The IMF released the World Economic Outlook‘s forecasts yesterday. There’s been plenty of coverage, so I won’t recap the main points, but rather focus in on some interesting aspects:

- The rapidity of the downshifting of estimates since January.

- Commodity price prospects and the LDCs.

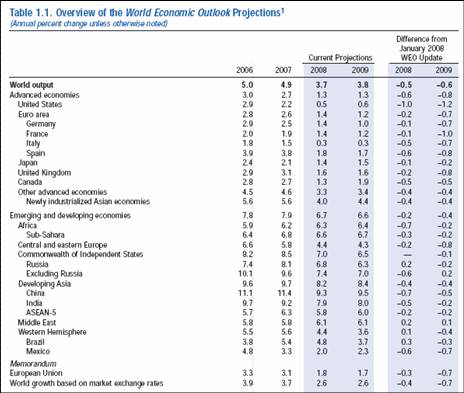

Here’s the key table, outlining growth prospects for 2008 and 2009:

Table 1.1 from IMF, World Economic Outlook, April 2008, Chapter 1.

My first observation is that there’s been a remarkable drop in projected growth rates in just a few months. Looking at the second column from the right, one sees that the 2008 forecast for year on year growth has dropped by a whole percentage point from the January forecast. This highlights the fact that growth prospects have deteriorated rapidly, in the views of many analysts, although perhaps not as much as represented by the IMF economists. For instance, the Economist‘s poll of forecasters only evidenced a 0.6 percentage point drop in 2008 growth forecasts, going from January to April (see this post). The WSJ poll exhibited a 0.8 percentage point decline in 2008 q4/q4 growth going from January to March (April numbers have not been released yet).

The second observation regarding this table pertains to the 2009 forecasts for the US. This forecast dropped 1.2 percentage points. This suggests the IMF is one of the first multilateral organizations I’m aware of that is predicting that the slowdown will be substantially more persistent than earlier thought (well, some people thought, and still think, a recession is avoidable). The Economist‘s poll shows only a slightly less pronounced downward revision — of 0.9 percentage points.

Third, note that the Euro Area lags the US in slowing down — but does slow down. Growth in the Euro Area is in fact projected to be 0.2 percentage points slower in 2009 than 2008.

I think the view that the slowdown will be more persistent than originally thought makes a lot of sense, given the deleveraging that is likely to take place as the financial sector takes hits to its assets. In that sense, the main thesis of the IMF GFSR (discussed in this post) and the macro outlook in the WEO are consistent.

On the second major area of concern, I think the IMF has it right that there is a chance that emerging markets will continue to grow even as the developed economies slow substantially. As they rightly point out, many of the vulnerabilities that made emerging markets sensitive to developed country shocks have been attenuated. Most importantly in my mind is the fact that emerging markets and less developed countries (including the oil exporters) have been exporting capital to the US, rather than being dependent upon US capital markets. In the past, increases in real interest rate in the run-up to recessions have induced reductions in emerging market asset prices and subsequent slowdowns (see this paper). So the mean forecast for the emerging markets make sense to me.

However, the IMF staff also warn of downside risks predominating. I think they are right to highlight these concerns. To my mind, the main downside for the LDCs is that the commodity prices do not rise in line with forecast, and perhaps even decline.

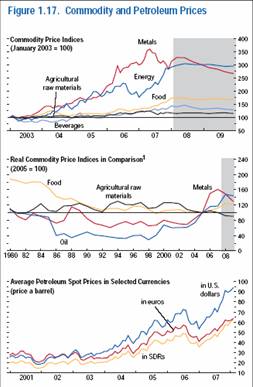

Figure 1.17 summarizes the IMF. projections for commodity prices, including oil prices.

Figure 1.17 from IMF, World Economic Outlook, April 2008, Chapter 1.

Just as prices for commodities have surprised on the upside over the past couple years (at least I’ve been surprised, but maybe I’ve been naive), they may surprise on the downside. Whether they do probably depends upon the source of the spurt in commodity prices. If they are due to loose monetary policy, as suggested by Frankel [1] (manifesting itself in negative real interest rates) and more recently by Jim [2], then high commodity prices should persist as policy becomes expansionary in the Euro Area and the UK (that’s my projection, not the IMF’s).

If commodity prices are high due to fundamental current demand, then — given the higly price inelastic nature of both commodity demand and supply — we might see big drops in prices as the recession takes hold in the US, and the slowdown propagates to the Euro Area and perhaps even to China (in the latter case, a slowdown would be single digit positive growth). (For the IMF’s comprehensive analysis of the origins of the commodity price surge, and the implications for the emerging markets and LDCs, see Chapter 5 of the WEO.)

A big hazard that I foresee, then, is the possibility that the commodity exporting country governments acclimate themselves to high revenues at exactly the time revenues decline.

Nice post, Professor.

Unfortunately, this is par for the course, revising numbers downward only as the bad news unfolds. The underlying fundamentals driving such — off-the-chart household debt to GDP; potential, now here, return of the risk premium; derivatives time bomb waiting to blow up, tamping down appetite for risk — have been there for view by all.

Kind of hilarious (scroll down to see the chart on actual vs. forecast earnings), how analysts revise their numbers only after the news unfolds:

http://bigpicture.typepad.com/comments/2008/04/how-cheap-are-s.html

Get ahead of the curve, folks: it is going to be an unprecedented disaster.

developing countries may not be dependant on our capital, but they are now dependant on our import consumption, no?

But look at China. Even the trolls at the IMF believe that China is going to maintain an almost 10% growth rate while the US will tickle zero. Doesn’t this cause some concern? The US overwhelmed Great Britain in 100 years because we had only a slightly higher growth rate. Consider a 9.4% growth rate compared to a .5% growth rate. It doesn’t take a rocket scientist to see something is wrong.

Ever since the Democrats took over congress the US growth rate has dropped like a rock. You couple that with inflation especially reflected in the oil price that has eaten nearly all of the postive effects of the Bill Thomas supply side tax cuts and it is easy to see. Our central government is leading us into a central planning nightmare from monetary policy to fiscal policy.

DickF-

The US overwhelmed Britain fundamentally because Britain over-extended itself militarily and culturally. The expense of Britains almost continuous military adventures from the Crimean war through WWI proved to be too high to service without economic collapse? WWII and the subsequent loss of its colonies proved to be the coup de grace.

I am mystified why you believe that supply-side tax cuts and Republican lack of US central economic planning are good things? From my perspective both were intended to maximize short term profits at the expense of future liabilities. (Mortgaging the future for current prosperity). The Reagan revolution was fundamentally a securitization revolution.

We have seen the BIS reported worldwide derivative market (notional value) expand from $100 to over $500 trillion in the last five years. This market is effectively creating money far faster than the worlds central banks, and for the most part without liquidity requirements. This is the real bubble! The reason the FED is no longer reports M3, (currently expanding at 17% annually), is because the FED no longer controls M3.

If we assume the historical average that 2% of commercial deals fail, we can extrapolate that there is a potential credit loss exposure of +$10 trillion on the derivative contracts now in force. I would expect most to shake out over the next four years as the business cycle goes through its ”creative destruction”.

The international banking and finance industries have becoming more like casinos than market places. Unacceptable long-term risks have been accepted for short-term commissions and underwriting fees. Eventually, there is no money left after the slicing and dicing is done. The paper at the end of the line becomes illiquid thus valueless.

Either we get organized enough as a society to regulate and control the securitization process, or we stand still and let the steamroller flatten the entire world economy. I have every faith that human avarice will trash everything of value without law and conscientious management to protect the innocent. You might like Greenspan, but I like Voelker.

I’m struck by the fact that the IMF commodity price index forecasts are so very smooth when the historical series are so very volatile. I’m guessing that this simply implies that their forecasting models for these series are not much better than random walks. Is anyone out there familiar with the historical performance of such commodity price index forecasting models (the IMF’s or others?) How much uncertainty should we associate with these forecasts?

DickF says, “Ever since the Democrats took over congress the US growth rate has dropped like a rock.”

This is one of the more incredible statements that has been made on this website.

The Democrats were given control because the US was so clearly on the wrong track. Deficits have been soaring ever since Bush took office. Wages have been stagnant. The dollar was tanking. Oil was soaring. Inflation was rising. The mortgage crisis was evident and Nouriel Roubini was getting bearish– all of this prior to January 2007.

Now, after 1 year and three months of Democratic control of one of three branches of government, it’s all their fault that things have not changed direction.

This is in the “clap your hands three times and fairies will appear” realm.

Here’s the bigger question. Does anyone take a marginally-employed wingnut like Dicky seriously on this blog? Dear God, I hope not.

When this country was consistently prosperous with wide-ranging growth in income and standards of living, it was when this country had more progressive taxes in the 1940s, 1950s and 1960s, and balznced budgets. Same thing happened in the mid-1990s, especially with huge increases of entrants in the workforce (and why the spin of 5.1% unemployment being low is a lie- it’s 5.8% by 2001 participation standards). Only when we overextend ourselves in military adventures and eviscerate the middle class have we seen the recent phenomenom of growth in GDP without growth in real median incomes.

As MarkS accurately points out, the supply-side thinking has led to a shift where shareholder value and stocks are more important than broad-based income and WORK. The result is that the vast majority of Americans see rewards for their work further out of reach, while a small percentage of others gets paid for all of their work.

It’s why consumer confidence is at its lowest level in several years now, and the economy isn’t coming out of this funk anytime soon until we recognize that fiscal responsibility, work and making products should be rewarded over the feudal mentality of supply-siders. A new president with half a financial brain, guts to make the tough choices, and little supply-side idiotology will go a long way toward this.

But the parallels between the decline of the USA today and the UK at the beginning of the twentieth century are striking.

Both were the old dogs being challenged by nimbler and more efficient rivals – in those days the USA and Germany, today – China and maybe the EU.

Both had failed wars where they were defeated by vastly inferior guerrilla armies – the UK the Boer War, the US Iraq.

I think this is a turning point. When you combine China’s growth rate with the appreication of its currency, then it’ll likely overtake Japan by 2009, and begin challenging the US in a serious way by around 2013.

And let’s not forget when the “belle epoque” ended. 1914.

JM – I wonder if it’s fair to decry supply side economics as the entire problem. I ‘m no expert but I wonder if supply side is more of a symptom than a problem. And I’m also not sure that it was the more progressive i.e. higher, tax regime that accounted for our prosperity. Maybe we just were so damn productive making stuff that we overcame them. I agree with your last paragraph though. Somewhere along the line America got off course on what we decided to be. The move to a so called service society was a conscious decision in the face of globalization rather it can or would work or not – it was the easy way out. The famed society based on credit and asset inflation versus wages. This was facilitated by essentially fiat money (sorry if I’m channeling a certain Texas Congressman) that made it possible for Americans to live in an island of delusion that in retrospect seems pretty obviously false. Never-ending budget and trade deficits along with a depreciating currency should be some kind of heads up, don?t you think? Add to that the world wide garrisons and a never-ending war ? does this remind you of any other country?

I am extremely disheartened at how far economic education has fallen from the clear reasoning of Adam Smith and the other giants of economics who debunked mercantilism long ago. They clearly demonstrated that no one has the omniscience necessary to centrally plan an economy and that the errors that come from central planning simply breed more central planning until economic control is total socialism or economic Fascism.

MarkS praises central planning and then rails against derivatives without understanding that derivatives exist because of central planning. Economic actors create instruments, deratives, to hedge against the wedges that central planners create with their government intervention. If the central planners stopped their destruction most deratives would disappear for lack of a market.

Just an aside, Mark gives me Greenspan and takes Volker for himself. Volker depreciated the dollar so that in 1980 it hit $850/oz of gold for the first time in history, then Volkers knee-jerk reaction against the falling dollar threw us into the recession of the early 1980s and the highest unemployment since the Great Depression. Greenspan gave us Black Monday in 1987, he gave us the deflation of the mid-1990s, and he created the current credit crisis right before he left office. Mark, you can have them both and I will even throw in Bernanke just for grins.

Charles obviously has not had much exposure to the US Constitution because he doesnt know that bills concerning money and spending must originate in the House of Representatives.

But speaking of unusually strange comments, consider JM attributing prosperity to progressive taxes.

The lack of understanding of classical economics and especially supply side is amazing and is the driver for the low economic growth rate in the US. I remember a Mad Magazine piece that illustrates this lack of understanding perfectly. Two children are sitting in front of the television and the announcer is saying, The sign of true intelligence is listening to the William Tell Overture without thinking of the Lone Ranger. So concentrate as you listen. Music flows from the TV and the children close their eyes and strain. In walks the old man in his t-shirt swinging a beer crying, Hi-yo Silver, away.

So if, when you hear supply side economics, you think of taxes you probably need to wash your t-shirt and slow down on the brew.

DickF: You can’t seriously be asserting that the only reason that derivatives (including plain vanilla types like forwards and futures) is because of the existence of governments, and the regulatory/spending/taxing decisions undertaken by governments.

I think you might also consider that, just like biological sciences have moved beyond Galen, the economic science has perhaps transcended Smith.

DickF says, “Charles obviously has not had much exposure to the US Constitution because he doesnt know that bills concerning money and spending must originate in the House of Representatives.”

DickF must get his Constitutional theory from Rush Limbaugh, since that’s the only Constitutional “thinker” who doesn’t understand that presidents propose and accept or veto budgets, and that both houses of Congress independently produce legislation that determines what budgets will be. The notion that the House writes budgets is laughable.

But I suppose no more laughable than the notion that a political party can travel backward in time to produce problems that were evident well before their election.

I predict that which no one seems to conceive: China will suffer more severely in the world-wide credit collapse (once it really gets going) than the US. Because of artificially low interest rates, pegging of the Yuan, political distribution of capital, & other politically engendered distortions, we will discover that they have misallocated resources on a massive scale. By the time the Yuan approaches a market value (at which time US 10yr Tres rates will have doubled), China will suffer tremendous unemployment & little growth.

Algernon, it’s not unusual for developing nations to experience greater economic extremes than developed economies. This is because developed economies tend to be larger (which statistically tends to level things out) and have countercyclical policies in place. Also, developing nations generally experience much higher interest rates, which can spike at the first sign of trouble.

However, in the present case, China has substantial reserves. They could afford to put everyone on holiday for six months. More realistically, that means that they have the surpluses to run a much stronger countercyclical policy than they have normally. Whether they will do that is unknown.

By contrast, the United States is very susceptible to interest rate shocks. As Paul Krugman and others have noted, the TED spread indicates that the credit market could seize up. So, the US economy is behaving more like what one expects from a developing economy. And in this case, the inertia of the economy is potentially a very bad thing: if things fall apart, it could take a very, very long time to put them back together.

The US has a managed economy, but it is managed by very large corporations rather than by the government. Hence the bailout for Bear but not for homeowners who may well have been defrauded in the mortgage crisis. Hence the very peculiar corporate state journalism that managed to miss the signs of the mortgage crisis even as it was blindingly obvious to economists like Nouriel Roubini.

China’s economy suffers many distortions. But our economy suffers many of the deficiencies of central planning without the benefits of sensible regulation and government oversight.

This case is somewhat like the two men who are attacked by a bear. One of them starts running. The other says, “You can’t outrun the bear.” The first says, “I don’t have to outrun the bear. I just have to outrun you.”

Menzie wrote:

DickF: You can’t seriously be asserting that the only reason that derivatives (including plain vanilla types like forwards and futures) is because of the existence of governments, and the regulatory/spending/taxing decisions undertaken by governments.

Menzie,

There are many reasons that the market hedges, farmers use futures to lock in profits for example, so no, I am not saying that is the only reason, but I am saying that the massive increase in hedges in the market have been caused primarily by government intervention.

I think you might also consider that, just like biological sciences have moved beyond Galen, the economic science has perhaps transcended Smith.

Our transcending Adam Smith gave us the Great Depression among economic problems. Today it is giving the US a growth rate lower than the world average. Those countries who are turning back to basics are like those schools who turned from the “new math” and began to actually use common sense again. If transcending Smith brings mercantilism then it is actually regressing rather than transcending.

Just for the record Keynes was proud that he was returning to mercantilism.