From the CBO’s report “Policies for Increasing Economic Growth and Employment in 2010 and 2011” released Jan 14, is an assessment of the boost to GDP and employment from various policies. Proper consideration of these measures are critical given the prospects for the output gap [0] and employment growth [1].

Table 1: from CBO, “Policies for Increasing Economic Growth and Employment in 2010 and 2011” (Jan. 14, 2010).

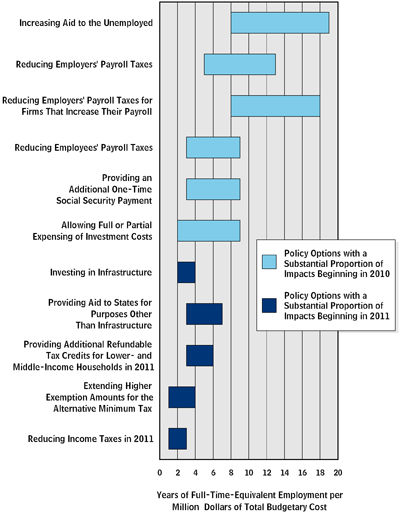

The estimates of employment effects are summarized in a graphic form in this chart from the CBO Director’s blog post on this report. Notice that employment and GDP not necessarily ranked similarly.

Figure from CBO Director’s blog

Interestingly, the two policies that have the maximal (and mean of range) impact on employment are “Increasing aid to the unemployed”, and “Reducing Employers’ Payroll Taxes for Firms That Increase Their Payroll”. Both of these have larger impacts than measures that take away revenue streams from Social Security. The former measure is described thus:

Under current law,

some people who exhaust their unemployment benefits

by the end of February 2010 will be eligible for additional

weeks of benefits through emergency unemployment

compensation (see Box 1 on page 4). People receiving

those benefits also are eligible to collect an additional

weekly payment of $25; payments for those supplements

are scheduled to phase out beginning in March 2010. In

addition, under amendments to the Consolidated Omnibus

Budget Reconciliation Act of 1985 (COBRA, Public

Law 99-272), the government will pay for 65 percent of

health insurance premiums for up to 15 months for individuals

whose employment was involuntarily terminated

between September 2008 and February 2010. The policy

option analyzed by CBO would provide further assistance

to the unemployed by extending through December

2010 the benefits that will begin to phase out in

March 2010 under current law; under this option, no

added benefits would be paid after July 2011.

The latter measure is described thus:

In the late 1970s, the New Jobs

Tax Credit was enacted in order to increase employment

by reducing labor costs (see Box 5). CBO analyzed a

related policy that would give employers a one-year nonrefundable

credit against their payroll tax liability for

incremental increases in their payrolls during 2010.

Because the credit would be nonrefundable, the credit

amount would not exceed the firm’s payroll tax liability.

Such a credit could be based on payrolls in each calendar

quarter so that firms could receive the credit quickly. To

prevent firms from firing existing employees and hiring

new ones, the credit could be based on the difference

between the wage base in the current quarter and the

wage base four quarters previously (the “reference

period”). Also, to reduce the incentive for firms to delay

hiring or to lower their wage base before the policy was

implemented, the policy could be retroactive to the

beginning of the quarter of enactment. In addition, the

eligible wage base could be capped at an annual amount

for each employee. Wage bases for the Federal Insurance

Contributions Act (up to $106,800 in annual earnings

for 2010) and the Federal Unemployment Tax Act (up to

$7,000 in annual earnings) can be calculated quarterly for

most employers from information already reported to the

Internal Revenue Service, thus reducing the administrative

costs of this option.Providing tax credits for increases in payrolls would

increase both output and employment. The effect on output

would come through the same four channels as the

effect on output of reducing employers’ payroll taxes.

CBO estimates that this option and the preceding one

would have approximately the same economic impact per

dollar of budgetary cost through the first three channels

discussed above. Through the fourth channel, however,

this option provides a substantially larger increase in

employment and hours than the previous option because

this policy would provide tax benefits linked to payroll

growth; fewer budget dollars would be used to cut taxes

for workers who would have been employed anyway, so

the incentive to increase payroll per dollar of forgone revenue

would be greater. However, linking the availability

of the credit to payroll growth would provide no incentive

to maintain employment at firms that have been contracting

and thus less incentive to maintain employment

overall in industries and regions where the economy

remains the weakest.

As noted on Box 4 of the report, in this study, the Fed is assumed to withdraw monetary stimulus in 2011. Hence, the multipliers are smaller in the previous CBO analysis [2].

The report is full of useful information; one interesting tidbit illustrates where the biggest state budget shortfalls are.

Figure 4: from CBO, “Policies for Increasing Economic Growth and Employment in 2010 and 2011” (Jan. 14, 2010).

These shortfalls are something to keep in mind given trends in state and local employment (see Figure 7 in this post).

Update 1/31/10 10pm Pacific: Here is a link to the Bartik-Bishop proposal for an employment tax credit.

Thanks for the detailed summary, but shouldn’t the

last graph use red color instead of light blue for the states without a massive budget shortfall?

More needs to be made of this, because quite a number of public commenters have stated that continued unemployment benefits keep unemployment high.

OK. Well some of that is intuitive. As an employer, I could approve of a short period of tax abatements, up to 100% (including payroll and income tax) for new employees for a period up to, say, three months. Employers (like me) are often uncertain about hiring in difficult times, and such a program would help overcome psychological resistance. And then once someone’s in your office, they will have a tendency to stay. Work expands to fill capacity.

I have no idea why unemployment insurance raises GDP. It reduces the incentive to work. It may be necessary, but I really don’t understand how the payback can be that high.

Finally, the range of outcomes is completely unacceptable. If I am reading the chart correctly, almost every option has the potential to both increase GDP (dollar for dollar c/b > 1) or be a loss-maker (less than 1), and typically by a wide margin. If that’s as close a spread as you can manage, then you’re a lousy analyst. If you presented such numbers to, say, a senior manager at a Fortune 500 company, they would take your head clean off. A coin toss could tell them as much.

It would have been good if other policy options, including the impact of increasing education and health care access, were included in the chart.

Both health care and education spending are investments in the workforce, create jobs (see, for example, a U Mass study http://www.peri.umass.edu/fileadmin/pdf/published_study/spending_priorities_PERI.pdf), and are known to have have high future returns.

Education spending, in particular, has a remarkable return on investment, estimated by the CBO to be 10%:

http://www.cbo.gov/ftpdocs/91xx/doc9135/AppendixA.4.1.shtml

I can safely predict, particularly in light of Mr. Brown’s election in Masschussetts, that the most likley course Congress will take is extending the AMT and extending all of the Bush tax cuts through 2011, the least stimulus band for the deficit buck.

Steve: one of the problems with the F500 environment is that managers demand false precision. The range is probably as wide as presented or wider. Presenting a smaller range is just giving bogus data to generate comfort.

Unemployment benefits get spent, not saved, in general, thus have pretty decent velocity. Most unemployed are not simply expressing their preference for leisure.

Unemployment insurance payments go 100% to consumption. My guess is that the CBO is simply making that assumption, and spitting out the result. I doubt it takes into account the dynamic effect of the increased incentives to remain unemployed. Further, there is simply no way unemployment insurance can result in a net gain of jobs. The job benefits have to be a reduction in job losses (unless we are experiencing deflation).

The fact that $1 million only creates 7 jobs at the most is absurd, if unsurprising for a government program. Under this analysis, the government should just give companies $25,000 for every job they create. That would be 40 jobs per $1 million.

Hell, I’d hire 1000 people as my personal assistants under that scenario.

“…and “Reducing Employers’ Payroll Taxes for Firms That Increase Their Payroll”. Both of these have larger impacts than measures that take away revenue streams from Social Security.”

HUH? How does this not reduce revenue streams to SocSec, even if you assume that every “new hire” was previously unemployed? (Or, if you want to be technical about it, how does this not have a negative impact on the actuarial balance of the SocSecTrustFund?)

Ken Houghton: Yes, you are right. It does, but not anywhere as much as the outright payroll tax reduction options that are suggested.

In response to Ken Houghton and Menzie Chinn, most proposals for reducing payroll taxes on increases in employment would reimburse the Social Security and Medicare Trust Funds for any loss in revenues. For example, that is a feature of the Job Creation Tax Credit proposal that John Bishop and I wrote up in a report for the Economic Policy Institute.

so then why is not the best policy to fire everybody and have the government pay unemployment? We would get the best results based on CBO. Now we know why they said that unemployment would only go to 8% if we passed the stimulus bill. Truly calculations that only Menzie could love. Not very good economics. We need more “Scott Brown” moments so we can stop governement spending and create supply side economics to create jobs. It is not a matter of demand shortage. It is supply of jobs.

Haha. Anyone who thinks that unemployment benefits decreases unemployment has their head up there ***. What you need to account for is the RETURN on investment. The problem with all of keynesian economics is they forget what makes a country rich is high returns on investment. Something that no government cares about. Returns on investment are tangible. I.E. I build a plane and enough people fly it to make me money. They are not economic voodoo.

Truly lousy employment bang-for-the-buck on all of these proposals, as joe pointed out. I’d rather see my tax dollars go to WPA-type programs. The Federal Government hiring has taken a big jump, which I think is probably the most efficient stimulus they have undertaken.

We really need to keep in mind that Treasury will someday have to repay the debt being incurred, so an inefficient jobs program can be worse than no program.

Comparisons with Japan’s debt to GDP ratio are truly nonsense – the Japanese debt is internal, so payments are a net drag on the economy only to the extent that accomplishing the internal transfer is not costless (taxes impose deadweight losses). Much of the U.S. debt, in contrast, is external, and furthermore, much of the increase in this debt from current attempts to maintain AD are funded abroad, which completely negates the stimulus from the borrowing, but does not reduce the future cost.

this is where the problem lies. the assumption is that unemployed spend 100% of benefits thereby increasing the velocity of money and therefore jobs. bad assumptions. maybe in 1875. today’s labor pool is dynamic. if I need to increase production, I can hire in India, China or South America or I can increase productivty with technology. No more jobs. If you want to increase jobs, you need supply side. If I give th employer more money, he needs to earn a return on it. He needs to take a risk to earn his hurdle rate. Expand business and create jobs domestically. Menzie and CBO are flawed with bad assumptions, the results have proved them wrong.

It is always so annoying to read comments that have no factual basis. For instance, tim kemper seems to have a problem with the CBO’s assumption that unemployment dollars have a relatively high velocity. Well, do you have any reason to believe otherwise? I would like to see some analysis to back up your skepticism.

What does 1875 have to do with it? The first government sponsored unemployment insurance system, in England, was started in 1911. The first federal bill in the US was in 1935. How would you have any idea what the velocity of money for unemployment compensation was in 1875? If you are stating that the options for increasing production, as a response to the demand generated by unemployment compensation, are more global today, that is a perfectly reasonable worry. But do the CBO numbers not account for that?

When you say the results have proven them wrong, to what results are you pointing?

When you say it is not a demand shortage, but a supply of jobs, I take that to mean a shortage of demand for jobs. But isn’t the demand for labor tied to the demand for goods and services?