The dollar is declining, with no apparent support. That’s because the recessionary factors seem to be dominating. But a reporter’s question about what factors might support the dollar prompted me to think about other influences that might work in a direction opposite the forces alluded to in the conventional wisdom.

First, a recap of the current state of play regarding the dollar.

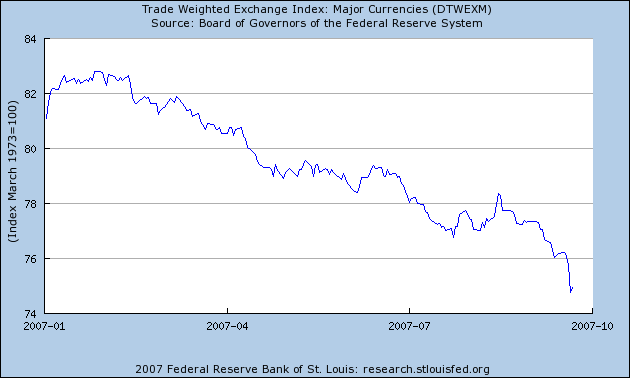

Figure 1: Trade weighted value of the US dollar against major currencies. Source: Federal Reserve Board via St. Louis Fed FRED II.

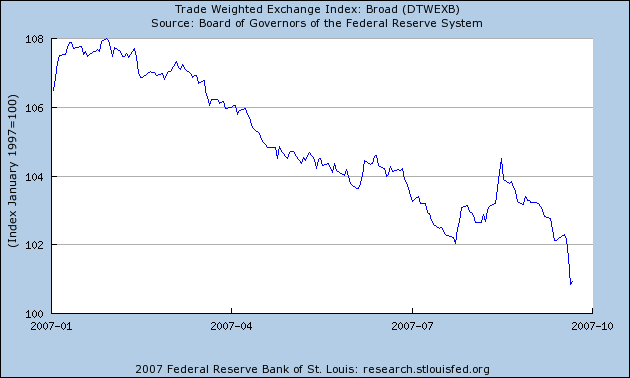

Figure 2: Trade weighted value of the US dollar against broad set of currencies. Source: Federal Reserve Board via St. Louis Fed FRED II.

These two graphs highlight the fact that the drop in the dollar’s value is broad based, and unlike the past, is not restricted to just a movement against the other major currencies. From Bloomberg:

Dollar Trades Near Record Low Versus Euro Before Housing Data

By Min Zeng

Sept. 25 (Bloomberg) — The dollar traded within a cent of its record low against the euro before U.S. reports forecast by economists to show falling home sales and consumer confidence.

New evidence of slowing growth may encourage the Federal Reserve to cut interest rates at least once more this year, reducing the attraction of U.S. assets. The dollar sank yesterday to the lowest since September 1992 against a basket of six of its major peers.

“A negative dollar is still the overriding sentiment in the market,” said Michael Malpede, a senior currency analyst in Chicago at Man Global Research.

The dollar traded at $1.4084 per euro at 6:51 a.m. in Tokyo after yesterday touching $1.4130, the weakest since the European currency’s debut in January 1999. The dollar will drop to $1.43 per euro by year end, according to Malpede. The U.S. currency traded at 114.89 yen after falling 0.5 percent yesterday. The euro traded at 161.82 yen after declining 0.5 percent.

The U.S. dollar has fallen against 13 out of the 16 most actively traded currencies this quarter, depreciating 4 percent against the euro and 7.2 percent versus the yen. For the year, the dollar is down 6.7 percent against the euro and 3.7 percent versus the yen.

The one-month risk reversal rate for the euro-dollar rose yesterday to 0.35 percent, the highest on a closing basis since April, suggesting traders are willing to buy euro-dollar calls more than puts. A call option gives the right, but not the obligation, to buy euros against the dollar.

These are the standard macro factors. However, as mentioned in this post, other factors are at play, including the changing attitudes of central banks with respect to holding dollar assets, reserve accumulation, and dollar pegging.

From IDEAGlobal‘s FXAlert of 21 September:

Whilst we are not at the recessionary door

just yet, it will take very little in the data to

suggest it may start getting priced in. The

danger and curve ball in all this is that

inflation may doggedly refuse to lie down

and this is a volatile cocktail for the US

economy and their stock market. Funding

and liquidity remain the problem globally but

we see the investment guns turning on the

US and if there is any evidence that the

reserve managers are looking elsewhere for

a home then the size of the move could

surprise. We are at a very crucial stage of

the year and the investment cycles and the

central banks cannot afford to make any

mistakes from here.

What this quote highlights is that while there are (at least) two categories of forces pushing down the dollar’s value, there’s one that might possibly push the opposite direction — namely, inflationary pressures and the consequent policy response. While this seems an unlikely fear, I found this Reuters article of today of interest:

NEW YORK, Sept 24 (Reuters) – The Treasury Inflation Protected Securities (TIPS) market is likely to show inflation expectations rising through year end, a Pacific Investment Management Co fund manager said.

Break-even spreads between the nominal 10-year Treasury note yield and the equivalent TIPS should widen to near 250 basis points by December from about 230 basis points currently, John Brynjolfsson, a managing director at PIMCO, told a Euromoney conference on inflation-linked products in New York.

Widening break-even spreads reflect investors’ rising inflation expectations.

Higher inflation implies a weaker currency over time. But to the extent that the Fed responds to observed and anticipated inflation, then this implies higher policy rates in the future. Then the big question is which effect dominates in moving the dollar. In addition, higher interest rates have an impact on output and asset prices at different horizons. Hence, a surprise in inflation could prompt an increase in the policy interest rates (relative to what was anticipated), which when combined with sticky prices would lead to a higher real interest rate that appreciates the dollar instantaneously and in the short run (Note: This argument relies upon a Taylor rule interpretation of monetary policy — the currency value implications of which are drawn out in this post).

To the extent that higher interest rates depress economic activity in the medium term, this will tend to lead to a weaker currency at the longer horizon. This means that the path of the dollar may be subject to more influences than would be obvious at first glance. And that changes in policy rates may very well have different impacts at different horizons.

(By the way, I’m using a loose definition of “stagflation”; usually it applies to a period of declining output and rising inflation. Here, we’re considering declining output growth (with a possibility of declining output level) with recalcitrantly durable inflation, or slightly rising inflation.)

Technorati Tags: dollar,

interest rates,

recession,

foreign exchange reserves,

Taylor rule,

Federal Reserve, and inflation.

Menzie wrote:

Higher inflation implies a weaker currency over time.

This has it backward, a weak currency creates higher inflation, and it is not a trivial difference. The FED has total control over the currency. If the currency is weak it is because of the FED failure, either bad policy or inaction, to stabilize the currency. Granted fiscal events do influence the value of the currency but this does not relieve the FED of its mandate. If the currency is unstable the FED is the only one to blame.

If you analyze the BB FED you will see that they have attempted to use the Taylor rule and it has been a failure. It relies on 1) the FED establishing some arbitrary “rule” of inflation; 2)pulling some “full employment” number out of the air and 3) guessing at “full employment” interest rates. Each of these require analysis but at best the information is 6 months behind the curve so timely action is not possible. It requires accurate information, which we have recognized here is seriously lacking, and even then it relies on the judgement of an handfull of “experts,” most academics or politicians who have never run a business, to guess how our economy should be running. If they get their estimates wrong the whole thing is a failure from the start, yet it is very questionable that a handfull of people can make better decisions than the market.

Bottom line is that the inclination to micro-manage the economy does nothing but create problems, and to the extreme of a command economy we could get a credit crisis or an FDR style Depression.

Sorry, I am anonymous.

Great post, anonymous. You should be the one blogging here. Make more sense than all these keynesian self-appointed luminaries.

A weak currency can’t be the only cause of inflation. For instance, the strength of the U.S. dollar or U.S. interest rates have only some effect on changes in commodity demand in China, the Mideast, and Latin America, while increasing demand obviously affects changing commodity prices, which affect inflation. Although unlikely to happen, I don’t see a theoretical reason why those systemic factors couldn’t be large enough to cause high inflation even with negative U.S. GDP and a stable dollar

When politicians talk about trade, they like to say that their favored policy is “good for America”. Man in the street, more so than economists, thinks different trade policies are good for some constituents and bad for others. Sometimes they are both be right in the sense that economists can correctly say which trade policies maximize a given aggregate measure of income (so perhaps income re-distribution could theoretically make it so a given policy helped almost everyone), while man-in-the-street can be right that there is a lot of variance within the aggregate measure and the income redistribution necessary for the benefit to be evenly spread ain’t gonna happen.

In the case of interest rate and monetary policies, there are also winners and losers. But the aggregate measures that economists should and do consider optimizing are less precise and perhaps more controversial – e.g. some choices pit lenders vs. borrowers and workers vs. retirees. It makes sense to separate arguments about what the goals should be from arguments about the methods for achieving the goals.

Inflation, whatever the cause, tends to scare holders of a currency, since it dilutes their purchasing power. Interest rates have a lot to do with currency values, and longer term rates are set by markets rather than the Fed in the US. They’re rising now, meaning investors are demanding more interest to cover perceived higher risk of loss.

Weak economic prospects tend to cause weak currencies, and the weakness of the moment in the US is self evident.

The upside to all this is that a weaker currency will stimulate agricultural and manufacturing exports, and cause import substitution through the mechanism of price rather than government actions. Exports of manufactured goods from the US are rising at 16% or so right now.

I’d suggest that wild borrowing and lending has fed inflation in the US, derived not from earned income but from the housing market in recent years. You can’t blame it on a “weak currency.”

chas: Two questions: (1) Why are you reading a blogsite with “self-appointed luminaries”? (2) What aspect of my discussion is it that you feel is objectionably “Keynesian”? If it’s the sticky-price aspect, well, I’m in good company, with a good chunk of the academic macroeconomics profession. This aspect of the salt-water/fresh-water battles is over. The essential debates now surround the necessity of microfoundations in analysis, along with the approaches to modeling those microfoundations.

Anyway, just curious.

DickF:

“…an FDR style Depression”

Nice try. It’s usual to refer in a fairly neutral way to “the Great Depression” or a “1930’s style Depression”. Almost no one even attempts to pin this one entirely on Hoover with “a Hoover style Depression” these days.

But however much you hate Roosevelt or regret the New Deal, well … Let’s just quote the Sainted Ronnie (an FDR supporter): “facts are stupid [sic] things”.

Year GDP (in Billions of $)

Hoover

1929 103.6

1930 91.2

1931 76.5

1932 58.7

Roosevelt

1933 56.4

1934 66.0

1935 73.3

1936 83.8

Source US Department of Commerce.

And here’s a convenient graphic including the shallow recession in the later 30s which is the basis for endless revisionist nonsense about FDR causing all the trouble.

STS,

I have added the USDL unemployment numbers to your chart and carried it through 1940, right before WWII.

Do not misunderstand my comment. My calling the Great Depression FDR’s was simply because he caused more of it over a longer period than Hoover. They were both to blame.

Contrary to the general myth the Great Depression had very little to do with monetary policy. Monetary statistics were simple a reaction to the economic disaster the government was creating. It was the first massive failure of socialism (better labeled National Socialism) and the command economy in the United States. There was no way that the FED could keep up with the Fascist (meaning Mussolini-style central control) destruction of the economy.

The Great Depression started with the election of Hoover when the markets realized that he was going to destroy international trade. It deepened when Hoover destroyed domestic trade increasing both domestic taxes and government spending by over 50%. FDR was then elected on a platform that promised to reverse the Hoover mistakes (the policies sounded like Coolidge), but in practice FDR instutionalized Hoover’s failed “volunteer” programs.

The Great Depression ended with Roosevelt’s death and the end of the great academic Fascist central planning experiment.

During the Depression there was actually both over-production and under-consumption but not as most economists mean that. Over-production was caused by government preventing wages and prices from declining while government subsidized production from higher taxes. Products were abundant on the shelves of stores and on the farms, but businesses were not allowed to sell them at a price people could afford, for example while there were bread lines in the big cities government was burning mounds of potatoes. The massive destruction of products by the government did just what it was intended to do. It forced agriculture prices higher, but the unintendd consequences were consumers could not consume.

Notice below that Hoover started the massive unemployment, but it was FDR who administrated the worst period of unemployment in our nation’s history.

Year GDP (in Billions of $)

Hoover

1929 103.6 3.3(1923-29)

1930 91.2 8.9

1931 76.5 15.9

1932 58.7 23.6

Roosevelt

1933 56.4 24.9

1934 66.0 21.7

1935 73.3 20.1

1936 83.8 17.0

1937 **** 14.3

1938 **** 19.0

1939 **** 17.2

1940 **** 14.6

Wow! A triple-axle double Godwin! (Hoover=FDR=Hitler) Despite my awe at such mental gymnastics, I have a nagging sense that it’s a pretty vacuous theory that fails to draw any meaningful distinction among those three.

Your USDL figures confirm the narrow factual points I wanted to establish:

The US Economy:

A. deteriorated dramatically during the Hoover administration,

B. recovered dramatically (if incompletely) during the FDR administrations

There is ample room for criticism of the New Deal and FDR’s political behavior, but to have a shred of credibility it has to begin with acknowledgment of that basic reality.

For example one could legitimately argue along any of the the following lines:

The US economy recovered dramatically during the New Deal, BUT:

a. FDRs methods were unsound on moral, political or longer-range economic grounds,

b. FDR’s emergency methods should have been discontinued sooner

c. FDR success could have been improved upon by replacing method X with method Y

d. FDR was “just lucky” and there was no causal relation between the New Deal and the economic recovery which took place

etc. etc. etc.

If your house is on fire and the fire department rushes over and breaks some doors and windows putting out the fire, you could complain that:

a. hey! you broke my picture window!

b. hey! you wasted so much time that my entire second story is ruined!

and look pretty churlish.

But you decided to call the fireman an arsonist instead.

I guess some might consider it a success for FDR if after 6 years in office (1933-1939), the economy still had not reached the output level it had prior to the depression and one in 7 were still out of work (compared to 1 in 30 prior to the depression).

Yes, more successful than Hoover’s record of shrinking the economy by 40%. And it is tough to recover from a draw down like that.

Could he have done better by other means? Maybe. You’re welcome to do some counter-factual speculation. But the propaganda shell game here is to brand a world-wide economic crisis which had fully materialized by the time he took office as somehow caused by FDR. Causality is subtle in economic matters, but not so subtle as to allow the future to produce results in the past.

Where is Orwell when you need him?

Hey …now we have a Military Industrial Complex to keep people working …who needs Socialism? Of course our pumps are failing and our bridges are collapsing …but our bombs are the best! 🙂

Well STS, before the depression (which FDR had plenty of time to cure but did not), “panics” occurred. At times, the contraction in economic activity was quite severe, yet the economy recovered relatively quickly, without the massive interventions that Hoover and FDR undertook.

I think Dick’s point was that the cure was worse than the disease.

STS,

Can you give me a period in our history with a worse record than the FDR New Deal. You use the standard rationale, he was better than Hoover. Bozo the chimp would have been better than Hoover and Roosevelt put together.

I will buy your argument if you can tell me how destroying food while there were food lines helped feed the starving, or how the Blue Eagle program preventing merchants from selling at a price people could afford helped the economy, or how buying food products above market prices and putting them into warehouses helped the economy, or how government confiscation of retained earning through FDR’s Undistributed Profits Tax helped the economy.

Can you even tell me one Hoover program that Roosevelt did not continue just under another name?

Rich,

Thanks, you are absolutely correct. The 1920-21 decline was worse than the Great Depression, but it was over quickly because there was no Hoover-Roosevelt tag team to abuse the American people.

Macro Economics 101 tells me that that Fed can fight recession or inflation, but not both. If they fight recession and ignore inflation it tends to spiral into stagflation, because even though there is reduced productivity there are still too many $s chasing too few goods.

Since we live in a global world now though there are additional forces. One would expect the declining US$ to cause significant inflation due to increased import and energy prices …but what if the world deflates along with us? What if our lack of consumption drags down other economies? Then inflation should drop because there are fewer external price pressures.

Personally, I think a US recession is baked in at this point (and I think the Fed agrees or they would not have dropped 50bp). Inflation on the other hand depends on the severity of the US recession and the level of impact on other countries (due to reduced exports to the US). I don’t think anyone can predict future inflation with any level of certainty. Just too many moving parts…

When the dollar fall started years ago, everybody was pointing Bush’s spending spree that led to huge twin deficits. Today, it’s the Fed for their inaction on controlling the currency.

I belive that infaltion has more to do with housing buble than weak dollar, actually, dozens of economists suggested that a weaker dollar was desireble considering the trade deficit, some even said China was to blame (actually the Chinese helped keeping inflation low).

DickF/RichB Tag team:

Hoover and FDR might have objected to being called a tag team. But by your standard, you guys qualify.

“give me a period in our history with a worse record than the FDR New Deal”

I just did: the Hoover administration.

Yes there were “panics” — there still are but our regulatory response is different. No they weren’t worse than the great depression. The Fed was supposed to fix those and probably didn’t do quite the best thing in ’29 and ’30. Note that I don’t blame the whole world-wide depression on the Fed alone any more than on Hoover alone.

“Bozo the chimp would have been better than Hoover and Roosevelt put together.”

Hmmm. Generous of you to put Hoover back into the equation. That’s the key point. And you seem to have Bonzo (chimp, costar of Ronald Reagan) mixed up with Bozo (clown).

Here’s how the shell game works: Voters in 1932 and 1936 sure did blame Hoover for the depression. (By 1940 voters were probably more concerned about the war in Europe.) So gotta fix that somehow. Aha, let’s introduce a lot of

fast talk about how many terrible mistakes FDR made (that fireman broke windows!

let the second story burn! etc.). So now we have the poor mark watching a ping-pong over HOOVER! FDR! HOOVER! FDR! (shells switching places furiously)

The mark is now too dizzy to even remember which was which: Herbert Delano Hoover?

Franklin Clark Roosevelt? Aack! A plague on both your houses! Then for the piece de resistance: drop Hoover from the conversation with an ever-so-casual “FDR style depression”. Rinse and repeat. Voila! New conventional wisdom: FDR = Very Bad Hitler Guy. Hoover absolved. The miracle of “moral equivalence” + “selective recall”.

To attempt a segue back to the main topic: one of many material differences between FDR and Hoover was the FDIC. I think the ‘non-bank bank run’ either just past or still in progress (not sure which) is a good example of how we are better off with well-designed regulatory institutions. The existence of the FDIC means a real BANK bank-run is hard to conceive of. The existence of the Fed means we don’t have to allow bugs in otherwise useful financial innovations like MBS and ABCP to automatically whack the real economy. We have the means and opportunity to cushion the blow. We’ve got some issues about how much insurance to buy and who pays the premiums, but insurance is a useful tool.

Dick F

You make excellent points. Both Presidents did more harm than good. However, the Great Depression strikes me as primarily a function of credit expansion & then collapse rather than who was president. The bureacratic Fed allowed a third of the banks to fold.

Similarly, the strength of the US$ & US inflation are primarily a function of the restraint or lack thereof on the part of the Fed in creating money.

STS,

I have been thinking about my response to you and I need to be clearer. When I use the term Fascist I do not mean that FDR was some tyrant who set up concentration camps (though I am sure the Japanese would take issue with me here). After the horrible job that Hoover did with the economy, not just in the US but also in the whole world, our nation was shell-shocked. The people knew that Hoover had created a disaster but they did not actually understand why. They had done everything he asked and things just got worse.

The Democrat was their only option and besides he promised to cut taxes and to return the country to prosperity. I would have voted for FDR. The people did anything the FDR administration asked.

Even economists who knew that what FDR was doing would probably lead to disaster, were so lost they felt that something, anything, had to be done. FDR felt the solution could be found in the academic world and so he brought in the brain trust. The only problem is they also did not know what was going on, but they were prepared to try anything to reverse the disaster. The result was an even worse disaster. Sure Hoovers Presidency was awful for 4 years, but FDR did the same things over and over for 4 terms.

FDR was a better politician than Hoover. He understood that if he took away $10 from one person then gave $4 to another the one who received the $4 would be a loyal supporter. Then later when $10 was taken away from the one who got the $4 he could win the favor of the one he earlier took for $10 by giving him $4. But for our country, and actually the whole world, it was a disaster.

The Great Depression was proof of the failure of central planning and it was lived out in almost every country in the world.

Consider that you are one of the 25% out of a job and every night you come home to hungry children. Very soon you will be willing to do anything to get something for your family. In some ways FDR used that, but in others he simply did not know what he was doing.

This was the condition of the whole world and it gave us not only the Hoover-FDR Great Depression but also it caused the German people to get behind Adolph Hitler because he was returning pride and prosperity to Germany. If we understand the power of FDR we can understand a little the power of Hitler. It was not in dictatorship but born in desperation, and in the end it was because they both received the blind faith of their people.

Algernon wrote:

…the Great Depression strikes me as primarily a function of credit expansion & then collapse rather than who was president. The bureacratic Fed allowed a third of the banks to fold.

Similarly, the strength of the US$ & US inflation are primarily a function of the restraint or lack thereof on the part of the Fed in creating money.

At one time I believe exactly what you are saying. I changed when I began to do research on a book about the Great Depression, which I am still working on. Rothbard in his book blamed credit creation and an overheated economy in the 1920s but the more I learned about economics and the more I looked at the evidence I saw that he was wrong.

Friedman and Schwartz on the other had blamed deflation after the stock market crash in 1929. Their research is an absolute masterpiece and an amazing resource, but their conclusions were not correct. The deflation that Friedman saw was actually a response to the contraction rather than the cause. The FED was operating then just as it does today, about 6 months behind the curve.

Hoover was the cause of the depression because he and congress refused to consider the horrible condition of international trade. As US trade policy move forward the world saw that nothing was going to stop the US form increasing their tariffs. Many nations took preemptive action on tariffs others instituted tariffs out of necessity. Canada is a good example. They were the number one trading partner with the US. The trade wars cut US-Canadian trade by 50%.

Granted imports and exports were directly a small part of our economy but international trade is more than just magnitude of numbers. It is critical to look at the details. Almost every country in the world put high tariffs on US autos for example. Auto exports crashed and auto layoffs caused a ripple effect through the economy, the local stores couldn’t see products without reducing the price and the Hoover administration was doing all they could to prevent that.

The biggest problem with the banks was not the FED. Banks were local with no support structure as the banks in large cities had. If there was a run on a bank in New York the other banks pooled funds and helped them through, but the little bank in Kansas had no support. Branch banking was not allowed. The FED simply could not have saved the banks.

On the gold standard the FED was prevented from creating both inflation and deflation. I know that today it is fashionable to blame gold for the “deflation” but it simply did not happen, it could not happen because of gold flows. Where the FED did make a deflationary mistake is when banks began to hold twice the amount in reserve as they were required so they could ride out a run the FED mistakenly doubled their reserve requirement. Duh, that just forced the banks to increase their reserves even more and that pulled money out of the economy.

That is enough. I could go on but you get the picture. I would encourage others to do independent study questioning all of the common myths about the GD.

what about the holc?

I don’t want to buy into this conversation in any way, shape, or form, but I do want to go back to Menzie Chinn’s original article. He said

“But a reporter’s question about what factors might support the dollar prompted me to think about other influences that might work in a direction opposite the forces alluded to in the conventional wisdom… What this quote highlights is that while there are (at least) two categories of forces pushing down the dollar’s value, there’s one that might possibly push the opposite direction — namely, inflationary pressures and the consequent policy response.”

So, in his search for “other influences,” the only thing he came up with was the possibility that the Fed might *raise* interest rates. Surely there must be something else.

As OldVet said, “Weak economic prospects tend to cause weak currencies, and the weakness of the moment in the US is self evident.” What matters here is *relative* prospects, and it is not at all self-evident that prospects for the US are worse than prospects for Europe and Asia. I think the main thing supporting the dollar is that there are really no good alternatives.

DickF:

I’m fine with: “The people knew that Hoover had created a disaster but they did not actually understand why.” And I’ll take “the Hoover-FDR Great Depression” as a reasonable attempt to be fair about it.

I would be happy to read your book once it appears, but would have higher expectations for it if you did not appear to go into the project with the notion that “The Great Depression was proof of the failure of central planning”. It would make more sense to say that the response to the Great Depression demonstrated the failure of central planning.

What caused the GD is the more urgent issue for those of us privileged to live in developed unplanned economies.

STS,

Thanks. That is fair.

One of the most surprising things about the Great Depression is how fast it hit. That led me to two considerations. First, nothing in the 1920s caused the decline. If there had been something like malinvestment, or credit expansion, or “normal” business cycle (what ever that is) that was the cause of the depression there should have been warning signs. But what we can see if we look at the forward looking stock market is that from the moment that it appeared Hoover would be elected the market reacted strongly negative to moves in congress to increase tariffs. This stock market roller coaster ran up and down for over a year before the crash.

Tariff wars continued through the 1930s and were a major reason that countries aligned as they did in WWII.

Second, the cause must have been some shock so it is doubtful that the length of the Great Depression was due to the same thing as the start.

Dick F & STS

“It would make more sense to say that the response to the Great Depression demonstrated the failure of central planning.”

The Fed & high tariffs are elements of central planning.

I would aver that the Austrian thought that increased demand for investment in the 20’s would have increased interest rates had the FED not been generous with money/credit creation & thereby assuaged the stock market bubble that misallocated so many resources. The credit-created bubble was the trigger for the GD, tho’ not necessarily the determinant of its depth.

algernon:

“The Fed & high tariffs are elements of central planning.”

Well, yes and no. Yes, in that they are attempts to manipulate prices. No, in that they don’t really plan a whole lot about what people do. There’s a whole spectrum between the Fed and Soviet-style 5-year plans.

I would further distinguish between price manipulation for money/credit and price manipulation applied to other assets. So the Fed is less intrusive than tariffs. The Fed is constructive, tariffs probably not so much.

algernon,

I am very familiar with the Rothbard view of the Great Depression. Consider the old saying when your only tool is a hammer everything looks like a nail. Rothbard felt he had to force the GD into the ABCT and so he expanded his definition to money supply beyond what most would ever accept. He actully included investments through borrowing which always happens in a growing economy.

Friedman’s hammer was monetarism and so his nail was deflation.

It is interesting that both Rothbard and Friedman used Q theory to justify their conclusions but I do not believe either would intend that.

algernon,

Sorry, one other thing. Rothbard did a great job of revealing Hoover as a central planner when everyone else was calling him laissez faire.