In the summer of 2005, Cambridge Energy Research Associates received a lot of publicity for their optimistic assessments of near-term oil supplies. Two years later, it’s interesting to see how the details of those predictions have been borne out so far.

The foundation for CERA’s optimism seemed to be quite concrete. Daniel Yergin stated the case this way in July of 2005:

There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day — from 85 million barrels per day to 101 million barrels a day — a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand.

Where will this growth come from? It is pretty evenly divided between non-OPEC and OPEC. The largest non-OPEC growth is projected for Canada, Kazakhstan, Brazil, Azerbaijan, Angola and Russia. In the OPEC countries, significant growth is expected to occur in Saudi Arabia, Nigeria, Algeria and Libya, among others. Our estimate for growth in Iraq is quite modest — only 1 million barrels a day — reflecting the high degree of uncertainty there. In the forecast, the United States remains almost level, with development in the deep-water areas of the Gulf of Mexico compensating for declines elsewhere.

While questions can be raised about specific countries, this forecast is not speculative. It is based on what is already unfolding. The oil industry is governed by a “law of long lead times.” Much of the new capacity that will become available between now and 2010 is under development. Many of the projects that embody this new capacity were approved in the 2001-03 period, based on price expectations much lower than current prices.

Though the specifics of CERA’s calculations were not publicly released, in August 2005 they featured some supplementary material on their webpage (since removed) that included the following details of which important new oil fields would contribute to this surge in capacity:

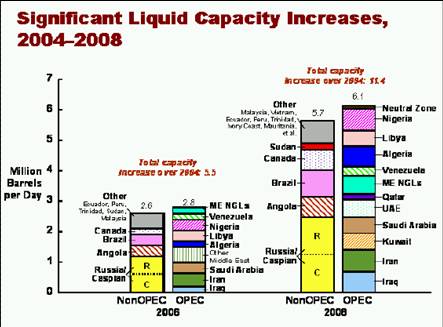

CERA also at the time publicly released this graphic of the contribution by specific individual countries to the anticipated increase in global capacity, predicting that global oil production capacity would increase by 5.5 million barrels per day (mbd) between 2004 and 2006:

Two years later, we now know that global oil production increased not by 5.5 mbd but instead by only 1.5 mbd over this period.

On the basis of eyeballing the above graphic, I estimated the magnitude of the increases that CERA had evidently been predicting for the key producing countries. These calculations are indicated by blue bars on the figure below, which can then be compared with what actually happened (in red, from EIA Tables 11abc and 22) in each of these countries:

So where exactly did the methodology go wrong? Part of the answer is to be found in what CERA called “above-ground risks” and might be described in the vernacular as “stuff happens.” Thunder Horse, BP’s magnificent offshore production platform, has not produced a drop since it was found listing in the water in 2005. It was originally thought to have been damaged by Hurricane Dennis in 2005, but is now believed to have suffered from construction problems. Nigeria’s Bonga and Erha fields indeed appeared to be contributing significant new production, but political turmoil in that country has meant that Nigeria’s total production is in fact now down several hundred thousand barrels a day from the 2005 values. The “quite modest” production gains that CERA forecast for Iraq were not to be, for reasons painfully well known.

|

But CERA overestimated production by a significant margin in every one of these countries– missing 11 out of 11 can’t be solely bad luck. Nor in my opinion can it be attributed entirely to the principle, “things take longer than you think,” though I have no doubt that’s also a factor.

As evidence that something else is also involved, I note referring again back to the first table that Iran’s Darkhovin field did indeed begin production of 55,000 barrels per day as predicted in July 2005. But despite that fact, Iran’s production in February 2007 stands 320,000 barrels per day below the value in July 2005. And Stuart Staniford believes that Saudi Arabia’s Haradh III indeed did start producing 300,000 barrels per day in the summer of 2006, as predicted. Yet we have seen total Saudi production decline by 700,000 barrels per day since that time.

It is hard to form a clear picture of what is going on in some of these Middle East oil producing countries, since the hard data are not made public. But I think it is safe to conclude that in general, depletion of the oil from existing fields has been more significant than CERA had anticipated, which is one reason they systematically erred on the side of predicting more oil than we actually are seeing. Mature fields naturally and necessarily enter a period of declining production. That means that remarkable new oil fields, like the ones detailed in the first CERA table above, do not guarantee that annual production will increase. Big new discoveries every year are necessary just to keep annual production from declining. That CERA may have been underestimating depletion was the key criticism raised by the Oil Drum back in August 2005. With two more years of data, an impartial observer would be tempted to conclude that TOD’s side in this argument has gained some credibility.

And let me say something about those “above-ground” risks. I can readily grant that if the world’s remaining oil were located in peaceful, capitalist democracies, more could be produced. But the fact is, we have no choice but to be counting on oil that is vulnerable to disruption by hurricanes in the Gulf of Mexico, war in the Middle East, and chaos in Africa. And who knows how the games of Venezuela’s Chavez and Russia’s Putin will ultimately be played out? I am willing to assert with near certainty that somewhere in that group, there will be significant disruptions in oil production over the next five years. Actual oil production is virtually guaranteed to end up below any theoretically calculated capacity. Call these above-ground risks if you wish, but they are clearly going to be important factors determining the price and availability of crude petroleum over the foreseeable future.

Two years ago, Cambridge Energy Research Associates overstated the case for optimism about near-term oil supplies. But you already noticed that the last time you bought gas, didn’t you?

Technorati Tags: oil prices,

oil,

peak oil,

oil supply

CERA’s forecast was at the high end, was it not, and but a considerable margin? I don’t bring this up to criticize what you written, but rather to say that there has been reason all along to doubt the CERA estimate.

Now the only question is: will the press ever stop listening to Daniel Yergin? Wrong about North Sea oil, wrong about North American natural gas, wrong about global oil supply. When does his license to be the go-to expert for every innumerate reporter in the country get pulled?

If lack of growth in spare capacity is really due is some significant part to depletion, then we can expect the problem to get worse over the next few years. Production declines due to depletion compound just like interest.

But the estimates were of “There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production)” and the graphs of “liquid capacity” not production.

You are comparing apples to orchards

Stuart, the Four-Corners program on oil from Australia was the most revealing piece on CERA I have seen. If you watch the program, and then watch the extended interviews, you will see how bad CERA really is. The interview with the ‘scientist’ from CERA is a real hoot.

Stuart,

Ah, but we have learned with experts on Iraq, that those who make the mistaken forecasts are viewed as the best experts to explain why their forecasts were wrong. After all, they made them, didn’t they? These “experts” never get retired, just permanently recycled, unlike petroleuem.

There are really only two explanations for CERA’s positions and intellectual dishonesty: 1) they delay our seeking alternatives to oil thereby increasing profits for CERA’s clients (ARAMCO, et al.) down the road; 2) they justify US intervention around the world to deal with those pesky “above ground” factors and give rational support to the American imperium. In reality, CERA serves both these masters (overtly and covertly).

As a trader and energy investor, I will no doubt benefit from the confusion created by CERA’s obfuscation. But as an American, I object that this global meddling fails to serve my legitimate self-interests and is far less useful than dedicating the same resources to energy alternatives. Once again, the national interest is hijacked by the special interests.

Professor-

At first I thought that oily was just being a smarty pants, but he put his finger on the flaw in your analysis – CERA predicted “capacity to produce oil (not actual production)” so you can’t use actual production to evaluate their claims. Now some could argue that CERA’s projection was rather slippery since capacity to produce is harder to verify than actual production. Nice to have a projection that can’t be proven wrong. On the other hand, they did lay their cards on the table and if something misinterprets their work, tough.

I also note that a misread of CERA’s projection gave various commenters a chance to restate their most cherished and unverifiable opinions.

Oily and Rich, I do not believe that I mischaracterized CERA’s predictions, neither in 2005, when I took their statements as providing an objective basis for optimism, nor today, when I declare they miscalculated.

In what sense is it accurate to claim that Thunder Horse currently has the capacity to produce 250,000 barrels/day? In what sense is it accurate to claim that Iraq currently has the capacity to produce 3 mbd? And, if Iraq and Thunder Horse indeed have such capacity today, in what sense did they not have the same capacity in 2004?

If you truly believe that the world currently has the capacity to produce 90 mbd, then you are either living in a fantasy or are using the term “capacity” in such a bizarre way that the statement has no meaning or relevance for shaping the world we currently inhabit.

Instead, the way in which CERA used “capacity” as distinct from “production” was very real and tangible. They anticipated that capacity might exceed production because some producers would deliberately cut back on production in order to prevent a complete free-fall in price. That is not at all what is going on now.

You try to defend CERA by interpreting their predictions as being completely vacuous. I instead believe their predictions were objective, verifiable statements about reality. The nature of such statements is that they are subject to empirical verification or refutation. The facts now available are sufficient to conclude that CERA’s predictions were in error.

Professor-

I was surprised by the vehement response to my comments, because I didn’t think I said anything that was particularly controversial. I simply followed the links you provided and read the summary of CERA’s predictions. Clearly production has to be less than capacity, and there are specific examples that you have cited where capacity is not being translated into production. Capacity cannot be directly observed, only inferred. You inferred that the increase in production was less than predicted capacity increases and therefore CERA’s predictions were wrong. That could be. Without forking over $999 for the CERA report I cannot know more than has been summarized.

I am neutral regarding CERA, and hadn’t considered them before reading your post. I note that there is antagonism between CERA and the Oil Drum due to very different views on Peak Oil. Clearly, CERA’s credibility and profitability is impaired by off-target predictions. They have incentives to be honest.

It’s usually easier to get a magnitude right than it is to get timing right. I think a very common flaw among forecasters is underestimating time lags. (We see the logical chain, and we are so excited that we’ve figured it out, that we want it to happen quickly.

Maybe CERA will be right in a few more years.

Rich, if “They have incentives to be honest.” was a valid argument, there would be no public dishonesty in this world, and not much private, either.

Instead of “an impartial observer would be tempted to conclude that TOD’s side in this argument has gained some credibility.”

How about “an impartial observer would be hard pressed not to conclude that TOD’s side in this argument has gained some credibility.”

It would seem to me that a person who predicts oil production should take in consideration possible shortfalls which are bound to happen. As an investor, I am more interested in the difference in the amount of oil produced and the amount of oil consumed. This is, after all, the more meaningful statistic.

Energy Trader,

Precisely. Another component to the CERA PR campaign is to stave away any more nationalization of reserves or further regulation by the fortunes of assets that Standard Oil of New York and New Jersey owns around the world, outside the US.

Clearly, in order for the Iraq war “not” to be about oil, there must be abundant supplies left around the world in non-OPEC countries *and* OPEN countries. Enter the CERA schnooks selling the usual Hayekian schpiel in order to cover up their avaricious agenda… Markets will deliver in excess of 120 million barrels a day 30 years from now! No need to setup a police station in the desert to control and modify regional actors… No, no–we just love spending hundreds of billions of dollars for our soldiers to saunter off into the desert, get blown up by IEDs driving around in hummers spreading democracy is a country engaged in a cultural/religious civil war. As I’m sure our buddy Rich Berger will inform us, we are there to spread freedom while fighting the terrorists on their own turf. Yay Global War on Terror!

The circular/reverse illogic of corporate and OPEC front groups is truly impressive. Ditto their apologists, who actually believe the propaganda they spew forth with such glee.

Rich Berger writes,

“I note that there is antagonism between CERA and the Oil Drum due to very different views on Peak Oil.”

Wow, you really are astute. More so than I previously thought. Yeah, buddy, there is a big difference between 2 trillion and 4 trillion.

The major institutional differences between CERA and her antagonizers? Well, for one CERA isn’t interested in diverse and dissenting opinions. In fact, they’re not even interested in a conversation. They are the Vatican of the energy industry and TOD is a secular society of engineers, scientists and concerned citizens. Second of all, CERA states as a matter of fact that we have 30 more years of expanding global net liquid oil production! First off, the analytical premise at which they start off is immediately discredited when you realize the inherent contradiction of someone not seriously engaged in debate with experts of varying opinions. However, that’s not all–they are guilty of precisely what they accuse others of doing! I’ll just note here as a polemicist that this is very similar to how charlatans and con-artists operate (not to mention moralizing televangelists, or perhaps to fit my metaphors together, Catholic pederast priests.)

CERA says “absolutely, we’ve got no problems to worry about until 2030, period.”

What happens when someone disagrees with them?

“We’ve measured all the oil fields in the world, the new ones coming online, and the depletion of currently existing ones and we say this proves without a doubt that the world has excess reserves and production capacity of *at least* 30 million barrels a day.”

Conveniently “their data” is ungodly expensive and mostly purchased by CERAs friends just to keep up appearances–sort of like how Hobby Lobby has to have all the crafts around to make sure no one finds out they’re laundering drug money. 😀

To compare TOD to CERA is to compare the concepts of natural selection to intelligent design (if the latter can even be considered as a concept).

TOD is an open community driven by dialogue and free exchange of ideas. It is a passionately questioning environment, where people gather to learn and discover. CERA is about as open and democratically inclined as the current White House of Leo Strauss lovers…

Finally, the last difference is that the main ideological strain that runs through the peak oil community is a concern for our future (not just a few quarters away, but 10, 20 years down the road.) CERA has a glib disinterest in honestly discussing our future with others who have come to different conclusions on the stochastic outcome of production trends. The list of eminent people with established credentials is quite long, and yet CERA does not really want to engage in discussion–they’d rather issue childish press releases with lame-o titles like “why peak oil theory falls down” and go on CNBC and talk about ethanol. More corporate hacks being paid to believe something, so they do. Hell, the majority of people believe ridiculous things (religion, etc) without getting any money. And when you’re charging $10,000 for a one single “field by field” report, you’re surely making a lot of money…

I have more diatribe in me right now, but I’ve gotta run…

Until next time,

Good Work at Econbrowser

Dr. Hamilton at Econbrowser is performing a vital function that contributes to rational debate: evaluating verifiable claims and predictions from interested …