While the latest GDP figures suggest an economy that continues to grow, today’s employment data are more consistent with the claim that the U.S. economy has entered a recession.

The Bureau of Labor Statistics reported today that the seasonally adjusted number of workers on nonfarm payrolls fell by 51,000 in July. Their separate survey of households put the decrease in employment at 72,000. Earlier this week, ADP reported a tepid 9,000 gain in private-sector employment.

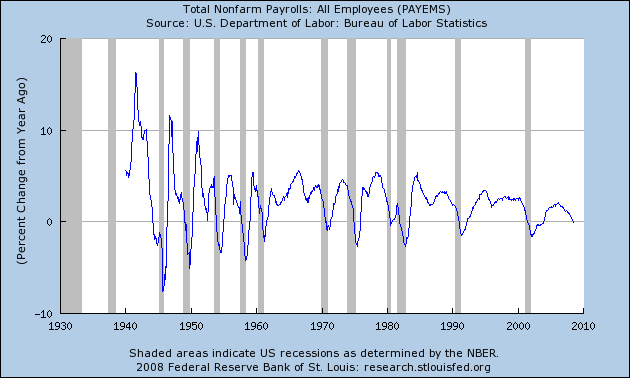

Though the monthly employment figures contain considerable measurement error and are prone to revision, a clearer picture emerges from the year-over-year percentage change, which is now negative. We’ve never seen a year-over-year decline in nonfarm payrolls without an economic recession.

|

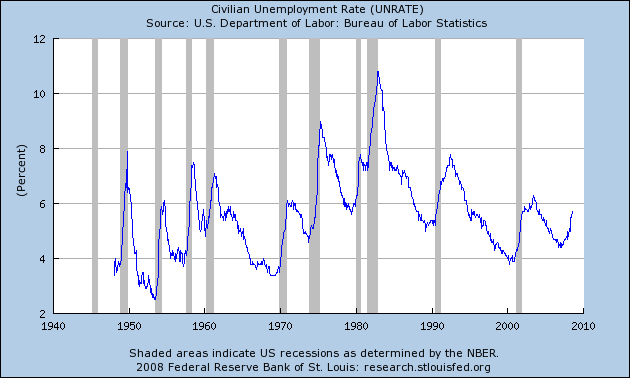

The BLS also reported that the unemployment rate increased 0.2 percentage points to 5.7%. A spike up in the unemployment rate is another defining characteristic of an economic recession.

|

These numbers are not necessarily inconsistent with yesterday’s GDP report. Okun’s Law is an economic regularity noted by Arthur Okun in the 1960s that has held up reasonably well in the decades since. It asserts that for if GDP grows 2-3 percent slower than trend for one year, the unemployment rate would rise by 1%. Real GDP growth over the last 4 quarters has been 1.8%, compared with an average annual growth rate of 3.4%. The unemployment rate has increased over the last year from 4.7% to 5.7%. Thus slow GDP growth alone, rather than an outright fall in real GDP, would be consistent with the rising unemployment rate.

I’ve argued previously that the question of whether we’ve entered an economic recession is a materially important one, and I still believe this to be the case. But after this week’s numbers, I’m also sympathetic to the position of Fed Chair Ben Bernanke:

Whether it’s a technical recession or not is not all that relevant,” Mr. Bernanke said. “It’s clearly the case that for a variety of reasons families are facing hardship.”

Technorati Tags: macroeconomics,

employment,

economics,

unemployment,

recession

I think that the ultimate label assigned to this period is of more interest to academics than businesses or consumers. From their standpoint economic conditions are bad. Not as bad as in prior periods that are defined as recessions but still bad nonetheless.

Given the somewhat conflicting signals between GDP data and other variables, there is still some uncertainty as to whether this period should or should not be called a recession. Throw in possible data revisions and it becomes even more uncertain. I don’t think the NBER is going to be in any hurry to make a call on this one.

In combination with the inventory and consumption data it’s possible that once buffer stocks of inventories are depleted we will start to see larger reductions in hours and employment. The ‘slowdown’ thus far as been kind to workers relative to previous recessions.

Jim-

I’ve got a different take. Looking at the pattern since the 1981-82 recession, each unemployment peak has been lower, and it looks like it’s about time for the current rate to start turning down.

I also suspect that once businesses and consumers adjust to the oil price rise and as the interrelated losses in the financial markets and housing markets are digested, activity will return to normal growth.

I cannot remember such wailing and gnashing of teeth since the 1990-1991 recession which was very mild. Of course, by the time Clinton was using his “It’s the economy, stupid” the recession was long over. I don’t recall the MSM challenging him on that.

The MSM didn’t challenge Clinton on his claims that “it’s the economy stupid” because Clinton was correct. Even if the recession was over the electorate did not feel like it.

Spencer-

I don’t think you are right. According to BEA, real growth in 1991 was in the 2% range, but it jumped up to the 4% range in 1992. The MSM was not anxious to broadcast the improving conditions. I also remember that Clinton got in there because most of the prominent politicians thought that Bush was too strong at the time.

Rich,

Since we are ‘eye-balling’ the data — A couple of points stand out as signaling turning points in the trend. Notice that the uptrend in unemployment ~1968 – 1984 was characterized by a series of higher highs and higher lows. However, following the peak in early 1980’s the next cyclical trough for unemployment (~1988-89) was lower than the prior trough (~1978). If you look at the downtrend for the period 1984-present, you see a series of lower highs and lower lows, BUT, the last cyclical low in unemployment (~2006) was actually HIGHER than the prior low around 2001. The trend of lower highs for unemployment may be ending. Perhaps we have reached a turning point in the trend and cyclical highs in unemployment may begin to trend higher. Jim is the turning point expert, maybe he can throw something more rigorous at identifying a trend change.

In terms of eyeballing, it’s weird that unemployment has that sawtooth shape. Straight up, and then smoothly down in a more or less straight line, until we go straight up again. One can’t help wondering if we could get it to level off and stop declining sooner, maybe it wouldn’t have to shoot back up.

tjgje, you might want to read this letter from the FRBSF about whether output really has become less volatile:

http://www.frbsf.org/publications/economics/letter/2005/el2005-24.html

Another reason why it matters if we are actually having a recession: the duration and size of stock market losses tend to be more severe during a recession than during an “average” bear market.

I agree that it is hard to see a recession in the data available so far. In a monthly version of the Qual VAR model I use to predict and identify recessions ( Econbrowser 2/5/08)), the probability that one of the first six months of 2008 was in recession does not exceed 20 percent. This is coming from a model that uses employment as its measure of economic activity.

So far, it seems that the economy has dipped closer than it ever has to a recession without actually entering one.

It is interesting, then, that Martin Feldstein, a member of the NBER business cycle dating committee, is saying that it is a matter of choosing between Dec. 2007 and Jan. 2008 as the business cycle peak.

The GDP graph looks like a single degree of freedom system with small damping in the early years and then some effective damping is applied. The system is certainly not single degree of freedom and what ever is damping the system is made of of many components. Interesting that the graph has that visual aspect.

BB – “Whether it’s a technical recession or not is not all that relevant,” Mr. Bernanke said. “It’s clearly the case that for a variety of reasons families are facing hardship.”

So, what measure of hardship do we use to justify loose monetary policy? Some will have hardships during a boom. Was Greenspan right to keep rates so low for so long? If we set the bound too low for preventing hardship, we end up putting off correcting imbalances. The next round could be truly disastrous.

July 31, 2008

So my current assessment is that a U.S. recession had not yet started as of 2008:Q1.

August 1,2008

today’s employment data are more consistent with the claim that the U.S. economy has entered a recession

What a difference a day makes.

But will we hear JDH say ‘we are in a recession’ prior to a declaration from the NBER? Stay tuned.