New home sales picked up in July, and new orders for durable and capital goods grew strongly. But that was then and this is now.

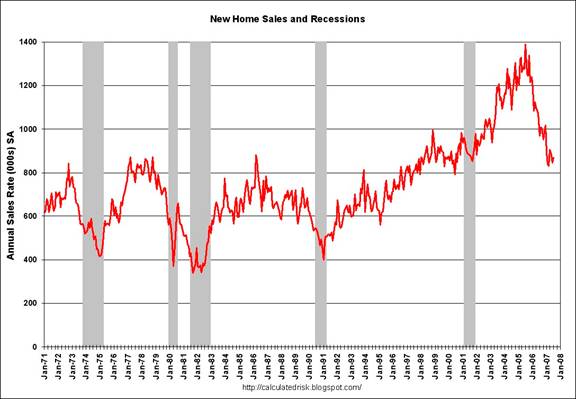

The Census Bureau reported today that seasonally adjusted new home sales in June were 1.4% better than had been reported last month, and July sales were up an additional 2.8% from June. To put this another way, the seasonally unadjusted drop in home sales from June to July was more modest than might be expected in a typical year. Even so, it’s unquestionably still been a pretty bad year.

|

The following plot from Calculated Risk makes clear that July’s bump up could easily just be statistical noise on an unambiguous deep decline:

|

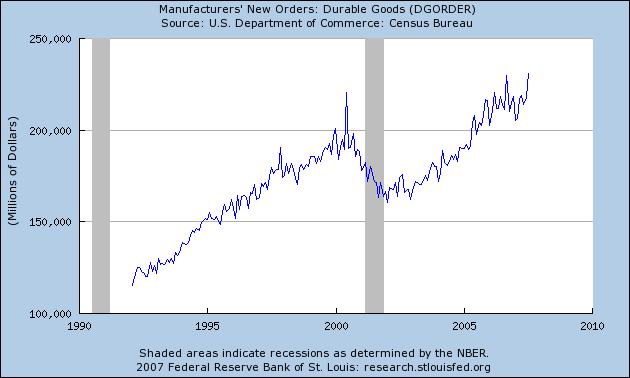

On the other hand, there’s no denying that today’s numbers for manufacturing orders from the Census Bureau were quite strong. New orders for durable goods were up 5.9% within July alone,

|

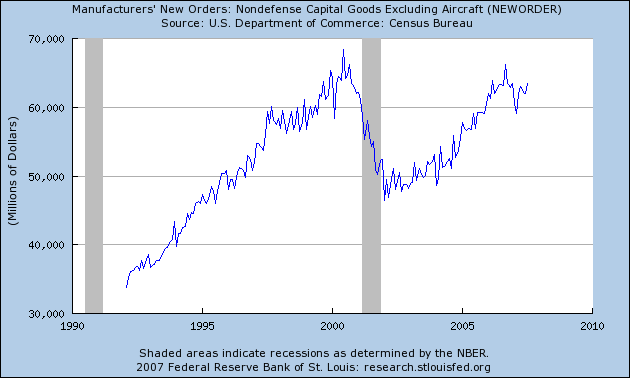

while new orders for nondefense capital goods (excluding aircraft) were up 2.2%:

|

| Date | Effective | High | Low |

|---|---|---|---|

| Aug 23 | 4.88 | 5 1/2 | 3 |

| Aug 22 | 4.77 | 5 1/2 | 2 |

| Aug 21 | 4.89 | 5 7/8 | 3 |

| Aug 20 | 5.03 | 5 1/2 | 3 |

| Aug 17 | 4.91 | 5 3/8 | 1 |

| Aug 16 | 4.97 | 5 3/8 | 2 |

But all these numbers predate the fun and games in financial markets of the last two weeks, which continued yesterday with more Fed injections to the tune of $14 billion in 12-14 day repurchase agreements (meaning those reserves will come back out of the system in two weeks) and $3.5 billion in overnight. This again came on a day when the effective fed funds rate ended up at only 4.88%, confirming that the Fed is not currently targeting the effective fed funds rate. It’s also interesting that the recent trend in which there is a huge range of prices at which fed funds get traded each day is continuing, as the data at the right from the Federal Reserve Bank of New York reveal.

One interpretation consistent with all this is that there are two sets of banks, one of which, despite the high level of excess reserves in the system, needs to offer over 5% to obtain funds, and the others which could usually borrow at a much lower rate. The goal of the repeated reserves injections is perhaps then to keep the former from paying too much over the 5.25% “target”. That would also be consistent with the otherwise mysterious decision of four big banks to borrow 30-day funds from the Fed at 5.75%.

And it also suggests that the liquidity crunch for such institutions is far from over, making it difficult to expect today’s good news on home sales and capital goods orders to be repeated next month.

Technorati Tags: macroeconomics,

housing,

fed funds,

Federal Reserve,

economics

Is it possible that Bernanke is trying to have it both ways — that he’s lowering the target rate through the back door while trying to maintain the impression that he is an inflation hawk by sticking to the official federal funds rate?

Are the collateral requirements different for the discount window than for Fed Funds? If the same collateral can be used, then why would these banks borrow at 5.75 when they are (let’s assume) in the group that can borrow at a rate much lower than the Fed Funds target?

Anonymous, fed funds have no collateral requirements, so whether someone lends to you on this market depends entirely on whether they think you’ll pay them back tomorrow. That’s why one bank may be charged a higher rate than another, or refused a fed funds loan outright. Discount window loans are always collateralized, as described here. My inference is that these banks are not in the group that can assume they will be able to borrow at a much lower rate than the Fed’s target.

Professor, you sure are taking a hard line, recently, with those snarky tag-ons, ‘…that was then and this is now…’

I look forward to seeing, in mid-late September, those housing statistics for August.

July’s New Home Sales were way off. Last July’s were heavily revised downwards and is usually the month described when the housing boom ended.

I suspect impressive revisions downwards.

the 4 banks using the window were making a political statement that they support the Fed– no more, no less.

Could be, Spencer. But couldn’t you make essentially the same statement with an overnight loan instead of a 30-day loan and save yourself about half a million?

The view of the “crisis” from my desk…..

I have a personal ETF and traditional fund equity and fixed income portfolio with rather conservative characteristics. It is substantially US centric. I suspect that it is fairly representative of most “ordinary” seven and eight figure portfolios.

On the final day of each quarter I compute the present value of the entirety. But as a result of this “crisis” in the world economy I decided to do an evaluation today at the close. On June 30, 2007 I had been expecting that the third quarter 2007 would bring an “ordinary” five/ten percent “correction” and that at the close of the quarter the portfolio would show down closer to ten percent than five percent.

The actual figure is -0.91% quarter to date. I notice that the S&P 500 index is down less than 2% quarter to date. (Maybe I should be jumping up and down, having “outperformed” the S&P500 by close to 1% during this period, but I find it rather difficult to jump at my age.)

The point is that this is no “civilization-ending crisis.” Some very rich and very manipulative (evil?) people have lost large parts of some very stupid bets. Some very uneducated and very greedy people have been “steered” into a con game from which there is really no escape. An egotistical and overly-experimental political w**re of a central banker has been unmasked and is “without legacy.” (AG not BB.)

And I hope that all of us have learned the lesson that it is impossible for a society to “borrow itself rich.” Once the credits and the debits find each other, there is no free lunch and there are no free homes.

Let us all take a deep breath and be thankful for the gift of life that each of us possesses.

Egads! Those fed futures!

no cut, .25, .5 and .75 cuts all with probability between 20 and 30%.

And the meeting is just a few weeks away.

Durables were up this much because of Non-defense aircrafts and parts decided to roll foward production into July. In otherwords, it wasn’t that impressive and Augest will be a corrective month. Something similiarly happened in 2000 interestly.

JDH,

The Fed announced last night that they were allowing two banks to use 25% of their capital base for broker-dealer affiliate transactions of $25b each. Presumably other banks have been issued similar letters.

The obvious implication: capital backing FDIC-insured funds is being put at risk to provide liquidity to the mortgage and ABCP markets.

The involvement of capital backstopped by the government’s safety net goes way beyond the use of the discount window, IMO.

Durables — good, or bad?

Real, nondefense capital goods ex-aircraft new orders, year-over-year change, 1993-2007

Now, the kids just loved the last durable-goods report. ‘New orders for durable goods were up 5.9% within July alone, while new orders for nondefense capital goods (

“Durables were up this much because of Non-defense aircrafts and parts decided to roll foward production into July. In otherwords, it wasn’t that impressive and Augest will be a corrective month. Something similiarly happened in 2000 interestly”

Durables are not a leading economic indicator this expansion. Because of the borrowing defense spending and overseas production in big goods, you have healthy growth there.

It is in the Housing,Auto,Retail/Luxery(soon to add CRE) that the recession is starting. We have not even seen job cuts in these areas overly yet. So far the Durables,healthcare,high tech and government is offsetting the stagnation of growth in those areas. Consumption is the key, if it goes negative, watch out.

When the big 4 begin to contract in real terms, the job losses will be intense. General Dynamics and Catapiller won’t be be able to offset those losses…….

Of course then the defense budget will get slashed next year lol.

Constantine,

I also see that the June durables were revised upwards from 1.4% to 1.9%. This doesn’t sound like rolling forward into July. It looks more like serious economic growth.

BTW, 5.9% vs. 1.0% is either a really bad mistake or way too much pessimism on the part of analysts. I think the later and this is why the market can’t even correct much.