Fed Chair Ben Bernanke’s comments Tuesday about anchors for expected inflation left some analysts unsettled and others mystified. Bernanke was speaking to a group of academic researchers, and I believe his message was intended to provide some insights from practical policy-making to help improve the quality of academic research. So let me offer my interpretation of his message.

Here’s part of what the Fed Chair said about inflation expectations anchors:

long-run inflation expectations do vary over time. That is, they are not perfectly anchored in real economies; moreover, the extent to which they are anchored can change, depending on economic developments and (most important) the current and past conduct of monetary policy. In this context, I use the term “anchored” to mean relatively insensitive to incoming data. So, for example, if the public experiences a spell of inflation higher than their long-run expectation, but their long-run expectation of inflation changes little as a result, then inflation expectations are well anchored. If, on the other hand, the public reacts to a short period of higher-than-expected inflation by marking up their long-run expectation considerably, then expectations are poorly anchored.

One of the academic studies that Bernanke mentioned in support of this view appeared in the American Economic Review in March 2005 by Refet Gurkaynak, Brian Sack, and Eric Swanson, which is also one of my favorite papers. The authors’ conclusions are based in part on analysis of forward interest rates, which are the future interest rates implicit in the yields available on bonds of different maturities today. For example, consider for simplicity bonds that paid no coupon but compensate you entirely through a future redemption value that is higher than the price you pay today. Suppose you simultaneously bought some 10-year bonds and sold some 9-year bonds with an equivalent current market value. You won’t have any net receipts in or out until 9 years, when you’re obligated to pay the redemption value for the 9-year bonds, and then at 10 years, when you receive the redemption value for the 10-year bonds. In effect, you’ve set yourself up to make a 1-year investment 9 years from now, at terms you lock in today. The interest rate on that investment is known as the 9-year forward rate, which is a number that can be calculated from the current 9-year and 10-year yields.

Gurkaynak, Sack, and Swanson then looked at how forward rates of different maturities respond to economic news, for example, comparing how much the 4-year forward rate (an implied 1-year interest rate you could lock in for 4 years from now) changes today in response to the extent to which analysts were surprised by today’s nonfarm payroll number. The responses of the n-year forward rate to a few of the news variables they looked at are plotted below as a function of n, along with 95% confidence intervals. For example, the bottom right panel shows that if nonfarm payroll employment today is higher than expected, the implicit forward rate becomes higher for essentially as far ahead as one can see.

|

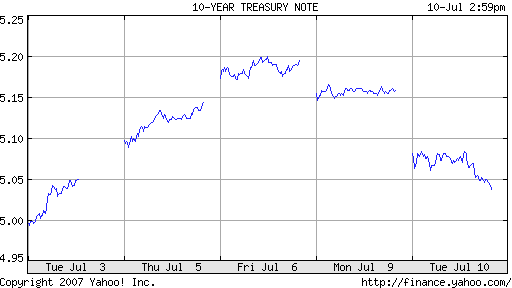

It is surprising that such a noisy, short-run signal as the NFP has any implication for something so far into the future. The same phenomenon was quite in evidence this last week, as we saw 10-year yields jump on the favorable ADP and NFP employment reports, only to come back down this week on new pessimism about retail sales:

|

Gurkaynak, Sack and Swanson also analyze a standard model of the economy to illustrate why it’s difficult to account for such a strong long-run response to short-run news. If the Federal Reserve is facing a short-run tradeoff between inflation and output, but its long-run ideal rate of inflation is constant over time, Gurkaynak, Sack and Swanson’s calculations suggest that it would be impossible to generate such a big response. The authors conclude that instead the Fed’s long-run target for inflation is constantly changing, and markets are continually changing their opinion about where the Fed is going to take us next.

But Bernanke was telling the academics that as an insider he doesn’t buy that interpretation. He knows that his own long-run target for inflation hasn’t budged a tenth of a percent since he took over the Fed’s reins. He instead urges us to look at models in which people are continually changing their minds about how the economy works:

The traditional rational-expectations model of inflation and inflation expectations has been a useful workhorse for thinking about issues of credibility and institutional design, but, to my mind, it is less helpful for thinking about economies in which (1) the structure of the economy is constantly evolving in ways that are imperfectly understood by both the public and policymakers and (2) the policymakers’ objective function is not fully known by private agents. In particular, together with the assumption that the central bank’s objective function is fixed and known to the public, the traditional rational-expectations approach implies that the public has firm knowledge of the long-run equilibrium inflation rate; consequently, their long-run inflation expectations do not vary over time in response to new information.

In addition to the research papers that Bernanke cited, I might also mention an interesting

study by Northwestern University Professor Giorgio Primiceri which appeared in the August 2006 issue of the Quarterly Journal of Economics, which argues that it is the Fed itself that is learning about the economy, and in particular miscalculations by the Fed were a big part of the story behind the surge in inflation in the 1970s. Bernanke perhaps is also a fan of that paper, but may feel constrained about endorsing its conclusion openly.

In any case, it seems the market is still trying to learn about Bernanke. And I still say the truth is pretty simple– the Fed now does have a very good understanding of inflation, and is not going to tolerate a resurgence.

Technorati Tags: Federal Reserve,

Bernanke,

macroeconomics,

inflation,

inflation expectations,

inflation expectations anchors,

inflation anchor

I agree. I just have trouble accepting and depending on the bond market apparent sharp shifts in inflation expectations that this methodology and the inflation adjusted bonds generate. I just do not want to believe that inflation expectations change as much as the various bond market signal seem to suggest.

“Inflation expectations” has become the new economic buzz word. When I read articles this term is always stated in such a way that it is some fixed number that people have determined to be the proper level of inflation under present circumstances.

While this may be true for some economists the actual consummers and producers who determine the economy do not have a singular inflation expectation. They have an inflation direction that is in large part determined by their understanding of government policy as expressed in the popular media.

Inflation is always and everywhere a monetary phenomonon and in today’s world that is determined by the FED.

More on the specifics of what Bernanke said later.

Is it really surprising that information today about what the FED may or may not do would impact the forward rates going forward?

Remember that those forward rates today are “conditional” forecasts.. i.e the rate 6 months forward so to speak is conditional on our expectation of the rate… 3 months forward.. or say the next fomc..meeting..

Everything else constant.. if in our imaginary world you increase the probability of the FED acting at just one FOMC.. unless for some reason your forecast of the conditional probability of the FED moving at the next meeting actually decreases… you will have to by necessity increase the “probability” of the FED moving at the next meeting as well.. or at the very least keep it constant..

Thats all you need… By mathematical necessity.. all your forward rates will move in a “linear” fashion..

The interesting question is of course, when will they not move in a linear fashion.. we’ve just experienced this over the last two years..

But one can see that ex ante if one could predict when the process would turn.. i.e when the Central Bank will either stop moving in one direction.. or turn entirely.. obviously if you can come up with such a forecast.. call me collect at anytime…

Mr. Bernanke’s speech and particularly the critical references he makes to the Mankiw,Reiss, and Wolfers paper is clear. It’s no surprise that Mr. Wolfers is the leading “theorist” of Prediction Markets…

The name of the game is to change the “conditional expectations”… which “chained together” vis a vie the law of iterated expectations produces the current term structure…

As Mr. Bernanke and others have endlessly repeated.. no one really cares what the FED Funds rates is today.. or even next month.. its where the FED FUNDs rate will be 1 year from now.. and how long it will stay there..

Even with the FED being on hold for almost a year.. the problem remains the same…

As Mr. Bernanke comments in footnote #3… looking back at the Volcker experience.. it took almost 3 years for market “disagreements” about inflationary expectations to diminish…

That said.. a tough talking FED is an inevitable

policy result..

What ends up happening like the toss of the coin we’ll eventually see. But as with Keynes example of the Archbishop of Canterbury.. its critical to convey to us that the coin is not rigged in one direction or the other..

Agreed, Stan, if the Fed raises the target 25 bp and keeps it there for a while, the 3-month forward should go up 25 bp, and the 6-month forward should go up 25 bp, and so on. But the question is, by what mechanism would the Fed have the power to keep the target permanently higher? That, according to standard models, would have to involve the long-run inflation rate.

Given my background in investing and the detailed work done by researchers in behavioral finance over the past 5-10 years, I was pretty surprised by Bernanke’s choice of terms . . . . . because in behavioral finance, “anchoring” refers to the irrational tendency of humans to systematically under-react to changing conditions.

As in all the major oil companies using $40 oil in their project analyses today when the observable price of oil is over $70 and when futures strips are signalling that prices over $40 are much more than a short term blip on the pricing screen.

Or as in bond investors back in the late 1960s and early 1970s systematically UNDER-REACTING to higher rates of inflation in large part because their inflation expectations were so well “anchored” in the moderate price inflation experience of the 1930-1965 era.

It just seems strange to me for the Fed Chairman to say that inflation expectations being well anchored is a good thing when the under-reaction of bond investors in the 1960s and 1970s helped perpetuate the negative real interest rates that allowed the borrow-and-spend mentality to rage so far out of control that we had to endure the painful Volker monetary shocks to restore sanity to the system.

I agree that if you assume a model of risk neutral, single decision investors with limited choices, the bond market is more volatile than it should be.

But in reality, Treasury rates reflect various economic elements, only one of which is future inflation. The real Treasury rate is a function of perceived opportunity cost of investing money. When there are ample profitable investments available, relatively low Treasury rates seem unattractive, driving the real Treasury rate higher. When investment opportunities are scarce, funds flow toward the Treasury market.

This is in part a function of investors changing perception of risk. For example, when default risk is perceived to be low, investors may choose to own high-risk junk bonds and eschew Treasury bonds. But when default risk is perceived to be high, the opposite will happen. Or if prospects for the stock market are perceived to be strong, low Treasury yields seem inadequate. Etc. etc.

The varying view of risk and opportunities world wide alters every day. So for the yield on the 10-year Treasury to move 5-10bps on a given day suddenly doesn’t seem so surprising.

Furthermore, a large percentage of bond holders do not hold bonds for profit. Many are holding for hedging or asset-liability purposes. This alters demand for rates product. Hedgers particularly can cause movement in rates to accelerate.

I’d be easy to say this is a case of academia not understanding reality, but it isn’t that. I think here we have a model which produces less volatility than is observed, but that is only because the base assumptions eliminate many of the reasons for the volatility. I think it would be possible to create a model which could indeed account for market volatility.

Bernanke listed as valid measures of inflation expectations the following:

-consensus of economists forecasts

-TIPS spread

-ISM prices paid

-Michigan sentiment survey

Notably, he left off commodity prices and FX; which of course is convenient since those traditional measures of inflation expectations are certainly not well anchored, and haven’t been since the Fed’s deflation-fighting experiment began in 2001.

By largely ignoring commodity/FX inflation signals, the Fed runs the risk of discrediting itself. The longer these price signals warn of inflation, the harder it is for the Fed to explain them away as “one-time” supply or demand “shifts”. Any explanation that incorporates the signals as valid expectations metrics creates a “sea change” in Fed thinking and may surprise the market: the opposite of what the Fed is trying to accomplish with its communications policy.

David Pearson:

By largely ignoring commodity/FX inflation signals, the Fed runs the risk of discrediting itself

This seems like fait accompli now. Irrespective of anything, main street is losing faith in the inflation stats. The question now is whether inflation will be generated economically or politically. Higher wages or govt spending?.

Academic theory eggs, meet the pavement

Not at all. Weakening dollar due to the world boom means higher inflation. Now and later. Oil is also undervalued after a long secular bear and should be up to 100b’s range soon enough.

If you watched, the US has had long decadel expansions from the 1960’s through 2000’s except for the 1970’s. What happened? Collapsing dollar and Oil shock. Anything can cause a Oil shock. One minute 3 dollar gas, the next 8. Ouch!!

Still, between lines, one can read the following message “strong movements in inflation are not impossible”. I am sure that one can come soon but not sure that the Fed has means to counteract it.

http://inflationusa.blogspot.com/2007/07/is-deflation-probable-post-6-of-6.html

It is very likely that the educated guess of bankers and academic researchers on the input of the Federal Reserve in the Great Moderation is highly overestimated (a victory always has many fathers). Whatever is the source of the GM, it is better looking for potential sources of thread for the GM than praise own input. It is always better to be prepared to the worst scenario. And, the longer is the time gap between two earthquakes – the larger in the next one. So, the GM can end in a disaster, if a ten-year deflationary period is a disaster.

The following was written by one of my friends who runs an international manufacturing company. I am posting this because it expresses my opinion better than I can.

Most distressing was Barnanke and his staff’s sole reliance on Phillips Curve and Neo-Keynesian constructs in their approach to managing and measuring inflation and inflation expectations. Greenspan, had some respect for Gold and Commodities. Vice Chairman under Greenspan, Wayne Angel, was a price level targeting guy. Volker used monetarist precepts encouraged by Friedman. Barnanke is searching for a neo-Keynesian Phillips Curve model that can learn and operate in an over all central model of equilibrium….so that the economy could be centrally managed by a wise fed that would tweak its statistical tool.

Apparently, Barnanke rejects money aggregates as ‘OK for UK and EU, but not for US.’ Apparently, Barnanke rejects price level targeting as too disruptive in its forced corrections…apparently he discounts the possibility of using price level target information to avoid the need for corrections.

His comments about the fed approach to predicting inflation were as sad as they were revealing. The staff breaks the indexes apart and then projects the increase in component costs in the near term. Such, strategy reveals a failure to distinguish price behavior with inflationary effect….

Properly understood, the CPI index and the PCE indices are themselves predictions of inflation, albeit after the fact. So, Barnanke and staff are hard at work forward predicting a backward looking (lagging) prediction and they think this is the inflation rather than a distorted measure of an inflation effect that is separate from the index. [My emphasis]

I guess the big secret is that inflation is a condition of the supply of money. The money supply is best managed with reference to the volatility and trend change in the currency price of gold. Dollar/Gold volatility is the best measure of inflation expectation. The change in the moving average price of gold informed by gold volatility is the best predictor of future inflation as measured by composite indexes.

It has been pointed out to me that the current FED has been successful thus far primarily because they are confused and that confusion has frozen them into inaction. They have not been able to implement their theories because their indicators are not cooperating.

Another of my friends made the point that we are all in big trouble if they ever figure this out and do institute their pro-cyclical policies.

David Pearson,

You make a good point about Bernanke “largely ignoring commodity/FX inflation signals.” I believe this comes, in large part, from his work on the Great Depression and his misunderstanding of the role of gold.)

Just to make sure the FX portion is clear we must never forget to apply Einstein’s theory of relativity: is one currency appreciating over another or is the other depreciating under the one. So, unless we have a common reference point to measure FX, it is meaningless.

The Bond Market is Excitable

Prof. Hamilton at Econbrowser commented on a speech by Bernanke in which variability of inflation expectations was discussed. JDH went on to reference a very good academic paper, The Excess Sensitivity of Long-Term Interest Rates: Evidence and Implica…

What does one get from this article. From:

a: Fed actions have weighed the infationary expectations anchor.

b: Bond markets price s-term factors

One derives

c: Bond markets do not reflect inflationary expectations but expectations of unanchored fed policy

d: In large part Anarchus bond pricing would appear to be right.

e: the Ms

f: we have been led by the nose