For the first time in 5 years, markets were actually unsure what the Fed was going to do, with yesterday’s fed funds options calling it an even chance that the Fed would settle for a 25-basis-point cut or go all the way to 50. Capital Chronicle had prepared amusing posters as to just how to interpret a 25-basis-point as opposed to a 50-basis-point cut. Fifty it was, disappointing perhaps knzn who wanted a 175-basis-point cut, but delighting economic researchers like Refet Gurkaynak and Eric Swanson who both emailed me their high spirits at finally getting another data point for what happens when the Fed surprises the markets.

So what did happen? The 3-month Tbill rate fell by 15 basis points, about the same as the implied expected fed funds rate from the CBOT October futures contract. The 6-month Treasury yield was down 20 basis points, suggesting the Fed’s move nudged markets in the direction of believing even more firmly in subsequent cuts. The farther-out futures contracts now seem to anticipate a 4.50% rate before the end of the year and 4.25% by February.

But the really interesting thing is what happened at the longer end of the yield curve. The ten-year nominal yield actually increased, which is in contrast to the usual historical pattern for long yields to move, albeit less dramatically, in tandem with the short. Taken together with today’s fall in the 10-year inflation-adjusted Treasury yield, the bond market seems to view the Fed as having surrendered some on its long-run inflation goals.

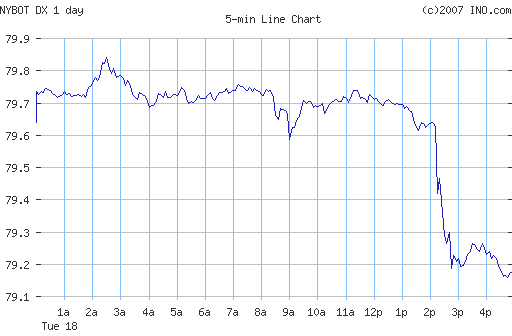

A lower short-term interest rate makes dollar-denominated assets less attractive relative to foreign currencies, which along with any perception of increased inflation should mean a weaker dollar. And indeed it did, with the exchange rate dropping half a percent within a few minutes of the Fed’s announcement:

|

That drop in the dollar of course will also make the Fed’s job of containing inflation more difficult, but the Fed must have anticipated this response. Concerns about a more precipitous decline might constrain the Fed in the future, but this much they can live with.

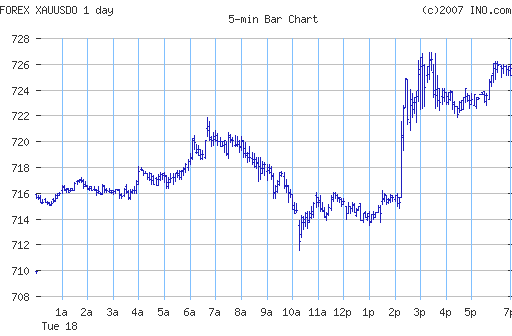

Lower interest rates also mean a lower carrying cost for commodity speculation, which inflation fears make all the more attractive. Oil and gold each gained more than 1%, oil now up to $81.50/barrel and gold to $725/ounce:

|

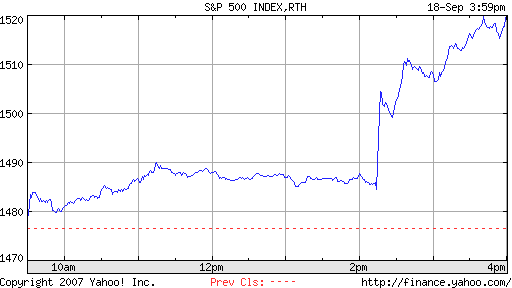

But the giddiest of all was the stock market, which shot up 2-1/2 percent today:

|

This last one seems out of place. I don’t believe the Fed has the power to add 2-1/2 percent to the value of the capital stock with such a simple thing as a dozen-basis-point surprise on the fed funds rate. Yes, worries about the financial system have weighed heavily on the market. But those worries should still be there. Real estate prices still must fall, and mortgage defaults still must rise. If an employment decline has already begun, rate cuts may be too late to prevent a recession. That reality is what prompted the Fed to act today. I expect that the FOMC is very somber about the current situation. Perhaps Wall Street should take the same tone.

The Fed deliberately took a step back from its longer-run mission of containing inflation today. I don’t think Bernanke did so because he’d like to see 3-1/2 instead of 2-1/2 percent real growth next year. I’ve been saying all along that his intention is to squeeze inflation as much as possible without sending the economy into recession or financial crisis.

The verdict is still out on whether we’ve avoided one or both of those last two pitfalls. If we have, I’m not sure that the market’s confidence in another 50 basis points of cuts is warranted. If we haven’t, today’s exuberance in equity markets cannot be rational.

I expect that Bernanke is still worried about both inflation and recession. Sooner or later, Wall Street will come around to the same perspective.

Technorati Tags: macroeconomics,

Bernanke,

Federal Reserve,

inflation,

recession

JDH wrote: “I expect that Bernanke is still worried about both inflation and recession.”

I believe his worries and the tensions he feels are similar to those undergoing execution in days of old through the technique referred to as “disruption” or “drawing and quartering.” The stallion of inflation is tied to one end of Bernanke, the steed of recession on the other, both tugging. And in the audience, counting his millions in book royalties, sits Alan Greenspan.

Professor,

As a former researcher/consultant(?) for the Fed, do you have any insight into what quantitative data they might have used to came to the conclusion that the impact of inflationary pressures and weakening dollar resulting from a 0.5% cut is not as much of a problem as a potential recession without such a cut?

I lived in Canada during the late nineties when the Can$ fetched 0.62–0.65 US $. Now it is 0.98 US$ and is looking at parity. That is close to 60% appreciation for the loonie. It all happened within a little more than a year. It puzzles me that the Fed doesn’t think such a sharp fall of the $ is not costly.

It seems to me that the Fed wanted to ‘shock’ the system by doing 0.5 now, but they probably will have to leave the rate unchanged for the remainder of the year.

Good article. I think the stock market reaction over the Fed rate adjustment is mostly psychological in nature. The liquidity injections and rate cuts will only help to prop up improper real estate investments rather than letting the free market run its course. The housing bubble is still there, and it will only enlarge when the Fed cuts rates.

I am also watching the price of gold closely, as well as comparing euro area debt to Treasury debt. Also interesting is how Greenspan mentioned yesterday that the Euro may replace the USD as a favored reserve currency. These are certainly fascinating times we live in…

I am glad to see the 10-year and 30-year Treasury yields go up some finally. After the re-introduction of the 30-year Treasury bond in February 2006, and the resulting 0.5% drop in its yield, the Fed has had less room to maneuver short term rates without causing yield curve inversion and therefore liquidity issues. There was a slight inversion in the yield curve between 2/06 and 6/07 and now the Fed is being forced to readjust short term rates lower for liquidity reasons. The price of gold clearly shows the economic environment is ripe for upward inflationary pressure. That brings up the oft-asked question — why haven’t long term bond yields moved significantly upward as well?

Professor,

Thanks for your blog. It’s very helpful.

What will be the key indicators you will be watching to see whether we’re navigating the tight rope between the two pitfalls or not?

From your post, I’m guessing the behavior of the longs bonds will be one.

TedK, you bring up a very good point about the Canadian dollar… Pretty soon, when people accidentally include a Canadian coin to pay for something in the U.S., it will be prized instead of shunned. :^)

ClementeR, perhaps the most important upcoming statistical release would be the September employment report.

TedK, I don’t claim to have any special inside-the-Fed information on this, but I’ll take a stab at your question anyway. The United States, due to its size in world capital markets, has more of an ability to set its own interest rate independently of the rest of the world than is enjoyed by essentially any other central bank. That ability, however, is not unlimited, and I expect there was some discussion within the Fed about the exchange-rate consequences of a 50-basis-point cut. Whether the Fed puts more or less weight on this next time might depend on how much of a further exchange-rate and capital-flow response we may see from here. But at the moment, I expect the Fed believes it could go much further if it needs to.

You’ll have to explain to me that if there was roughly a 50% probability that the FED would either go 25 or 50 basis points..

How going 50 basis points was a “surprise”..i.e.,what wouldn’t have been a surprise??

It’s interesting to note that beyond October Fed Funds.. the Fed Funds futures are not as high as they were say 3 weeks ago.. nor of course are any of the Eurodollar futures..

If there was a “surprise” its the combination of a 50 basis point ease with language that has lead the market to believe that is probable that the FED will go twice and be done..

Phyronic, if you don’t know for sure what the outcome is going to be, then either way the outcome has news value. The market was responding to the news.

It’s easier to talk about this with the precise language of mathematics rather than possibly confusing expressions such as “surprise”. The actual outcome (-50) differed from the mathematical expectation (-35). That difference is what caused the market reaction.

Yes, there also would have been a difference between the expectation and the realization if we’d had the other outcome. So, you can say you were not “surprised” that there would be a difference between the outcome and the expectation. But neither you nor I knew for sure which direction that difference was going to be.

I’m not sure the Fed is taking the international side of this seriously enough, given our huge dependence on capital inflows. If I’m the PBoC or any other foreign holder of US debt, I am even more inclined to reallocate my portfolio towards Europe today than yesterday. If our creditors start selling, today’s increase in long-term rates could be the start of something big, and seriously damaging to the real economy.

I think the stock market is wrong to have reacted that way, but 2 things are worth noting: never underestimate the power of positioning, and don’t feel it necessary to judge a rally or selloff as the real thing…it could just be the positions talking. Secondly, the level of bond yields and lack of requirement for external funding are likely assisting stocks at this point. THey’ll fall when the data really turns.

As for the Fed, consider that 3mth Libor is going to set tonight reasonably close to where it spent most of 2007 (Aug/Sept aside). So where’s the cut, really? Banks, corps and ARM resets aren’t getting full benefit, so the Fed will have to cut again…and probably again. Demand for debt is less elastic currently, banks aren’t inclined to chase new assets given their balance sheets (and on tighter terms anyway), and the way inflaiton is in China, the disinflation trend looks to have at least bottomed, if not reversed. The bond curve ought to steepen ….. a lot.

Professor,

Its interesting that the Fed likely believes is is cutting near the start of a recession. Why doesn’t it say so? If it did it might retain more of its inflation fighting credibility.

The reason this is important is that commodities have been trading near highs despite the prospect of recession. In the eyes of the markets, that prospect has now dimmed. So what is to stop these commodities from running to the upside? And what are the consequences of that for inflation?

The erosion of Fed credibility is a squishy thing, tough to model or even grasp in terms of a chain of events. Perhaps you could give us your opinion on why the present chain will not result in higher long term inflation? I imagine its because you still see a high likelihood of economic slowing. Is that enough to stop commodities from rising in price, especially that some slowing is widely discounted already?

David Pearson, I may have used a poor choice of wording. I am not saying that the Fed believes that a recession is starting, but rather that this is one of their worries.

I do think that a recession, if it comes, would bring commodity prices down. So commodities, like equities, seem to be moving on the theory we’ll avoid a recession.

I think that it is more accurate to say that the 10 year yield was essentially flat. Yes, at about 4.5% it is off its lows in the 4.4% range, but it was well over 5% just a month or so ago.

Maybe your expectation was that it would fall a little bit rather than rise a little bit, but the small rise could be nothing more than volatility.

JDH wrote:

I don’t believe the Fed has the power to add 2-1/2 percent to the value of the capital stock with such a simple thing as a dozen-basis-point surprise on the fed funds rate.

Professor,

Thanks for the post. Great information.

Of course the FED does not have the power to add anything to the capital stock. They don’t produce. But they do have the ability to destroy. They have the power to distort the value of money and they have the power to ruin the loan market.

But there is a way for them to add 2.5% and more to the capital stock: get out of the way! Get the FED out of distorting interest rates’s pricing and directing the allocation of savings and the value of money.

Then get the congress out of the business of driving wedges between domestic traders through capital gains taxes, business taxes, and a host of local and state taxes. Get congress out of the business of driving wedges between foreign traders with their dangerous attempts to penalize nations because their currencies are tied to the dollar. Stop floating currencies that have invite trade wars.

The more we see the resurgence of mercantilism with its increased command and control of both domestic and international trade the worse economic conditions become. This was not something that came from spontaneous generation. There is a reason the loan market dried up and it is not the market.

The dollar weakened relative to other currencies except quite notably the Yen — word out there that funds are flowing back into the Yen carry trade.

Also, it’s going to matter very much whether or not the markets interpret this 50 bp surprise ease as the first shot in a typical Fed easing cycle or as a large one-off event intended to cure the liquidity lock-up in bonds with an unexpectedly large burst of liquidity and lower rates. We’ll see — for now, the expert parsers of Fed words are trying to build a case for at least an extended “pause” in easing.

My old fundamental rule of thumb is that the realtionship between the market PE and interest rates is close to one to one — that is a 100

basis point drop in rates should generate a 100

basis point rise in the s&p 500 PE. That is roughly what regressions generate. Of course using bond yields rather than fed funds gives you about the same results. If you use both its about two-thirds bonds and one-third long bonds, but the one-to-one relationship still holds.

At a current market PE of 16 a 50 basis point cut in fed funds should move the PE from 16 to 16.5, or a 3.1% increase.

The 50 bp cut was much more of a surprise than implied by the 50/50 October fed funds pricing going into the announcement, as the market was really expecting a 25 bp cut with continued ample liquidity (ie. keeping fed funds in the 4.90-95 range) to help sort out the financial system, and a much smaller chance of 50 bps – at least that’s how we built it into our pricing curve. I’d have to interpret this move as meaning the Fed is much more worried about the financial system than is widely believed, or in particular that the stock market reaction would have you believe.

The 50bp reduction was exactly what the FED should have done, the time was ripe and thought there would be little point in a 25bp band aid, the 50bp made a clear statement that there is a serious problem in the banking system and we need to steepen the curve, but we know that inflation is right around the corner, but perhaps this surprise might do the trick. No it won’t alleviate the fact that ARM’s are going to reset and people will lose their homes, although I do see the timing of OFHEO’s announcement on FRM and FNM today was too correlated. Stock market reacted exactly how it should with a big run up, with some follow through today, but soon they will be reminded that slow growth and high inflation will be the recipe for months to come and both equity and fixed income will lose ground…..the FED is effectively devaluing the the dollar but would never outright come out and say that, just hope the PBOC doesn’t get too angry, although the Japanese may be there to pick up their slack anyway……great posts on this one thanks prof. and everyone……..Magne13

JDH —

Here is a graph of the target versus effective Fed Funds rate over the past 1.5 months.

It seems that, at the daily frequency, the effective Fed Funds rate has already been hovering around the newly-announced level (more or less as you discussed in an earlier post discussing the between-FOMC-meeting discount rate cut).

So far we’ve noted how “surprising” the rate cut is according to futures markets. Is there anything to the fact that the large commercial banks have been essentially *acting* as though the Fed Funds rate were 4.75 for the past month? Does that belie the “surprise” of this move?

the bottom line is that stocks, even before yesterday’s rally were not far from all time highs; commodity prices have been rising, including an explosion in the price of oil; the dollar index was less than 1/2% from 30 yr lows; while we are at it, it looks like improvements in the annual budget deficits are now behind us; trade imbalances, despite improvement over the last 6 months are still approximately 6% of gdp; and you have a central bank that acts more like financial guaranty insurance co or an asset manager than an institution that is supposed to worry about inflation.

of course the yield curve steepened and long end securities got pummeled. the ten year note is still trading 20 basis points below fed funds. it will trade well above funds soon. of course the dollar is under pressure. of course gold is surging. and, despite the fed’s worries about the economy, the stock market is responding to cheaper money, with more probably on the way.

the fed is bailing out the capital markets once again. in a for a dime, in for a dollar. there is probably more to come. easy money, however, is a palliative, not a cure.

can some one comment about the post on mish blog…..i am confused since looke like he is saying that FED is actually not printing money as we all thought they are.

http://www.howestreet.com/articles/index.php?article_id=4744

TECHY, Mish is correct. I’m not sure who the “we all” are that you refer to– maybe I should do a post on this if this is thought to be a popular perception. You have some particular URLs in mind claiming there’s a huge monetary expansion under way?

Prof JDH,

I am stumped.

“if this is thought to be a popular perception”….

I thought its a given. I watched Marc Faber and Jim Rogers. I have also watched Milton Friedmans videos (Where he stands next to the actual printing presses).

Are you going to drop a bombshell with your post by refuting the fed-is-a-printing-press theory ?

Dr. Dan, sorry I don’t understand your question. Of course the Fed creates money, and of course that ultimately leads to inflation. TECHY asked about a particular post by Mish, which looked sensible enough to me, and I wondered why TECHY thought there would be a lot of controversy about Mish’s claims. I was thinking that perhaps there was some misunderstanding about exactly what the Fed has been doing over the last month or years and its relation to money creation, and asked if TECHY or others wanted to nominate particular URLs making the claim that the Fed has revved up the printing presses. I’m not sure how to respond to a thesis without seeing a precise statement of the claims being made.

A falling dollar gives mixed blessings but for me it’s a net positive. The products and engineering services I offer in the market are in international competition against organizations with very close relationships with foreign governments (up to and including state ownership.)

A cheaper dollar makes my products more competitive price-wise to foreign and domestic buyers. My boiling water reactors will be cheaper compared to the Canadian CANDU and the French EPR.

Granted, many products I personally buy will have higher prices but the big budget items (housing, food, and automobiles) are largely domestic and only subject to second order pressures.

Lower long term financing costs in the US also help my product as foreign competitors offer essentially zero percent financing as part of their governmental industrial policies. My company wants a big chunk of cash upfront.

Overall, I’m happy to see the recent FED action and hope for more to come.

When returns on money are negative economic slowdowns will not necessarily lead to lower commodity prices. In fact, as the economy slows down, lower interest rate assumptions should lead to more commodity hoarding as a way of escaping larger negative real rates.

JDH:

I do not know how the monetory system actually works, but from my reading of blogs and comments, i inferred that the only way FED can actually make the dollar cheap…is by increasing its quantity in circulation (am i wrong?).

so when people complained about the discount window being open for marked-to-model papers….i though FED is funding all the by printing money.

and when FED has increased liquidity in the past 4-5 months by lending to bank….again i thought that the same principle applies.

please point me to any link you know which can make these things clear to me.

IT WAS the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

– A Tale of Two Cities by Charles Dickens

Does it stike anyone as odd that the S&P is back near it’s all time high, yet we are in the midst of the deflation of the largest financial bubble in the history of the world?

Frankly, it blows my mind.

Professor,

Thanks for your comments in response to my question about inflation vs. falling dollar.

…the bond market seems to view the Fed as having surrendered some on its long-run inflation goals…

I wonder, though, if one might attribute the rise in long Treasury rates to an increased willingness to accept risk, making long Treasuries less attractive relative to riskier long-term bonds, as well as a perception of improved liquidity in markets in general, making long Treasuries less attractive relative to less liquid investments. These factors would also help to explain the intensity of the stock market’s response.

(…continuing from my last comment) From what I just read in the WSJ online, it looks like there was a pretty strong supply response at the long end of the corporate bond market. Arguably, the reason long Treasury yields went up is that the Fed’s move gave corporate borrowers (and perhaps people who just had corporate bonds they wanted to sell but were waiting until market conditions improved) the confidence to provide competition for those long Treasury bonds.

With a days time, perhaps you’re “surprised” that FED FUND futures…. the key November Contract is actually lower than it was 3 weeks ago…. after the FED’s “surprise” 50 basis point move…

One must conclude then.. that the market place was looking for bigger or earlier FED move… (as of course it was)…

December Eurodollars are still substantially lower in price higher in yield.. than they were weeks ago…yields on the Two Year note are 20 basis points higher than they were 10 days ago?

So I gather you would be “surprised” at the direction of those too?

Surprise is a nice word… a more technically and mathematically correct description would be.. that when the subjective probabilities” are around 50%… its as close to LaPlacean uncertainty as we can get.. time for a uniform prior… and or the Beta distribution that would follow…

When you get around to looking at the data… here’s where the tradeable market was before the announcement.. and trading actively..

Probability of FED going 50 basis 37%

Probability of the FED Not Moving 13%

If one believes in the law of Total probability.. the residual was rather nicely 50% probability of the FED easing 25 bp’s..

Expost.. as in your comments.. everyone one of these will be wrong.. but… I suggest to refamiliarize yourself with Stephen Morris’ work

on how one should deal with heterogeneity in subjective probabilities on a consistent basis..

I would say that a distribution such as the one we had and the pricing in the marketplace… since the FOMC statatement implied as you should expect.. that even if you were certain there was going to be a 50 basis point move.. it was priced into the marketplce.. i.e prior to the FOMC statement there was no risk free “bet” that you could have taken to profit on the FED’s announcement..

The only thing close to a “surprise” would have been if the FED had done nothing.. but by Tuesday.. you would have to have paide 130 dollars to make 870 if the FED had done nothing..

13% in probability terms…

Phyronic, we need to distinguish between the probability distribution (which summarizes the ex-ante probability you assign to the various possible outcomes) and the actual value of the random variable. The expected value is one way of summarizing the probability distribution, and the difference between the actual value and the expected value is one way of summarizing what the news is. Researchers sometimes refer to this difference as the “innovation” or the “shock” or the “surprise”. There are many hundreds of academic studies looking at the response to various types of news as represented by these innovations.

If you write down essentially any model, you will find that the most important reaction to the news could be written as some constant times this innovation. It is most important in the sense that, as the size of the variance or the interval of time you are looking at shrinks, this term dwarfs the others. If investors were risk neutral, this would completely summarize the reaction even for large shocks or long intervals.

My rough calculation is that the innovation was about 15 basis points.

30 years ago, when a central bank cut interest rates, they still had some idea where the cheaper money/credit they were enabling would go: standards for mortgages, restrictions on international flows, and so on, tended to direct credit along channels that would stimulate local business demand and job creation.

Today, they can hope that credit ends up where they would like it, but it is equally likely to end up in the carry trade, in sub-prime mortgages, in plant investment on the other side of the world. What will the central bankers do when they find their tools have less and less predictable outcomes?