Since Halloween, financial markets seem to be getting spooked again.

Until recently, I thought the Fed could stand pat at their December 11th meeting. However, I have completely changed my mind in light of the continuing credit market turbulence.

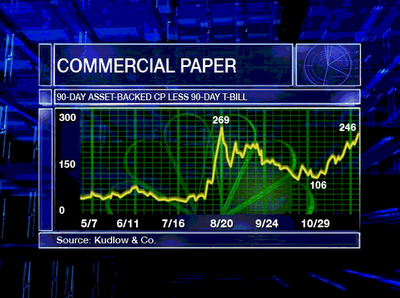

Kudlow notes that the spread between 30-day asset-backed commercial paper and U.S. Treasuries, which spiked up dramatically after August’s liquidity events but subsequently eased back down, climbed back up during November to the neighborhood of its previous high.

|

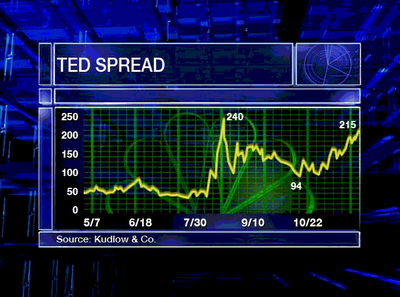

The same is true of the spread between the London interbank offered rate and Treasuries.

|

One of the features of the initial financial turmoil on which I commented last August is that it seemed to be confined specifically to the financing of problematic securities, but was not showing up as a broader risk premium in something like the spread between Baa-rated corporate bonds and 10-year Treasuries. But the latter spread has made a significant move up over the last month, and now stands 80 basis points higher than in July.

|

A sharp upward move in the Baa-Treasury spread is often associated with the early stages of an economic downturn, as the following longer-term perspective using monthly data illustrates:

|

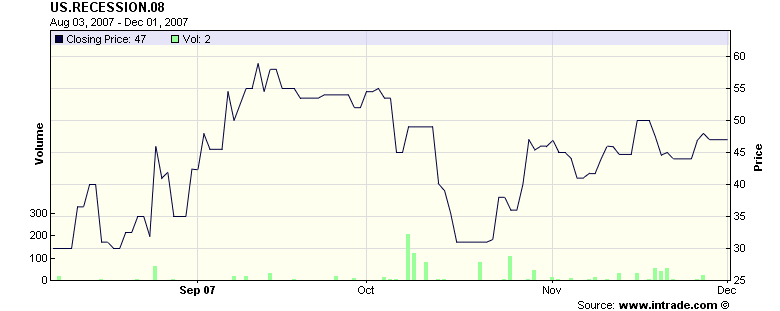

For what it’s worth, bettors at Intrade also seem to believe that the risk of a U.S. recession during 2008 has crept up since mid-October.

|

Technorati Tags: macroeconomics,

interest rates,

yield spreads,

economics,

recession,

risk premia

I’m kind of shocked to see the Perpetual Pollyanna, Larry Kudlow quoted on this site. If there is anyone with less objective insight into the economy I would hate to meet him (or her).

Footwedge, but when Pollyanna turns dour, does that mean something? In any case, I thought his graphs were interesting and wanted to share them.

That’s a very good point. I’ve also noticed a distinct change in tone on his show; his usual exhortations are taking on almost a hysterical tone and he’s having a tougher time badgering his guests into agreeing with him. Maybe it IS a buy signal!

So, they sold Wall Street 50 basis point dime bag in August and they’re ALREADY Jonesing? At an average of one month per quarter point the stash will be empty REAL SOON.

Why do economists insist on using words no else uses? To all English speakers other than economists, the plural of premium is premiums.

Do they insist? Only economists?

I’m sure there is not a single latin scholar who would dare say “premiums”, but far be it for me to insist…so Avocado, you figure James is stoopin here with this mention and illustration of Kudlow’s?

Makes me nervous, I can tell you flat out…more impact than the few graphs, for sure.

Nothing Kudblow says has any value whatsoever — even a blind squirrel finds a nut every once in a while.

I’m currently using a copy of his book to make a table of mine stop wobbling. Incidentally, I laugh every time I think about the irony of the title he picked – ” American Abundance: The New Economic and Moral Prosperity. ” Moral? Really? I wonder when neocons will receive their appropriate name of Jacobin by the MSM.

But I digress.

How is this not a cart-and-horse question.. treasuries and the consumer are tanking because the dollar is tanking, 70% of the US economy (and the baa-companies) is dependent upon the consumer, so the solution is.. more tanking of the dollar? I smell a rat.

Kudlow does not want to ever take the pain that is absolutely necessary to restart the locked credit market, and is willing to make the US revisit Japan’s economic wasteland to do it.

Spreads are certainly prices of risk, but what about the levels? The levels of these rates haven’t move much (most of the action has been in treasury and fed funds rate), thus some may argue that credit conditions haven’t really tightened, they just haven’t eased much either.

Then again, senior loan officer survey has shown a tightening of lending conditions that is comparable to the last credit crunch (1991)…

Bernanke had some time to think about it, and finally agrees w Greenspan — he wont be truly happy until Fed Funds are back to 1.0% and Wall St loves him unreservedly…

PLEASE don’t give Kudlow a shred of undeserved credibility by quoting him on this site (unless it’s ridicule, which is well-deserved).

I tend to use first principles when looking at economic cycles. One of these principles indicates that changes in quarterly productivity should be a variable in a predictor equation for recession. By the way, I was looking at your graph for NBER recessions and Baa-10year Treasury and decided that you’d appreciate the fact that when I overlay that on a graph of intergalactic cosmic bombardment, you could infer a weak relation as well, despite the fact that there is none.

http://farm3.static.flickr.com/2222/2107001249_efa919017a.jpg?v=0