Plan A didn’t work. Plan B didn’t work. I suggest the Fed get going on Plan C.

The Bureau of Labor Statistics announced last week that the seasonally adjusted consumer price index fell by 1% during the month of October, implying an annual deflation rate around -12%. That’s the biggest monthly drop in the CPI since publication of

seasonally adjusted changes began in February 1947. The core CPI (excluding food and energy) saw its first decline in a quarter century.

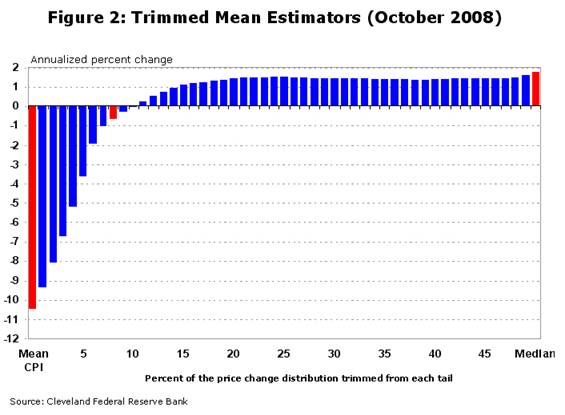

Does this mean that deflation is now upon us? Mike Bryan argues that despite the indication from the headline and core CPI, actual decreases in prices were not that widespread in October. One of the ways that Bryan proposes to measure this is to order the different components of the CPI by how much the price changed, with those whose price fell the most at the bottom and those whose price increased the most at the top. Suppose you threw out items in the bottom category until you’d eliminated 10% of the total spending by the typical consumer, threw out the 10% in the top category as well, and calculated the sample mean of the remaining 80%. That basket of “typical items” did not change in price during October. If you threw out more than 10% of the bottom and top categories, you’d end up with a slightly positive inflation rate for the month. The graph below shows the resulting average October inflation (reported at an annual rate) when you throw out the bottom x% and top x%, plotted as a function of x. The value x = 0 corresponds to the usual sample mean (the headline CPI itself), while x = 50 corresponds to the sample median.

|

Alternatively, we might look at the cumulative inflation readings over the last year, rather than the single month of October in isolation. These suggest a 3.7% inflation rate from the CPI and 2.2% for the core CPI. Trimming x = 8% from the bottom and top yearly changes gives an annual trimmed mean of 3.0%.

|

So maybe everything’s OK? I think not. Two forward-looking indicators are profoundly troubling. First, the yields on inflation-indexed Treasuries for medium-term maturities are actually higher than those for regular Treasuries. If taken at face value, that means investors anticipate an average deflation over the next 5 years at a -1.29% annual rate. Perhaps one might dismiss this as another indication that the usual arbitrage activity is completely absent in current markets, so that the nominal-TIPS spread is no longer a meaningful indicator.

|

But a second and equally troubling suggestion of expected deflation is the extremely low yields on short-term Treasury bills.

Again there may be those who interpret this not as a harbinger of deflation but instead as a reflection of the astonishing (and equally frightening) flight to quality that we have been witnessing.

Even if you don’t interpret the October CPI, TIPS yields, and nominal T-bill yields as warning flags of deflation, they nonetheless raise what is to me the core question: If the Fed wanted to use monetary policy to stimulate the economy at the moment, as I believe it should, what would it do?

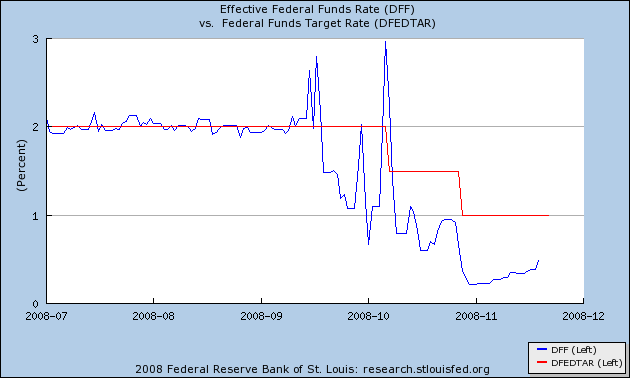

The traditional answer would be to lower the fed funds target. But surely further cuts in the target rate can accomplish nothing in the current environment. The effective fed funds rate and 3-month T-bill rate are already more than 50 basis points below the current target, so cutting the target by 50 basis points is supposed to accomplish what, exactly? If you’re counting on another couple of rate cuts as the last arrows in your quiver, I’m afraid to report that continuing this battle rather desperately calls for a Plan B.

|

Nor should there be any enthusiasm for yet another lending facility. What started as a few billion dollars is now in the trillions, and credit spreads continue to widen. If we keep doing the same thing we’ve been doing for the last year and a half, why should we expect any different result?

So here’s my suggested Plan C. The goal of monetary policy should be to achieve a core inflation rate of 3.0% (at an annual rate) over the next 6 months. That’s something that can be accomplished without rate cuts or lending facilities, and here’s how.

Step 1 is for the FOMC to form a clear determination that a 3% core inflation rate is indeed their immediate goal. If you hope to get somewhere, it’s a good idea to start with a plan of where you’re trying to go.

Step 2 is to communicate the goal to the public. Bernanke and Kohn should state clearly that they’re worried by the October fall in the CPI, that they see a danger of too much slack in the economy developing, and that they will now be adopting quantitative easing with the goal of preventing further declines in the overall price level.

Step 3 is to start creating money and use it to buy up assets until the goal set out in Step 1 is achieved. What sort of assets? My answer here would be the exact opposite in philosophy of the kind of purchases and loans that the Fed has been implementing over the last year. The Fed has been trying to sop up the illiquid assets that nobody else wants. But I think what the Fed should be doing is instead acquiring assets of a type that would allow it to quickly reverse its position if a sudden shift in perceptions causes inflation to come in above the intended 3% target. The Fed can’t afford to dump the illiquid securities it’s been taking on recently, and that leaves it with substantially less flexibility to ease out of an expansionary policy once it starts to be successful. My goal would therefore be to buy assets for the Fed that won’t lose their value with a reversal of expectations and whose sell-off by the Fed wouldn’t be itself an additional destabilizing force.

What specifically would such assets be? I’d start with those clearly undervalued TIPS. Next I’d buy short-term securities in the currencies relative to which the dollar has been appreciating. Here again if the Fed has to sell these off in a sudden change in perceptions, the Fed will have both made a profit and, by selling, be a stabilizing force. If we’re still seeing no improvement, the Fed can start to buy longer-term Treasuries.

What if the policy is unsuccessful, and we still get severe deflation despite the 3% inflation target? In some ways, that’s the best outcome of all, since, as I explained previously, in that scenario the Fed has solved the nasty problem of all that debt owed by the Treasury.

Targeting inflation is not just another arrow in the quiver; it’s a bazooka, at least for purposes of preventing deflation. Time to take aim and fire.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

interest rates,

deflation,

inflation

So do like FDR did and buy gold.

Interesting topic James. In spite of the empirical relationships, I think it’s too early to play the deflation card. The flight to quality bid in Treasuries is distorting traditional metrics. Yields fall each time a new source of fear pops up. (most recently, Citi Group). This morning we find that the immediate crisis at Citi has been ‘solved’ and we see yields on treasuries rising, equities and commodities rising, and the dollar falling.

I think a reasonable scenario is that as the global crisis winds down over the next ‘X’ quarters, that funds will flow back out of Treasuries and into risky assets like equities and commodities. Short term Treasury rates will rise and the dollar will depreciate. Rising commodity prices and rising import prices should negate any short term deflation. Note that this scenario would follow several quarters of above average money supply growth which puts upward pressure on long run inflation.

Perhaps deflationary pressures will persist until housing prices bottom. I think the first ‘real’ sign we get that housing prices have bottomed will be the trigger that initiates the above scenario.

I’ve been very happily influenced by your work. I imagined just such scenarios here:

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25199231

Read it and hopefully you’ll get a chuckle.

Gregor

Of course there is deflation. And what’s more its going to get deeper. The falls in October were nothing to what they will be in November and probably December.

Is that a bad thing? I certainly don’t think so. In the short term it means holders of redundant stocks have to write down the value of their inventories, but once that painful process is completed it will restore profit margins and effective demand.

Great call. Any probability Ben and friends will do this anytime soon? Buying assets with value now enables them to precisely control the inevitable inflation down the road.

Won’t buying foreign currencies be seen as mercantalistic and beggaring thy neighbor?

What currencies would we be buying? Euro and Pound? We’re actually doing pretty well against the yen, it was as low as 93 to the dollar last week.

Does Step 3 above mean that the government must begin printing money (as opposed to borrowing it)?

“Step 3 is to start creating money and use it to buy up assets…”

If so, does printing money cause a devaluation and thus a disincentive to those who are now being asked to loan us money to fund the TARP and a possible multi-hundred billion dollar stimulus?

Deflation matters because (with a zero lower bound) it raises real interest rates and so reduces demand for new goods and services. In this context, the CPI is not a useful measure of deflation (nor is trimmed mean). We need to focus instead on the prices of new goods (consumer plus capital) with a high interest elasticity of demand. http://worthwhile.typepad.com/worthwhile_canadian_initi/2008/11/a-useful-definition-of-deflation-the-principle-of-charity.html

the time to change at the Fed was 1987.

Professor,

Paul Krugman recently made the point that the market reacts to both current and FUTURE Fed policy. Given the Fed’s credible promise to maintain price stability, market actors are likely to see any quantitative ease as temporary. Krugman’s point is that the temporary nature of the ease undermines its intended effect (presumably on velocity). He believes that the Fed should behave “irresponsibly” with regard to future inflation, and that will revive velocity.

I suppose your 3% rate comes close to “irresponsibility” in the context of the Fed’s previous 2% target. However, I wonder whether its really enough of a difference to scare cash hoarders.

Michael: The Fed can do this on its own, without needing the Treasury (the government’s tax collection and spending arm) to do anything. Technically, it wouldn’t “print the money”, but simply pay for the assets with new deposits it credits to the Fed accounts of the sellers’ banks.

David Pearson: This is an issue that Paul Krugman and I simply see differently. I believe that (1) the announcement I describe would move expectations, and (2) if it does not, and instead there is no response of inflation, then: “In some ways, that’s the best outcome of all, since, as I explained previously, in that scenario the Fed has solved the nasty problem of all that debt owed by the Treasury.” I have yet to hear a response from Krugman to that last argument.

Professor,

The caption makes it look like you want to change the people at the Fed :-).

I think with all the bailouts going on, and with the massive fiscal stimulus announced by Obama (Summers and Gaithner are not going to worry about deficits), monetary policy makers should simply wait and see.

Oops, it is Geithner.

Professor Hamilton, I made the same argument in an October 2003 paper in Economic Letters entitled “Does Monetary Policy Become More Desirable as it Becomes Less Effective?” I argued that the standard interpretation of IS-LM’s policy implications was backward–and that a flatter LM curve actually made monetary expansion more desirable than fiscal expansion, not less, for the reasons you just outlined. I also have not heard any counterarguments.

I’m discouraged by how few economists understand the role that monetary policy plays in the current crisis. Please keep publicizing this issue.

Professor,

Bernanke was supposed to be an inflation targeting guy. Your suggestion is actually what I expected (hoped) from him when he took over from Greenspan, but he moved into Never-Neverland with his monetary tricks.

Your suggestion would do a lot to bring us back in the right direction and could actually remove much of the monetary errors that have been exacerbating the fiscal errors.

But that is the rub. While your suggestion would probably moderate the monetary problems, it is the fiscal that have the economy in turmoil. Increased social spending/union gifts – even if it is disguised as an auto industry bailout, or relief to home owners, or “solving” the credit crunch, or paying people not to work … I mean unemployment – will require taxes that will sap the capital out of the productive economy and create unemployment.

We need to begin to focus on the fiscal rather than the monetary. The new Obama team appears to be ready to increase taxes, increase regulation compliance costs, and create Hooverite/New Deal social programs all needing funding from the productive segment of society.

But consider, Professor, if your suggestion is ignored, monetary policy will simply amplify the problems with fiscal policy and as a friend said today this will destroy the lives of real people, it is not just academic. And I expect double-digit unemployment by the summer-fall of 2009.

The Fed’s balance sheet is completely wrecked and it would be insolvent under proper accounting. Multiple trillions of dollars of guarantees, negative seigniorage (this one makes me laugh), and other bailouts. Not only does this pose a risk to the credibility of the currency; not only does this call into question the independence of the Fed; but the icing on the cake, it will make it technically difficult to curb inflation if it does happen to succeed through sale of assets.

I guess I see no harm in doubling down on TIPS, because if the Fed recognized even losses incurred to this point it would be the end anyway. They’re the right thing to buy, because it makes deflation appear less, carries a government guarantee, and it decreases our exposure if we do have to massively devalue.

I fear we’re in a positive feedback loop here, though. Increased borrowing by the government causes real interest rates to rise for all borrowers. Credit isn’t exactly easy for them to come by, either. These rising real interest rates make deflation worse. There is another equilibrium state here, and I don’t want to be in it.

I want to see plan D. What do we do if monetization proves counterproductive?

If this proposal has merit, it needs to show it by comparing to Japan’s quantitative easing program. They created a lot of money supply and got very little for it. My opinion is these kinds of proposals will not work because: 1. in being focused, they lack leverage / power to affect very many consumers, and 2. though the Fed has shown it can push with trillions, the deflationary forces are global and push back with many trillions. This is not a US only problem, to state the obvious.

We are not out of the swamp yet, and I think the Fed should keep its powder dry to fix potential future problems with bank solvency. If even a few thousand people loose their savings in a bank failure, we will have problems erupt that are inconceivable. The economy can best be revived through government sponsored spending, e.g., repair bridges, build solar power generators, etc.

Nice post. I think you are right on, JDH. I’ve been waiting and waiting to hear a good response to this option over fiscal policy from the likes of Krugman or Brad DeLong.

I am really surprised they or others are not chiming in about the prospect of printing more money and buying long term bonds. I like to TIPS idea a lot too–that’s a thin market that shoud be easier to manipulate with open market purchases and directly tied to inflation expecations. I guess they sorta chimed in, but not really–they need to flesh out their arguments in much more detail.

Besides, isn’t this exactly what Bernanke always said he would in a situation like this?

Professor,

Eventually, the Treasury debt purchased by the Fed would have to be canceled or repaid.

Let’s assume that canceling the debt is unlikely (as it would damage the Fed’s balance sheet). If the debt is repaid, then the only way Treasury benefits is if the real value of the debt has declined — i.e., if there’s FUTURE inflation. This basically takes you back to Krugman’s argument: if there’s no promise of future inflation, the either 1) the temporary inflation target will have little impact on expectations; or 2) the Treasury will have to repay the debt to the Fed in full (in real terms). Either way, there’s no benefit to Fed policy on either velocity or government liabilities. How do you get around this problem?

To echo Mike Laird above, we need to know much more about why the Japanese version of quantitative easing and inflation targeting failed so miserably. The running theme among all liberals now is that the state can do all things if only it tries. Why will the Fed succeed if only it tries, when the Bank of Japan failed? Because, ipso facto, the BOJ did not really try?

In addition, one could also mention the merits/demerits of an exchange rate target as a producer of inflation.

David Pearson: I’m not following your argument. The Fed buys the TIPS, so now both coupon and principal on that security are owed by the Treasury to the Fed. The Treasury pays the coupon and principal, and the Fed then returns those payments back to the Treasury. If, as you conjecture, there has been no effect on inflation or on expectations, then we’ve gone from an initial situation in which the Treasury had to on net pay a real sum to outside bondholders to a new situation in which the Treasury never has to pay anybody other than itself.

We all have fears, but should fear stop of from acting the way we should be acting. The recent bailout just passed. I still see people living in their fantasy world. A world of dreams of which they think they can live forever, what they dont see is that they are just lying to themselves. First of all lets look at this bill, and its tax breaks Bows and arrows for children. WOW! That sounds very serious. On refrigerators too! Oh my God that is really going to help us. These greedy people in Wall Street are getting away with this. People the government is allowing them to run this government. Not the citizens who work endlessly from pay check to pay check. Or just want a standard home and decent living for their families and children. We are not giving our children a good future. We are giving them one full of debt and hyperinflation. What we dont see is that things are going to get worse because the people on Wall Street once they get their bailout will most probably ditch and run off or find some other way to rip off the world. Who knows but it is said when congress passes a law when they themselves say its flawed and needs improvement and I hope it will work. Okay what is going on here? If its flawed should you not fix it? Improve on it? Nothing comes good from hasty rash decisions? Didnt we learn that in Iraq? We are giving more and more power to individual people and it seems to me this is starting to become the end of our democracy. Our freedoms which are giving to us by the constitution maybe the best piece of legislature we have is being comprised by people who have failed to understand the meaning of this grand work of art and are turning it and twisting it into a dictatorship. A Presidential empire, the senate has proven useless time and time again. The house is partially composed of corrupt politicians and the ones that do know the right things to do are far too few. We are falling to see the end of our own demise people.

It seems to me that the Fed is buying up all sorts of stuff to increase the monetary base,

and the treasury is selling off bucket loads of bonds and with the procedes buying things that the market is selling in a panic. Which seems to me to be along the right lines, but maybe they need to do more of it.

Wouldn’t changing the emphasis for the Fed towards high quality bonds and away from the stuff that isn’t selling so well in the market exacerbate the credit problems because there is already panic buying of high quality government debt?

Andrew: There certainly isn’t “panic buying” of 5-year TIPS, given the current yields that I cite, and that’s where I propose the Fed begins. No, I’m not saying they need to buy more 3-month T-bills.

JDH,

I believe the Fed only returns profits to the Treasury, not assets. It retains the Treasury principle payments and the interest needed to offset its own financing costs (small but no longer zero).

In normal times, Treasury debt payments reduce base money. The Fed then has to decide whether to inject the same amount to neutralize the payment.

In a situation where the Fed is taking back reserves, its stock of Treasuries would be declining. This is equivalent to the Treasury debt being repaid, or to a loss in financing if you want to look at it that way.

Think of it as being the Central Bank of Brazil and not the Fed. How does the Brazilian government benefit from having the CB buy its debt? It still must repay it. The answer is that the Central Bank prints more and more dollars to purchase the debt, and the government’s tax revenues increase accordingly; such that paying back the debt is not a problem. Its all based on the currency being debased. Otherwise the Central Bank would be of no help to the government.

David Pearson: When the Fed buys the security, the Fed is now the owner of that security. So coupon payments from the Treasury to the owner of the security now go from the Treasury to the Fed and from there right back to the Treasury. When the security matures, both the Fed and the Treasury roll over their positions and nothing changes– all coupon payments continue to go from the Treasury to the Fed and from there back to the Treasury.

When the Fed becomes the owner of the security, the practical meaning is that the fiscal obligations that the security imposes for the Treasury have disappeared.

Yes, if there is inflation, that changes the story. But it was your premise, not mine, that the process would cause no inflation. My premise is that 3% inflation is exactly what we were trying to accomplish and exactly what a policy like this can deliver.

Professor,

You pointed to two problems in the current crisis:

1) collapse of housing prices

2) high gasoline prices.

I assert that the two are related. Notice that the price collapse is highest for housing far from urban core. (Anyone have a reference?)

Plan E should be incentives for green energy startups. We have a big menu of choices here:

1) direct federal investment

2) tax holidays for green energy companies

3) production tax credits

4) price floor for oil

5) cap and trade for carbon

6) other incentives for venture capital

This crisis is the a game changer. I’m not sure Plans A,B or C recognize the real problem here.

JDH,

The Treasury is obligated to pay principal on T-bonds held by the Fed. The Fed does not transfer that payment back to the Treasury unless it buys an equal amount of T-bonds.

You are implicitly arguing that the Fed perpetually finances the growth in Treasury liabilities. In that case, yes, a perpetual bond at zero coupon is the same as canceled debt.

However, for the financing to be perpetual, the Fed’s balance sheet can only move in one direction — up. Your scenario implies that the Fed will take back reserves to keep inflation from exceeding 3%. I believe that taking back those reserves would amount to demanding payment of the no-longer-perpetual bond. In that case, the government’s liability would not be reduced by the Fed’s actions.

A Fed who’s balance sheet only moves in one direction is a Fed that creates permanent increases in the price level.

Robert, I wouldn’t be suprised to see that the decline in qualified loan applicants also lags high gas prices.

In addition to the risk introduce by increasing costs and decreasing margins, the response to high prices has been declining fuel efficiency. This just compounds the problem.

I think there are some problems similar to the tragedy of the commons and also incentives and disincentives become counterprodutive if they are excessive. Personally, I think most of your suggestions would fall into the category of excessive and counterproductive. But perhaps I have more faith in people than is warrented. Economics is about social behavior and finance is just a way to track it, and I’ve always found where people are concerned that influence is far more powerful than control.

Dr. Hamilton –

This posting, like several before, continues your advocacy of increased money supply… Unfortunately, in the real world, monetary policy can not dig us out of the hole that securitization and derivative proliferation has placed us:

The US residential R/E market will probably decline 40% by 2011 ($8 Trillion). The US equities market will probably decline about 70% by 2011 from its high ($14 Trillion)… Add-em together, and we have $22 Trillion in market losses…. There are simply NO AVAILABLE ASSETS IN THE REAL ECONOMY to support rational capital growth to balance this level of liquidity destruction!

FACE UP TO IT! Its natural for the economy to go through a period of deflation when the Ponzi scheme collapses… Failure to endure the economic pain only postpones the reckoning a short while longer at a higher level of destruction. Advocating currency growth until 3% inflation occurs will do little except create another bubble of unproductive “investment”.

I’m really kind of surprised by this post, Jim. We’ve had too many instances of the Fed panicking already. One month of a declining CPI is no reason to add to them.

Treasury yields at the short end are very distorted right now. There is evidently a huge demand for short-term nominal T-Bills to be posted as collateral by CDS sellers as the value of the securities they insure decline. For this purpose, a short T-Bill is actually better than straight cash, and this has led to a couple of occasions recently where the T-Bill yield was actually negative, a sure sign that the demand for nominal T-Bills is extraordinarily high.

The correct response to this is not to draw doomsday implications from the TIPS spread, as TIPS bonds are evidently not usable as CDS collateral, and this is what the TIPS spread is reflecting, not a market expectation of deflationary doom.

So what to do? The Treasury should accommodate the unusual demand for short T-Bills by issuing an unusually large number of them and either use the proceeds to retire longer-term debt or leave it on deposit at the Fed and let them buy longer-term instruments with it. The effect is the same either way.

I’m surprised by the six month time horizon. Conventional wisdom is that monetary policy times lags are long (and variable). And that’s the lag to spending/employment/production. Lags to inflation are even longer. Do you think the Fed could influence the inflation rate over the coming six months? I have trouble seeing that, unless they conduct open market operations at the Gap, Macy’s, or WalMart.

(That sounds flippant, but I’m seriously curious.)

JDH,

Looks like the Fed took your advice, except they decided to buy mortgages instead of TIPS.

Robert Baertsch above seeks a reference to connect rising gasoline prices and the collapsing housing market. Joseph Cortright provides an excellent paper at http://www.muninetguide.com/articles/Gas-Prices-Impact-Suburban-Housi-272.php. I have referenced Cortright in an op-ed on TCSdaily.com at http://www.tcsdaily.com/article.aspx?id=112008A. A rising political committment to “get America off carbon fuels” has, in my opinion, played a key role in bringing this current financial crisis. Cortright shows that housing prices have fallen most for houses more distant from central business districts of cities and have even increased for houses close to CBDs. Likewise, cities with better educated residents in the urban core have showed substantially smaller house price declines.

JDH, it looks like the Fed didn’t take either your advice or mine. Shocking !, right. 😉 Rather than focused investments, they went $600 Billion broad, long, and risky in both repayment and interest rate fluctuations.

Time will tell, but I still think they are ignoring the feedback that works in any system. In this case, US bond rates will eventually rise because of the large amounts that’s already been generated and the additional amounts the Obama administration wants to add. Then the Fed’s bond investment in long mortgages will be under water. With higher rates, bond issuance will be debated and criticized. Remember how bond issuance was debated and curtailled in the first Clinton administration? We’ll have to see if this is the kind of Fed that the new administration wants.

A friend sent me an email that contained the following sentence. It is very though provoking and very telling of the mentality at the FED right now.

“It has occurred to me that Bernanke, and Paulson I suppose, have destroyed the Federal Reserve by loading up its balance sheet with junk and thereby turning it into a failed hedge fund.”

Even after all the government shenanigans and machinations, the markets, if left alone, will correct the problems. As an example, the housing market is trying to do just that, and may well have already done so, if left alone.

We have a taxpayer-funded court system to handle bankruptcies, mete out responsibility, and adjudicate fairness, and we have a plethora of government agencies and programs (FDIC, PBGC, SIPC, unemployment insurance, etc.) to cushion the shock of economic adjustment. Let’s assure that these programs are adequately funded, and start acting like we believe in the capitalist, free-market system we’ve been urging on the rest of the world.

There has been far too much over-reaction to events or perceived events. The CPI negative 1 percent for October is mostly in oil and food. Take those two out and the number was -.1 percent. I would submit that CPI dropping 1.2 percent over the course of a year is insignificant, an adjustment. We could all go back to the discussion we had during the summer as to whether the run up in commodity prices was a speculative bubble or not, but oil dropping from $147 to $53 sure looks like a bubble bursting. Americans drove 4 percent less in September of 08 than in September of 07, so the price should go down, but not 60 percent. I looked at the EIA reports the other day, and I am not seeing inventory of refined fuels rising much, certainly not enough to justify a 60 percent drop. Also the March 07 to March O8 drop of 4 percent PRECEDED the big runup in oil prices. What has changed is nobody seems to care anymore what the Nigerian rebels are doing, if Bush or the Israelis are going to bomb Iran. And the “genius” types at Goldman Sachs and Morgan Stanley who were predicting ever and ever higher prices have gotten burned.

Has everybody forgotten the 1.1 percent monthly increase in June, and the .8 percent increase in July? Take the change in the CPI for the last six months, and it would annualize to +3.2 percent. So… since we are already at the target rate, let’s wait for a trend.

This is not deflation, this is just commodities coming back to earth. Bernanke and Paulsen have spread enough panic already, and done enough damage already.

BTW did anyone notice that earlier bailouts are not working as expected? The HUD secretary was on CSpan the other day, and has said that the participation in the federal housing program passed in July is very small, and is puzzled by that. The fact that they did not get it up and running until October 1 might be part of that. We should not constantly blame the Bush Administration, but we have to be honest in saying that these guys are not very competent at dealing with disasters, financial or weather related. Let the Obama people and Congress perform due diligence on stimulus packages, bailouts, and where all the tax money is going that we sent to AIG. Have hearings and do a lot of staff work in December, have some firm plans by January 1, work them through Congress by January 20, ready for Obama’s signature one hour after he gets done with his inaugural speech.

We need to quit reacting and start thinking things through. I have a great deal of respect for the people on this website, but sometimes even you guys can be influenced somewhat by the hysteria out there.

As has been stated previously, it takes quite some time until monetary policy shows some results – unless someone really gets this Bernanke helicopter flying.

However, I remember that the Nixon shock was quite immediate, too. Of course, the situation and the system was different that time, but I wonder if something with similar immediate effects could happen if official targets would be declared on currency exchange rates.

So, what about officially declaring a weaker dollar instead of focusing on a tiny 3% inflation target? Some markets seem to anticipate a weaker dollar anyway.

I have perhaps a silly question about economic stimulus, because it is in some ways the opposite of Keynesian stimulus. Say the administration sent out rebate checks to people but with the objective to make them save it rather than spend it. For example they might deduct a certain amount from their taxes if they saved it somewhere, like in a bank account, and had to pay tax on it if they spent it. What would be the effect of this? Say each person could get a tax rebate of 5% of their income as long as they invested it and if they spent it then they had to repay the 5%.

There is no real multiplier because people are not buying anything with the money unless for an emergency. Instead they save it, likely putting it in a bank. This money helps to make the banks solvent again, the banks would pay interest to these people probably more than the government would be paying to borrow the money and distribute it to people.

Since the tax disadvantages would make it bad to spend, people would not do this unless it was an emergency. So this would rebuild savings more quickly and the money spent might have a high multiplier because it would go on what people really needed, not wasted.

I don’t see what bad effects this policy would have. It is the opposite of what Keynes suggested, creating liquidity with individual people as well as banks. It should not be inflationary because people aren’t spending much of it. It repairs the low savings rate. If the government needed it back then it could change the tax laws so it was recollected in higher taxes.

People might also be allowed to spend the money on something and if they replace it in say 30 days then there would be no tax advantage. So then they could make short term safe investments, such as repairing a car to sell it, start a business, etc.

If a financial stimulus was needed the rules could be changed so people could spend a certain amount of it with no tax penalty. So the effect would be immediate, since the people have the money in the bank already.

RCH, I’m going to jump in and disagree with your plan.

First, I don’t think it is efficient to recapitalize banks by sending money from the treasury to the taxpayer to the banks. Just send it straight to the banks (TARP), if that’s what you want to do.

Second, I’m unconvinced we need to reward savings. During the Great Depression, savings rates rocketed. (But to no avail: People’s assets were declining faster than they could save, so they couldn’t save their way out of declining worth.)

Third, I don’t think you’d raise savings. You’d just displace other savings. This is the constant debate regarding 401(k)s: do they encourage people to save for retirement, or do they simply hand out a tax break for behavior that would’ve occured even w/o a tax incentive?

OTOH, I don’t agree with the Prof.’s plan above either, so who am I to listen to? The prof.’s plan is a good idea, but not with TIPS. Targeting TIPS to raise inflation is like targeting intelligence by ordering teachers to hand out more A grades.

Thanks for the thoughtful reply JJ.

1. I thought of this from watching a video of Peter Schiff:

http://au.youtube.com/watch?v=TP_aJ7LcAAA

He says that a recession is a good thing because it makes people save instead of wasting money. So perhaps encouraging this rather than consumption might make a recession deeper but over quicker.

2. The argument against this would be that tipping points in an economy would cause collapse unless the government stimulates it enough. Fixing a collapsed part of the economy would cost more than the stimulus to tide it over while an orderly reorganization is done.

3. However adding to savings this way costs very little. I believe it is more flexible than TARP because people can choose where to invest the money, using the power of the market instead of socialism. If they were allowed to invest it in stocks as well that could help the stock market from collapsing further.

4. Money in a bank is loaned out at high leverage so this is a kind of multiplier effect, or relveraging. So there is a kind of Keynesian stimulus, but not in consumption. So this stimulus is targeted at insolvency and lack of liquidity using the power of the market.

5. Savings are at a historic low so I doubt the savings would be done otherwise at the moment. Increased savings in the great depression might have been a way the economy was healing itself.

6. If much of the previous rebate checks were saved then this experiment has in effect already been tried, so I wonder if this saving helped solvency in the economy already. I wonder if anyone has looked at the statistics in this way.

7. The question here is also whether this policy would do any harm. It is unlikely it would create an investment boom and bust. The government can always get the money back quickly from raising taxes. It can relax the tax rules so people would suddenly spend it, so it could on a week’s notice get spending into an economy.

8. I doubt I am proposing a magic bullet for the current problems. I was wondering also if there was any research on bolstering savings like this in an economic crisis and how it helped. It seems the opposite of Keynesian stimulus but still has a multiplier effect, so those against Keynes might consider this as the opposite of his policies.

JDH,

What makes you so sure the Fed wants to stop deflation?