Yet another one of my chief worries gets some relief from new data.

Sales of domestically manufactured autos were up 5.9% in May 2007 over May 2006, and up 8.9% from May 2005:

|

And despite the high gasoline prices and struggling residential construction sector, domestic light truck sales were also up 2.9% from the previous year:

|

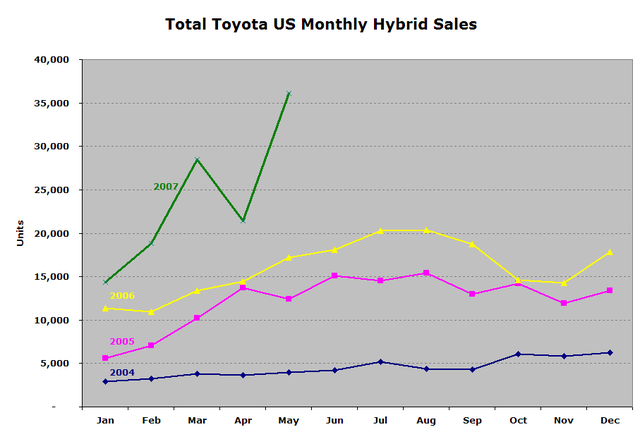

On the other hand, sales of Toyota hybrids more than doubled from the previous year:

|

It takes a lot of determination to stay pessimistic about the economy this month.

Technorati Tags: macroeconomics,

autos,

auto+sales

Prof Hamilton, if the RBOB (reformulated gasoline) contracts don’t stop rising so much then we might see a little weakness in sales of gas guzzling vehicles, but let’s hope that the RBOBs take a breather. For what it’s worth, Colorado State University forecasters now say there is a 74% chance that a storm will make landfall (but I have no idea how they arrive at a 74% estimate).

Also, I wanted to let you know that you are at least partially correct that pension fund managers may not fully appreciate the risks of what they are doing because some of them have been investing in the risky “toxic” CDO equity tranches:

http://www.bloomberg.com/apps/news?pid=20601109&sid=aW5vEJn3LpVw&refer=home

It is hard for me to believe that these pension fund managers have some kind of informational advantage in the CDO markets.

The BEA data on auto sales on a seasonally adjusted annual rate has May auto sales of 16.159 Million as compared to 16.268 in April.

The rebound in manufacturing output last month supposedly signaled that the inventory correction was over. But auto output increased from 10.3 to 10.8 million (SAAR) and accounted for half of the increase in manufacturing output. But with auto sales down it looks like the expanded auto output may be moving into inventories.

so it looks like auto sales are continuing to weaken and auto inventories may be expanding — the inventory data is not out yet. I am not as positive on the outlook as your.

the BEA SAAR auto sales are:

jan…16.744

feb…16.636

mar…16.325

apr…16.280

may…16.159

spencer, please pass us your link to the BEA auto data.

I’m not determined to stay pessimistic, but that 3.2% drop, March to April, in pending home sales of resale homes (and a 10.2% drop year-over-year) puts a damper on my enthusiasm.

Continued weakness in homes sales will continue to push down home prices, which will continue to manifest itself in weaker consumer spending (look at real April PCEs compared to March; 5 of the 14 categories moved south, month-to-month).

http://www.realtor.org/press_room/news_releases/2007/phs_april07_pending_home_sales_stabilization.html

The domestics are stemming the blood, it seems, but still heavily burdened by overly generous promises made in the past and a deserved reputation for lower quality. Toyota is certainly the franchise to have. I spent a few years working for a toyota dealership. Awesome company.

Hitchhiker, do you have access to the management compensation info for this “awsome” company. At one time I read that their entire management team made much less than their US counterpart’s executive management (top 6?), but I can no longer find that link.

Thanks for that post spencer. I too am less optimistic than JDH as even Toyota had to increase incentives to move those trucks, no? Also, on the domestic side, the sales, at least until very recently, were to a surprising extent, to former clients already underwater on last year’s model so we now have the dubious 6 yr (or more) loans that have trouble keeping ahead of the depreciating vehicle.

spencer, this Wall Street Journal article says “Domestic auto makers all reported inventory declines”, however, you may be correct that inventories will increase this summer:

http://online.wsj.com/article/SB118070412762021386.html?mod=yahoo_hs&ru=yahoo

Regarding truck sales, both GM and Toyota have clean sheet redesigns that just came on the market. Both are significantly better vehicles than the trucks that they replace, and both are significantly better than their competitors.

Ford has a new heavy duty truck as well. It has an interior that would look good in a Lexus.

The rise in truck sales could reflect the new models, and not the economy in general.

Charlie– the WSJ data does not say if the drop in inventories they report is seasonally adjusted or not & I do not have the SAAR inventory data yet.

All I’m doing is reaching a conclusion based on early data.

The dealers near me seem to have a lot or cars on their lots.

calmo, No, I do not have any info on mgmt compensation. As another reader already noted, Toyota just came out with a brand new truck. They typically increase incentives to help dealers unload the old model prior to release of the new one. They have never jumped on the bandwagon of large rebates like the domestics. These rebates just help unbury people who like to trade often. An extremely short term boost that does nothing to address long term issues.

The reason I like Toyota so much is their focus on the long term, their devotion to quality, and their willingness to take calculated risks and innovate. The new Tundra with the optional 5.7L comes with a six-speed automatic transmission. Their hybrid system is now in its 4th generation while the domestics are just getting started in this area.

Thanks for that Hitchhiker. My feeling is not that the consumer is holding back waiting for that new and improved vehicle (nth generation hybrid that uses the wind maybe or giant magnet that is turned on just after the semi passes…), but that he has less to spend.

My thinking about the rebates was the domestics needed to keep the cash flow coming rather than face even worse market share decline and a steeper decline in that sagging reputation.

Toyota is an interesting company. A lot of their intiatives, like just in time production and continuous improvement, are nothing more than ideas in a few Japanese engineers’ heads. They’re NOT well documented, or formalized in procedures, from what I’ve read.

Now, maybe that works in Japan, in a small company situation, but can that possibly work in a global company with factories and design bureaus all over the world? Can it work at a company that is growing 10% per year?

Toytoa 2007 could very well be GM 1965. They’re at the top of their game now, with nowhere to go but down. And corporate culture is going to take them there, just as it got them to where they are today. Adapting a corporate culture to new realities on the fly doesn’t have a great track record.