August auto sales were less dismal than July. But don’t uncork the champagne quite yet.

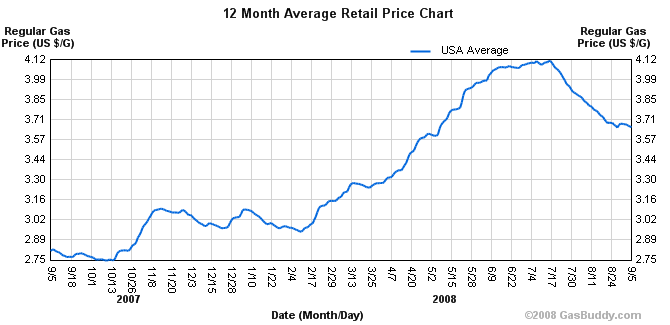

Domestic sales declined by 15.5 percent in August compared with the previous year, the fifth consecutive month of double-digit declines, despite some relief in recent weeks on gas prices.

I like to look at these data using graphs like the ones below, to help distinguish seasonal and cyclical factors from trend. (By the way, Econbrowser remains the only site on the web, to my knowledge, where you will find the auto data displayed this way.) You can make year-on-year comparisons by looking across entries within any given set of columns, and see month-to-month changes by looking across groups of columns.

|

Sales of light trucks (which includes SUVs) manufactured in North America were clobbered this summer, and August 2008 was down 22% from August 2007. But August domestic truck sales were up 23% compared with July 2008, and you can’t describe any significant chunk of that July-to-August improvement as a typical seasonal movement.

|

August sales of domestic cars were down 12% year-over-year but up 6.6% month-over-month. The dramatic drop in gasoline prices thus appears to have reversed some of Detroit’s hemorrhaging.

|

Spencer at Angry Bear is encouraged by the uptick in seasonally adjusted auto sales and wonders if we’ve passed the bottom. The NYT quotes analysts from GM and Ford as cautiously optimistic.

I am less so. For one thing, even though gasoline prices are lower than they were a month ago, they’re still much higher than the last time you bought a car. The swing away from SUVs is in my opinion inexorable, and will continue even if we see, as we may well, significant further declines in oil prices. And there is no way that works to the benefit of the American companies whose market strength has always been in the less fuel-efficient vehicles.

Second, if I’m reading things correctly, the U.S. economic downturn can now be classified as a recession. I don’t share the views of those who think we may have seen the bottom there, either. Exports, the key sector that’s been keeping GDP growth positive, are significantly threatened by a slowing world economy. And have we turned the corner on the financial mess? If that’s how you read the latest developments with Fannie and Freddie,

then God bless your cheerful spirit.

I’m expecting job and income losses to continue, and that doesn’t bode well for auto sales, no matter what’s been happening or may be about to happen to gasoline prices.

Technorati Tags: macroeconomics,

autos,

auto+sales,

gasoline demand,

economics,

recession,

gas prices,

oil shock

At least I generated some interesting discussions and got away from all the political talk we have been too absorbed in over the past month.

FWIW, I’ll second the dismal outlook.

spencer: Sure, let’s not talk about politics; let’s talk about a recession that looks much worse than anything anticipated by market participants and economists alike only 9 to 12 months ago.

On a more serious note, how do you see the future of General Motors? Any significant probability of bankruptcy? I ask because I’ve been rolling over an overweight position in short-term GMAC paper for a couple of years now on the best guess that GM might disappear in a merger or acquisition but would not go bankrupt. Would appreciate an opinion.

“…you can’t describe any significant chunk of that July-to-August improvement as a typical seasonal movement…”

Really? My read is that July to August auto sales were modestly up in ’06, nicely up in ’07, and are nicely up again in ’08. I have no idea why the seasonality changed (July to August auto sales were down in ’04 and ’05), but August now looks to be an up month compared to July for three years running.

Probably some global warming thing (ha, ha).

Of course this is anecdotal, one dealer, in one part of the country. My sister-in-law works at a Pontiac dealer. I am not sure if they have other lines or not.

She said that 60% of their business was leases and there are NO leases.

The balance cannot qualify for a loan to buy a vehicle so they are trying to push them into less expensive used cars.

The salespeople are sitting around with nothing to do.

On another note the dealers here in Atlanta are switching salespeople to salary because there are no commissions and they don’t want their top people to quit. (Not sure where they would go).

I would be very curious if anyone has projected the domestic manufacturers current product mix of sales and gross margins over the next 6 months to a year. I have always heard that trucks and SUVs provided virtually all the profit to domestic auto manufacturers while they made next to nothing on their small cars. In addition (in what may be a stunningly stupid observation of the obvious) the domestic manufacturers have derived significant earnings over the past 5 years (until 2007) from their financing subsidiaries which are now being projected to need cash and thus exacerbating the big three’s woes.

How is this July-August rise any different from 2007? The derivatives look the same on every graph that you show.

I don’t see much in the way of any seasonality on these graphs. Remove the huge outlier that is 2005, and things look pretty flat March-September (that is, if we are eyeballing things, since nobody is actually doing any real curve analysis here).

At best, the seasonality looks like a rise in March when the new models come in, and a drop in September with a brief rise in December as people buy year-end models. But the data is so noisy, that is really just a guess from the business cycle, not the data itself.

OK: gasoline prices are just one little thing, though significant.

If we’re experiencing further income losses, this implies that the so-feared phase of “Macroeconomic negative NON-Linearities” is just at the beginning!

In reality until now the overall US macro-cycle has been slowing, but not contracting yet!

WE NEED NOW AN EXPECTATION OF WEAK ACTIVITY OVER THE NEXT QUARTERS JUST TO BRING DOWN CORE INFLATION!

IT IS INEVITABLE, THOUGH PAINFUL.

If we wanted to cut demand on oil, take out all drive throughs in every establishment and focus on parking and shutting vehicles off.

“You can make year-on-year comparisons by looking across entries within any given set of columns, and see month-to-month changes by looking across groups of columns.”

How does it look in 3-d bar charts?

I think vehicle sales are not in a typical cycle, most owners have decided to drive what they have ’til the wheels fall off. They are waiting for fuel efficency to go up and/or technology to change. Why buy now? What you buy could be obsolete in a year or two. Prediction if this is true is not really possible based to previous sales information.

I don’t think lower prices can do much to reverse this. There would need to be good reason for people to believe gas prices will stay down. I don’t think gas prices can get low or stable enough for people to ignore the possibility of high gas prices during the life cycle of their purchases.

Record automobile sales levels have been maintained until recently due to the availability of cheap, even free (interest rate less than inflation)money as the Fed has kept interest rates lower than the rate of inflation for 30 straight months. The party is now over and lenders (especially on car leases) have to take a hit as the car credit bubble implodes. Leases that were booked 2 years ago as profitable, are no longer so as residual values have plummeted. Lenders are forced to retroactively book losses on what was thought of as profitable transactions. The availability of cheap credit resulted in overconsumption and a crash in the new car market. There can be no rebound until the losses are realized and demand for new cars resumes.