How to reconcile the latest solid employment numbers with other indicators of economic weakness?

The Bureau of Labor Statistics reported today that the number of people working in the U.S., as measured by their survey of nonfarm establishment payrolls, increased by a seasonally adjusted 132,000 workers in June. While stronger than I had been expecting, the BLS payroll numbers were relatively modest compared to those from Automatic Data Processing, which handles the payroll records for over 20 million workers, and estimated that 150,000 net private sector jobs were added. When you combine this with the 40,000 new government workers reported by BLS, you get a June employment gain of 190,000 workers according to ADP. That agrees with the separate BLS household survey, which counted 197,000 new workers in June, and is also closer to the May nonfarm payroll gains, which estimate BLS has now revised up to 190,000.

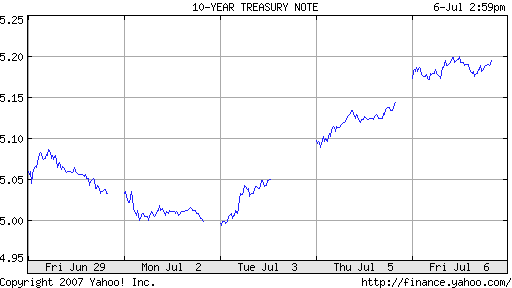

The bond market read this as signaling much more economic strength than we had believed possible at the start of this week. The yield on 10-year Treasuries surged 20 basis points this week, undoing in a few days essentially all of the bond-market pessimism that had accumulated since June 12.

|

It certainly is hard to reconcile these latest robust employment reports with the view that output is growing sluggishly. Nowhere is the disconnect sharper than in residential construction. The figure below updates a theme from Calculated Risk, displaying the number of new housing units completed each month and the number of people employed in residential construction. Employment has fallen nowhere near as much as output in this sector.

|

Let me therefore again revisit some of the possible explanations for that discrepancy.

Some have suggested that there have already been significant layoffs in the construction sector, but these have been concentrated on undocumented workers. While that claim is undoubtedly true, it is not correct to assume that these workers are not included in the BLS data. Note for example this from the Arizona Republic:

A 2005 report by the federal Government Accountability Office found that between 1985 and 2000, 9 million people got hired using this Social Security number: 000-00-0000. The report also found 3.5 million instances where a company had several employees using the same Social Security number. Most of the problem entries came from the food service industry and the construction industry.

A second possibility, articulated by King Banian and Stephen Stanley is that workers formerly in residential construction are now employed in the still-healthy nonresidential construction sector, though the BLS is counting those firms as if they were still operating primarily in the former category. If so, that suggests that strength in nonresidential construction has quite literally kept the economy chugging despite the woes for housing.

Another possibility raised by Calculated Risk is that the BLS establishment survey is underestimating the number of construction firms that have permanently gone out of business. Stone & McCarthy further argue that BLS is also missing the behavior of small firms in this sector. I had been leaning toward such hypotheses as long as the BLS household survey, which is not subject to these same problems, was signaling slower employment growth than the nonfarm payrolls. I still believe that we will eventually (perhaps next fall) see these current construction employment numbers revised down. But the strength we’re seeing in the separate household survey numbers the last two months suggests to me that these biases may not be as severe as I was earlier assuming.

So maybe our Little Econwatcher put on a frown too soon. But let’s wait to see if more data can help to settle his thoughts a little more clearly.

Technorati Tags: macroeconomics,

employment,

housing,

construction employment

James,

Good post as always but your argument over the strength of the household survey is essentially misleading.

The BLS publish a ‘payroll-consistent’ household survey jobs measure, which strips outs agriculture, self-employed and home workers. This has slowed sharply over the last six months, reporting average monthly jobs growth of c.45k compared to c.145k for the increasingly discredited establishment survey measure. When making comparisons – compare like with like!

As many have realised, the key problem with the establishment survey is most likely the accelerating contribution of the so-called ‘birth-death’ model, which is designed to capture the net contribution of new businesses outside their sample universe but which, by the BLS’s own admission, breaks down at cyclical turning points. Remarkably, the birth/death model accounts for around 55% of the total payroll growth over the last 12 months, with the assumed increase for new businesses in the construction sector inevitably (and bizarrely) playing a major role. Over the last 12 months, the birth/death model has added in some 135k construction jobs, 50k more than in the year to June 2006!

As a result, the establishment survey data are nothing better than insecurely estimated ‘guesstimates’. We will learn how good these guesses are when the annual benchmark revision is announced with early October. I expect hefty downward revisions of the order of 400-500k. Of course, this will not lift the unemployment rate but it may resolve much of the construction jobs ‘conundrum’ and would dovetail with the mounting realisation at the Federal Reserve that maybe the labour market really isn’t that tight – see Janet Yellen’s excellent speech this week.

But the Purchasing Managers and other indicators are also reporting a pick up in production. It looks to me like that with the end of the inventory correction we are getting a significant pick up in output. But at the same time it is obvious that final demand or consumption is slowing sharply.

So we are left with this basic conflict of supply expanding and demand contracting that the markets and economy are going to have to resolve. It could be resolved with a pick up in demand that is not yet showing up in the data. Or, alternatively it could be resolved with a much less benign solution.

My guess the revisions will solve this “mystery”, especially late 06/early 07 when the inventory correction was in full bloom.

“But the Purchasing Managers and other indicators are also reporting a pick up in production”

They have been showing that since March. The overhead number has been useless this entire decade as it has been to high. Industrial Production is only half of what it was last decade yet the number from these “surveys” are consistantly to high since 2003. The trend in ups and downs is probably a better read. Instead of a sharp increase, a dull surge(lol, as evidenced by the modest industrial production in the second quarter).

“But at the same time it is obvious that final demand or consumption is slowing sharply”

That is one quarter. The reason why the producers reloaded is because the consumption side told them to reload. Then the consumption went on a vacation while they did it. That doesn’t make a producer happy. My guess he will be watching the consumption side very closely this quarter. A slump in consumption will cause as you say, create a “less benign” way of handling the problem(slashing the throat and killing production cold).

According to my Wall Street insiders, most believe the global economy will crest around the Bejing 2008 Olympics. Then a sharp deceleration globally to recession by 2009, possibly a major recession. We shall see I guess, if my sources are correct. They perfectly timed the 2000 bust though they thought a recession would start the following fall.

Great Post Richard Iley. I think that the problem with the establishment data is not limited to the births/deaths adjustment. For sure, the lack of cyclicality herein is a problem and this certianly contributes to the apparent overstatement of payroll growth. But, we would be hard pressed to argue that the B/D model was the sole explanation of the massive +752,000 March 2006 benchmark revision. I would add to the B/D model inherent problems associated with the sample base portion of the monthly estimate. Recall the estimated change in payrolls is the sum of the sample base estimate plus the B/D adjustment.

Herein I suspect that the BLS sample is not capturing the payrolls of very small firms. The average private sector establishment paycount per the BLS sample is about 82 workers, but from the QCEW data it is only about 13. The BLS attempts to correct for this in the so-called “Probability-Based” sample by assigning weights to individual respondents, effectively weighting smaller respondents more heavily than larger repondents, to account for the mismatch of sample vs universe. My sense is that it is nearly impossible to gauge employment is the very small firms (ie 1 to 4 workers, and 5 to 9 workers). From the Q3-06 BED data it is apparent that the most acute weakness in payroll growth was in the smallest establishments.

Why argue about the data? It is what it is. Has the data collection changed significantly from previous periods? Then, as a trend why question it?

But the devil is in the details. Most of the job gains have been in the consumer end of the economy with actual decreases in employment in the manufacturing sector. This would indicate a shift from the higher orders of production to the lower orders of production as would be expected as the end of an inflation induced boom is approached.

The total employment number is not as instructive as the composition of the employment. The current shift away from higher orders of production actually seems to agree to some degree with the slowdown in housing and adds to the indicators of economic problems ahead.

FWIW I’m seeing significant drops in aggregate indicators of recruitment activity. The Conference Board Help Wanted Index, which tracks newspaper help wanted advertising, dropped 2 points in June (the most recent reported) to 27, a new 48-year low; and the Monster Employment Index, which tracks online help wanted advertising, dropped 3 points in July to 186, bringing its 12-month growth rate down to 8.8%, the first time it has been below 10% since the index began in October 2003.

The slowdown is here.

We are seeing decelerating growth in personal consumption — real personal consumption expenditures grew, month-to-month, 0.2% in April and 0.1% in May (and fell in March) (Table 7):

http://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm

Falling employment in certain locales — here in San Diego, seasonally adjusted employment has been moving down for three months straight, now:

http://data.bls.gov/PDQ/servlet/SurveyOutputServlet;jsessionid=f0302160ce32$3F$3F$0

With faltering consumption and the continuing tough times in residential construction, employment, nationwide, will move downward soon enough.

Another supporting data point regarding the slowing of job creation (if not outright losses) in the building industry is the remittance data from Mexican workers.

http://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?accion=consultarCuadro&idCuadro=CE81&locale=en

If you chart the YoY data the slowdown becomes very obvious as we have entered into negative territory now. These remittances should capture the illegal job market very nicely. I seriously doubt that illegals are the only ones feeling the stiff head winds.

Northern Trust also has a review of this job report:

http://mediaserver.fxstreet.com/Reports/c9c6414b-2317-4ebc-8734-4b6d7f422fef/fda57a51-5c87-4033-892f-cffebaa90bac.pdf

Of those untold millions (you need to hear it again?) of illegal aliens (my favorite is the refined “11.7 Million”…whose author should be set onto the problem of counting the mosquitoes in Alaska…during the grizzly bear mating season) who send remittances back home to Mexico (again somewhat counted), why izit that these jobs are counted and not, say, the co-ventured ones in China?

The figure below updates a theme from Calculated Risk, displaying the number of new housing units completed each month and the number of people employed in residential construction. Employment has fallen nowhere near as much as output in this sector.

That chart overstates the decline in output. The employment series shows all residential construction employees–those working on new construction as well as those working on existing structures. However, the completions series only shows new construction. As of Q1, improvements construction was still growing.

The amount of job losses so far is still probably understated by the BLS, but we shouldn’t expect employment to fall as much as implied by the decline in completions.

It wasn’t long ago that 150k jobs/mo was considered minimum required to just keep up with population growth. We haven’t maintained anywhere near that as an average for a long time so even assuming the BLS numbers are correct it does make you wonder why no one mentions that anymore.

Footwedge,

I think you need to re-check your stats. I was about to make a comment that it had to do with the LFP rate declining slightly (for whatever reason, as people argue about that one) and hence the unemployment rate staying low, but I thought I would just double-check job growth and here’s what I found:

Average Monthly Gains (using Seasonally Adjusted CES data):

2005: 211,800

2006: 188,600

2007: 145,200 (through June 2007)

So… thats probably why people don’t mention it.

I can’t believe that the phrase “solid employment numbers” and “132,000” appear in the same article. Whose chain are you trying to pull?

Nonetheless I’m glad I kept reading as the meat from the article was OK. But I can’t see any way to describe the employment report except anemic.

Chris, regular Econbrowser readers are well aware that the key question is whether in the short term we will see recession or just slow growth. These are not recession numbers, and that is the main thing I am communicating. In the current environment, 132,000 is solid, and a bigger number than I was expecting. Furthermore, I pull that 132,000 estimate up on the basis of the 190,000 ADP and 197,000 household estimates and the revised 190,000 NFP estimate for May.

There are many sites out there with a deep emotional commitment to seeing the situation one way or another. You’ll find that this is not one of those.