I’ve been offering reasons for believing that the flow of funds into commodity investing has contributed to the recent oil price highs. Although I believe this speculation has gotten ahead of fundamentals in the last few months, there is no question in my mind that market fundamentals are the main reason for the broader 5-year move up in oil prices. Here I review those fundamental factors.

|

The developed economies consume a disproportionate share of the world’s energy, with North America and Europe accounting for about half of the total oil use in 2006. However, it is the newly industrialized countries and oil producers that account for the recent rapid growth in demand, with Asia and the Middle East accounting for 60% of the increase in petroleum use between 2003 and 2006. North America and Europe contributed only 1/5 of the growth.

|

Particularly dramatic in this growth has been China, whose petroleum consumption between 1990 and 2006 increased at a 7.2% annual compound rate. It’s always amusing to project these impressive exponential growth rates. If that rate of growth were to continue, China would be using 20 million barrels a day by 2020, about as much as the U.S. is today. By 2030, China would be up to 40 mb/d, twice the current U.S. consumption.

|

Are such projections plausible from the point of view of potential demand? During 2006, China used about 2 barrels of oil per person. For comparison, Mexico used 6.6– Chinese oil consumption could triple and they’d still be using less per person than Mexico is today. The U.S. used almost 25 barrels per person. According to the data collected for a new research paper by Max Auffhammer and Richard Carson, there were 3.3 passenger vehicles per 100 Chinese residents in 2006, compared with 77 in the United States. Yes, I would say that these astonishing numbers for potential future Chinese oil demand are not at all inconceivable.

|

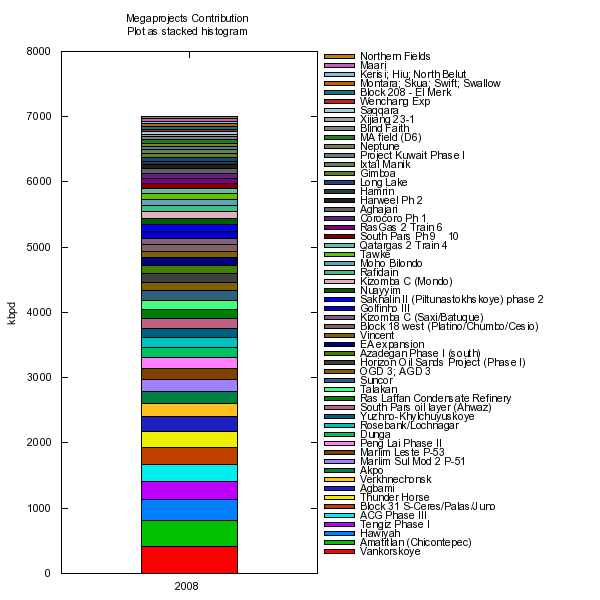

Are such projections plausible from the point of view of potential supply? Not remotely. I do think there are prospects for a significant boost to world petroleum production this year, thanks to a number of big new projects scheduled to begin production. The Wikipedia database reports 7 mb/d in eventual gross new production capacity eventually expected from projects that are supposed to begin producing during the current calendar year. Before you get too excited about that number, however, several cautions are in order. First, 7 mb/d refers to the eventual peak production, not the amount that can be produced this year. Second, there is inevitably some slippage and delays. For example, the list includes 250,000 b/d from Thunder Horse, BP’s Gulf of Mexico project that was initially hoped to start giving us oil in 2005, but is still undergoing repair work. Third, the above tabulation refers to gross new capacity, much of which is needed to replace declining production currently being observed in the world’s mature producing fields. At any point in time, some of the world’s producing fields are well into decline, some are at plateau production, and others are on the way up. It is not clear what average decline rate is appropriate to apply to aggregate global production, but a plausible ballpark number might be 4%. That would mean that in the absence of new projects, global production would decline by 3.4 mb/d each year. To put it another way, a new producing area equivalent to current annual production from Iran (OPEC’s second biggest producer) needs to be brought on line every year just to keep global production from falling. Of the 7mb/d in gross new capacity from the projects tabulated above, projects in Saudi Arabia, Russia, and Mexico account for about a third of this gross increase. Data currently available for the first two months of 2008 show actual production in Saudi Arabia down 350,000 b/d from its average 2005 value, though the latest news suggests that Saudi production may be close to returning to 2005 levels. Mexican production is currently down 400,000 b/d from 2005, and Russian production is down 100,000 b/d from its average level in the second half of 2007.

To summarize, I think we will see some net production gains this year, and expect this to bring some relief for oil prices. But I cannot imagine that the projected path for China above will ever become a reality. Oil prices have to rise to whatever value it takes to prevent that from happening.

So yes, I do believe that speculation has played a role in the oil price increases, particularly what we’ve observed the last few months. But it’s a big mistake to conclude that speculation is the most important part of the longer run trend we’ve been seeing.

Technorati Tags: oil,

oil prices,

China

Saudi Arabia,

Mexico,

oil bubble,

oil price bubble,

oil speculation,

oil supplies,

oil demand

“Although I believe this speculation has gotten ahead of fundamentals in the last few months..”

Any reason for this belief? Your article doesn’t seem to support this it, as you clearly show that the long term fundamentals indicate a structural shortage of supply, which implies higher prices to keep the spot market in balance.

Any calculation of how much higher is extraordinarily difficult, faced with that, I don’t have strong beliefs.

Maybe you can point at something to read to help resolve a disconnect?

1) Can I interpret your post as meaning that, although there are jiggles from speculation, one can expect a long term real price trend upwards for oil?

2) Assuming that’s the case, can you recommend good papers about effects expected on US GDP from something like a multi-decades long oil shock (as opposed to the usual oil shocks)? [I used to spend lots of time with petroleum geologists, and nothing I heard makes me disbelieve Peak Oil.]

3) The reason I ask is : in studying economics of climate change mitigation, i.e., like Nicholas Stern’s “The Economics of Climate Change”, I see an assumption of indefinite 2.5% CAGR in world GDP (page 183), and this seems fairly typical.

A similar analysis is found at MIT

and specifically, in the Reference Case (no climate mitigation), page 2 of MIT Appendix page 2.

It shows, from 2005 to 2050 (if my spreadsheet is right):

2.9% CAGR US GDP

1.4% CAGR Total Petroleum Energy [from 42 EJ to 79 EJ, which seems to say we’ll use almost 2X more oil]

1.8% CAGR Petroleum Price increase (!), i.e., oil price in 2050 is only 2.25X that of 2005.

4) Climate change economics studies seem to assume a 2-3% GDP CAGR for another 100 years, irrespective of any effects from Peak Oil & Gas, and of course, serious policy arguments seem to be using this assumption.

Do economists in general believe either that Peak Oil+Gas doesn’t happen, or if it does, it doesn’t matter? I know a few who think it matters (i.e., like Bob Ayres & Benjamin Warr, or Charlie Hall), but they seem to be a small minority.

Anyway, any thoughts or pointers would be most welcome.

Some commentary on your post you may find of interest.

I believe that a decline in the value of the dollar is a better explanation for the rise in oil prices in the past 8 years as opposed to supply/demand fundamentals. All commodity prices have increased in the past 8 years, not just oil. If you look at the price of gold, it has followed the price increase of oil during this time in percentage terms (although in the last few months, oil has gotten ahead of gold). The fact that gold and oil have moved together fits better with an inflation explanation rather than an oil market fundamental explanation.

JDH, thanks for setting me straight in the comments on your earlier post on futures speculation driving up the spot price in the oil market. Even after I re-read it and understood what you were saying, it took me a while to conclude that you’re probably right. I still can’t tell exactly how much of that is going on, as it seems to me that the “ratification” of higher prices through actual production and consumption levels is not just something that will happen some day in the future, it ought to be a continuously growing pressure as speculative demand increases. With world oil inventories generally declining (or so I hear, most recently from Boone Pickens who ought to know more about it than I do), and prices once again even stronger than usual on nymex as the front month went into expiration (although it does not account for any great fraction of the physical oil traded in the world), it seems a bit complicated.

As I saw mentioned again today while lurking at The Oil Drum, the increase in production I can optimistically agree we might see this year does not necessarily mean an increase in net exports. With oil and product prices in many exporting countries having very little to do with global market prices, this could continue to be important.

The notion that speculation adds to price increases makes sense. If we look at the increase in outstanding contracts in the past few years, there has been a clear increase outstanding commodity derivatives relative to the underlying cash market. An increase in commodities held in investor portfoios means opening new net long positions, and that reasonably would put upward pressure on futures prices.

But saying that speculation adds to the rise in commodity prices means that commodity prices are likely to fall below their fundamental value once the portfolio shift toward commodities is complete. Uh Oh. One more opportunity for a bubble (however small) to result in lost wealth to retail investors.

I recall reading an article in 2006 that stated Goldman Sachs adjusted its basket of commodities for pension funds giving oil a smaller weighting. The price of oil dropped about 10% after the rebalancing. This, along with the argument made by Prof. Hamilton, leads me to believe that speculation is contributing to (but not causing) the price increase.

The Grandstand Is Open

Executives from five major oil companies–BP America, Shell, Chevron, ConocoPhillips and ExxonMobil–will testify today at a hearing of the Senate Judiciary Committee. If past, similar exercises are any indication, dont expect much substance. In fact,

Thanks James for your analysis on oil. You might find this article fit in your analysis well:

Michael Masters’ Testimony on the speculation in commodities:

http://hsgac.senate.gov/public/_files/052008Masters.pdf

all that good for starters but i personally doubt that producers have real incentives to pump out more oil just to benefit from the high prices. they are saturated with dollars and rather cut production than produce more to make more money of which they have more than they need…

If there is a lesson in economic history, that is that you can not project past trends into infinity. And that’s basicly it for oil. The prices are now substantialy above 1980 peak. To remind you, those prices in 1980 caused severe demand destruction – oil consumption have not picked up to 1980 level untill 1989.

Weak dollar argument is crap – dollar has been very weak in 1980 also, just look at the dollar index.

A valid argument is understated inflation.

The world still has huge oil consumption reduction ability. Just imagine what can happen to demand if an average US Joe switches from his SUV to efficient diesel engine, nevermind every alternative energy source.

Also, according to BP growth in world energy consumption in absolute terms has been decelerating since 2004. And China growth has been decelerating also.

In 2006 OECD have in fact lowered energy consumption – keep in mind that oil was at 66 dollars average price for 2006, not 132.

Even US, the most inefficient consumer from OECD has lowered oil consumption in 2006.

And this EM consumption idea is that EM will increase consumption at any price? Nonsence.

All saving effects come with a lag of several yeas, just like new upstream oil projects.

All this commodity speculation will run into a demand destruction wall may be already this year.

There have been many cases in the past where people thought they were looking at exponential curves, when in fact were looking at logistic ones. They look very similar in the first half.

this is far from a bubble:

http://www.peakoil.net

The capital that is being invested in commodity index futures has ZERO productive value. It doesn’t induce anybody to do anything…as we see from supply and demand for the last three years.

All index money does is drain liquidity…that’s right DRAIN liquidity (as Mike Masters points out). Speculators are normally OK b/c they provide liquidity…index speculators are robots that just need to “put money to work” at any price and they always buy. That sucks liquidity out and causes the market to “blue screen.”

Shut these things down, send whatever money is left back to investors. If you want to invest in commodities, go buy the land or invest in an oil company.

Heck, real-estate didn’t have a widely established futures market, and thank goodness… an etf on that would’ve exacerbated a ridiculous problem to begin with…by driving up prices and providing zero productive impetus…kinda like now.

btw…kharris, oil doesn’t have a “fundamental value.” If it does, its probably on par with water or air. That’s what everyone is missing.

Futrues ARE NOT EQUITIES NOR ARE THEY BONDS.

Commodities don’t have a finite intrinsic value…if you were to model the cash flows of it, your discount rate would be “0” b/c there are little or no substitutes…therefore your CF would be INF…futures are there as a price discovery mechanism. They are more along the lines of an option…options have no intrinsic value, aside from the spread between the strike price and spot price. That’s all you own if you’re in an index fund. You’re not investing in the infrastructure or the E&P of oil companies…you’re just long a bunch of spreads…that’s it. A waste of capital IMO.

Jeffery,

I do believe that inflation is a large component of the oil price, but oil and gold have not increased in the same ratio. the gold:oil ratio in the past was 10-12L1. Now it is around 7:1. I believe that this supports the professor’s case.

I do not believe that many of us believe that the Professor’s plot of China’s oil use is realistic (even JDH).

Over the past 30 years there has been a phenomenal increase in energy efficiency in the US and I expect that to continue. There will also be alternatives coming on line. This includes not only alternative fuels but alternative ways of using energy.

The US energy usage is so much higher than the rest of the world because our economy is so much stronger. We can afford it. As the rest of the world catches up, as our growth rate continues to fall, we will use relatively less and the rest of the world more.

But I have no fear of an energy crisis. The market prices energy sources and the consumer responds. If the environmentalists really want consumers to reduce their use of energy simply let the price rise. The government is actually dislocating the market price of oil by subsidizing oil production, bio-fuels, forced auto price increases due to unnecessary add-ons, controls, and regulations, factory emmissions, the list could go on and on.

But as long as the market is allowed to work, even with these dislocations, there will be no energy crisis. Nixon showed us how to create an energy crisis. I only hope we are wise enough to draw from his failure and understand how not to create one.

flipper wrote:

Weak dollar argument is crap – dollar has been very weak in 1980 also, just look at the dollar index.

Your history is off. All through the 1970s inflation roared and the price of oil climbed. In the 1980s inflation subsided and the price of oil dropped to where Texas has an “oil” depression in the late 1980s. In large part the price of oil was being driven by the value of the dollar.

You can also consider the stability of the dollar in the 1990s. Oil was relatively stable until the mid-1990s when the Greenspan deflation hit. The price of oil fell to almost production cost level and we are still suffering from the shut down of productive wells. The world got caught by a loss of oil producing infrastructure just as world demand took off. Had we been on a stable dollar, as good as gold, we would be in a much better condition now.

JDH,

I highly respect your views on this and maybe have been partially convinced that commodity price increases are, at least in part, speculation facilitated by lower interest rates.

But today we got at little bit of the experiment you were looking for: the Fed released its minutes and it was revealed that Board has turned hawkish and are likley to freeze rates. To markets this is very much akin to a surprise rate freeze or rate increase by the Fed. While I’m not at all surprised by the news, it seems clear that markets were surprised.

In response to that announcement we saw bond prices rise, the stock market fall, and (drumroll….) commodity prices rise.

Isn’t that opposite of your prediction?

As Engle alluded in the article you linked to the other day, it seems a little strange that prices keep rising, that the market’s expectations seem to have errors continually on the same (downward) side. After all, the basic fundamentals do seem rather predictable. So, if the story is mainly about fundamentals, why the steady progression of prices upward?

I offer the following guess: Neither economists nor markets have a good understanding of the fundamental supply and demand elasticities that give rise to the prices and quantities we observe. Instead, we all have to learn these slowly over time. Sorting out these elasticities is hard, since it can be hard to isolate exogenous and unexpected supply and demand shocks, as every good econometrian knows. It’s especially hard to figure out longer-run elasticities. So, while markets know supply is shifting out slower than demand, we don’t know by how much this will influence prices and quantities.

It looks to me like supply and demand are a lot more inelastic than markets had thought. We’re starting to see price response in U.S. consumption now (finally), but how much will we ultimately get? And how much of that price response is really just from the macro downturn rather than movement along a long-run demand curve? Supply response also seems inelastic.

Anyway, it seems to me that a model wherein we learn slowly about fundamentals it is possible that errors could be one-sided for awhile. But that’s just a hunch.

But I’m most curious about your view of today’s little experiment. Does it change your views about fundamentals vs. speculation?

By the way, I like your blog a lot.

Finally, some one else does the maths on oil

the price of oil will rise without limit until coal to oil and nuclear to hydrogen fills the gap. And right now, coal to oil projects are insignificant, and nuclear to hydrogen is not even on the drawing board. Therefore in the next decade or so, oil…

Why is it so difficult for investors to accept that the price of an investment can disconnect from its true value when a commodity is involved. It happens to stocks all the time.

Again, the term “speculation” is a loaded term. I am not sure what it means. If it means that people are hoarding oil in order to sell it later at a higher price, then where are they hoarding it? Why aren’t they reporting it to the EIA?

Today,(Wednesday) the EIA released its weekly petroleum status report and crude oil and gasoline stocks were DOWN. I don’t have a PhD in economics but what econ I do know would seem to point in the opposite direction, that gasoline and oil prices are too LOW, because consupmtion is exceeding supply.

I just don’t see any utility in throwing this “speculation” word around.

Eric, the difference with oil is that people don’t hold onto it like financial instruments or property.

How many people do you know that have oil containers in their back yard? People buy it as they need it. The people that do store it, for the most part, energy suppliers, are monitored by the EIA, so we know how much they are storing.

The one distinguishing factor between stocks/real estate/gold and oil/corn/natgas is the former are repositories of value that can potentially accrete or grow, while the latter are consumed and disappear upon use. Inventories lend the latter category some level of speculation I suppose.

Agree the term ‘speculation’ is somewhat loaded. Perhaps the term ‘arbitrage’ is fairer, since non-end user participants in the oil market help in price discovery and given that oil was likely undervalued for a long time.

vorpal,

I agree with you, in part. You seem to be taking Paul Krugman’s position that this can’t be speculation because inventories are low.

Two big “Buts”:

1) In some places, perhaps Saudi Arabia, there could be excess capacity, which is very much like storage. They store more simply by extracting less.

2) When markets are as tight as they are now, small changes in storage, which could be hard to see, could have a big effect on prices. That, I think, is JDH’s position.

I tend to concur, however, that this is mostly fundamentals and little speculation. But I do accept that some of it may be speculation. Today’s market events make me lean a bit more on the fundamental side of things.

“4) Climate change economics studies seem to assume a 2-3% GDP CAGR for another 100 years, irrespective of any effects from Peak Oil & Gas, and of course, serious policy arguments seem to be using this assumption.

Do economists in general believe either that Peak Oil+Gas doesn’t happen, or if it does, it doesn’t matter? I know a few who think it matters (i.e., like Bob Ayres & Benjamin Warr, or Charlie Hall), but they seem to be a small minority.

Anyway, any thoughts or pointers would be most welcome.

Posted by: John Mashey at May 20, 2008 11:33 PM”

=======================

John Mashey, You are raising a number of interesting questions here.

I doubt very many economists were familiar with the peak oil concept until earlier this decade. That is surely changing. Economists tend to be technological optimists and envisage folks innovating themselves around energy price shocks though some combination of increased supply, more efficient use, better substitutes.

As a group, I would guess that economists would be more optimistic than most professions about the prospects of innovating past increasingly expensive oil. I would not expect to find much fear.

I doubt the prospect of negative shocks, of which an oil price shock is just one possibility among many, would stop a research economist from going with a simple trend growth assumption. The approximation to real GDP time series is close enough for many purposes at hand.

In my own estimation, “Peak oil” matters in that the ‘peak’ should be preceded by a period of increasingly expensive fossil fuels. Once the actual peak is behind us, I would guess that in a short period of time, the alarm over declining reserves of sweet, light crude liquid will have effectively dissipated and we’ll be on to other things. Fresh water perhaps?

Maybe you good folks in the Southwest should investigate the urban vision of Paolo Soleri and similar?

i think everyone is missing the point with futures when they link them to inventories. Index speculators don’t care about inventories…they trade based upon the notional value, whether or not that amount of oil even exists is not even an afterthought…the index speculators create notional value (i.e. paper demand) when they have to put their asset inflows to work. They could care less how much oil they are commanding, they just want the cash to be exposed to oil. They go to GS or MS. These IB’s write a contract based on that notional amount and then the IB’s hedge themselves by going long swaps or options…the point is, the amount of oil is merely a number that is used to quantify the contract. nothing more. It’s almost like a cdo squared…you don’t really own anything…just a bunch of options based on the notional value of something. There is no economic discussion necessary.

E. Poole

Thanks for the comments.

1) Soleri is interesting… Of course, San Jose is in Silicon Valley (NorCal), as is my town, Portola Valley, where a more common issue is difficulty in doing PV solar, due to the redwood trees. In any case, the SF Bay area is scrambling hard to do infill development to reduce sprawl, encourage cycling, etc, etc.

2) It’s hard to think of a bigger concentration of techno-optimists than here. However, many recognize the difference between Moore’s Law and laws of Thermodynamics, and worry. It is no accident that many energy efficiency techniques, wishes for electric cars, wishes for more efficient cars, venture funding of alternate energies, and CFL-donating utilities are located here. CA has managed to keep electricity/person flat for 30 years, while the US has a whole has grown by nearly 50%.

But still, people are worried, at least in part because we know how much energy comes from fossil fuel, the huge time & investment to replace it, and the possiblity of massive stranded assets.

See Charlie Hall’s Balloon Chart.

3) Have you looked at theories of economic growth and where it comes from? If not, for a start see SOlow residual and then Total factor Productivity, of which the latter says:

“Technology Growth and Efficiency are regarded as two of the biggest sub-sections of Total Factor Productivity… Total Factor Productivity is often seen as the real driver of growth within an economy and studies reveal that whilst labour and investment are important contributors, Total Factor Productivity may account for up to 60% of growth within economies.”

So, whatever it is, maybe 60% of the growth comes from it. I’m no economist, but it makes me nervous when I don’t quite understand where 60% of some important effect comes from, so I’m reading and asking economists.

a) At one extreme (majority), GDP growth just keeps cranking along, ignoring fossil fuel Peaks, i.e., energy is *not* part of Total Factor Productivity.

b) At the other (a small minority of biophysical economists, like Ayres), TFP is very well modeled by

work = energy-used * efficiency

with a modest residual boost over the last 20-30 years from computing. See page 34, which gives US GDP projections assuming different levels of efficiency. BY comparison, to see 2% CAGR on that chart, assuming that 2008 => 22.5X GDP(1900), 2050 => 50X, about 3X the green line on the chart, and about 1.5X that of the black line.

Of the two cases:

b) Says that energy*efficiency is a major driver of growth, which makes some sense to me. [A farmer with electricity, tractors, and fuel tends to be richer than one who has only a horse, and the latter better off than someone who has no draft animals.] It also could make sense that the UK got rich early by harnessing coal, and the US by really exploiting oil.

a) Seems to have something to do with technology and efficiency, and I don’t yet quite understand how that works, but hope to, since it seems to be a majority position, which one does not casually ignore.

A classic forecasting problem is extrapolating a trend from past data, and not understanding some underlying limit or factor that causes a major inflection point. [I used to have to worry about such things in the computer business, where business life-or-death decisions on expected trends and trend ratios happened every few years. ugh.]

a) Predicts no inflections.

b) Predicts a specific kind of inflection.

There is as much as a 4:1 2050 GDP difference between a) and the lowest version of b). It matters which is the closer approximation of reality. Climate change economics and related policies are being argued furiously right now.

Anyway, I know that as oil&gas get more expensive, we’ll get more efficient, first by behavior, then by fleet replacement, by building improvements, etc and we’ll build alternate energy sources… but much of this cannot happen overnight. What people here worry about around here is “Can we do it *fast* enough? (and not go big-time into coal, for climate reasons).

Michael Roberts: there is very little non-producing excess capacity. Of course this could depend on your definition and your economics. For example, you could claim there is excess capacity in Nigeria or Iraq. Additionally, there is excess capacity in the US.

We could sink another one thousand wells in the Gulf of Mexico and quadruple production, but that would lead to damage and rapid depletion of the reservoirs. The cost of production would also soar as each well produces less per day.

If the Saudis really had much excess, don’t you think they would be producing at these levels? They promised more oil at 70, at 80, at 100. The honest story is that Saudi production could be increased only by damaging the reservoirs.

Hello Peak Oil.

Expat:

I doubt there is much low-cost excess capacity. But there could be some. That is why I said there “could be excess capacity” and “perhaps in Saudi Arabia.

It’s not clear to me what Saudi Arabia should do. With inventories this low, they have a lot of market power. If they cut production a little they could cause prices to increase a lot. This would likely raise their profits in the short run, but may further induce development of alternative energy sources, which could be bad for their profits in the long run. But at this point I don’t think SA could stop innovation even if they tried.

I have an oil tank in my back yard – in my car. Such tanks may not be individually large, but I wonder how much storage they amount to if they are kept topped up in anticipation of rising retail prices.

Looks like speculation may have played a part, but in keeping prices down, short covering now raising them.

Peak oil may solve climate change for us.

Record numbers of people running out of gas on the freeway says this is no consumer event.

Why $120/barrel is the optimal price of oil.

If you include the fact that the Chinese auhorities are subsidizing energy to the tune of $40+ billion a year and that globally Governments have been increasing their royalty take across the board then it kind of throws a couple of huge monkey wrenches in your “free market” models of supply, demand and price.

It is not well recognized that Oil & Gas markets are manipulated as much as EU farming and the infamous “mountain of butter”.

That China projection is pretty impressive.

Um… dare I ask what happens if we add India?

Jeremy…great point.

http://www.platts.com/Oil/News/9859432.xml?src=Oilrssheadlines1

John Mashey,

Nobody disputes that an upward oil price shock of this magnitude will ‘strand assets’, and temporarily reduce measured productivity growth and output growth. Rich western economies will decelerate for a short period; some poor countries will experience significantly increased malnourishment, starvation, resource conflict. New capital will likely embody all kinds of efficiency gains, many that are unrelated to fuel inputs.

Total or multifactor productivity growth is a useful empirical measure and theoretical concept. The term ‘residual’ should alert one to the indirect way that this latent, non-observable variable is estimated by subtracting some weighted measure of inputs from an index of output. Practically it is a large black box of unmeasured inputs.

60%? That sounds like a number generated by value-added multifactor productivity estimates. I wouldn’t attach much importance or reliability.

Nobody can accurately forecast structural breaks.

If the prospect of major structural adjustment is daunting, consider a new regime of European-level excise taxes on gasoline and diesel scheduled to take effect over several years. If sufficiently credible, the announcement of such a tax regime should immediately reduce the price of oil. If President Bush II wants to reduce oil prices, he could credibly signal to the global market America’s intention to sincerely conserve energy by imposing hefty taxes. More feel-good, cater-to-special-interests programmes will continue to clearly signal the exact opposite.

IT’S ABOUT TIME THE SENATE LOOKED AT THE CULPRITS IN THE RISE IN OIL AND GAS PRICES….WALL STREET…NOT THE OIL AND GAS COMPANIES..WAKE UP PEOPLE.

A U.S. Senate panel listened to testimony on May 20 that said financial speculation by institutional investors and hedge funds in the commodity markets are contributing to energy and food inflation. See full story.

Speculative activity in commodity markets has grown “enormously” over the past several years, the Homeland Security and Governmental Affairs Committee said in a news release. It pointed out that in five years, from 2003 to 2008, investment in the index funds tied to commodities has grown by 20-fold — to $260 billion from $13 billion.

The growth offers “justifiable concerns that speculative demand, divorced from the market realities, is driving food and energy price inflation and causing human suffering,” HSGAC said.

“If Congress makes some laws that reign in speculation, it’s possible that speculators will move out of the U.S. markets and into Dubai,” said Phil Flynn, a vice president at Alaron Trading.

E. Poole:

When you say “no one can predict structural breaks”, I’m not sure what you mean. I would have thought that US Lower48 Peak Oil was a structural break, and Hubbert predicted it reasonably closely almost 15 years earlier. Was that not a break, or did it not happen?

I have a question:

Oil price per barrel goes up to $135, so the price of gasoline goes to $3.99/gal. Why then, if price per barrel has come down from $135 to say $130, is gas still priced at $3.99/gal?

Brian, it takes some time for a change in oil prices to be fully reflected in retail gasoline prices. The latter may still be adjusting up from last month’s increase in crude prices.

One rough rule of thumb I’ve sometimes used is to expect the average national retail price to be the NYMEX futures plus 60 cents per gallon. With NYMEX July gasoline currently at $3.43, that gives you a predicted national price of $4.03/gallon, compared with the $3.95/gallon average retail price currently being reported by NewJerseyGasPrices.com. So it’s quite conceivable that retail gasoline prices could continue to climb this week even as crude oil prices fall.

It’s all based on total production by a company or country, and who controls the most production. Cut production, prices go up. Increase production, prices go down. It happened in the 1970’s with the false “oil shortage”, but the response to that was to conserve, which meant, no one was demanding as much.

If everyone conserves now, it would help lower the prices, but won’t be the cause.

Another factor: more countries have nationalized their oil fields, because of the “ownership” mentality of the big oil corporations.

Hugo Chavez is advocating a southern hemisphere oil cartel to compete against OPEC, and Iran, Russia and China are doing the same.

If cartels don’t have a direct impact on the price of crude per barrel, then I’m from outer space.

Leaders of the cartels will drop or raise the price on their own time, not ours. Better start hoping the next president understands this and

send better ambassadors than Sec. Rice or VP Cheney.

I’m surprised at many of the comments here that seem to downplay the importance of speculation on today’s oil prices. The price has DOUBLED in less that two years. Demand has increased maybe 1/50th of the price. I’m not an economist, but it seems like speculation to me (or specifically overspeculation). To say that the price of oil was “undervalued” for so many years is like saying Pets.com or Nortel stocks were “undervalued” before their stock prices skyrocketed. Are we to seriously believe that the collective intelligence of analysts and investors was so lacking that they let the price of oil be so undervalued for so many years?

Speculation is not a loaded term. It’s what drives the markets. Not many investors buy stocks to cash in dividends, or oil to store in their backyards. They make a bet that the price will change to their advantage. Then the biggest and most powerful of them go on T.V. and the internet, and talk about a “new normal”. They try to convince us that oil prices will further double, and we’ll all be paying $8.00 a gallon in a year from now. This convinces other investors to pour their money into oil stocks and futures, further increasing the price and fulfilling the prophecy of ever increasing oil prices. None of the “experts” want to speak the truth about why oil prices have risen because they’re making so much money from it. They talk about “peak oil”, dependence on foreign supplies, and increased demand from China as explanations for the precipitous rise in price. Are these issues we need to deal with in the long-term? Yes. Do they explain the DOUBLING of oil prices in a year? Absolutely not.

During the tech bubble, talking heads would speak of a “new plateau” in the stock market. Sounds a lot like the “new normal” in oil prices they speak of today. Like all bubbles, the oil market will crash eventually.

Peter Sutherland:

I understand that to non-economists that it might be easy to connect the current price risk in commodities to earlier bubbles in real estate and stocks. But it is important to separately examine the fundamentals of each case.

Bubbles in commodities are possible. If it were a bubble, we would have to see an accumulation of inventories. You see, if the market believed prices were going to keep increasing, future prices would be well above spot prices, and this would encourage accumulation of inventories.

If you want to base your opinion on what talking heads are or are not saying, please note that many of the best and brightest that called the bubbles long before the talking heads did (PK and JHD, for example), also say this is not a bubble in commodity prices.

The talking heads are wrong today, too.

If it’s been said or written I’ve missed it. But why isn’t the answer to the run-up in price, that the countries that possess the oil have simply concluded they can? If you looked at a 36 month period over period line item analysis on both all the discrete measurable and qualitative (Iraq, leader changes) things… There are no external drivers FORCING the price higher.

The oil is critical to the economies and there is drastically reduced opportunity costs to the owners if they do.

A couple dollars a barrel every 2-3 weeks for 2+ months. That doesn’t seem like “testing” the limits to everyone? For months and months the PR people sung concerns about supply. The Saudi King (or minister of something) came out last week saying first hand the price was not reflective of the overall situation. Zero drop in price.

The biggest change in the last 36 months is that the US has lost disproportionate influence as a consumer with burgeoning economies around the world. All the other qualitatives are better.

Demand is spread out among more diverse political machines (the US isn’t the only big dog at the spigot).. we are seeing oil replacing technology accelerate which might feed a story of a limited 20-30 year earning window… but mainly…oh by the way… there is physically no alternative in the short term to these increases other than passing on the increase and continuing down the path of wealth transfer because we are technologically unprepared.

Day after day vague reasons (many of which reverse but the price never does) for the increases. Ask yourself this question… If they raised oil to $300/barrel tomorrow ($8+/gallon)… how much would you cut consumption? 5%? maybe 10%?

I don’t think this is related to some middle function in the financial markets. Our lives come to a screeching halt without oil. Until we have a choice they can charge whatever they want.

These are union dynamics… not speculators.

I have no doubt $400/hr consultants from the west outlined these points well for the various Emirs and Cabinet chiefs worldwide.

My apologies…

I meant to write

“A couple dollars a barrel every 2-3 weeks for 2+ YEARS” (not months). That doesn’t seem like testing?”

I’ve read this precious article and the good comments on it.

As I saw some opinions on comparing gold and oil prices, i may say that, yes, gold and oil prices together with other commodities go up by inflation.

As far as there were some disagreements on this issue on the comments above based on the fact that oil price grew more than gold in last 8 years, i may say that, this is because the oil price were kept pretty low in the years 2000 or so to 2003 by implementing PRICE BAND MECHANISM by OPEC keeping the oil price between 23 to 28 dollars in those years.

But, the market reality made the oil price to explode in and from 2003, so it grew up so fast to compensate for the past stoppages.

I think that was a kind cooperation by OPEC, but not a good idea that was suggested by IEA and pushed by Neo Cons.

Today, we have speculation, weak dollar and every thing else coming out of inflation, because we have wars, occupations and political tensions. These impose gigantic amounts of expenditures to the world and humanity, so inflation and prices go up.

Can you imagine how beautiful the world would be if Neo Cons weren’t there in Iraq, Palistine, Afghanistan, Somalia, and… Can you imagine how it was if there were not missile shield programs and other arm expenditures !!!!

I may say every thing would be cheap enough, and there would be no poor in the world in that case…Thanks

I would like to find a historical chart of oil, priced in gold (for example, 1 barrel of oil cost .1 oz. of gold in 2000 and costs about .14 oz. recently). I think this would give closest to the “true” price of oil–and adjust for currency price inflation.

Might anyone be able to know where I might find a chart like this? Thanks.

John Mashey,

On the importance of resources’ use to TFP, there is a paper, “Are we consuming to much?”, where Arrow et al. make that point. Very interesting.