The Bush Administration’s last Economic Report of the President [large pdf] (Link updated 1/21/09 12:35pm Pacific) was released on Friday. From Chapter 1:

The Administration’s forecast calls for real GDP to continue to fall in the first half of 2009, with the major declines projected to be concentrated in the fourth quarter of 2008 and the first quarter of 2009. An active monetary policy and Treasury’s injection of assets into financial institutions are expected to ease financial stress and to lead to a rebound in the interest-sensitive sectors of the economy in the second half of 2009.

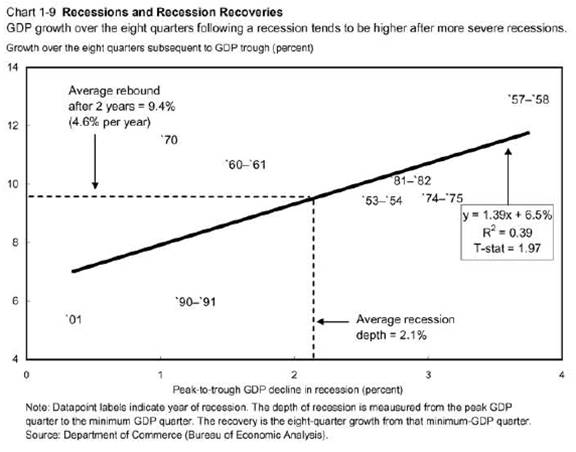

Part of the Bush CEA’s optimism (relative to other forecasts [1], [2]) is based upon this correlation:

Chart 1-9: From Economic Report of the President, 2009 Chapter 1 pdf.

The regression suggests that if the decline in output is severe, then the rebound will be strong. If, on the other hand as indicated in some forecasts, [3], the peak-to-trough decline in output is 2%, then the rebound will be right about on mean value of 4.6% for two years (in other words, we’re right on the dashed lines in the chart).

My one observation is that the last two recession observations (’90-’91; ’01) are substantially below the regression line. One aspect of the 1990-91 recession that seems particularly relevant is the fact that it was accompanied by a capital crunch — that is a crisis that required injections of capital into the banks. In that sense, that recession was conjoined with a financial crisis and a housing crash (see IMF analysis discussed here). So, while I’m hopeful, I’m not too sanguine [4].

I agree. I think the ’90 recession is the one we should be thinking about.

Looking at Figure 1 of this post, the 1990 is one of the only recessions to be still on a downward trajectory this far into the recession.

A regression of rebound against date of recession would, I predict, have a larger R-squared, and would have a pretty small rebound for the current recession.

During the 1990-91 recession, household credit ceased expanding, paving the way for a substantial rebound. Today, household credit has no backing for expansion and the losses in jobs and foreclosures has not yet peaked. I expect the current depression to be much more severe than anything in recent experience. Recent experience is a poor guide to what to expect this time.

For this to be true you have to assume that there is a business cycle exogenous to actual macroeconomics where no one actually has any effect on the outcome. I don’t know of anyone who actually believes this as they are constantly calling on the FED, or congress, or Treasury, or somebody to fix it.

The one element that always seems to be left out of these predictions is the cause of our current problem. If you persist in repeating the policies that actually caused the problem why do you assume that we will come out any time soon.

In truth the timing of the end of the recession is in the hands of Barak Obama. I am hoping that he will use more wisdom than the Republicans did after 2004, but comments like $850-900 billion bailout and “deficits don’t matter” don’t give me a warm fuzzy.

I’m sorta with Ray…for attitude anyhow. Why don’t I have the confidence, even guarded confidence as most of these comments above are, in this linear regression?

It would help if the previous recessions were similarly housing weighted –if MEW was a significant factor in the booms leading up to the bust; if the Finance sector was a similar factor in hogging the recovery efforts/resources as the bust unfolded; if the export-led nations were as coupled with co-venturing transnational corporations in those previous recoveries; if we were not beset by unstable geopolitical burdens taking a sizable portion of those resources.

The present is sufficiently different from the past to discard this projection…such is my respect for linear regressions.

did ‘they’ leave a number to call later in the year for clarification of what went wrong with the execution of ‘the plan’?

R2 is pathetically low–to the point that the trend line shows virtually nothing in terms of predictive value (or even correlation). Obviously part of a small sample problem. Anyone with EXCEL could do a more complete and useful assessment.

Just another (and hopefully last) case of the the Bush Administration manufacturing “intelligence” to fit its policy position.

The 1990-91 recession was only 9 months long, and the total peak-to-trough job loss was less than what has already occurred in this recession (even after adjusting for population). This recession is already 13 months in, and 6 more to go, for a total of 19 months.

The recovery in 2H WILL be strong, because there are just too many things in favor of the recovery by then :

1) Low oil prices for several months

2) Near-zero interest rates

3) Productivity growth remaining high

4) Inventory excess of consumer electronics will be fully flushed out, and new, more advanced products will be out to buy.

5) 500K+ jobs lost per month cannot sustain for more than a few months.

) Low oil prices for several months

>>>>>>>No impact. Min. savings compared to the debt. Eventually we will be giving away gas free.

2) Near-zero interest rates

>>>>>>>No impact. Again, the savings are to minimal. I would raise rates to get this contraction over with sooner. If the FED idiots had done that, the recession would have been sharp but short and over already.

3) Productivity growth remaining high

Uh, that usually is the case in deflation

4) Inventory excess of consumer electronics will be fully flushed out, and new, more advanced products will be out to buy.

>>>>>>>I have heard this before

5) 500K+ jobs lost per month cannot sustain for more than a few months.

>>>>>>>Sure it can.

You don’t respect the amount of debt that it took to fuel the last expansion. If the FED had figured out they needed to rid the debt in 2001, we would have had to solid double dip recession and the massive debt leverage that was encouraged to make the 2001 recession as mild as possible would have been avoided, thus also that debt wouldn’t have become the housing bubble and financial services bubble that is now wrecking the economy. Market forces were pushing for it, they were the ones that wanted it loose and ready. Same as in 1836,1857,1873(really 1871), 1892, 1907,1929 on and on and on. The FED has not stopped leverage bubbles though it is supposed to be its main job.

Bush came at the wrong time. We needed Gore to be a 1 term recession President like W’s father, maybe Jr. would have made it as President, but no, he had to force his way in. He would have beaten Gore EASILY the 2nd time around.

To much debt, we couldn’t expand any further. Now we must pay it off.

This reminds me of the 90-91 recession but 3-5 times as bad.

I think the report has just been moved to Gov. Printing Office site.

” 500K+ jobs lost per month cannot sustain for more than a few months”

Seze who? and why not? The more people out of work this month the less people to buy goods and services next month.

I notice you did not discuss house prices and foreclosures. Who knows where that is going?

All existing realities are relevant for influencing the future – including the possible stimulua package – and the discussion of the possible stimulus package.

prostratedragon: Thanks for the update. I’ve updated the link in the text. Use the search facility here to obtain individual chapter links.

1) Low oil prices are stimulative, just like high oil prices caused trouble.

Saying that ‘we will be giving gas away for free’ immediately loses all credibility you might have had.

2) Low interest rates help corporations, the national debt, and help those who still can hang onto their houses, lock in a lower rate.

3) Productivity being high improves living standards, even amidst deflation.

4) “I have heard this before”. You have not said why it is untrue. I suppose you are stumped.

5) No, job losses over 500K+ per month cannot continue for more than a few months. Lets see if it can sustain for 6 months straight (we have had 2 months of it so far).

Recession ends in August. Job losses moderate by July, and job growth turns positive in March 2010.

THIS IS MEANINGLESS GOBBLEDEGOOK. Where is 1930-1933 on there? What about 1873? Those are the ones you need to be comparing.

It’s not the previous recessions that matter because this is not a recession, it is a global financial crisis. What matters is, first, the private debt level ratio to GDP and second, the bank reserve ratio to loans outstanding. Both are waaayyy to high, at historically unprecedented levels. No fiscal policy will work on this problem. You have to grow GDP signficantly, and to do this you have to undo the free trade agreements that ship U.S. industries to China and India and Mexico. See my website for links and analysis.