Updates on some of the series we regularly follow, and they’re not good.

On Thursday the Federal Reserve Board announced that its index of industrial production fell by 2.8% in the month of September (yes, as in 33.6% at an annual rate). That’s the biggest monthly decline in the index since January 1975. To put it in perspective, UCLA Professor Ed Leamer suggested last August that a 6-month decline of more than 3% should be characterized as a recession. That had been the

one holdout among Leamer’s four indicators in suggesting that the economic situation was still not so bad. But according to Leamer’s criterion, the September drop in industrial production almost counts as a recession all by itself.

|

The good news is that the Fed attributed 2.25 percentage points of that 2.8% decline in September to the temporary disruption caused by hurricanes. On the other hand, another way to summarize the trend in industrial production is to become alarmed when there is a cumulative drop of more than 1% over a 12-month period. The August industrial production figure had already put us across that threshold, even if we completely ignore the September report.

|

On Friday we learned that the University of Michigan/Reuters index of consumer sentiment fell by 12.8. That’s the biggest drop ever recorded since the index began in 1978, and is enough to wipe out the bounce up in consumer sentiment provided by falling gas prices since this summer.

|

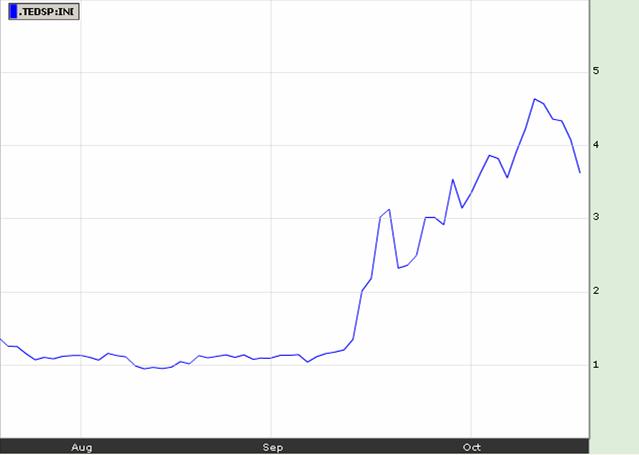

And, to complete a threesome of updates, the TED spread has remained above 350 basis points for most of the month, though it eased slightly during the last week.

|

Technorati Tags:

recession,

macroeconomics,

economics

So the “macroeconomic non-Linearities” have begun.

How many quarters (years) will they last?

Over the last 25 years we haven’t seen anything like that. Anything so painful.

Will it remain for a very long time?

Should we wait for the beginning of 2010 to see a recovery?

Just don’t forget, James: It’s all Obama’s fault.

Or Clinton’s.

What I find interesting is many of the chart patterns bottom at the end of the shaded area (recession area) except for consumer sentiment. Are we at least half way into this slowdown, if not more?

I’m sorry to be glib, but with any luck, cycle forecasters will be able to call a recession well before it is almost over!

Seriously, Dr. Hamilton: can you name one mainstream academic economist that has forecast the current financial crisis (except Roubini)? Is there any one of them that warned of this “Black Swan” occurring? Instead, what we have is after-the-fact explanations of what went wrong. But during the event, I remember hearing that foreclosures would be low because unemployment was low; that the banking system was well capitalized and in excellent shape; that our current account deficit was little cause for concern; that easy money policies put in place during the last recession could be reversed with little adverse consequences. These are only some of the “chestnuts” that were repeated in the face of the bubble popping.

So the question is this, and its a serious one: wasn’t it the job of academic economists to forecast at least the possibility of the most severe global financial crisis since the Great Depression? Or should we just all wait for Ed Leamer to declare a recession?

David, speaking just for myself, the mistake I was making through December 2006 was in attributing too much of the housing boom to the effect of low interest rates and not enough to the deterioration of underwriting standards. The main reason I did so was that we’ve got lots of data on interest rates and not such clear data on underwriting standards.

The big eye-opener for me, at which point I decided that I had been underestimating the contribution of underwriting standards, was the failure of New Century in March 2007.

I disagree with your broad attribution of statements and beliefs to all “mainstream academic economists.” For example, here is what I wrote in September of 2007:

Nouriel did distinguish himself in insisting that this was certain to happen. But I think it’s hardly correct to suggest that the rest of us were taken completely by surprise.

I think part of the reason that mainstream academic economists failed to predict this crisis is that many were focussed on a different major potential crisis centered on international capital flows and the US dollar. (For example, see Brad deLong’s recent post about “The Wrong Financial Crisis” at http://www.voxeu.org/index.php?q=node/2383)

That crisis has not happened.

Yet.

Professor Hamilton, if you look carefully at the industrial production criteria used in Professor Leamer’s recession dating algorithm you will see that threshold for industrial production was stretched down to account for 1950/1951 which are some of the years of the Korean war. At that time, a recession did not occur because public spending was increased substantially. If one excludes that episode, the 3% drop cut-off could be pushed up significantly, say 2% drop.

You are right, and I was wrong in stating that economists did not raise the “possibility” that an adverse feedback loop could occur. Perhaps its a matter of degree. Was sufficient weight given to that possibility to raise it to the level of a “warning”? Warnings carry with them policy implications and a sense of urgency. They allow policy makers time to act instead of react. They cannot arrest credit cycles but they can dampen them.

Policy makers do not operate in a vacuum. They swim in a sea of consensus opinion formed by their peers. There is no better example of this than the Fed, which was rarely taken to task for its decisions or depictions of events.

Were the banks really well capitalized? Was the OTC derivatives situation well in hand (as Timothy Geithner claimed)? Was the systemic effect of hedge fund leverage de minimus? Were 1% policy rates benign, and the “measured” rate hikes prudent? How well did the academic community address these questions? Was it the focal point of research, debate, symposiums? Were there influential economists that pointed out the risk inherent in the Fed’s view of the world (prior to last year’s Jackson Hole symposium)?

Hindsight is 20/20, and I realize that. I’m not taking economists to task for being wrong. I’m taking them to task for not doing their job. Ther job is not to get the answers right. The world is too uncertain for that expectation.

Their job is to get the questions right.

To SvN, that crisis not having happened is definitely a puzzle (at least to me). Why are US money printers better that other countries’? For example, Iceland. Had this crisis you are mentioning happened and things would be much worse. Not only what is happening now would have also happened, but it would have been impossible to have a bailout plan like the current one.

The fact that the US is on its way to a budget deficit above $1 trillion in 2009 certainly increases the probability of such crisis to occur. My personal believe is that the countries that have been financing the US in the last 10/15 years have too much money invested here to let the country go down. If the situation becomes unsustainable then this crisis can definitely happen.

Good points/questions, D-P-. I agree with you 100%.

Even a dummy like me saw this mess coming and took action: renting instead of buying a fourth home in La Jolla in ’04; holding gold mining stocks during gold’s run-up over ’05-’06; short selling the stock market back in Mar. ’07.

Mine was a voice in the wilderness at work and amongst family and friends. If respected folks like Dr. Hamilton and others had been loudly sounding the alarm beginning a few years ago, some folks may have taken note and changed their actions.

It is truly amazing to me that folks clearly smarter than me have not seen the full extent of this mess coming our way. Or, have only recently taken note and have only recently taken action.

A financial tsunami is heading our way, and is not too far off shore, now.

Prof. Hamilton,

As many on the blogosphere have noted, including the respected commentor “Conjure Bag” at Calculated Risk here (http://www.mediafire.com/?zwqk3i2mt2y), its not clear that the TED spread means anything at this point. We keep hearing that “interbank lending is frozen”. Now LIBOR is, by definition the average of “rate[s] at which [panel banks] could borrow funds, were [they] to do so by asking for and then accepting inter-bank offers in reasonable market size just prior to 1100.” (http://www.bba.org.uk/bba/jsp/polopoly.jsp?d=225&a=1413&artpage=all). Yet as of now, there is no “reasonable market”, or any market at all for that matter. To quote a recent Bloomberg story:

While the estimates that go into Libor used to be based on actual transactions between banks, they have become little more than guesswork since credit markets froze, according to three people with knowledge of how interbank rates are set.

Source: http://www.bloomberg.com/apps/news?pid=20601087&sid=a4r3HnlEV2jo&refer=home

Bearing this in mind, do you believe that it would be a good idea for commentators and analysts to stop reporting and cogitating on the TED spread, until such time as Eurodollar lending among banks resumes?

Can you not get comparative data for historical TED spread, and yields? Seems curious to post 30 and 50 yr data together with that for a 2 month period?

http://en.wikipedia.org/wiki/Image:Ted-Spread.png

http://www.federalreserve.gov/pubs/feds/2004/200418/200418pap.pdf

http://www.clevelandfed.org/Research/Trends/2001/0101/intrst.pdf

Hasn’t Roubini been declaring disaster “just around the corner” for as long as anyone can remember? I don’t see him as particularly prescient (nor alone) in ‘seeing’ this coming.

As for the dollar/international capital flow “crisis,” if anyone truly believes that sort of “tsunami” is barreling down on us I can’t understand why they’d stick around – and I mean literally. The descriptions of this “impending crisis” paint an image of nothing short of the utter financial/economic destruction of the United States, relegating America to little better than a giant third-world nation in every respect, plummeting down the GDP pecking order and losing every measure of economic power. Why on earth would anyone keep a cent in the U.S. with that coming?

That’s a very good question, PM.

Unfortunately, the answer seems to be “Habit.”

is there a solution to the lack of transparency of ratings agencies? it seems like they were indeed a fly in the ointment

PM,

Though Roubini was wrong in his timing of his recession calls, he was the only one among academic economists who was vociferously out and center in his predictions about the overall crisis in the banking sector, the credit market freeze, etc.

David Pearson,

There are many economists who made the right calls about the housing bubble and the excesses in the market– some names I have seen are Dean Baker, Stephen Roach of Morgan Stanley, Robert Shiller, Gary Schilling, Roubini, even Krugman. But only Roubini perhaps focused more on the credit markets and the “shadow banking” crisis in more detail. But even he has revised his predictions often; besides, his method is not based solely on solid analysis of data. Sometimes one does get the feeling that he is “shooting from the hip.”

Roach was said to be a perpetual bear; but his insistence that Greenspan’s policiies starting in the mid 1990’s were contributing to bubble after bubble was correct.

If we look at the chart for Dow, we can see that the steady growth till the mid 1990’s was replaced by first the huge tech bubble and its burst, then the real estate bubble and its burst. After the current crash, the markets seem to be aligned to the trend line from the mid-1990’s.

The thing I take away from all that is that no one, not even highly-rated economists, can get the timing right and many predictions are often wrong, but it helps to pay attention to the logic/illogic of their claims in light of our own observations in making our personal economic decisions.

Don’t know about you, PM, but I am getting my money to a private Swiss bank right after the market has its next tumble.

Who knows what sort of capital controls and investment limitations will come our way, given the ban on short-selling financials, the federal government picking winners and losers, tumbling federal and state tax receipts, etc.

As David Pearson said, policy makers (and many businesses as well) rely on the consensus forecast. And the consensus never forecasts disaster.

JDH wrote:

David, speaking just for myself, the mistake I was making through December 2006 was in attributing too much of the housing boom to the effect of low interest rates and not enough to the deterioration of underwriting standards. The main reason I did so was that we’ve got lots of data on interest rates and not such clear data on underwriting standards.

The big eye-opener for me, at which point I decided that I had been underestimating the contribution of underwriting standards, was the failure of New Century in March 2007.

Professor,

For me this is a great insight and you are definitely one of my heros for stating it. I have heard few economists this candid and some are even attempting to explain away the deterioration of underwriting standards.

Great comments today.

RE:Roubini

He was the boy who cried wolf. If you shorted the market when he first said it would crash, you would be broke. He called a recession at the end of 2004.

While the housing boom and deterioration of underwriting standards certainly were certainly big inflators of the bubble, I’m guessing fraud was a very small part. And, I think the main cause of the crisis was the rise in commodities prices, particularly oil. We could have easily had a soft landing or no crisis at all if expenses had remained low, but the rise in expenses made the market of low-medium risk borrowers evaporate and made existing loan default risk sky-rocket. The problem was that lenders didn’t expect costs to increase so much more than incomes.

I agree with aaron. If one ponders the tasks of this crisis perhaps that’s a way of assessing its duration?

1. reduce residential construction to an appropriate level – down 67% nearly done

2. clear out inventory and stop house price falls – not yet done but rate of decline is slowing and some signs that purchases are increasing

3. write down sub-prime lending to clear out dodgy lending – $660bn plus several hundred billion of nationalised losses – not yet done but a fair way

3. restore lending by ending the credit crunch – nearly done the risk of a systemic crisis no longer existing owing to the nationalisation of banks and finance houses

4. reduce commodities prices to “affordable levels” so raising aggregate demand and restoring profit rates by reducing costs – done

So certainly a recession underway but one that is a fair way towards restoring conditions for an upswing.

Just more unpatriotic negative talk by people that hate America, and the troops.

To David Pearson,

Using traditional indicators in a dynamic model did signal the 2008 recession in real time

[ Econbrowser 2/5/08 ], and the signal would have been even better if quality spreads among interest rates, such as Baa versus Treasurys, were included in the model.

In the intervening months, I have learned to appreciate quality spreads to a greater degree.