On Thursday, the White House released its new forecasts. How does it compare against other forecasts?

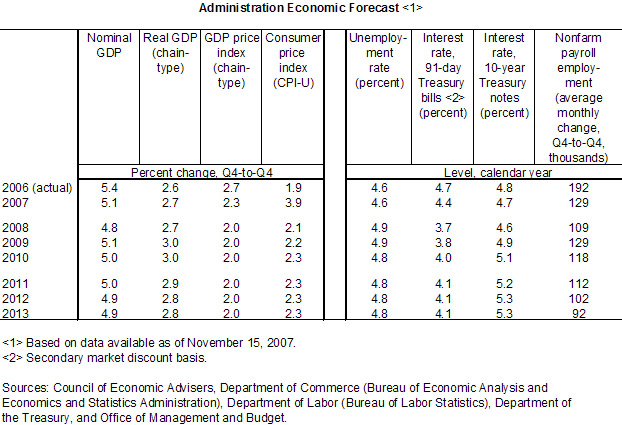

The Administration forecasts are summarized in this table:

One point of interest. The 2.7% 4q/4q growth rate forecasted for 2008 is somewhat higher than in other forecasts. For instance, the Wall Street Journal forecast for 2007 is 2.45%, if one calculates it by simple average of the q/q growth rates for 2008 (the WSJ forecast reports the 2008 forecast growth rate as 2.4%). This survey was conducted over the November 2-7 period, about a week before the Administration’s forecasts were being finalized (for more on the WSJ forecast, see this post). According to Reuter’s (Nov. 10), the Blue Chip forecast growth rate was 2.4% as well.

In the press briefing, CEA Chair Lazear responds to the obvious questions:

Q I wonder, the Federal Reserve, when they put out their projections a couple weeks ago, the range among the 17 governors and regional bank presidents was that 2008 GDP is going to be between 1.6 percent to 2.6 percent, which means that your 2008 projection is higher than the most optimistic of the Fed governors. Any thoughts on what either you know they they don’t, or they know that you don’t? (Laughter.)

CHAIRMAN LAZEAR: We’ve tracked the accuracy of our forecasts and other forecasts, and they’re all in the same range, so we have about the same accuracy. The other thing we know is that we are within forecast error of the other forecasts. So there are some years, like — if you compare ours, say, to the Blue Chip, for example, we’re a bit higher than the Blue Chip at the beginning, then there are some years in which the Blue Chip is higher than ours. But in terms of statistically significant, they still all seem to be within the same forecast error range.

Q What might be going on in the ins and outs of your model that might make your expectation more optimistic than both the Fed and a lot of private firms, for what they’re expecting next year?

CHAIRMAN LAZEAR: Yes, again, as I said, I mean, these models are very complicated. You’re looking at something on the order of 400 variables. And it would be virtually impossible to figure out which one factor is causing one number to be higher in one year than another. But the way we think about it is, again, just sort of track what’s the forecast error associated with this, and if you’re getting something like a point or a point-and-a-half — a percentage point or a percentage point-and-a-half standard error on these kinds of estimates, you know, then we’re talking about being well within the range of forecast error.

You know, our — I mean this is, as you know, it’s a pretty inexact science. We try to do the best we can, but look at what happened this quarter. I mean, no one was forecasting 4.9 percent GDP for Q3; that was way, way out of range. So sometimes we err on the downside, sometimes we err on the upside. This time we were pleasantly surprised by forecasting too low.

Q So you feel like there’s no single assumption or way you’re approaching these questions that accounts for the difference between how you’re viewing the economy and Wall Street and the Fed and other —

CHAIRMAN LAZEAR: Not that I know of, not that I know of.

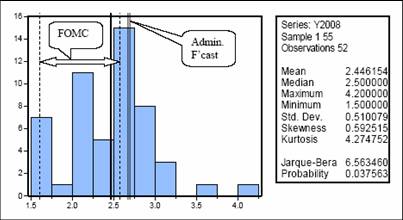

The Administration’s forecast is about 0.5 standard deviations above the mean forecast from the WSJ. Using a Normal distribution, this implies about 30% of the forecasts are above the Administration’s forecast; however, the tails are a bit fat on the distribution, so a t-distribution might be more appropriate. Using the t implies about 40%.

Figure 1: Histogram of WSJ forecasts, with mean (solid line), FOMC forecast range (between dashed lines, arrow) and Administration forecast (double line). Source: WSJ, Administration forecast, FOMC forecast and author’s calculations.

On the other hand, as highlighted by the question, the Administration’s forecast of 2.7% is definitely above the 1.6-2.6 range cited in the FOMC minutes of October 30-31.

I like the straight faced reply: ~”2.7 is close to the Fed’s prediction, within 1.5%…really means 1.2% to 4.2% , but in case that doesn’t satisfy you knit-pickers, it’s the result of 400 variables and we just can’t say *it’s a wide range* after all that heavy duty (dart throwing) computation.”

Does anyone take Lazear seriously…making industry or business decisions on the basis of these reports? Am I getting cynical in my old age to think these are just empty poorly attended pronouncements –exercises in public speaking for those occasions when there is more at stake than bolstering public confidence?

No less cynical than saying the emperor was naked. I think cynicism, while regrettable, is the only possible outlook after getting bad information over many years about nearly everything. (Geez, that’s REALLY cynical!)

You B right Footwedge (so you can go faster forward?)[wedge wrong way? so you can stop on a dime?], the mere asking of the question “Am I being too cynical?” unravels it — real cynicism would declare it with no possibility of listening for some redirection.

Even declaring itself sounds too hopeful for cynicism…any self identification by cynicism seems like a cry for help (not a call to party), and hence a sign of hope.

“cynical”, a 2nd or 3rd person (you/them) weapon used to marshal compliance for the consensus.

I think its politics at its worst. This is because how the economy is doing and the presidents approval rating are so closely related, so when Lazear projects a higher growth then the presidents approval rating might rise. When President Bush is at such a low rating they are clawing for any increase in rating that they can get. They are now in saving face mode instead of getting actual things accomplished. With the housing market slumping at its current rate it should finish the president’s term just as low which would leave another blemish on his already tarnished legacy.

I agree with you Jolly Green. The presidents rating and the economy is moving in the same direction. Now that they are in saving face mode, we probably will see no further progress or development. However, I look for the president and his campaign to come up with something to go out with a bang simply to increase his popularity or trust from the people, although it might be too late. The damage has already been done.

True AutryG, enough said. How will we recover from the damage??????????

I agree with what AutryG said that they do have to recover to save face. The answer to how is simply they need to turn around the economy. HOW they do that is another story… They need to raise GDP and increase employment. Also they need to increase consumer confidence which would bolster the eceonomy going into the Christmas season. With his presedential term ending in just over a year a bolster in christmas spending might make the economy jump, something it badly needs in the face of a downfall headed by the housing market.

This is the White House’s updated forecast. The “optimistic” 2.7% predicted growth of GDP in the next year is actually a marked decrease from their first numbers. The White House’s old projection called for a stronger, 3.1 percent increase. Lazear states that “the housing market decline has been more significant that we expected,” was the major reason for curbing their enthusiasm.

Well Jollygreen, you are quite the pessimist. This summer’s numbers shocked everyone when released and then shocked everyone again when their revised numbers were even higher. There is some reason for optimism and pessimism. Lazear expects the drag from housing on the economy to continue through the first half of 2008. Others expect a much longer drag on the future economy. The main question is how much will the housing slump and credit crunch reduce the growth brought about by the boom in exports and the back-to-back Fed rate cuts?

The Administration’s forecasts, formulated by the Troika of CEA, OMB and Treasury, has been in the past the product of the professional civil service employees (as opposed to political appointees). There may be very good reasons why the staff of these three agencies have a somewhat more optimistic view of growth than the Fed staff and the staffs of the Federal Reserve Banks.

I also note that in Orszag’s new CBO blog, a survey of other forecasts is provided here. Macroeconomic Advisers and NABE bracket the Administration’s forecast for 2008, at 2.8% and 2.6% respectively.