The dollar declines in response to the drop in the target Fed Funds rate. What next?

The dollar has declined in value to record lows against the euro. It’s declined to a record low against a basket of currencies in the Fed’s basket of major currencies.

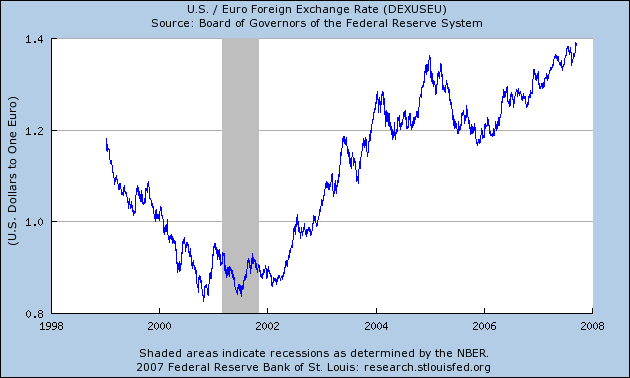

Figure 1: USD per EUR; up is dollar weakening. Source: St. Louis Fed FRED II.

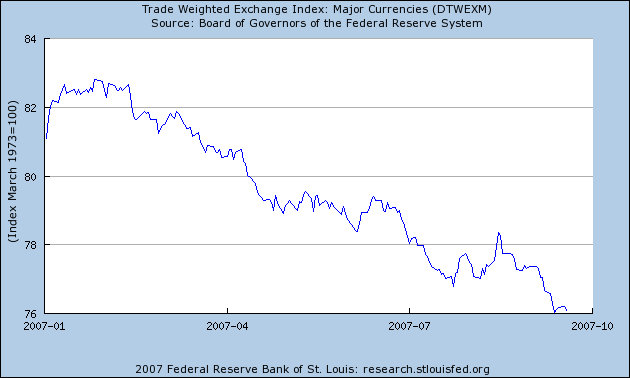

Figure 2: Trade Weighted Dollar Value; up is dollar strengthening. Source: St. Louis Fed FRED II.

It’s important to recognize that the drop in the dollar’s value in response to the Fed’s action is only latest in a trend decline. From Bloomberg:

Dollar Near Record Low Versus Euro Before Bernanke’s Testimony

By Stanley White and David McIntyre

Sept. 20 (Bloomberg) — The dollar traded within a half- cent of its record low versus the euro before Federal Reserve Chairman Ben S. Bernanke’s congressional testimony on the mortgage market and economic growth.

Traders are betting the central bank may reduce borrowing costs further this year as the worst housing slump in 16 years threatens economic growth. The first U.S. interest-rate cut since June 2003 on Sept. 18 has pushed the dollar to a 15-year low against an index of six major currencies.

“We’re going to see a continuation of U.S. dollar weakness against the euro,” said Greg Gibbs, a currency strategist at ABN Amro Holding NV in Sydney. “Bernanke will talk about the housing market and how that could flow through to the rest of the economy. The possibility of more U.S. rate cuts is completely open.”

The dollar traded at $1.3975 per euro at 9:18 a.m. in Tokyo from $1.3957 late in New York yesterday. It reached a record low of $1.3988 on Sept. 18 after the Fed’s rate decision and will finish the year around $1.42 per euro, Gibbs forecast. The U.S. currency was at 115.97 yen from 116.10 yen yesterday.

The U.S. currency has lost 5.7 percent this year versus the euro as traders bet the Fed would cut interest rates while the U.S. economy slowed. The European Central Bank’s benchmark interest rate is 4 percent.

…

Defending Options

The dollar’s losses may be limited against the euro on speculation investors will buy the U.S. currency to protect options that would become worthless should it weaken beyond triggers at $1.40. Investors use triggers to reduce the premium paid for currency options that grant the right to buy or sell a currency at a specific level on a predetermined date.

“Defensive dollar buying is picking up in intensity,” said Shinichi Hayashi, foreign exchange trader at Shinkin Central Bank in Tokyo. “I don’t think the dollar can fall very far against the euro.” The dollar may rise to $1.39 against the euro today, he said.

U.S. reports yesterday showed consumer prices unexpectedly declined 0.1 percent last month while housing starts fell to an annualized 1.331 million during August, the lowest in 12 years.

“The data validated the Fed’s view to take growth before inflation and to cut interest rates,” said Kathy Lien, chief currency strategist at DailyFX.com in New York. “The market is taking a break. The dollar is losing interest-rate support, and I think $1.40 against the euro is within reach this week.”

The New York Board of Trade’s Dollar Index comparing the U.S. currency against six primary peers, including the euro and yen, touched 79.091 yesterday, the lowest since September 1992.

The analysis laid out in this article is quite straightforward and makes sense. Weakening output growth in the US, combined with a Taylor-rule monetary policy, implies a weakening currency.

But, as I’ve discussed before, the dollar, like the euro and the yen, is a reserve currency. Indeed, it’s the pre-eminent reserve currency, and so the valuation of the dollar depends upon factors in addition to the standard macro ones (see here and here, and this paper). These include:

- Desired holdings by central banks.

- Relatedly, pegging to the dollar.

- Desirability of dollar assets, aside from rate or return (i.e., liquidity motivations).

- Invoicing of trade in dollars.

While the last point is unlikely to change rapidly, the second to last point is one where, clearly, conditions have changed. The share of dollar assets perceived as easily bought and sold has shrunk as the asset backed corporate paper has — if not frozen, then — slowed.

The first point, regarding desired holdings by central banks, could also change as the perception of the dollar’s trajectory is shifted more and more to a downward one (see here). While central banks do not have a primarily profit, or even mean-variance optimization, motivation, they must be somewhat concerned by returns on holdings.

Many students of central bank behavior will point to the fact that East Asian banks held low yield Treasurys for many years, with little apparent complaint. However, currency valuation changes can dwarf the effects of different interest yields. Recall:

“excess returns” = i USD – i * – E(USD %depreciation)

where USD denotes US dollar, a given non-US country currency, and E(.) denotes a subjective expectation.

The excess return on a dollar denominated asset could be very negative if a distinct trend appears in the the rate of dollar deprecation. Sufficiently negative returns might induce an attempt to reduce dollar holdings (proportionately, even if not in absolute dollar terms). Of course, this has been something that many analysts have worried about for many years, with those worries largely unrealized (see this post).

But big changes in dollar trend depreciation put a lot of strain on pegs. This is where this article’s point (from the Telegraph) comes into play (thanks to Jim H. for the tip to CR):

Fears of dollar collapse as Saudis take fright

By Ambrose Evans-Pritchard, International Business Editor

Last Updated: 12:18am BST 20/09/2007

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.

“This is a very dangerous situation for the dollar,” said Hans Redeker, currency chief at BNP Paribas.

“Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States,” he said.

The Saudi central bank said today that it would take “appropriate measures” to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg.

As a close ally of the US, Riyadh has so far tried to stick to the peg, but the link is now destabilising its own economy.

advertisementThe Fed’s dramatic half point cut to 4.75pc yesterday has already caused a plunge in the world dollar index to a fifteen year low, touching with weakest level ever against the mighty euro at just under $1.40.

There is now a growing danger that global investors will start to shun the US bond markets. The latest US government data on foreign holdings released this week show a collapse in purchases of US bonds from $97bn to just $19bn in July, with outright net sales of US Treasuries.

The danger is that this could now accelerate as the yield gap between the United States and the rest of the world narrows rapidly, leaving America starved of foreign capital flows needed to cover its current account deficit — expected to reach $850bn this year, or 6.5pc of GDP.

Mr Redeker said foreign investors have been gradually pulling out of the long-term US debt markets, leaving the dollar dependent on short-term funding. Foreigners have funded 25pc to 30pc of America’s credit and short-term paper markets over the last two years.

“They were willing to provide the money when rates were paying nicely, but why bear the risk in these dramatically changed circumstances? We think that a fall in dollar to $1.50 against the euro is not out of the question at all by the first quarter of 2008,” he said.

“This is nothing like the situation in 1998 when the crisis was in Asia, but the US was booming. This time the US itself is the problem,” he said.

Mr Redeker said the biggest danger for the dollar is that falling US rates will at some point trigger a reversal yen “carry trade”, causing massive flows from the US back to Japan.

Jim Rogers, the commodity king and former partner of George Soros, said the Federal Reserve was playing with fire by cutting rates so aggressively at a time when the dollar was already under pressure.

The risk is that flight from US bonds could push up the long-term yields that form the base price of credit for most mortgages, the driving the property market into even deeper crisis.

“If Ben Bernanke starts running those printing presses even faster than he’s already doing, we are going to have a serious recession. The dollar’s going to collapse, the bond market’s going to collapse. There’s going to be a lot of problems,” he said.

The Federal Reserve, however, clearly calculates the risk of a sudden downturn is now so great that the it outweighs dangers of a dollar slide.

Former Fed chief Alan Greenspan said this week that house prices may fall by “double digits” as the subprime crisis bites harder, prompting households to cut back sharply on spending.

For Saudi Arabia, the dollar peg has clearly become a liability. Inflation has risen to 4pc and the M3 broad money supply is surging at 22pc.

The pressures are even worse in other parts of the Gulf. The United Arab Emirates now faces inflation of 9.3pc, a 20-year high. In Qatar it has reached 13pc.

Kuwait became the first of the oil sheikhdoms to break its dollar peg in May, a move that has begun to rein in rampant money supply growth.

To the extent that demand for dollar assets falls in response to depegging or relatedly reserve diversification, yields on US dollar assets will have to rise or the dollar’s value will have be lower (unless dollar, euro, yen and other assets are perfect substitutes). CR calls this a “vicious cycle”; I’d call it a self-reinforcing feedback loop, but you get the idea.

Lest I be accused of doom-mongering, I should say that the change in central bank reserve behavior is (in principle) something that is desirable. An increase in the required rate of return on dollar assets — including Treasurys — is probably not desirable in of itself, although it might impose some disciplining on a spendthrift government. A lower dollar also spurs further expenditure switching away from foreign goods and towards US goods.

Of course, if the depegging happens in a discrete fashion (say, as all the central banks herd), then that would be problematic.

Postscript: Note that one has to be careful about interpteting the magnitude of the drop in the dollar’s value. If prices are sticky, then according to the Dornbusch monetary model of exchange rates [1], the dollar will overshoot on the way down its long run value.

Technorati Tags: China,

Saudi Arabia,

foreign exchange reserves,

Treasury bills,

Federal Reserve, and financial balance of terror.

I hate to keep bringing this up, but doesn’t the purchasing power of the dollar help to maintain its value. The euro is currently 25% overvalued compared with the dollar. The yen is about 17% overvalued. In fact, all major freely traded currencies appear overvalued compared with the dollar. Shouldn’t this constitute some sort of floor under the dollar. See http://fx.sauder.ubc.ca/PPP.html

A “Federal Reserve Note” is not a U.S.A. dollar. In 1973, Public Law 93-110 defined the U.S.A. dollar as having the value of 1/42.2222 fine troy ounces of gold.

The principle driver behind recent currency revaluations/depegging moves (India, Saudi, Syria, UAE, Brazil) has been a desire to stem food inflation. Rising food prices are political dynamite in most emerging markets, for obvious reasons.

The monetary policy of remaining dollar peggers is ultimately Fed-determined. So now here comes a 50bp cut, which in all likelihood results in an further acceleration in food inflation. What are the pegger’s expectations now? Certainly the Fed could yet more — the last time they showed a distinct lack of restraint. Even with a higher trough rate this time, still higher food inflation would ensue.

Excess money causes inflation (at least in food and energy); one side is fighting it, the other side is producing it. How much longer can the two walk arm in arm?

It is much too early to determine the effects of the FED move on the value of money. The FED in theory believes that lowering the interest rate drive the dollar value down, but if the decrease in rates increases business activity and the demand for money, this may not be true at all. We must give the economy time to adjust to the new interest rates before we make such a judgement.

It is much like condemning a family for the way they handled dad’s latest salary increase because he too them all out to dinner and on a shopping spree. You won’t know if this is a pattern after only one or two days.

checker wrote:

The euro is currently 25% overvalued compared with the dollar. The yen is about 17% overvalued. In fact, all major freely traded currencies appear overvalued compared with the dollar. Shouldn’t this constitute some sort of floor under the dollar.

checker,

How do you know that the euro and yen are overvalued? What if the dollar is undervalued? What if the dollar is a ceiling? What do we use as our base? The dollar? The euro? The yen? How about a basket of goods. I am sure that a hamburger is valued exactly the same in New York, Paris, and Tokyo (tongue planted firmly in cheek).

David,

The reference you gave links to Edwin Vieira who wrote:

If FRNs were not “dollars” when they explicitly promised to pay in gold or “lawful money, they did not magically become “dollars” when they stopped explicitly promising to pay in anything at all.

This is where Vieira makes his mistake. When Nixon broke the dollar link with gold dollar the FRNs did suddenly and magically become money, in the US that means a dollar. It is a fiat money but it is still money and must be analyzed and treated as money just as every citizen of the US understands. Now that is not to say that the FRN is better money than a gold certificate, but it is the only money the US has at the moment.

Gotta love the new fangled economic thinking! Lowering the value of the dollar should increase the demand for it.

The IMF thinks the dollar was (as of ca. 1.38 Euros/dollar) about 10-30% overvalued. Granted that it’s much more overvalued vs. the yuan, and the 10-30% is an average. But, since markets tend to overdo, it wouldn’t be surprising to see the Euro go much higher.

What are the first signals of capital flight?

The 10 yr yield doesn’t look good.

Mr. Chinn: I am recalling the ’round trip’ the dollar took against the D-Mark in the 1980’s, with the USD topping out in roughly 1985 and falling into the First Gulf War period. I’d offer that the rise in the USD was pure economics, and that the decline of the USD 1985-1990 was first from overvaluation and then from the approach of war. This first chart above looks like a repeat. (If history doesn’t repeat, it does reverberate.) Are we seeing the impact not of economics but of geo-politics, the impact of war in Iraq and the anticipation of war in Iran? Is there a similar outcome in store?

No fear of capital flight. Having devaluated the dollar, US stock is cheaper than before. Expect foreigners to buy up everything in sight. Tourism and the Chinese fake souvenir industry will flourish.

The Fed lowered rates for one reason. To calm the credit fears and to ease some of the negative contagion that was spreading not only domestically but globally. Thats why he opted for the 50bp instead of the garden variety 25. Bernanke admitted in his speech in Berlin on Sept. 11th that the FED is influenced by external global forces and I quote “the U.S. current account cannot focus on developments within the United States alone. Rather, understanding these developments and evaluating POTENTIAL policy responses require a global perspective.” So like I have said in the past the FED no longer has control of the United States Monetary policy, they like everyone else in the real world that is up to their knees in debt is at the mercy of the Creditors. Bernankes foolishness in alleviating the fears of those who have recklessly taken on leverage and risk did one thing and that is it solidified his legacy as an obvious non-inflation hawk and effectively confirmed his devaluation of the dollar. Devaluation against commodities, other currencies, to the point where the United States debt should be completely downgraded and put on credit watch…They can print money till they are blue in the teeth and it still will not help…he like Greenspan before who praised the uses of derivatives and “ARM’s” as a necessary tool for modern economics to pass on inherent risks…well pass on risk to whom? I will tell you whom, every poor American that will see his pocket book and any savings virtually dry up and be deemed worthless….This is not about doom and gloom it is about reality and reality is in any chart of any equity, fixed income, commodity…you will say well equities flew up after the announcement, well look at the earnings from a foreign currency like the Euro and tell me your gain, U.S. interest rates are heading higher (10yr rate 4.4% pre announcement and 4.66% today) Good Work!!! and there is nothing Bernanke will be able to do about it, except perhaps if to pull the plug on 30yr auctions and retire the bond again, this may be good for a 30bp drop in the long end…and you know what, I wouldn’t be the least bit surprised………

Some central bank will probably start selling gold to save their dollar holdings. It will probably be ours.

the FED easing will not solve the huge systemic risks in asset based US economy, what they are doing is shifting risks around, from credit crunch to inflation/US dollar.

1. Though run on the bank type credit market meltdown are avoided, the recessionary consequences of housing bubble bust will continue pressure employment, consumption growth. Globally growth outlook should peaked, even for China.

2. Expected return of US asset ( property, equity, bond / cash)all look very unfavorable, US dollar is plunging like stone while GOLD/OIL surging.

3. FED influence on Long term rates are slipping. Long term rates are rising post Fed cut amid Dollar plunge, global investors are demanding higher inflation/FX risk premium to fund US current account.

This is very different from 1998 n 2001 when US dollar surge more than 20% . The implications are stark, FED is pushing at a string in near term, higher credit premium/rising inflation/plunging US dollar will offset FED cut impact on long term rates.

4. The Inflationary implications of plunging dollar/rising oil put FED between a rock n hard places, how aggressive they could ease in 2007 amid plunging US dollar n rising oil prices??

Though Asian market tends to negative correlated with US dollar index since 1995( financial crisis & latest Asian boom show strong negative relationsihp), However in last US recession in 1990, weak dollar is not supportive for Asian equity at all.

I think market is probably too optimistic, macro conditions 2007 are very different from 1998 n 2001 when Strong dollar, weak oil allow for aggressive FED easing.

“What are the first signals of capital flight ?”

halliburton’s move to kuwait ?

The USD round-trip from 1980-1990 was in the result of the Plaza Accord (1985) which was a 5-way, agreed-upon intervention in the currency market to depreciate the USD. (parties to the agreement were US, UK, Japan, WGer & France).

The goal was to reduce the US trade deficit & it worked.

Then the plan was halted/reversed at the Louvre Accord in 1987.

I don’t think these events are in dispute…but people here may know more than I do.

Calculated Risk has a great chart showing the effects of the above-mentioned actions in a post dated 9/20/07

InquiringMind

I’m interested to hear opinions on long-term (10-20 years) projections for the U.S. Dollar. I live between Europe and the U.S., and am considering moving my U.S. Dollar assets to Euros, as I fear that the devaluation of the dollar will continue over the long-term (and I plan to retire in 15 years in Europe). Do any of you see any chance of the U.S. Dollar regaining strength against the Euro, particularly once Bush is out of office?

All of the suffocating negative press that has been ongoing during what appears to be a final push lower for the dollar, coupled with the large amounts of small traders getting short the dollar tends to tell us something.

Althought the dollar may drift lower against the Pound and Euro, I do see the worst as being over. As a matter of fact a climax low in the dollar versus the Canadian dollar may have already taken place.

When you find yourself in the hardware store and you hear talk of the crashing dollar and all the gloomy fallout thereof, I believe it safe to say a major low in the greenback is very near if not here already.

Did I happen to mention that the commercial traders have been very strong buyers of the dollar over this last 1/4 of the decline.

Nice post. Excellent comments too, which is a refreshing change from most blogs.

The pendulum has probably swung too far against the dollar in my opinion.

By the way, Professor Hamilton, I had to look twice at the post due to the charts you used from the St. Louis Fed. I used the first chart and then added a second on Fed Funds in this post (see below). But at first glance, I thought I was seeing things.

http://fundmasteryblog.wordpress.com/2007/09/29/how-far-has-the-dollar-fallen-and-why/