Some thoughts on the extent of the problem and options for solution.

John Hempton (hat tip: Mark Thoma) offered an interesting perspective on the nature of the current problems facing the banking system. Hempton suggested that there are three different numbers we might use when speaking of the problem assets held by the banking system: (1) the loss that banks have already acknowledged or have made loan loss provisions for, which Hempton puts at around 10%; (2) the loss that banks would face if they had to sell the assets right now, which Hempton puts at 50% or $3 to $4 trillion in losses; (3) the loss that would actually be realized if the assets were held to maturity, which Hempton claims would be 25% or $1.5 to $2 trillion in losses.

A question raised by those last two numbers is why buyers are only willing to pay 50 cents for something that’s ultimately going to be worth 75. Hempton’s explanation is if you buy the assets at 50 cents on the dollar, hold them 5 years over which you’ll collect the interest on that portion of the assets that still represent performing loans, and then receive back 75 cents worth of principal, you’d basically be earning a 15% annual rate of return as compensation for the risk of holding these assets.

As I understand it, Hempton is claiming that there is a probability distribution for what the true value of the assets held to maturity is going to be– might be higher than 75 cents, might be lower than 75 cents, but with expected value of 75 cents. There’s no question that risk premia at the moment are very high, but a figure of a 15% expected return seems hard to defend. The highest differential we’ve seen between Baa-rated and Aaa-rated bonds over the last century was 550 basis points in 1932. The spread fell from 340 basis points in December 2008 to 310 this January.

|

And of course you don’t expect to receive 3.1% more on Baa-rated bonds than on Aaa– 3.1% is the most you could earn. There’s also a probability of default built into those numbers, so the expected excess return– what I would define as the true risk premium– is necessarily smaller than the yield spread itself.

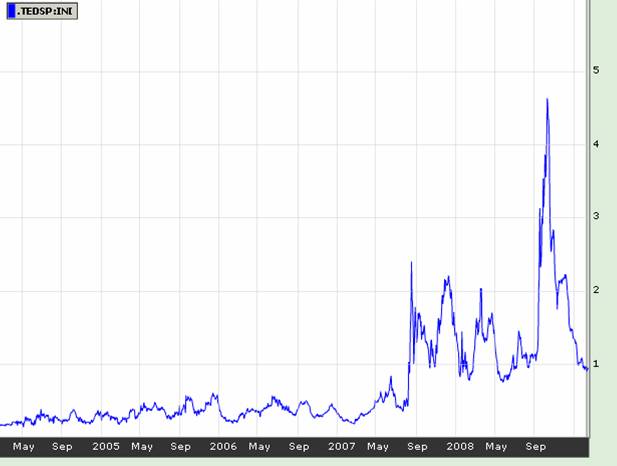

The recent dramatic values for the TED spread also never exceeded 500 basis points.

|

If purchasing bank assets today at 50 cents on the dollar doesn’t offer an expected return as high as 15%, then it’s hard to claim that the expected value of the assets held to maturity is as high as 75 cents. Either 50 cents is too low a valuation, or 75 cents is too high an expectation.

Although I’m not sure which numbers to use, this seems like exactly the right way to frame the problem. Figure out what are the possible parameters for the capital loss that is to be allocated among the various parties— specifically, a loss that must be borne by some combination of stockholders, creditors, managers, employees, and the taxpayers– and try to reconcile those numbers with the current liquidation value of the banks.

Whatever the true value of the assets may be, the perceived value is low enough to prohibit the financial system from functioning effectively in the current environment. So what can we do about it? Greg Mankiw articulates why he thinks nationalization is the wrong concept:

I certainly do not want the government deciding who deserves credit and who does not, what kind of investments are worthy of financing and what kind are not. That is a big step toward crony capitalism, where the politically connected get the goodies, and economic stagnation awaits the rest of us.

If the government is to intervene in a big way to fix the banking system, “nationalization” is the wrong word because it suggests the wrong endgame. If banks are as insolvent as some analysts claim, then the goal should be a massive reorganization of these financial institutions. Some might call it nationalization, but more accurately it would be a type of bankruptcy procedure.

Bankruptcy could become, in effect, a massive bank recapitalization. Essentially, the equity holders are told, “Go away, you have been zeroed out.” The debt holders are told, “Congratulations, you are the new equity holders.” Suddenly, these financial organizations have a lot more equity capital and not a shred of debt! And all done without a penny of taxpayer money!

For myself, I don’t know the true value of the assets, but I suspect it’s well below 90 cents on the dollar. And I fear that the debt-for-equity swap, though attractive in principle, could prove to be quite a destabilizing process. It would be nice if there were a painless way out of this, but I don’t see one.

What we need is not a painless resolution of the crisis, but rather a plan that puts the pain behind us.

Technorati Tags: macroeconomics,

economics,

bailouts,

interest rates,

credit crunch

uh…It’s great!

I’m not sure that I completely agree with your assessment that the risk premia for troubled mortgage securities is too high. I speak, not as a theoretical economist, but a participant in the non-agency mortgage market.

1. while there is a range of outcomes for non-agency mortgages, I don’t think it is possible to determine what the *expected* return is. anyone who pretends to is a liar or fool.

there are three reasons why it’s impossible to determine the expected principal return on a non-agency mortgage:

a. the level of defaults is a function of home prices and unemployment. unfortunately no one has a good model for expected defaults in this type of economic environment. there is some evidence from regional price cycles in the 80’s, but those were completely different animals. there, the price declines were a function of unemployment. in this cycle, unemployment is arguably a function of the price declines!

b. the severity calculation very much depends on what happens to home prices. there is a great deal of uncertainty about where home prices settle out. in order to calculate an expected value for a non-agency mortgage pool, one must have a probability density function for trough home prices. again, a very difficult set of inputs to develop with any precision.

c. even those of us who feel that we’ve tackled #1 and #2 have no way to handicap the ways in which political risk can impact non-agency MBS values. it’s all fine and good for the academic crowd to argue about how cramdowns may reduce the dead-weight loss associated with foreclosures. however, everyone needs to understand that this directly contributes to risk aversion among non-agency MBS investors – and hence an erosion of bank capital levels.

i am not going to put my shareholders’ hard earned money at risk in a pool of non-agency mortgages for a mere 300bps over the Baa rate. the risk profile once the politicians begin re-writing contract law is far too high. this is equity risk and i need to be compensated accordingly.

2. the other problem with saying that “problem assets” should trade at 300bps over Baa bonds, adjusted for the expected losses embedded in the security, is that this analysis completely misses the fundamental supply/demand dynamic in the market place.

there is a severe shortage of risk capital worldwide right now. there are basically two types of assets: those that are perceived as ultra-safe (government bonds & high quality corporates) which trade at 3-7% yields; and everything else (high yield, equities, real estate, emerging markets) which trade at > 15% yields.

non-agency mortgage definitely fall into the “risk assets” category and therefore are being bench marked against equities, high yield debt and other risky asset classes. right now the only buyers of risk assets are vulture investors who demand unlevered 15-20% returns in order to part with their equity.

as long as they are the only bid in the market for non-agency mortgages, it is highly unlikely that the securities trade anywhere close to what many rational folks would consider “fair value”.

The issue – I am talking junky assets – pools of loans with significant defaults. You can’t borrow to buy them. You can borrow to buy BBBs…

J

In Japans Stagnant Decade, Cautionary Tales for America by Hiroko Tabuchi in the NYTimes on February 12, 2009:

More alarming? Some students of the Japanese debacle say they see a similar train wreck heading for the United States.

I thought America had studied Japans failures, said Hirofumi Gomi, a top official at Japans Financial Services Agency during the crisis. Why is it making the same mistakes?

Many American critics of the plan unveiled Tuesday by Treasury Secretary Timothy F. Geithner said the plan lacked details. Experts on Japan found it timid especially given the size of the banking crisis the administration faces.

I think they know how big it is, but they dont want to say how big it is. Its so big they cant acknowledge it, said John H. Makin, an economist at the American Enterprise Institute, referring to administration officials. The lesson from Japan in the 1990s was that they should have stepped up and nationalized the banks.

Instead, the Japanese first tried many of the same remedies that the Bush administration tried and the Obama administration is trying ultra-low interest rates, fiscal stimulus and ineffective cash infusions, among other things. The Japanese even tried to tap private capital to buy some of the bad assets from banks, as Mr. Geithner proposed.

* * *

Economists say these blunders meant Japans financial system did not start to recover until late 2002, six years after the crisis broke. That year, the government of the reformist leader Junichiro Koizumi ordered a tough audit of the countrys top banks.

Called the Takenaka Plan after Heizo Takenaka, who headed the governments financial reform efforts, the move finally brought the full extent of bad loans to light. Initially, banks lashed out at Mr. Takenaka. The government cant order bank management to do this and that, Yoshifumi Nishikawa, president of the Sumitomo Mitsui Financial Group, complained to the press in October 2002. Its absolutely absurd.

But Mr. Takenaka stood firm. His rallying cry, he said in an interview on Wednesday, was, Dont cover up. Dont distort principles. Follow the rules.

I told the banks clearly, I am in a position to supervise you, Mr. Takenaka said. I told them I am not open to negotiation.

It took three more years to finally get the majority of bad loans off the banks books. Resona Bank, which was found to have insufficient capital, was effectively nationalized.

From 1992 to 2005, Japanese banks wrote off about 96 trillion yen, or about 19 percent of the countrys annual G.D.P. But Mr. Takenakas toughness restored faith in the banks.

That was a turning point in the banking crisis, said Mr. Gomi of the Financial Services Agency, who worked with Mr. Takenaka on the audits.

Instead, the Japanese first tried many of the same remedies that the Bush administration tried and the Obama administration is trying ultra-low interest rates, fiscal stimulus and ineffective cash infusions, among other things.

bondinvestor: I appreciate your insights. It appears that we are using the expression “probability distribution” here in different ways. You are using it to refer to something you have to know, whereas I am using it as something that characterizes the things you don’t know. I assure you that there is a quite detailed mathematical theory supporting my use of the expression, according to which the decisions one makes in the face of unknown magnitudes can necessarily be represented in terms of a probability distribution if those decisions satisfy certain axioms of rationality.

But rather than try to persuade you of the reasonableness of my use of the concepts of probabilities and expectations, let me try to understand better how you are suggesting decisions should be made in the face of these unknowns. You refer to investors who demand 15-20% returns– what exactly do you mean by that? Surely we’d both agree, for the reasons you enumerate, that nobody knows for sure what the returns will be. Are you allowing the possibility that returns could end up being higher than 20% and lower than 15%? Are you thinking both are equally likely? Or are you saying that, if things go well we’ll get 15-20% but there’s a good chance we’ll end up with much less than that, and it’s as compensation for that risk that we need the 15-20%?

John Hempton: I have basically the same question for you. A par-value junk bond of course has a much higher coupon yield than Baa, but its expected yield (in the sense I am using the term) is much lower than its coupon yield because there is a non-negligible risk of default. Is your 75 cents figure and 15% yield an upper bound in the same sense that the coupon on a par-value junk bond is an upper bound on what you’ll actually receive?

The question raised is why buyers are only willing to pay 50 cents for something that’s ultimately going to be worth 75. I would suggest the answer is that buyers need to borrow to buy the risky assets but banks are being irrational and refusing to lend on reasonable terms. This reduces the number of players in the market increasing liquidity risk.

I would argue that in 2006 when spreads on high yield bonds were very narrow there was more risk investing in junk bonds than now when spreads are very wide. But because of the compensation structure in banks, lenders were more willing to lend in 2006 than in 2009.

Here is an article from the Federal Reserve that analyzed the rising junk bond yields during the previous crises.

Rising Junk Bond Yields: Liquidity or Credit Concerns

http://www.frbsf.org/publications/economics/letter/2001/el2001-33.pdf

Here is an interesting statement about the ongoing bank stress test :

http://www.nakedcapitalism.com/2009/02/william-black-there-are-no-real-stress.html

–by William Black and Yves Smith – that is an outsiders view.

From my ex-buddies at GS I heared a loud laugh about that ongoing stress test – that is an insiders view.

Cheers to you american taypayer.

I’m surprised how little discussion there has been of endogeneity of value. Original post and comments seem to assume that the expected value of realized losses is independent of the policy adopted. Is this a good approximation? Surely the total losses to be realized are higher in a “Great Depression” scenario than a “bad recession” scenario. Presumably the policy chosen affects the relative probabilities of those scenarios. Is the resulting endogeneity such that there are multiple equilibria? Or do we have reason to believe the proportion of bad loans is relatively insensitive to the path of the economy?

If the true aggregate value really is 75% five years out, the banks are gone. Let’s just get this over with and move on.

Professor,

This second Great Depression actually does have its silver lining. Many who accepted unproven economic theories are once again learning the wisdom of the great economists. Here we have John Hempton leading us toward the time preference theory of interest. It is a very positive trend because if it is understood the fallacy of the current FED methodology is easily seen.

I would encourage any of you who are lost in the Keynesian economics taught today (as I was in the late 1970s) to discover the writings of the classical economists and let it revolutionize your thinking (as it did mine in the 1980s). These men dealt with the errors of Keynesian mercantilism in the 18th and 19th centuries long before Keynes reintroduced them. There is no need for you to have to suffer the same errors to learn their profound truths.

It will also help you see how quickly we are rushing toward a Fascist totalitarian system of central planning, making the trains run on time.

The assumption that finding the correct valuation of the CDOs on the balance sheet of the banks will ultimately determine the fate of our banking system seems to be only part of the story.

My understanding is that it is not the CDOs themselves that have under-capitalized the banks, but derivatives on the CDOs–the credit default swaps.

The best idea that I have heard about solving this problem is ‘porfolio compression’ or everyone who used these types of assets would have to drop a zero (reduce to 10% of the original face value) these contracts.

This would benefit the most the bank who purchased poor mortgages and took out this type of insurance to hedge their risk. However, the downside is that it hurts most the people who understood early on the mortgage market problems and made a bet against the mortgage market with these instruments.

John Hempton assumes an expected value of 75 on a security trading at 50. Why, he asks, isn’t the market willing to invest at that price? The reason is, probably, that one of his key (implicit) assumptions is wrong.

Is John assuming a normal distribution of outcomes? If so, its likely that the market sees it differently: the distribution is skewed to the downside. The reason is that adverse feedback loops (unemployment leading to credit deterioration leading to unemployment) are much more likely to occur than beneficial ones. Is the mean outcome really 75, or is it skewed lower by the “fat tail”? In short, John, what’s your forecast for unemployment, and have you built in the possibility that the downside risk is greater than the upside?

Policy makers tend to view skewed distributions as irrational. The idea is that the government should step in to “sculpture” the distribution to a more favorable one. This is the essence of the “insurance” idea that gets floated periodically. The problem is that the skewed distribution reflects reality, and that offering insurance to banking system assets merely transfers the tail risk to the government, which of course creates its own uncertainties (and likely explains the performance of the gold price).

John Hempton proposition that there is not enough risk capital to buy these assets is just another way of saying that the risk premium is high.

The probability distribution on potential outcomes is just incredibly wide. Plus, comparisons to the corporage bond market are difficult becuase in that market, you do not have government actions changing the incentives for the borrowers on the fly.

John Hempton says: The spread between the origination value of a loan and its secondary value is huge. It simply makes no sense to originate new loans when you can buy old loans so cheap. Because it makes no sense to originate loans banks will not do it unless they are driven by an institutional imperative (they dont know what else to do) or they are forced to by regulators or they are trying to prove their solvency by using capital (something I have accused Barclays of).

Maybe this is obvious to others, but it’s a bit of a revelation to me. Perhaps it’s just looking at the problem from upside-down, but for me it drives home the point that when the supply of capital is contracting, reasonably priced credit will become increasingly scarce and policymakers will have a tough time counteracting that.

JDH: “What we need is not a painless resolution of the crisis, but rather a plan that puts the pain behind us.” I respectfully disagree. I think we should plan for some pain. Fama, Mankiw, Krugman and others (e.g. Volcker) all seem to agree on the solution – recognize the losses and quit dallying around. Why do you say that solution could be ‘quite destabilizing’? Might it not, with equal likelihood, give heart to markets and bring a much swifter end to our current malaise? The biggest problem I see is that the true losses are still mounting – assets are still overvalued. That is, I disagree with Hempton’s surmise that long run prices will prove higher than current ‘distressed’ prices.

I suspect bondinvestor understands the notion of subjective probability. I suspect bondinvestor believes that in the current environment risk premiums are in fact quite large and much larger for toxic assets that for other risky assets.

This strikes JDH as irrational because it would seem to leave money lying on the table, and I mostly concur. Two buts:

1) The amount of risk (variance around the expectation) is unusually large and that increases the premium even holding the expected value constant.

2) There is plenty of evidence to say people and even whole markets are sometimes irrational, especially in times like now.

These things would also suggest that the right plan should be able to lure private investors to the table so that taxpayers do not have to shoulder all the risk. For one, a good plan will reduce uncertainty and by itself reduce political risk and perhaps even housing market risk. These things may increase expected values and reduce variances. Second, a good plan may get these assets trading again. When assets start trading uncertainty goes down because traders learn about each others information in the price discovery process.

This also suggests there could be real upside potential for taxpayers under the right plan.

Nevertheless, even ‘correct’ valuation of the assets would likely make most banks insolvent, which is why they aren’t trading and why there are no prices and why uncertainty is unusually large.

There is one thing I haven’t seen in all the discussion around the crisis: how have cash flows been affected so far?

Specifically, some people have stopped paying their mortgages, while others continue to pay them but are suspected to be likely to default in the future. What is the magnitude of the defaults so far, in terms of cash flow? In other words, how much of the expected flow of payments on underlying mortgages is still rolling in every month?

Has anyone seen any data on this?

Why do you say that solution could be ‘quite destabilizing’? Might it not, with equal likelihood, give heart to markets and bring a much swifter end to our current malaise?

i surely don’t want to speak for JDH, but following on chris whalen’s recent comments there is a massive political component to forcing haircuts.

the bank bondholders are generally other commercial banks, pension funds, central banks and foreign governments. commercial bank resolutions might cascade down, with defaults begetting more defaults, but the chain would end. pension funds, being already deeply underfunded, are at some point going to have to reduce promised payouts and/or be refunded by government.

but how to manage the threat to central banks and foreign governments — some of whom might not be in a position to survive the losses? particularly when some very large foreign creditors who own lots of this debt are already howling over lehman and wamu, and rattling sabres over being made whole by the american taxpayer? these are very thorny issues — which, to my knowledge, japan never had to confront because of their massive current account surplus and hugely positive NIIP.

JDH is on the right track – 75 cents on the dollar is too high an expected future recovery – The firm I work for is valuing hold to maturity at more like 60 cents on the dollar, which I would characterize as a modestly optimistic assessment of reality. The Fed is guaranteeing $306 billion of Citibank assets for a reason – expect the ultimate loss on that to be in the $100 billion range, as I understand C’s current mark is about 90 cents. This is almost equal to their entire current capital base.

Louis R. Woodhill’s recent article suggests another method to value the assets now and clean up the mess later. It seems worthy of consideration.

http://www.realclearmarkets.com/articles/2009/01/one_way_to_deal_with_toxic_ass.html

Valuable to whom? With the banks able to borrow for free, these are much more valuable to them than to anyone else. Why would they want to sell them if they don’t have to?

Turbo, could you tell us more about how you are getting the “60 cents on the dollar” valuations?

What specific kind of assets are you valuing? What discount rate are you using, and how is this rate adjusted for risk? What assumptions are you using about the uncertainty in the future cash flows, and how are you generating these assumptions?

James Hamilton:

I am not sure if you were referring to a distribution in the total value of the pool of assets or distribution within the pool. Clearly there is some uncertainty about the return of the total pool.

However, this may be dwarfted by uncertainty about the distribution of returns within the pool. Given early reports last year of AAA CDO tranches that went to zero – no recovery, there is probably considerable risk here. Far greater than AAA-BAA spreads.

Moreover, there is a lemons problem. Why is a bank willing to sell THIS set of assets. Is it because they have better projections about its future performance.

What I have not seen are the actual payment scenarios that go with various valuations. For example, what is the payment scenario under which losses are $4 Trillion. I really have to see that.

Given that there is likely to be some recovery – lets just use 50% as a starting place, are we really talking about $8 Trillion in defaults. At that point it is becomes hard for me off the top of my head to think of what collection of final credit products actually sums to $8 Trillion, if we are not counting Agencies.

JDH: “If purchasing bank assets today at 50 cents on the dollar doesn’t offer an expected return as high as 15%, then it’s hard to claim that the expected value of the assets held to maturity is as high as 75 cents. Either 50 cents is too low a valuation, or 75 cents is too high an expectation.”

In an asset pricing framework (e.g. Cochrane’s, where p = E(mx)) there is a coherent relationship between expectations and prices, but right now these instruments are not trading. So is the disparity you note simply a definitional result of lack of equilibrium or the inability of a market to form? I.e. this sort of contradiction is exactly what you would expect when there is no market?

ed – sorry but no. Without wanting to sound like wanker, the 60ish mark on the pool is public knowledge, the details are not. I’m also rounding a little. My ultimate point here is I’d go with a $3T loss estimate, and deal with the problem asap. Depressions result from recessions combined with insolvent financial systems.

Fine, Turbo, but then I’ll have to conclude that your number is completely useless to us, since we have no idea what it is supposed to represent.

There are a variety of ways in which today’s prices may not reflect fair value in the sense of properly discounted cash flows until maturity. I’m currently reading up on bubble mechanisms for a project and found some of the papers touch on the discussion. I’m by far not through yet but thought I’d leave some of my favorites for the more theoretically minded readers.

For example, there is a very nice paper called Mimetic contagion and speculative bubbles in which Andre Orlean shows how it can be rational for investors to go with the flow and imitate each other if the fundamental uncertainty is just big enough. Currently, everybody is kind of pessimistic AND the fundamental uncertainty is very large (as can also be seen in some comments here) so the theory maps quite nicely to what happens.

Harrison and Kreps, in Speculative investor behavior in a stock market with heterogeneous expectations describe what curious thing can happen when people’s expectations (and risk assessments) are all over the map. Namely, you can end up with prices that lie beyond even the fair value estimate of the most optimistic investor (they are treating bubbles there). This is because people do not only take into account the full realization of value (via cash flows) but also the potential/risk of reselling the asset into the market. There are some difficulties to map this theory into our situation but this is a blog comment so indulge me and the idea can still illuminate a very nice part of the story. Concretely, who can still afford a 5 or 10 year horizon to hold the assets to maturity? Everybody but Buffett, it seems, has significant risk of having to sell the assets back into the market and this can lead to a situation where, in the absence of a more optimistic and very, very deep-pocketed arbitrageur, the assets will trade for below the assessment of even the most pessimistic trader.

So, what about the whole competitive market thing? Shouldn’t that prevent such situations? Not necessarily if this segment of the market is dominated by delegated portfolio management, i.e. investing other people’s money. According to The limits of arbitrage by Shleifer and Vishny, even if there are informed parties who are more assured and willing to take the plunge, the pressure by one’s uninformed investors may be such that they can’t or won’t. The outside investors will basically pull their money out of funds or other institutions who want to “touch” toxic or whatever you call them assets, no matter the expected return on them. If you get paid by how much money you manage, you don’t want to aggravate your investors, even if you know it would be best for them. So even if they are really, really sure that there was value in the market, they wouldn’t touch it. At the moment, it’s a majority game for everybody outside distressed specialists.

PS: bondinvestor, srb, those were interesting comments.

You mean other than the fact it’s the mark a major investment bank put on a multi-billion dollar pool of diverse investment grade cdo’s as an arm’s length, good faith hold to maturity valuation? Yep, pretty useless info that.

Turbo, the answer is useless if you don’t know what the question is. That’s true regardless of how reliable the answer-er may be. My questions were not about the details of your model of cash flows, is was about what types of assets you are valuing and what you mean by “value.”

“And I fear that the debt-for-equity swap, though attractive in principle, could prove to be quite a destabilizing process.”

Debt in a bankrupt bank gets converted to equity all the time. FDIC has gotten really good at closing insolvent banks and selling off the assets. Ok, some very big banks may have some critical trading desks or other assets that need to stay in stable operation. I would suspect the FDIC and the Fed could keep these going fine, especially with credit backstops from the Treasury. Also, “destabilizing” compared to what? Trends don’t look great, and with European banks heading down into uncharted conditions, the US government better get moving quick on our insolvent banks. If we don’t, the European’s upcoming crisis will deliver a fait acompli, and we will have far less discretion in how to fix our banks.

I also appreciate the practitioner insights (having been a practitioner myself a long time ago, and learnt the value of such details the hard way).

I have no idea what this is worth in terms of losses, but it occurs to me that, given the non-recourse nature of many US mortgages, there is a danger that it becomes acceptable for almost everyone whose house is worth less than their mortgage debt to simply walk away. Presumably, in this case the losses are much higher than any model of previous experience based on unemployment rates etc would predict, and some probability of this may be discounted.

I thought the biggest problem here was adverse selection.

Basically the current holders of debt have more information about it than potential buyers. So the concern is that while the average security may be worth 75% held to maturity, those likely to be worth more aren’t getting offered, while the securities likely to be worth much less are.

I think Mike Laird makes agood point “there is a danger that it becomes acceptable for almost everyone whose house is worth less than their mortgage debt to simply walk away”

In past housing market busts people mostly stayed put and paid up unless they simply found it impossible to pay up due to loss of job or higher interest rates. This has still happened to a great extent in this bust. I think there are two risks to this though that would see more people walk away.

1. People have very negative feelings towards banks: bailouts big bonuses etc. So they feel that reneging on obligations is no big deal given lack of ethics of other party.

2. Foreclosures are very much a problem of loan viantge – 2005-07 and these are therefore concentrated in new housing estates. Given the level of foreclosures to date these communities could become seriously disfunctional. That would lead to a lot more people walking away.

Clearly the new plan tries to encourage peopel to stay put and so encourages them to bear capital losses in preference to those that hold the loan – in exchange for some deal on the loan.

What I think bondinvestor is talking about here is not only “risk” in the sense of probabiliy distribution but uncertainty. True anyone can form a probability distribution abotu likely future returns – but if you know that’s it’s just a guess and that it maybe radically wrong then you have uncertainty. Investors are adverse to uncertainty.

You have risk distribtion with low uncertainty when you are in situations where you beleive the past probability distribution is a good guide. People are percieiving this situation (correctly I think) as different to the past so they know their best guess could be way off – uncertainty. Economists are good at talking about risk but they tend to ignore uncertainty. So in the real world you want 15% expected returns as a margin for safety in case it turns out you’ve been wrong – and the risk is on the downside.

So the return needs to be high for buyers of the assets. On the other hand banks have the lowest cost of capital and face a whole lot of incentives not to sell and and so not to recognise the losses. In addition they face psycological biases contributing to their feelings against taking the hit: sunk cost, loss aversion etc. So the banks won’t take the hit unless it’s some forced reorg/nationalisation -whatever you want to call it.

Turbo, I’d be most interested in what terminal value you’re using for home prices in your calculation of value.

It seems to me that the 60 cent – 75 cent CDO & mortgage pool valuations assume that we’re close to a bottom in home prices . . . . my perspective just eyeballing Case Shiller data and price-to-rent ratios suggests there’s another 20%-40% downside depending on the regional market, which puts me in the Armageddon camp.

Will be fun to watch the current administration try to prop up home “values” in this environment.

Mankow (?) wants to convert debt into equity and recaptialize the banks by that means.

What is included in debt? HOw do you classify an insurance contract the bank has sold to a private investor to insure that the mortgage he bought will not default? It looks like a form of debt – contingent debt – may be debt. But is not owed today.

How to treat these insurance contracts is the sticky thorne. The toxic assets that cannot be priced are largely credit default swaps that insure mortgage purchasers.

My answer is simple and highly biased. I think such contracts should never have been permitted to be written. They are the ultimately source of the speculators confidence that he will come out ahead, regardless of what happens to the rest of us. We should set up a system whereby banks and insurance companies are allowed to fail AND insurance contracts they sold to pay for mortgage defualts are wiped out – cancelled. This change in public policy would include lots of money for recaptialization of the banking system after the big bang.

One thing we know is what we do not know. We do not know the exact composition and distribution of the “toxic assets” that Paulson, correctly in my mind, identified as the problem to be conquered.

We do not know these things because a 2000 law forbid the Federal government from collecting informtion of the type needed.

The private sector created this problem. I insist that the Federal government should take whatever steps are necessary to insure that the private sector resolve the problem.

The quickest way to do that is to delegitimatize selected “assets” – define them as null and void. Desparate times require desperate measurses. To determine what assets to delegitimatize, we must know how much of what kinds of toxic assets exist so enough of them will be destroyed.

I know this sounds wacky. But thinking along these lines might be more productive than assuming that every potential debt on the books of every bank must be honored.

Uhhhhm where is my bailout???

The 50 or 60 vs. 75 argument is akin to asking how many angels can dance on the head of a pin. There is a huge market dislocation in ALL assets. Oil was 145 and 35 in a period of 8 months.

Sharp price movements require large variation margin for loans, and most mortgage assets are levered. The marks to market caused many mortgage hedge funds to get their assets sold out by their clearing brokers. You’d have to be an idiot, under the current circumstances, to pay full fair estimated value for an asset.

That’s why mark to market is an absurd way to view capital adequacy now. It’s like the Army Corp. of Engineers going to New Orleans, seeing Hurricane Katrina at full flood stage, and proposing to build levees with a large margin of safety during maximum flood stage. Yes, you won’t get hurricane damage, but what a waste of assets.

JDH,

Your argument ignores three important realities:

-Because there is no financing and the range of potential outcomes in this environment is likely skewed toward the downside as was mentioned above equity rates of return are required

-These assets are highly illiquid. The Baa bonds you are using for a spread comparison are far more liquid by comparison. Illiquidity requires a bigger discount.

-These assets are inherently riskier than an index of Baa bonds, they need a bigger spread, independent of the lack of financing or illiquidity.

Yes, but I don’t think the risk is just holding to maturity. There’s also risk of intervention from government to modify (changing bankruptcy laws or something else).

Four days ago, James Hamilton said: “It would be nice if there were a painless way out of this, but I don’t see one.

What we need is not a painless resolution of the crisis, but rather a plan that puts the pain behind us”.

Perhaps I didn’t read the succeeding posts carefully enough, but I did not see an answer to this challenge. I will try.

Clever economists Paul Krugman is upset that current efforts to stop the downturn do not seem to be working. An equally clever columnist (David Brooks) says that sometimes we just have to swallow our sense of outrage at the people that caused this problem and give them more money. No! Because I have a sense of outrage I don’t want them to get any more money. Maybe the answer Krugman is seeking can be found in respecting the perspective of the ordinary citizen.

Current efforts to stop the downturn are not working because the people in charge persist in trying to avoid punishing the culprits. Outsiders like me would gladly support additional federal funds aimed at speeding the death of the big players in this game – AIG and Citigroup for starters. And all the firms to whom they owe credit default swaps can go down the tubes as well. We don’t need these kind of bankers, insurance companies and hedge funds.

I want to see a task force set up in the U.S. Treasury Department assigned the responsibility of drawing up new rules controlling the procedures for dealing with the creditors and counterparties to these firms that are insolvent without federal aid. Current rules and procedures were not designed for current circumstances. Congress will need to pass new bankruptcy laws for banks and insurance firms.

Begin with the procedures currently set up for taking non-bank businesses through Chapter 7. There is a hierarch of which creditors shall be paid in what order. Set up a new hierarchy appropriate to the banks and insurance firms today. First in line would be insured deposits, individual annuities, other contracts whose essential nature was set up years ago, before 2000, that do not involved derivatives or futures or any instruments made legal by the Commodities Futures Modernization Act of 2000. Experts will be needed to define in advance and make public the new order of payments for the existing assets that will protect individual consumers and firms that did not play the game that created the problem. Next will come payback to the Federal government. After all of the “legitimate” liabilities have been taken care of, the remaining assets of the firm can be distributed among remaining creditors. As in Chapter 7, when all the assets have been distributed, all other claims against the firm are worhless.

The purpose of this exercise is to treat the players in the game as piranha and leave them with as little as possible. Low and behold, satifying my thurst for vengance will cleanse the finance system of a large number of the “toxic assets” that are holding back lending. Get rid of toxic assets by insisting that these private contracts with AIG and Citigroup and others do not extend beyond the ability of these firms to pay. If AIG and Citigroup can’t pay, the claim is void.

This is not a quick fix. It is a sure fix.

gaius marius, post of Feb.18, 12;06 PM says there is a massive political component to forced haircuts. Some of the debtors that my scheme above would wipe out are foreigners – suggesting, I suppose, that forced haircuts will destroy the reputation of the U.S. as a safe place for storing funds. In my opinion, that reputation is gone for private firms. Foreigners apparently still think Treasuries are a safe place to put money. How long that reputation will continue will depend, in large part, on whether the U.S. government acts forcefully to dislodge the currently pervasive fear.

It is also the case that pension funds and University endownments will be hurt by forced haircuts. Sorry. You made excellent returns in the past. Let that be your compensation. I feel sorry only for late comers to the game. Late comers always get hurt.

When I posted on calculated risk (at the end of 400+ comments about Giethner) a summary of my proposal that toxic assets have no value above what can be supplied by the remaining assets of current insolvent banks, a guy nameed Beezer posted a way to achieve that objective via nationalization. Sounds like a good idea, on first glance. May not require a new law. I don’t care what means are used, I just want to resolve our current banking problems without providing any more money to the guys that caused the problem.

It would be possible to nationalize the banks only long enough to destroy the value in the toxic assets and then sell them back to the private sector.

Mankiw is a Republican mouthpiece who might be qualified to be an assistant anchor at CNBC.

http://delong.typepad.com/sdj/2009/02/charlatans-and-cranks.html

Republican talking points are bad, mmkay?

Bondinvestor: How, exactly, would any rational person aware of the origination process for loans after 04 (fog a mirror, here’s a million dollars) bid anything more than .05 per dollar for mortgage securities? That’s the fair value – and until the 0.95/1 loss is acknowledged on balance sheets through writedowns, the entire economy will suffer.

What are the political implications of nationalizing a bank that has a Saudi prince as a major shareholder?

Well, thats the answer of nationalization or not.