There was also some interesting action on the Intrade betting exchange this week.

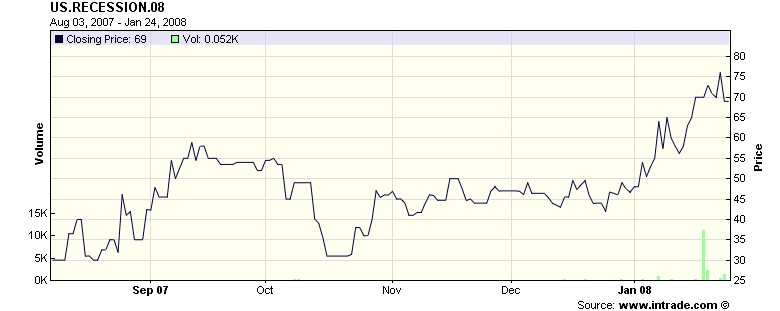

The Intrade recession contract pays $10 if the U.S. goes into recession during 2008, defined as two consecutive quarters of negative real GDP growth. The price (quoted as a multiple of 100) has been edging up as the unfavorable economic indicators have been coming in this month.

|

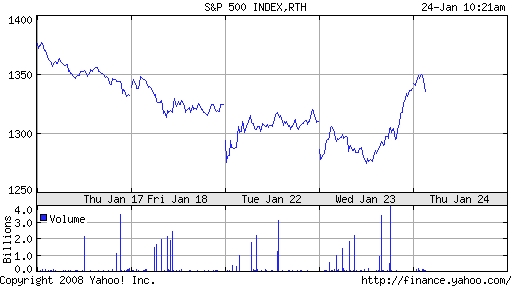

Arindrajit Dube (via Mark Thoma) notes an interesting detail of the action this week– the Intrade recession contract spiked up on Monday as the global stock market decline began, consistent with my suggestion that these equity price changes signal a turn for the worse, both in the U.S. and abroad. Equally dramatic was the sharp drop in the implied recession probability on the news of the Fed’s surprise move.

|

Which puts us back where we left off last week, with a 2008 recession a 70% probability, according to Intrade bettors. Interestingly, the U.S. stock market also seems to be calling it a wash– bad news on the economy, offset by the positive response from the Fed.

|

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

subprime,

Bernanke,

recession

Forecasting a recession is hard because so much depends on what is done to counteract recessionary tendencies on the front end. If nothing was done in the 1st qtr the U.S. would certainly have a recession. But understand that GDP is derived from money times velocity (aggregate demand). Both can be changed in the near-term.

Sorry, but I just can’t take it anymore. “Negative real growth?” Blah, blah, blah.

Can we please call a spade a spade? Can we please speak like real people and not weasels? (Apology to fans of the actual furry creatures.) Contraction. Falling output. Falling demand. Do we really need to call this thing a negative-positive, when just a simple negative will do? It’s almost as if one is required to sugar-coat.

How about this? When things turn around, we all call it a negative recession? “There was a negative drop in real output of 3.2% (annualized) in Q3, to the highest level on record.” That would make sense, right?

Sorry, but I just can’t take it anymore. “Negative real growth?” Blah, blah, blah.

Can we please call a spade a spade?

That’s not a euphemism, thats just how we talk in general. Its actually more natural for people working with the data because when you calculate the growth during a recession period your answer turns out to be negative.

Given strong Q3 GDP growth and probable modest Q4 GDP growth, can JDH ever recall such a deceleration? From 4.0% + to 0% or less in 2 quarters?

My guess is that something happened to consumer confidence that is causing a sharp drop in consumption.

If it is the consumer, wouldn’t we expect a worst recession than in 2001 and 1990 as consumer is 70% of the economy? Or is that consumption spending is less volatile than investment spending (the cause of the slowdown) and/or has a smaller multiplier?

Thanks.

http://www.reuters.com/article/bondsNews/idUSN2424420320080124

Coming back to that issue of equity prices and using them as a useful aggregator of private and public information about near-term prospects for economic growth, this seems to blow that thesis out of the water.

Also see http://bigpicture.typepad.com/comments/2008/01/feds-folly-fool.html

Fed’s Folly: Fooled by Flawed Futures?

Thursday, January 24, 2008 | 10:15 AM

in Derivatives | Federal Reserve | Trading

Was it a misunderstanding of their mandate, inexperience, or just plain hubris?

Regardless, it took only 2 days to learn just how ill-considered the Fed’s emergency market rescue plan was: To wit, a fraudulent series of losses led to a major European bank unwinding a huge trade: Societe Generale Reports EU4.9 Billion Trading Loss.

SG’s $7.1Billion dollar unwinding led to panicked futures selling on Monday and Tuesday.

Hence, we quickly learn what sheer folly and utter irresponsibility it is for the Fed to use its limited ammunition to intervene in equity prices. Their panicky rate cute were not to insure the smooth functioning of the markets, but rather, to guarantee prices.

Here is Globe and Mail’s report of the event. It does make Fed look rather silly — it couldn’t even afford to wait just one week or at least the end of the day.

“U.S. borrowers, give thanks to an unlikely hero: Jerome Kerviel.

As you revel in the lower interest charges on your line of credit

following Tuesday’s big Fed rate cut, think of how one brave Frenchman

came to your rescue, slashing the vig on that new 52-inch flat screen

to something a little more manageable (though you’ll have to find a

new place to hang it post foreclosure).

Mr. Kerviel, of course, is the Societe Generale trader who managed to

get offside to the tune of $7.1-billion (U.S.) on equity futures

thanks to a wrong-way bet that stocks would rise. SocGen ended up

unwinding all the misbegotten trades on Monday, putting immense

pressure on the futures market, and no doubt contributing in a big way

to Monday’s slump in world stock markets.

The chain reaction looks something like this. Traders see the plunge

in futures amid massive and mysterious selling, and even though the

U.S. markets are closed for Martin Luther King Day, they start selling

everything else.

The sell orders in an illiquid market cause shocks. The TSX falls 600

points and other markets around the globe swoon. Things look even

worse for Tuesday’s U.S. market opening.

To head off the worst of the disaster, Ben Bernanke steps into the

breach with a 75 basis point rate cut Tuesday morning.

Et voila, Jerome Kerviel is a friend of overstretched borrowers all

across the U.S. of A.

Maybe this will finally make people forget about Freedom Fries.”

http://www.theglobeandmail.com/blogs/streetwise

If you take the Intrade numbers seriously, it really makes you wonder about the Fed’s reaction. It is hard to see why a 6% rise in recession probability warrants a “3-step” emergency response.

Buiter’s comments about “buttock-clenching” monetary policy aside, you have to wonder what the Fed knows that we don’t on the financial side.

JD,

There are growing whispers that the Fed inherited this entire mess from Greenspan. Could you provide your thoughts on the subject.

JS, the primary tool available to monetary policy is setting the fed funds rate. I do believe this was allowed to get too low and stay there too long in 2003-2004 under Greenspan and that this has made a contribution to the current problems. However, I think a bigger factor was failure to recognize the need for more financial regulation and supervision. Many of the problems developed outside the existing regulatory authority of the Federal Reserve, so insofar as this is a criticism of Greenspan, I think it is one of a failure to exercise leadership in expanding the set of problems that the Federal Reserve worries about and tries to stay ahead of.

JDH,

Of course, poor regalatory oversight contributed to the housing bubble. I think its useful, though, to distinguish between cause and effect.

The cause of the housing bubble was the Fed’s grand experiment with deflation fighting.

The effect of the housing bubble was rising and non-volatile asset prices. The combination of the two made both lenders AND regulators more accepting of collateral-based lending. The theoretical support behind this lending was supplied by econometric models which showed relatively little correlation between default rates and FICO’s (within subprime), income documentation, debt-to-income levels, etc. These models relied on a data set that was primarily infuenced by the Fed’s 1% rate experiment.

The cause was the Fed. The effect was a lack of regulation. The enabler, the theoretical enabler, was the ubiquitous mis-use of econometric models.

I’ll bet the house on a US recession in 08.

Well, all that chart seems to show, is that a large portion of the people wasting their time ‘betting’ on economic statistics are 1) completely enraptured of the nanny-state Fed (but only for large corporations and stock gamblers), and 2) don’t even really believe in themselves.

In other words what that chart seems to show is that people believed there was going to be a recession until the Fed spoke up agreeing with them, at which point, they decided the fed cures all evils, and gave up on themselves. In still other words — their ‘bets’ are based on nothing but an emotional response to the very latest news, and this ‘betting market’ is largely composed of people who are also betting on the stock market, making the two strongly correlated, and hence effectively one data point.

I’m not quite sure why any of this is relevent to anything. If your point is to prove that stock pickers aren’t interested in facts then you have succeeded admirably. Otherwise, like most betting markets, the whole thing consists entirely of people’s opinions in an entirely fact-free discussion. This is supposed to be some kind of super-duper answer to all questions. it’s routine failings don’t matter — those are facts.

Regarding Jim’s remark on financial regulation there was a column in WaPo yesterday pointing to the role of a decision made in 2003 by the usually overlooked Office of the Comptroller of the Currency. Apparently several states, including Georgia, New York, and New Jersey, were moving to limit subrprime mortgages in various ways. Major nationwide banks ran to the OCC and complained, and it issued a ruling that effectively forbade the states to do any such regulating. One does not know what would have happened if it had not made that ruling, but presumably fewer of those mortgages would have been made (New York is a big market and the center of the US financial market), but probably there would have been fewer made, with less of a bubble and not as severe a set of problems facing us today.

I think John Mauldin poses a good argument in his latest e-letter regarding the surprise rate cut:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

…and that is just the credit default swaps (CDSs) from the monolines. What about the trillions that are guaranteed by banks and hedge funds? There are a total of $45 trillion CDSs outstanding.

No one is really sure who owes what and to whom, and what is the risk that there may be no one to pay that CDS when it comes due? The entire mess is going to have to be unwound in the coming quarters. It may take a year or more.

I think the concern that there is the potential for a much worse credit crisis than we are currently experiencing is what is driving the Fed. They are looking at the problem from the inside, and realize that they simply have to engineer a much steeper yield curve to allow the banks to make enough profits so that they might be able to grow their way out of the crisis over time.

If I am wrong and the Fed was responding to the stock market, then we will likely not see a cut this next week. But if we get another 50-basis-point cut, as I think we will, then it means the Fed is responding to concerns about the credit crisis. And we will get another cut the next meeting and the next until we get down to 2% or below.

A 50-basis-point cut takes the rate to 3%. It they had cut the rate by 1.25% next week, the market would have collapsed. Better to do it in two leaps is what I think they are thinking. We will see. And it is not just the Fed that is concerned.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The entire article can be found here:

http://www.safehaven.com/article-9320.htm

Professor Hamilton, will you be giving us your recession probability for 2007:Q3 and 2007:Q4?

trurl, I’ll be using today’s 2007:Q4 GDP numbers to calculate the recession probability for 2007:Q3 later today.