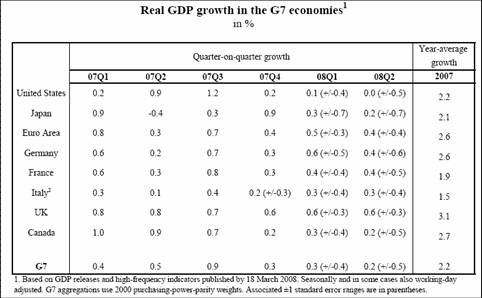

At the risk of losing my audience by skipping over the the record housing price decline, and an outsized drop in the consumer confidence index, I’m going to focus on what seems like old news (but is being reflected in current news on the dollar), namely the OECD reduction in growth forecasts for the G-7 economies. The euro area economy is slated to do better than the US economy in 2008H1, but that’s not saying much.

Note that the q/q growth rates are not annualized. From the report:

…short-term forecasting models taking on board the most recent dataflow, including the decline in payroll employment witnessed in the first two months of 2008, suggest that the US economy is now essentially moving sideways, if not contracting outright. It may be premature to declare a recession, but with the pace of activity so far below potential, economic slack is widening rapidly. In the euro area, the deceleration has been less abrupt but growth is set to remain on the low side of potential for some time, even though exports so far seem to hold up well in the face of euro appreciation. In Japan, quarterly national accounts are volatile and prone to large revisions, but overall the pace of underlying growth seems to be softening as well, notwithstanding the support from still buoyant neighbouring Asian economies.

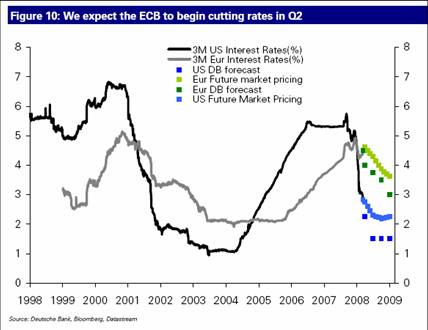

With the credit woes deeper in (but not restricted to) the United States, and growth slowing more rapidly in the latter, it’s no surprise that both forecasts and market based indicators suggest more rapid decreases in policy rates in the U.S. than in the euro area.

Figure 10 from Deutsche Bank, Exchange Rate Perspectives, March 20, 2008.

To the extent that a key determinant of the euro/dollar rate is the US-euro area interest differential, one should expect further weakness in the dollar (also noted in this post). Narrowing of the differential only begins in 2008H2. Whether this will be sufficient to overcome the negative effects of decreasing attractiveness of dollar denominated assets associated with their deteriorating default characteristics, or (potentially) the depegging of GCC currencies [1], [2] remains to be seen.

Technorati Tags: euro,

dollar,

OECD, exchange rates,

interest rates.

What people are failing to realize right now is that really all that’s happened over the last year is a) a fall in home prices, and b) a credit crisis of confidence.

But lurking beyond these current headline-grabbing issues is a truly very difficult US economic situation where, despite Fed bailouts of investment bank shares, nothing has really changed. Real wages continue to stagnate, energy prices are high, debt levels are at records, credit’s drying up in every corner, the savings rate close to zero. Worse still, as Brad Setser has so aptly documented, our foreign creditors are sensibly rethinking financing our current account deficit in perpetuity, which situation currently is holding long-term interest rates low and the dollar within some decent range. If these trends reverse, this credit crisis will seem like a drop in the bucket, as its effects on the real economy have been relatively small.

But the headwinds facing the real economy have NOT gone away.

And if “our foreign creditors” could simply abruptly stop “financing our current account deficit” (which is the sort of bizarrely misleading language to describe the financing of the current account deficit, as though the situation were little different than that between me and the bank that holds my mortgage), Setser and other long-howling wolves (“Any minute now – doom! It could be annnny minute now. Waaait for it. Waaaaait for it. Aaaany minute now. Maybe in a minute. Waaaait. Annny minute now ….”) I’d be a lot more worried.

The actual impact would be a process of painful but ultimately in the medium-term beneficial rebalancing to the benefit of everyone, not the least of which would be – again, in the medium and beyond term – the United States. Unfortunately, all anyone ever seems to be interested in is describing the edge of the world. “Here there be dragons” draws a lot more faithful blog-following, web hits and generally looking-to. I never cease to be amazed at how many years (nearly or perhaps over a decade now) that the same voices have been looking as far into the future as possible to determine the edge of the cliff, but with little apparent interest in the valley that lies beyond.

@Michael

Larry Kudlow – it’s great to see you back on the blogs.

But since the level of your economic analysis seems to be don’t worry, in the medium term and ‘beyond term’ (not sure when that is exactly), it’ll be “beneficial” (without detail or support or explanation), I think most uf us know where such vapidly-devoid-of-analysis-comments should be filed.

I will note that one difference (I’m sure you see it as trivial) between your mortgage and US Treasury debt is that I assume you personally can’t print money to pay your debt?

I’m sure you can’t understand the implications of this, so I won’t belabor the point, but I assume you’ll concede the technical point?

in response to the first comment, I don’t believe the question is one of “if” (in response to long-term rates being sufficient to attract creditors) but rather “when” long rates will increase in response to long-yeilds being insufficient to attract foreign bidders. It will be interesting to see how those foreign entities which peg to the USD will respond in their American government securities bidding in response to inflation.

When I first became interested in capital markets my problem was one of where to collect information; i didn’t have my primary sources mapped out. here is a link that provides breakdowns of auction results. enjoy

http://www.treasurydirect.gov/instit/annceresult/auctdata/auctdata_stat.htm

Also, here is another link with on topic talk

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2008/03/17/ccview117.xml

Menzie- you couldn’t lose us if you tried. great blog. always current even when i disagree. if we didn’t think we were learning here we’d all be calling in to fox news!

always remember if the European investors only wants to invest 1 billion euros in the US but the US needs 1.1 billion dollars in financing, a 10% drop in the dollar will turn that 1 billion euros into 1.1 billion dollars.

At some point, currency speculators have got to start worrying about whether it is wise to get that 2% higher euro return, when the euro is overvalued by more than ten times that amount. Some Japanese housewives learned that lesson the hard way about the yen carry trade. Maybe they can apply their experience to make money trading the dollar against the euro. The right time to make the trades would be when they hear market touts and ‘experts’ predicting something like $2 per euro, or when they see foreign central banks jumping out of the dollar.

Menzie,

This is much more important than housing prices and consumer confidence. We are slowly but surely losing our international dominance. Granted we have a long way to go but unless congress wakes up and stops attacking US businesses we will continue to slip.

Asia is actually learning about market forces. If they continue to liberalize and we continue to debase the dollar this shift will be sooner than most think and will catch a lot of people by surprise.

It should be a wakeup call when all of the G7 except France and Italy, the most socialist, are growing faster than the US.

One of the most frightening things I have seen is how many in congress believe that Fascist economics is actually market economics.

Menzie, I think what is hanging over the currency markets is the sense that the US is on the verge of hostilities with Iran. I get the sense that not many Americans understand how grave a step this would be.

In addition to the obvious points that it would create an oil shortage and increase the US deficit at a time when there is great financial unease, there are wider ramifications. Other nations, including Russia, India, and China, as well as the nations of Europe have strategic national interests at stake. While none are likely to enter the war directly, those nations might well strengthen their ties at our expense. It’s likely the US would end up isolated and without influence. It’s also likely that external financing of the US debt would cease.

It’s also likely that every place with a grievance against the US would choose that moment of American overstretch to create facts on the ground. China has long wanted to re-establish control over Taiwan, for example.

These are the kinds of things that economic modeling is not very good at.