about a solar yacht. There are a couple of flaws in the story you mean to talk about. The bank in question is forecasting that Saudi will reduce its production because of OPEC quota reductions. Your omission of this cogent fact leads me to believe that you are behaving in a disingenuous fashion.

BTW, the line about “5th largest bank” is a classic “appeal to authority” logical fallacy. The size of the bank has no bearing whatsoever on the validity of their forecasts.

Total Digression: I hate that solar yacht … barely beat Columbus’ time and he was not using fossil fuels … 500 years ago.

Oops. Sorry about the bad link – I mean’t to point here.

To me, the compelling argument rests purely on the number of rigs – that, ALONE, suggests that the Saudis won’t be able to increase production like they have been counted on to do. There aren’t enough mothballed or under-construction rigs in the world to make this happen – even if they truly have a bunch more feasibly recoverable oil than is apparent, if they need to invest this kind of money in infrastructure to get to it, it’s not going to be a repeat of the 1990s. Remember that the Peak Oil theory is NOT “the Saudis (or the world) are out of oil”, it’s “the Saudis aren’t going to be able to pump enough oil quickly enough to keep overall worldwide production from peaking”.

M1EK, have you seen the statistics on how fast the Saudis have been ramping up their use of drilling rigs? It doesn’t look that impressive on the chart JDH used but look at the blue line on this other chart from Stuart Staniford:

http://www.theoildrum.com/files/saudi_2_07.png

It’s through the roof! Saudis are drilling like crazy. Now, Stuart’s interpretation is that they are running as fast as they can just to stay in one place. But equally we could say that they are preparing large increases in productive capacity, so they can get back to the state where they are they real “swing producer” and can quickly ramp up production if there is a problem somewhere in the world. Certainly the claims and plans presented publicly by the Saudis fit better into the latter interpretation.

Certainly both positions are defensible – but if the Saudis were really preparing a huge production increase rather than desperately trying to stay level, one would suspect they wouldn’t be as secretive as they’re being.

Over at crossroads arabia, John Burgess notes that the Saudis have cut a deal with the Russians for a pipeline from the Shaybah fields in the Empty Quarter. He argues that their reserves are up, and that therefore there is not a production problem. He argues that they are holding production down to keep the price up for internal budgetary reasons, along with threatening the Iranians.

The Saudis aren’t being any more secretive than they have ever been. All of the Gulf oil producers are secretive. Heck, I work for an NOC in a Gulf country, and I have difficulty getting E&P information.

However, in 2004 the Saudis announced a capacity increase of about 3 mbdp. So they appear to be doing what they said they were going to be doing.

Of course, the peak-oil nuts are textbook conspiratorialists, in whose world every action and every outcome is a validation of their beliefs. So either an increase or a decrease, or even the absence of change can be seen as “proof” of their axioms.

One problem with trying to get this point of data: What is the most likely Iranian response to a U.S. attack. I would think that the first missles they launched would be aimed at the Saudi GOSP’s. It would take about 10 conventional missles to almost totally shut down Saudi production for about 6 months or so. If you were Iran, wouldnt that be your response. After all if you want to hurt the U.S. you dont do it by trying to take out a few U.S. troops (Iraq has proved that even thousands of U.S. military deaths and tens of thousands of wounded will not seriously affect the thinking of this administration). The second set of missles would be aimed at tankers in the straight of Hormouz. Watch what happens to insurance rates for tankers if even one of them is sunk there. They would not have to sink every tanker going through, just a handful.

Bartman,

Let’s test your assertion that “peak-oil nuts are textbook conspiratorialists, in whose world every action and every outcome is a validation of their beliefs.”

The real test of any theory is predicting the future. So who can speak for Peak Oil and offer predictions?

If Stuart is correct in his hypothesis that SA has peaked, a reasonable test is to see if in a year or two production has increased again. Stopping its slide for some period might happen if enough rigs are employed.

In fact Peak Oil theorists like Stuart and Simmons have been predicting a decline in SA production and have even proposed decline RATES post-peak.

A key prediction of PO was that production declinings even while rig count goes up. This appears to be the case. One does need to allow for time dependency in using a rig and when production starts from that well. For existing fields, that might be 6 months? (Need some oil field expertise to confirm.)

The critics like CERA have predicted increasing global production for many years yet (5 to 10 years into the future) while assuming continued demand growth, ie no global depression. That would almost require growing SA production also given known project development.

“Don’t like 15 captives, just add a zero and contemplate how that feels.”

Posted by: esb a

More like three zero’s.

Dirk: “One problem with trying to get this point of data: What is the most likely Iranian response to a U.S. attack. I would think that the first missles they launched would be aimed at the Saudi GOSP’s. It would take about 10 conventional missles to almost totally shut down Saudi production for about 6 months or so. If you were Iran, wouldnt that be your response.”

If a war breaks out, the position Iran does not want to be in is that they’re blockaded, while the rest of the Persian Gulf oil flows freely. The best achievable position for them (IMHO) is to shut down as much oil production, and as much oil shipping, as possible. This puts them into a much better negotiating position.

Joseph: please don’t call peak oil a theory. It is proudly and profoundly atheoretic.

And the true test of an actual theory is falsifiability, not selective observation of confirmatory incidents.

Bartman,

While you are correct that in the philosophy of science “the true test of an actual theory is falsifiability.” However, we can not run an experiment on history. History only happens once.

The real issue is, the one of practical importance, can “peak oil” predict the future? PO theorists will tell you that one can call a peak only AFTER it happens and this is what Stuart is trying to do. Using admittedly imperfect data (tanker shipments as production) he is fitting that real world data into the mathematical models developed from Hubbert and others. Historical experience from hundreds of exhausted and declining oil fields have also been fitted against these models successfully.

Another correlary of PO is that the effort expended to maintain production and reduce decline increases post-peak. The actual SA rig count is a pretty solid data set and it too supports the predictions.

Can deliberate, politically motivated intervention in oil production produce the same observable results? Probably in the short run. Can we propose a real-time test to differentiate the physical from the political?

I think that is a vital question. The increase in rig count is again telling – why spend so much on drilling when you are voluntarily withholding production?

Besides, isn’t it intutitively obvious that oil resevoirs play out and that when one has searched for resevoirs everywhere on the planet, that we’ll someday run out of new ones?

Of course, I am a former colleague of both Stuart and Euan, but only the latter is still speaking to me.

Stuart has gone out on a limb to say that recent Saudi production cuts are not voluntary, which means that his derived 8% decline rate is real — at least for the time being until projects like Khurais come onstream. For this conjecture to be true, the Northern part of Ghawar (Ain Dar/Shedgum) must be crashing. Therefore, the discussion has revolved around interpretations of where the WOC (water oil contact) is, based on an SPE paper — some of which you have reproduced here.

Today, HO (another friend, still speaking to me as far as I know) has come out and done some further analysis (at TOD) which indicates to him that the parts of Ghawar in question will be producing for another 10 years, though probably at reduced rates. What the real decline rate is as I write this is unknown. Clearly, the Saudis are putting additional money into propping up production at their Ghawar and older producing fields elsewhere. See the Rice conference paper HO cites.

Having had the temerity to suggest that the SPE paper said nothing of real interest — and therefore did not form the basis for an argument one way or another — I basically got chased off a recent Oil Drum discussion. My attitude was not sufficiently doomerish in that I expressed the attitude that no good case could be made based on circumstantial evidence, or reading interpretations into technical papers that were not warranted.

It has now become an obsession of some people to prove — based on no current production data — that North Ghawar is dying. Despite a wealth of evidence from producing countries all over the world that peak oil is a real concern, the Saudi argument has been made the central piece of evidence by those with an axe to grind. If this claim should prove false — if Saudi Arabia increases production substantially in the next year or two — the credibility of those talking about peak oil will have been jeopardized for no good reason. On the other hand, should Saudi continue to produce at reduced levels, or make further production cuts, this debate will go on and on and on. Finally, there is the possibility that Stuart is right, in which case we can all kiss our lifestyles goodbye.

So, under any scenario listed just above, there is no good outcome, given the agenda of some to bring the End of the World As We Know It to a swift conclusion. The “peak oil” theory — the conjecture of a near-term peak between now and 2015 — will either be 1) discredited; 2) wallow in endless speculation; or 3) be more correct than we currently know, with dire consequences for the world’s oil supply.

CERA’s fatuous guarantees of our oil safety for decades to come is irreponsible. Telling everyone that the oil supply is now irrevocably in terminal decline is irresponsible. What did the poet say —

Dave Cohen

ASPO-USA

I hope the meaning of Saudi actions is that they are getting ready for an embargo or knock-out of Iranian oil exports. Iran’s nuclear project is unacceptable for Saudia and the world.