Yes, I saw the discouraging headlines. But I also see signs of hope in last week’s economic news.

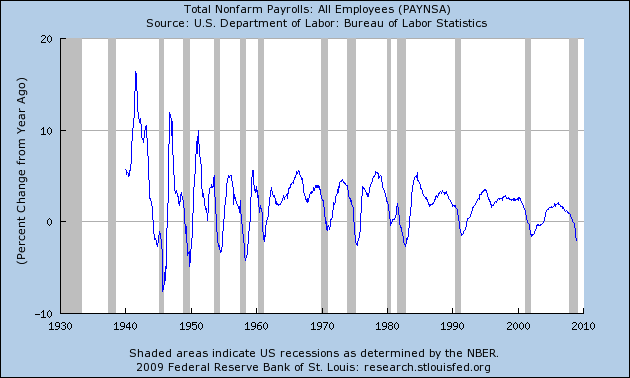

Let me begin by acknowledging the awful employment news. This was undeniably grim, though popular descriptions that BLS had reported the biggest job loss in any calendar year since 1945 are perhaps unnecessarily alarmist. Population growth would naturally mean that both job gains and job losses would be expected to be bigger absolute numbers than they used to be, and there’s no special reason to look at calendar years rather than all 12-month intervals. The graph below shows that in percentage terms, the employment decline so far is similar to what we see in a typical recession.

|

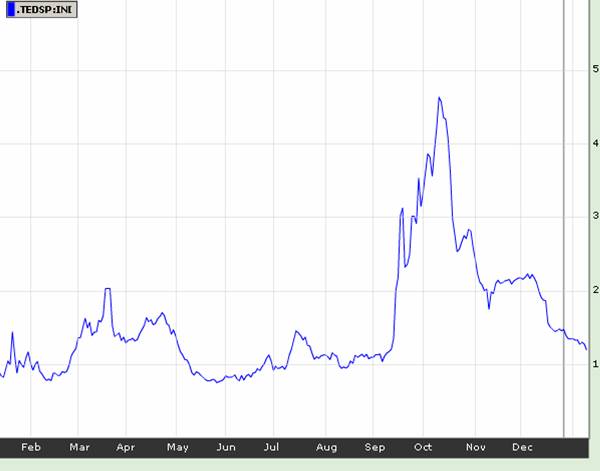

But my primary concern has not been unemployment per se but instead the dysfunctional financial market that produced it. And here there are some encouraging developments. The TED spread is the difference between the 3-month LIBOR rate (an average of interest rates offered in the London interbank market for 3-month dollar-denominated loans) and the 3-month Treasury bill rate. Its spike up last fall was a very troubling indicator of perceived bank risk, flight to quality, and frictions in the interbank lending market. But the TED spread has declined significantly over the last 6 weeks.

|

The gap between the A2/P2 and AA rates, which measures how much more riskier (but still prime) nonfinancial commercial firms must pay to borrow compared with safer borrowers, had also reached scary heights and has also come down significantly.

|

These may be among the developments that persuaded the Federal Reserve it could begin the process of contracting its now enormous balance sheet. The assets of the Federal Reserve had exploded from $940 billion at the beginning of September to $2.3 trillion by the end of the year, as the Fed expanded operations such as its Term Auction Facility, which offered term loans directly to banks at much more favorable rates than the previously spiking LIBOR, and the commercial paper lending facility, which propped up the commercial paper market with direct purchases. The Fed apparently felt comfortable enough with the current situation to reduce these balances by $126 billion during the week ended January 7. More than half of that reduction came from a reduction in the volume of term auction credit outstanding.

|

This reduction in assets was necessarily matched by an equal reduction in liabilities; for details on how this works see my earlier description of the Federal Reserve balance sheet. The primary change last week was a reduction in the Treasury’s accounts with the Fed.

|

The TED spread and A2/P2-AA spread have often exhibited a pattern of temporary respite followed by a resurgence of perceived risk, and the same could certainly happen again. Nevertheless, I read the recent numbers as clearly encouraging.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

interest rates,

term auction facility,

TAF,

Federal Reserve Balance Sheet

credit crunch,

Commercial Paper Funding Facility

Thanks a lot Professor for your info, I felt relief.

Will buy a second car now, already bought a beachfront property. As an ex-member of the GS clan, the last bubble has been my fortune. Originally, we at GS thought it might implode earlier (E2006). The unexpected dynamic in the system took it further into 2007, the popping was louder.

Anyway, as planed and expected the taxpayer payed the bill. Citation R. Fuld from the Lehman gang: “Nobody could be able to know that outcome.”

Although these spread reductions are encouraging, they really don’t measure actual credit availability, which is reduced, and also debt capacity of borrowers, which is also reduced. I’m also suspicious of LIBOR and other “reported” rates because of the scam last year with reported LIBOR rates. I’m most interested in your take on these comments.

Interesting observation. Alternatively, Jim Bianco ( http://www.chicagofed.org/news_and_conferences/conferences_and_events/files/2008_eos_bianco.pdf

) suggests that the TED spread is an example of a “medicated market”.

Imagine a regime in which the TED spread is a useful informationally efficient market based measure of risk. Then imagine another regime in which the TED spread is not a useful informationally efficient market based measure of risk ( Bianco’s hypothesized world of a “medicated market”).

The TED spread seems really useful if you know there is only one regime or if you know which regime you happen to be in

looks as if there is No end in sight with this downward economy

as long as the banks perceive that they will not get re paid monies owed to them they will not originate new loans. feels like a catch 22 turning into a downward spiral. economic conditions worsen because of a lack of liquidity. the banks down want to lend into a down economy. fasb115 needs to be remodified. the government needs to guarnatee not issue bank preferreds let private banks issue new preferreds with a federal government guarantee of performance. make the new guarantee come with the provision that the banks will originate new loans with the money raised.

Bloomberg maintains a Financial Conditions Index (symbol BFCIUS:IND), which is explained at page 12 of this report. The TED Spread and the VIX (VIX:IND) are components of the index. In late September and early October the FCI, which is quoted in standard deviations, dropped to negative 9.47 z. A Bloomberg reporter wrote:

Since then the FCI has crawled back up to -4.81, which is consistent with the other measures discussed above, but not totally normal.

The problem, as I see it, is that all of these measures could return to normal levels, and we could still be in the trough of a recession for sometime to come.

Personally, I think the recession will last until US consumers have repaired their personal balance sheets, and refilled their savings accounts. I think we have a ways to go.

I agree with JDH. Employment is scaring and will continue to deteriorate, but the panic of financial armageddon has started to subside. Banks are more willing to lend to eachother and to consumers, albeit at more restrictive terms. The TARP money banks received has not been a cure all, but it has stablized the banks that received it. The S&P small cap bank industry group is one of the best performing groups over the past 6 months…. hard to believe but true.

The percentage change in non-farm payroll employment tends to support the ‘Great Moderation’ theory, after 1983.

GK what do you mean?

I think the current employment level is weaker than the first graph might suggest. Comparisons to earlier time periods are difficult because of a number of trends, such as the large increases in women in the workforce, worker productivity and immigration. Workers today are far more productive then they were in the early 80’s, so if you lay off a similar percentage of people today as in the 80’s, you have lost far more productive potential. Does this make any sense?

I find this information extremely useful. These facts are not reported with the same vividness as the abnormal growth.

I assume that the panic among banks has subsidied. It should have, given the money the Fed has poured into the financial system.

Question: Is the world financial system now able to survive the failure of AIG? Presumably, Paulson made an accurate judgment months ago that failure of AIG would create world-wide panic. Given the role that AIG played in creating the false sense of security (guraranteeing more contracts than they could back-up), it would seem appropriate that the firm be broken up by bankruptcy, as a warning to other insurance firms.

It also seems appropriate that the government try to collect back some of the money sent to AIG.

Bernanke is trying to return his shop to normal.

Paulson should also try to leave the Treasury Dept with as close to a clean slate as possible. He should change policy regarding AIG before he leaves office, so as to leave on a high note of protecting the U.S. taxpayer, a phrase that comes off his lips often, but is harder to see in his actions.

I’m not buying the optimisim…

The recession just began in October (nevermind the NBER) and we are at the tip of the iceberg right now. What is coming is much worse than we can imagine.

As far as the improved market indicators go, the most objective way to look at it is that the Fed is cooking the books. In other words, the heroin is being supplied liberally. Yes, the market is medicated…

So much for the great moderation. What a joke…

This is absolutely the best site on the net for discussing the Fed Balance sheet! A great place to learn; the Fed Reserve Asset/Liability charts are extremely enlightening.

Interested in pulling the thread a little on the following speculation –

“The Fed apparently felt comfortable enough with the current situation to reduce these balances by $126 billion during the week ended January 7. More than half of that reduction came from a reduction in the volume of term auction credit outstanding.”

Any way to tell whether the Fed felt comfortable reducing the balances, or instead is just pushing on a string? Looking at the bid/cover ratio on the last few TAF auctions, it appears they can’t give money away! In that case, optimism may be premature.

I suspect that these improvement are largely due to direct FED/CB intervention. In particular, the FED has been providing massive support for the commercial paper market. Given recent dislocations in retail, CRE, and trade I would not be surprised to see another wave of credit contraction.

“…unemployment per se but instead the dysfunctional financial market that produced it…”

so artificial (fed induced) spread tightening cures distressed balance sheets and procudes jobs?

the rise in unemloyment started way vefore last autumn and the dysfuntional financial market was a symptom not the cause of a weakening overleveraged economy.

The implication of your piece is that employment will improve as the financial sector heals. This omits consideration of lags and evidence from our last (non-financial) recession.

Employment has fallen with a few month lag on the growing financial crisis and, as yet, not as steeply or as far (hard as that may be to appreciate). It has much further to fall no matter what happens in the financial sector.

Moreover, the “no employment growth” of the US economy as it came out of the last, much less damaging recession suggests that the link between finance/recession and employment is relatively weak.

I believe we will see unemployment move into the low double-digits and not return to something like full employment for a half-dozen years, even with a more aggressive economic recovery program than that laid out by Pres. Elect Obama. Moreover, we will likely be facing decreasing real household income then as inflation surges stemming from ongoing monetary and national debt expansion.

“James Hamilton, economist with the University of California San Diego, said there are signs that housing may be bottoming out. Since July, he said, mortgage rates have dropped by almost half a percentage point, which could be enough to bolster the market.

He noted that it typically takes up to 16 weeks for home prices to reflect changing interest rates, which means that the market could improve soon.

However, there are several factors that could keep prices declining, he said. A spike in loan defaults and foreclosures could give us a much uglier scenario.And home buyers might be slow to enter the market, hoping that the longer they wait to buy a house, the cheaper it will get.

I think it’s a little more likely than not that we have reached the bottom (in housing prices), he said. But there’s still a very significant possibility maybe 30 or 40 percent that things could get much more frightening.”

link to this 2006 article

If you destroy $14 trillion in monetary wealth worldwide (and still counting) but you create $14 trillion in government spending–what is the net effect?

Private wealth has been decimated. It’s on ice and isn’t going to thaw for years. The only silver lining here is that all that “debt” created by governments will carry a low interest rate.

guest: I was misquoted, and did not when speaking to this reporter make any statement whatever about house prices.

The study I described (which you can read for yourself here), refers to a 16-week delay between mortgage rates and the number of new homes sold.

The paper and all my statements to the reporter were about the number of homes sold, not about house prices.

You have 3-1/2 years of statements I made to pour through on Econbrowser, and I defy you to find one that makes any statement whatever about predicting an increase in house prices.

If you have experience in speaking to reporters, perhaps you know that they do not always report what you said.

Oh sure, after I read what I thought you said in the paper about the bottom in house prices, I went out and bought 5 homes on spec. Now I am ruined. When it comes to reporters, in the words of Dennis Green, “They are who we thought they were.”

My apologies though it seems that you get more than your fair share of misquotes as in 2007 they seemed to have done it again:

link to this 2007 article

“But Hamilton did not think such a worst-case scenario is likely.

‘I think there’s some indication, as far as home sales are concerned, that the worst may be behind us, he said.’ ”

guest: The second quote is accurate. I made an inaccurate prediction about the number of homes sold, and made no prediction about the price of houses. I was wrong about what would happen to the number of homes sold in December 2006, and changed my mind shortly afterwards. The key evidence that caused me to change my mind was the information that came out with the failure of New Century Financial in March 2007.

But being still misquoted about house prices 2 years later is irritating.

Now you know how Ponchahantas and her Nation felt, as she told Smith “your countrymen will lie much”.

The media still gets basic, fundamental information about the viability, operation, function and performance of electric vehicles and the infrastructure already available for them completely wrong, several times a day.

Product (and economic) education for the general public in this country is a disgrace. I blame sloppy, lazy marketers. No wonder everyone else is eating our lunch.

Some more words of hope out of the past from a famous person :

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. . . . With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. . . .

Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending . . . fostering constructive innovation that is both responsive to market demand and beneficial to consumers.” (emphasis added)

-Remarks by Chairman Alan Greenspan on Consumer Finance

At the Federal Reserve Systems Fourth Annual Community Affairs Research Conference, Washington, D.C. April 8, 2005

The spread between treasuries and BAA and AAA yields also appears to be peaking. But the improvement is not enough to signal a trend change.

Generally, quality spreads move with capacity utilization. So if they have peaked this would be earlier than normal.

In other markets the junk spread on bb paper improved but the spread for cc credit showed no sign of improvement.

Unemployment is not the result of the financial crisis, but rather can be attributed to the same reason for which we have a financial crisis:

Over production/over capacity in the East and over consumption in the West – which together reflect the global imbalances driven by the wide differential between cost of labor – combined with the substitution of income in the US with debt – combined with the creation of new debt/money by the so-called shadow banking system – combined with the lack of investments in the US due to production being shifted to the East – combined with surplus capital in the US (and elsewhere), finding a home in speculation (money begetting more money), rather than in material productive pursuits – all together constitute the cause.

Just a note –

This is a new ‘don,’ not the one that has been posting here regularly.

Just a note –

Red and blue ‘don’ are not the same people.

what a bunch of crap.

The Fed was the only buyer of MBS today. You think ANYONE is long J6P’s credit at this moment?

This “thaw” is an opportunity to save those THAT CAN BE SAVED: those already underwater or in their own career deathspiral are lost. The question is, can we save the creditworthy and shackle as many reasonably crediworthy consumers to homes before the FFR is over 8% in three years (a high FFR, of course, will devastate home prices, but oh well…)

The Fed can NOT BUY $500B of agencies: it’s PURE AND SIMPLE JAWBONIN’ and Enron accounting, folks.