For people who want an impartial survey of multipliers, see Patrick Van Brusselen, “Fiscal Stabilisation Plans and the Outlook for the World Economy”. It’s a useful antidote to the blogposts that cherry-pick multipliers from a given model to make a given point. The survey ranges over US, euro-area, and Japan; and structural macroeconometric models, DSGEs, and VARs.

The paper also takes a longer run perspective.

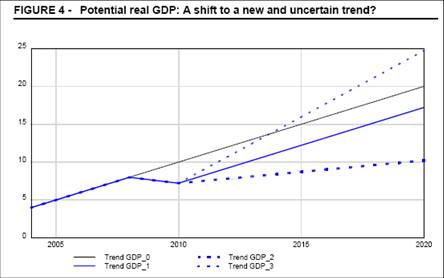

Figure 4 from Patrick Van Brusselen, “Fiscal Stabilisation Plans and the Outlook for the World Economy” NIME POLICY BRIEF

01‐2009 (Federal Planning Bureau, April 2009).

Figure 4 suggests lots of opportunity for econometric testing for trend breaks, difference stationarity and trend stationarity. For some of the reasons of why that debate would be relevant, see here and here.

Technorati Tags: multipliers, recession,

stimulus, potential GDP.

I just skimmed it, but it seems to support that idea that you really need to hit the bad bears with the entire arsenal.

This article just shows that, depending on your view of how the economy works, the multiplier can have a wide range of values. What’s the empirical evidence that the multiplier is not zero as Barro believes and that the Obama administration has not just thrown away a billion dollars?

@Patrick: billion or trillion?

Sam: The paper indicates large differences in multiplier values, depending on the type of model used and underlying assumptions. However, it does not say that all types of models are equally appropriate for analysing particular issues nor that all results are equally plausable in any given situation.

This is a graphical view how large we already loss.

mohel

The governement in the long term controls the MULTIPLIER SIZE!

What we tax dies. Taxes are like chemotherapy a little bit might just drive some businesses off shore. A lot will drive most business off shore and this DECREASES THE MULTIPLIER towards negative numbers.

What the government rewards grows. If I get my welfare check I lose the need to look for work. If when I spend it most of it goes to China the multiplier is samller.

Don W: What the government takes in taxes remains in the economy in the form of transfers, employment, and public expenditure. The important question is: what role do US citizens wish government to play, with what kind of (if any?) redistributive policies.

The endless pursuit of ‘something’ for ‘nothing’.

Malik: sorry I meant trillion

Patrick VB: That was my point–the article does not say which model or multiplier is appropriate in this circumstance but points out that a wide range of values is possible, depending on the model you choose. So I was asking, “What’s the evidence that the multiplier isn’t in fact zero?” as Barro and others have suggested. People seem to throw multiplier values around as if they are universal constants of nature yet when I look at the economic literature I don’t see any compelling arguments that multipliers really exist empirically. I understand the CBO, Fed, etc. have multipliers built into their models but it’s not clear what the real evidence is for having them. I’d like to see some study that shows authoritatively what the multiplier is. I’m sure such a study does not exist, or there wouldn’t be such fundamental disagreements between pro- and anti-Obama economists.

A very useful article. Appears to be evenhanded and includes a wide scope of literature and perspectives. The question of forecasting is exposed in all its difficulty.

Two side points were of great interest to me.

One was the table showing how the expected level of GDP growth for the U.S. for 2009 changed between 2008 and May, 2009, as provided monthly by a group of forecasters assembled by The Economist magazine. The numbers went from a positive 2% + in the early part of 2008 to a minus 2.7% is the most recent month. Like weather forcasting, the shorter the time interval between the forecast and the target date, the better the forecast. Also, extrapolation of recent trends obviously does not work when there is a break in the trend.

Second point that was new to me. The raised the possibility that estimating the contribution of the service sector (specifically the financial sector) to GDP growth greatly overestimated the size of GDP growth for the U.S. One study which attempted to control for this problem produced an estimate of GDP growth which placed the U.S. below developed nations generally. If this turns out to be correct, a lot of papers will need revising (those explaining how Europe should change to become more like the U.

S. and thus enjoy the more rapid GDP growth of the the U.S.)

All in all, a very enjoyable ride. I felt like I was in the hands of someone who was a scholar. expert.