Judging from some of the reactions across the blogosphere (not to mention any number of our own dear readers), maybe I should take another stab at clarifying why I see the hand of the Federal Reserve in the most recent movements in oil and commodity prices.

Let’s start with Free Exchange, who had this to say:

JAMES HAMILTON is an excellent economist and blogger [thank you kindly], but he’s confounded me today. In a post examining the roots of the recent surge in oil prices, Mr Hamilton displays a number of charts which seem to clearly indicate the extent to which petroleum production has stagnated– not just in recent months, but over the past few years– even as global demand growth has proceeded apace. He then goes on to note that this has practically nothing to do with increases in oil prices.

Then please permit me this opportunity to clarify. Stagnating oil production in the face of strong demand has everything to do with the broad run-up in oil prices since 2001, as we’ve been saying over and over from the very beginning of this blog. My claim that the Federal Reserve has now also started to contribute to the most recent oil price increases is very specific to what we’ve observed since January of this year, as I clarified when I first raised this issue February 28:

Although I have been skeptical of Jeff Frankel’s story that low interest rates were the primary cause of the broad movements in commodity prices over the last several years, it is very plausible to me as one explanation of what we’ve seen happen over the last two months.

And here’s what I said on March 28:

I have long argued that the broad increase in commodity prices over the last five years has primarily been driven by strong global demand. But I am equally persuaded that the phenomenal increase ([1],

[2]) in the price of virtually every storable commodity in January and February cannot be due to those same forces. This was a period when the economic news was getting bleaker by the day, eventually persuading many of us that a recession has likely started. To argue that January and February’s news instead signaled booming commodity demand strains credulity.

Paul Krugman, Lawrance Lux,

and two Angry Bears

are also skeptical of my claims. Some weeks back Paul noted that, if commodity speculation is playing a role in price moves, we should be seeing inventory accumulation. He appealed to a diagram such as the one below, which depicts the supply and demand curve in the absence of any inventory changes or speculation. Krugman noted that if speculation succeeded in driving the price above the fundamentals equilibrium price P0, it would produce a gap between supply and demand, and would have to show up as inventory accumulation.

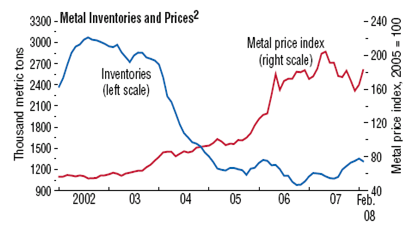

But where, Paul asked, is the current evidence of that inventory accumulation? On Sunday, he answered his own question with this graph of metals inventories:

|

But again, I agree with Paul and the others above that speculation was not the primary factor prior to January, and I draw the same conclusion they do from the historical graph. But in terms of interpreting the trends over the last few months, let me just note that the very short run supply and demand curves for most of these commodities are extremely steep– there is practically no way to bring more copper to the market over the next few weeks unless you are bringing it out of storage somewhere. And if those curves are extremely steep, the magnitude of the inventory change you’d expect would be quite small. Particularly since it could show up anywhere in the chain from production to consumption, I don’t think there’s a strong presumption you could find evidence of it in the available data.

No matter what your favorite explanation might be– whether speculation or fundamentals of supply or demand– any coherent theory says these shifts should show up somewhere in quantities produced, consumed, or stored. But given the very low short-run supply and demand elasticities and the quality of available data, hoping to find confirmation or refutation of that theory on the basis of the quantity data may be asking too much. I believe we have to rely on something else to persuade us. And the main thing that makes me doubt the demand-based story is the fact that the latest surge in commodity prices– that since January– came at a time when every indicator of which I’m aware pointed to slower rather than faster real economic growth.

The Free Exchange piece quoted above ends up with the following conclusion:

I predict that if the Fed did surprise by holding the rate steady, oil might crash–all the way back to $100 per barrel.

Again, that’s not so different from my own views. Except that I’d add that $100 a barrel would be a welcome development at the moment. If it’s within the Fed’s power to achieve that, the opportunity should be seized with enthusiasm.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

commodity prices,

interest rates,

inflation,

oil prices

Nice simple pictures. Even I can understand that. But if the curves are that steep, wouldn’t very small changes in supply and demand also explain price movement? I assume the only way to test your theory is if the Fed cooperates with your little experiment and shocks the speculators.

My sense of the Fed’s actions since January isn’t much different – we saw the break in order in the stock market at that time, which coincides with and was perhaps directly triggered by the breakdown of the mortgage lenders and financials.

I think the Fed was sufficiently scared by the potential for a widespread breakdown in the markets originating from these sectors spreading much more widely that they opted to unleash inflation as a means of insulating the bigger players from large scale failures – in essence, bailing them out by propping up the value of the real estate assets they hold by establishing a more stable equilibrium with other prices, not by letting real estate prices fall (which would result in several substantial large-scale failures) but by instead making everything else more expensive.

One other tidbit. There definitely is a slowdown at work, which is evident in looking at the volume of trade between the U.S. and China. U.S. exports have continued to grow at a strong pace, which you would expect from a weakening dollar. However, Chinese exports to the U.S. have slowed considerably. Through February, the year-over-year growth rate of trade is dropping to levels last seen during the 2001 recession. Given the lead times involved in producing and delivering goods from China to the U.S., we should be seeing prices of raw commodities dropping in a fashion consistent with this slowdown. That we’re not is perhaps another indicator that other forces are at work.

Ironman-

I’m confused… I do not understand why inflating costs in the rest of the economy should prop-up the value of real estate assets.

My viewpoint is that the FED and agencies have traded cash advances for degraded mortgage paper, increasing the money supply, thus future inflation in the process. Many banks are insolvent, but dance around their demise by not reporting their trading losses. The FED ignores the fiction to buy a little more time for the banks to recapitalize… More equity will allow a bank to declare its losses without entering bankruptcy.

Except that Chinese exports to the US in particular are being substituted by exports to the EU, now China’s largest market, and domestic demand, both of consumer and capital goods.

So it seems likely that even with a US slow down, they’ll be little let up in demand for raw materials, but it does seem reasonable to assume that the accelerated increase in prices of raw materials this year, is to do with the depreciation of the dollar and therefore, the decline in the unit of measure.

Inflation helps prop up troubled real estate assets in a couple of ways.

One is that mortgage debts are in nominal dollars. Falling nominal prices are what leads to defaults. Inflate everything else instead, and less homeowners are underwater. It’s an easy way to bail out borrowers; they now get to pay back their loans in cheaper dollars.

But normally this is not something banks would want. They’d prefer not to get paid back in less valuable dollars. I suppose it’s preferable to not getting paid back at all. But still, it’s a pretty blunt instrument. Inflation would devalue all of the good mortgages as well as the bad. If banks’s bad loans are really so numerous that this would be worth the tradeoff, that’s a serious problem.

The other is that it could accelerate price adjustments in the housing market. One reason it takes a long time for the housing market to adjust is the usual stickiness of housing prices. Sellers tend to be very reluctant to sell at a nominal loss. If housing prices really need to fall 30% to stabilize, it could happen more quickly by everything else inflating 15% while nominal prices only fall 15%.

But I’m not convinced the Fed will choose an inflationary path. There has been little expansion of actual currency so far. They have instead added liquidity by loaning against some of these assets, loans which presumably will be paid back, and so in the long run shouldn’t be inflationary or devalue the dollar. But, if commodity price pressures are bad enough, they may have to chose at some point between allowing inflation or further strangling economic growth in order to defend the dollar.

Personally I find it an unpersuasive argument that wage inflation (required to devalue the nominal price of assets / existing mortgages) will take place in an consumer lead recession.

If anything wages will go down as all the newly unemployed compete for the (fewer) remaining jobs, and existing workers refrain from demanding wage increases for fearing ending up among the unemployed….

The general price level may go up, but as this will not matched by increases in wages, the result is a fall in purchasing power, i.e. falling living standards.

This Angrybear doesn’t see this is a financial cause v. a real cause conceding that both factors are at play. After all, demand curves can shift out during periods when supply curves shift in. Nice post James – and yes, you have been talking about real factors for a long time.

Jim,

In a previous post you noted Saudi oil production has fallen off significantly y/y. They still remain the world’s major supplier. Is it possible they are controlling the price by acting as a “swing” producer?

Londoncalling,

You are describing an export economy. The currency is weak causing higher domestic prices. Workers produce goods and sevices for export which means they are producing more than they are consuming. In other words living standards fall.

While I think there may be a speculative element in some commodities markets, I still need convincing that it is significant.

1. Why is this time different?

2. I don’t see how you can invest in costly goods, using costly leverage and not have a good chance of fairly quickly getting badly burned. Are these investors just naive?

markg

Re the Saudi’s, you still have to explain why they are doing this now, and didn’t do it before.

Mark S: I can’t answer much better than acerimusdux already has. The only thing I would emphasize is that in the current situation, the “benefits” of inflation lie in protecting the solvency of lenders and institutional debt-holders who, given the scope of the matter, are the most at-risk of being taken down through defaults, which would at the present time cause even greater damage to the economy than higher inflation.

At some point, the Fed will determine that they’ve pulled enough of these distressed firms to safety through their policy and will resume focusing on combating inflation. Inflation just isn’t something they can afford to just let go – it’s certainly not a path they would choose to be on for an extended period of time.

“But if the curves are that steep, wouldn’t very small changes in supply and demand also explain price movement?”

Absolutely right, Joseph. That’s my point– it’s hard to look for confirmation of your story, whatever it might be, using quantities. It’s also the reason why commodity prices are so volatile.

MarkS,

The Fed has been draining reserves through bill sales to offset the increase in reserves through liquidity operations. Fed liquidity operations have not, in themselves, led to money growth faster than is normal.

Great post.

I’d like to add one important observation, though.

When supply curves are that steep (and IMO they’re non-linear and steepen with increasing quantity), very small increases in real demand produce large increases in price. Even if it’s factually correct that ” . . . the latest surge in commodity prices– that since January– came at a time when every indicator of which I’m aware pointed to slower rather than faster real economic growth”, if growth in demand is still POSITIVE, and I believe that global demand has been growing for all storable commodities since January, AND the supply curve in the short and long run has a steep slope and the steepness of the slope increases with rising quantity, then that’s as good or better an explanation than negative real interest rates.

But in the world we live in what should Ben do? Well, follow the professor’s advice and do zero rather than 25 bps. Of course.

http://money.cnn.com/2008/04/23/news/newsmakers/bernanke.commodities.fortune/index.htm?postversion=2008042310

Anarchus. I certainly hope they take Jim’s advice and we find out. I think those curves are non linear also. I think most are at least in the short run.

Ironman. A tough act. I hope he doesn’t lose credibility as an inflation fighter. That would not be good. I think there is a danger of being overoptimistic in their influence abilities and a corresponding avoidance of the bad medicine when it must be swallowed.

I think the Fed should not try to offset or minimize bad fiscal or regulatory policy. Popular opinion seems to have them controlling everything when, reality is much different. What are they going to do when the entitlement tsunami reaches shore and congress fails to address the issue with cuts? Inflate out of it?

The Commodity Conundrum Solved

The Hidden Parameter in

Interest Rates

The Shape of the Yield Curve as a First Order

Parameter of the Minerals’ Price Movements

Executive summary:

The commodities I am studying here are the one with

potentially very low storage cost.

Minerals when kept in the ground

have a storage cost next to zero.

Investors need of a

reliable, efficient, timely and precise index of the future evolution

of the price of minerals.

They need a mean to evaluate the

risk of a position in order to calibrate the size of

their exposure.

I observed a strong link between the

evolution of the market price of minerals and the shape of the yield

curve.

The slope of the yield curve indicates the preference of the Market between short-term assets and long-term assets.

When the yield curve is inverted, because of profit maximization, Miners and Drillers, as a group, prefer hoarding a higher proportion of their minerals in the ground (their preferred short-term assets) rather than extract them and invest the proceeds in long-term instruments.

Hence the marginal cost of extraction of minerals becomes irrelevant to their market price as miners stop maximizing their output under the constraint:

Market Price – Their Marginal Cost of Extraction > 0

Reminder: the Marginal Cost of Extraction does not include fixed cost (i.e. exploration cost, cost of an offshore platform…)

The quality of the

index, the slope of the yield curve, is superior to any other known

system.

It is Timely.

It is Accurate.

It Gives a

Measure of How Stable Is the Trend and How Safe is the Exposure.

The

Model of the Yield Curve is Proprietary.

Track Record: I post on my Blog, Independent Yield Curve Special Adviser, at the end of each week, the type of yield curve at the close (steep, normal or inverted) and the price movements of the components of my recommended portfolio over the last day of trading.

Request the Full Paper in HTML or PowerPoint Format by EMail

Shalom

Hamou

Independent Yield Curve Special Adviser

shalem.ashalem@gmail.com

Seeking

Alpha

For what it is worth, I have changed my mind about the prospects for oil prices. I think they may be headed for a higher equilibrium range, unless the U.S. slowdown extends to a global slowdown, and involves actual declines in global demand, not just slowing of growth. U.S. borrowing is unsustainable at current rates. When Ben responds to a U.S. slowdown by trying to maintain excess aggregate U.S. demand and when he shows little regard for inflation, he is signaling markets that global growth is unlikely to halt and giving heart to dollar commodity prices.

Oil has been subject to ‘backwardation’ historically, and this is the current state in the market (futures prices are lower than spot prices). It seems to me a good test of the importance of storage costs would be to look at their role in the past in determining backwardation/contango. Here is a rough history of oil futures that might be helpful if you know the history of real interest rates: 1997 – backwardation; 1998 – contango, 2000,2001 – backwardation; 2002 – contango; 2003 – backwardation. Uncertainty is important in determining storage strategies, and with markets tight, its role would seem naturally to rise. So I am unsure of your theory relating recent Fed actions, via effects on interest rates, to oil storage strategies. It seems to me that a test of other backwardation episodes could strenghten (or weaken) your argument.

Another brick in the wall of the “Free Lunch” thesis. Years of negative interest rates, a Fed that has proven it cannot stomach the business cycle, and a severely devalued currency — all of these are easily reversed, causing the oil price to “crash down”, by skipping a rate cut.

So easy, so costless really.

The reality, unfortunately, is that credibility is much harder to restore once frittered away. Just ask Paul Volker — he knows a thing or two about that subject.

Acerimusdux-

I follow your argument that inflating everything makes cheaper dollar payback easier for borrowers and toxic for banks. I also understand why inflation will clear real price levels faster. I would interject however, that privileged banks borrowing at 2.1 to 2.9% in the TAF and locking in arbitrage with treasury bonds at 3.75 to 4.5 percent yield amounts to a free subsidy.

Long ago, the FED chose the “inflationary path”. I would make the argument that “money creation” has for many years been more controlled by money-center/investment banks in their securitization schemes, than by the FED. It doesn’t take a rocket scientist to conclude that the 26.5% Dollar Index slide in the last 4.7 years represents 5.1%/yr inflation relative to other currencies in the index. To that, we can add a mean inflation rate deflator for the dollar index currencies of about 2% /yr to yield approximately 7%/yr real financial inflation in the US over this period.

Worldwide inflation will certainly increase for the foreseeable future as higher oil prices are factored through the rest of the world’s products. Limited high demand petroleum resources without sufficient substitutes will inevitably result in a rapid price rise.

Ironman-

I think that control of inflation will really come when government regulation forces over-the-counter derivative contracts into transparent public exchanges where counter party risks can be minimized, and the credit expansion market properly monitored and regulated. This will be a big deal, with the money-center/investment bankers squealing about loosing some of their juicy commissions and fees, (the value they strip out of each asset as it is repackaged).

In any case, higher US inflation relative to its trading partners is inevitable until the US current account balances. As Londoncalling suggests- falling living standards will be visiting America as general price levels outstrip wages.

One thought, just speculating (as it were)

Search for “wheat rice blight fungus” — there are known big problems out there moving around the world at more or less predictable rates, and the attempt to get new varieties of seed into the ground before the problem gets to that particular planting area is a major and critical one.

Makes me wonder if there are any stockpiles anywhere, or just shortages everywhere.

Talked with a professional yellowcake trader at a well-known and reputable company today about the uranium market.

His observation were that 1) new mines do take time to respond to demand and ramp production, 2) most yellowcake is under long-term contract so the spot market is thin, 3) the Chinese don’t know what they’re doing in this market – buying and selling at the same time, 4) hedge funds and other speculative money had been drawn by the “romance” or the prospect of suckers into playing with yellowcake.

So uranium is not a high volume commodity but it is a commodity. Maybe this story has applicability to others.

It really overweights the power of a quarter point rate cut, which most have already concluded will be the last. If markets strongly reacted to it, I would have to doubt their rationality. Now if the Fed announced it was raising rates to fight inflation at the expense of a recession, that would probably produce a reaction. If the increases were just in dollar terms, it might be more believable.

Rising oil prices increasing the costs of other commodities seems more consistent. The increases have been large and largely unidirectional. Since adaptation to these take many years, prices should continue to climb and remain volatile for a long time to come.

all what you’re suggesting is demand side argument that is pushing the commodities prices up. But what about supply side? is it possible that the more uncertainty in the market is inducing them to produce less?

The Fed, I think, cut too soon and too ambitiously. Now, when they should be strongly cutting, they may be getting cold feet. Had they dealt with the investment bank problems solely though liquidity means they would have allowed the psychology of slowdown to cause commodity price drops. Instead, they enabled the bubbly chasers to continue their game.

The commodities increases are strictly hoarding. If you have any other way to explain people buying multiple bags of rice in midwestern US Costco stores, I’d like to hear it.

Commodities got crushed today on the news (WSJ) that the FED is almost done with their easing cycle.

So Professor inflation just might be monetarily driven after all!

Probably better not to get deeply into a debate over one days’ price action, but the USD had a powerful snapback today:

FOREX-US dollar gains on economic data

Thursday, April 24, 2008 4:08:57 PM (GMT-04:00)

Provided by: Reuters News

“The U.S. dollar rose across the board on Thursday after U.S. government data showed resilience in the labor market, while a key measure of business sentiment in Germany plunged undermining the euro.

The euro’s fall followed a rally to a record $1.60 on Tuesday, the highest level since the euro’s inception in 1999, as investors bet the European Central Bank would raise interest rates to restrain inflation.

But ECB policy-makers’ comments on excess volatility in euro trading combined with weak economic growth data this week, triggered a sell off in the currency, analysts said.

“Now that we tried and failed to stay above $1.60 in euro/dollar, it looks like we’re coming back to the bottom,” said Brian Dolan, head of research at consultancy Forex.com, in Bedminster, New Jersey. “The U.S. data today is pretty clearly dollar positive and we’re coming off some weaker European data.”

The number of U.S. workers filing initial claims for unemployment benefits unexpectedly fell last week, the government said. For details, see ID:[nN23369389].

In Germany, a reading on business sentiment showed the biggest monthly fall since September 2001. The headline Ifo index fell to a much lower-than-expected 102.4 in April, its lowest since January 2006.

In late trading in New York, the euro was down 1.3 percent at $1.5676 , more than 3 cents below Tuesday’s record high and its lowest in at least two weeks . . . . . The Ifo, coupled with a slump in the euro zone manufacturing purchasing managers index to levels nearly implying an economic-contraction on Wednesday, suggested that the euro zone may not be immune to a U.S.-led economic slowdown.

The data poured cold water on expectations of an ECB interest rate rise this year, which had been fueled by recent comments ECB policy-makers. ECB President Jean-Claude Trichet said on Thursday that there is concern about the impact of currency fluctuations on financial stability.

The dollar was also up 1.0 percent as measured by the New York Board of Trade’s index of six major currencies at 72.535 at Wednesday’s close.”

In the very short run, I’m with Acerimusdux in believing that movements in the dollar have more impact on commodity prices than real interest rates . . . . though real interest rates have an impact on the dollar, so if we keep going very far with this we’ll end up gnawing on our tail, pretty soon.

You could also argue that inventories accumulated from price being above the market clearing level are just left in the ground. Failure to extract is basically costless storage in this case.

I interpret the events of the last few days as providing some evidence against a strong version of this theory. Going into the Fed meeting nobody was expecting a half point cut and there was something like a 20% weight on no cut. In fact they cut by a quarter point, issued a relatively dovish statement, and the result was a commodities sell off and a dollar rally. This fits with my theory that speculators are very important to what is going on but their actions are not directly linked to interest rates. In this case, reports of inventory builds in oil on Wed., Nat Gas on Thurs., and maybe the trader’s old friend “sell the news” were more important than the current Fed rate or its near term future prediction function.