On the one year anniversary of the passage of the ARRA, it seems appropriate to recap, not what the academics say, but what the business sector forecasters say about the impact of the stimulus package.

The Private Sector Forecasters

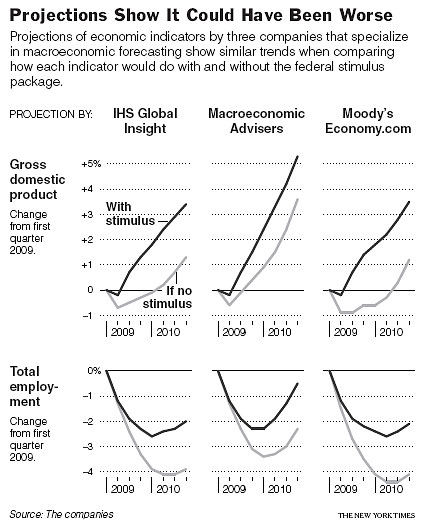

I can think of no better graphic to depict the bottom line that this one, originally posted in November.

Source: J. Calmes and M. Cooper, “New Consensus Sees Stimulus Package as Worthy Step,” NYT (Nov. 21, 2009).

The three forecasting firms represented are fully in the mainstream; the individual forecasters are regularly polled in the WSJ survey, among others. In each of these instances, one cannot resort to the complaint, often leveled by critics against the Administration’s estimates, that no “counterfactual” is estimated (see here). In each case, there a “no stimulus” and a “with stimulus” forecast.

Is there a political bias associated with each of the forecasting firms? I haven’t heard of there being any. Like all forecasters, there are any number of possible biases in play, but partisan effects I’ve never heard of. So, I think David Leonhardt is on safe ground when he concludes “Judging Stimulus by Job Data Reveals Success”:

…Perhaps the best-known economic research firms are IHS Global Insight, Macroeconomic Advisers and Moody’s Economy.com. They all estimate that the bill has added 1.6 million to 1.8 million jobs so far and that its ultimate impact will be roughly 2.5 million jobs. …

This is where many “analysts” (e.g. here) conveniently dismiss these estimates, preferring to focus on the one or two studies (typically from academics) that imply negative effects or near zero effects. Actual economists, such as John Taylor, are more careful; in addition to the conventional models, he cites Barro’s study (previously I have observed the potential sensitivity of Barro’s results to sample — see [0]), and the Smets model. The Smets models is a New Keynesian DSGE. Of course, one can appeal to the IMF’s DSGE, which has a similar assumptions regarding monetary policy, and obtains yet a different result, i.e., much larger multipliers (see a discussion of these DSGE’s [1], [2]).If there is an appropriate criticism of the forecasters listed, it’s that the forecasts are generated using old-fashioned models in the spirit of the neoclassical synthesis (demand determined in short run, supply determined in the long run) with (as I understand it) backwards looking expectations rather than model-consistent expectations. I leave it to the readers whether these characteristics are the biggest sins of macro modelers in the run up to the latest crisis, and the ensuing Great Recession. (After all, one could reasonably argue that assuming perfect capital markets, or a unitary bond market, might be more problematic assumptions that adaptive expectations.) Documentation of these models is floating around; Macroeconomic Advisers’ model is described here; by the way, Macroeconomic Advisers now has its own blog!

What Does a Respected, Non-Partisan, Organization Say?

Finally, we have in the Congressional Budget Office an organization committed to providing nonpartisan views regarding the impact of all sorts of government policies, including the effect of the stimulus package on economic activity. Yet, its assessments in this regard are conveniently ignored, despite its analyses being cited by those same critics when convenient. In any event, in its November update, the CBO presents the range of estimated impact on various measures of economic activity.

Table 1 from CBO, “Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output as of September 2009” (November 2009).

Longer range predictions (from February 2009) are here.

So, in order to make their case, critics who argue that the stimulus package passed a year ago had no positive impact on GDP need to either (1) explain why the commercial forecasters are incorrect in their assessments, (2) why the CBO is similarly misguided, or (3) why their preferred models are superior to the alternative approaches in this context (demonstrating, along the way, their superior predictive power). Until that occurs, I’ll stick with the mainstream. (Caveat: I freely admit I have no access to the simulations from the Fed’s DSGEs, which would also be in what I consider “the mainstream”.)

Additional Reading

In addition to Leonhardt’s story, see also Ezra Klein. For a typical criticism, read Russ Roberts, who mischaracterizes Leonhardt’s statements on ultimate employment impacts; after quoting Leonhardt (the same one reproduced above), Russ writes:

That estimate of job creation is embarrassingly imprecise and the 1.6 million number would not be a conservative estimate but rather the high end estimate.

I believe that the “conservative” adjective applied to the ultimate impact at 2.5 million. Russ should’ve read the February CBO letter, discussed in this post. Taking a look at the 2009Q4 impact, one finds in Table 1 the low end number at 0.8 million, the high end at 2.3 million. The end 2010Q4 impact is low/high 1.2 million/3.6 million.

Technical/quantitative expositions on the stimulus: [3] [4] [5] [6] [7] [8]. Latest CEA report here

[Update: 10:25am Pacific, 19 Feb] Alex Tabarrok asks for analogous plots of the actual data. Here they are, with the same vertical scales and horizontal scales to ease comparability.

Figure 1A: Actual GDP relative to 2009Q1. Source: BEA 2009Q4 advance release, and author’s calculations.

Figure 1B: Actual nonfarm payroll employment relative to 2009M01 (Jan 2010 release, blue; Dec 2009 release, red). Source: BLS January 2010 employment situation release, BLS January 2009 employment situation release (pre-benchmark revision), and author’s calculations.

Using the latest vintage of GDP data, it looks like Macroeconomic Advisers hit closest. On NFP, one needs to consider whether the forecasts were trying to hit the pre-benchmark or post-benchmark values. If pre-benchmark (which seems most reasonable), then I’d say IHT Global Insight forecast was spot on.

I tend to agree with Russ. The reason for the discrepancy in numbers is because he is not using the same numbers as the mainstream.

The idea that the government can create 3.6 million jobs (I know that is the high side), by just printing money and handing it out is somewhat absurd to me.

None of these estimates take account for crowding out.

Your first link is broken and should be https://econbrowser.com/archives/2009/11/baselines_count.html.

Since I’m here: Bob, do you really think that these companies have built huge consulting businesses with models that don’t include an elementary macro concept? If so, that would seem like a massive market failure.

What makes you think they aren’t factoring in crowding out?

If there was business activity to crowd out, we wouldn’t be in a recession. Low interest rates on treasuries tells you that people want to buy treasuries rather than lend money or spend it.

Crowding out is neglible when there is so much slack in capacity and labor.

Bob,

how can it not be obvious that at the moment there is no crowding out going on?

How can you say someone is crowded out if they’re (thus far) not even trying to be in?

Menzie,

It would be very interesting if you could overlay what has actually happened with the forecasts.

Bob: This is a demand-shock recession — collapsing asset prices, credit contraction, income insecurity have all led people to desire a higher level of savings. If the govt doesn’t run larger deficits to accomodate that desire, aggregate demand falls.

In such a situation, with high unemployment and factors of production sitting idle for lack of demand, there’s very little “crowding out”. (At least in the aggregate — it’s possible that the govt has hired so many concrete-pourers for infrastructure projects that a private company wanting to redo its parking lot would be “crowded out”. But since much of the stimulus is in the form of tax cuts, transfers to states so they can maintain their existing spending, etc, and construction overall is incredibly depressed, I doubt its a serious concern).

The other way the term “crowding out” is used is to refer to an increase in interest rates following increased govt debt issuance, thus discouraging financed investment spending. A quick look at interest rates shows that they are still extremely low.

Thoughtful piece.

What is really clear from reading this is that absent direct access to the models and the data, (not to mention the intellectual horsepower to know really understand how the models actually mesh with reality) one must rely on secondary indicators – the pedigree and reputation of forecasters, perhaps their ideological orientation etc.

This seems to be essentially an attempt at an argument from authority – i.e., adverting to the “mainstream” (implication: measured and unbiased of course, not like those crazy free market guys! Those fiscal stimulus “deniers”!). Sort of a “settled science” or “consensus” approach to the question of whether fiscal stimulus works.

Referring to Russ Roberts’ comments as “typical” was nice too (as were the scare quotes on “analysts”). Nothing more damning than to refer to criticism from one’s opponents as “typical”.

We all know that being “respected”, “non-partisan” and “mainstream” are guarantors of correctness.

On the question of predictive power, I’m a bit confused. Doesn’t the debate stem at least in part from the fact that unemployment with stimulus turned out to be substantially greater than the levels of unemployment originally expected for the same period in the absence of stimulus? To which the Keynesian response is in effect “Gosh, don’t pay any attention to our original forecasts of unemployment absent stimulus. Boy, were we wrong! We way underforecast unemployment in the absence of stimulus! Check out our revised hypothetical backcasting exercise based on an unshakeable conviction that stimulus must have worked”. Forgive me but I don’t see the empiricism here.

I second Robert Bell’s concern on the value of mainstream, and the value of comparing forecasts which apparently have a very low probability of actually being supported by even the forecaster 6 months later.

That would be in illustrative chart, probability functions for various economic forecasters against later evidence, and against tendency to support/counter forecasters school of thought.

The “Argument from Authority” doesn’t mean that there aren’t authorities. It means that you’re claiming something is true or proven simply because the authority says so. If you supplement your argument with other sources or provide evidence that you are separately capable of assessing the testimony or evidence of the authority, then it’s not an example of the “Argument from Authority”.

The AFA is most often used by people who really don’t have a clue about the topic discussed but who want desperately to avoid conceding a point in an argument.

In this case, it’s more of an appeal to unbiased sources or non-partisan sources. If you don’t think they exist or these sources aren’t, then you’re not likely to be convinced by anyone citing them. However, that must remain the case even if the sources end up agreeing with you. If people can’t agree on the reliability of sources or even what count’s as evidence in the argument, then you’ve got a problem. As Burke said ( AFA – by me ):

“Before men can transact any affair, they must have a common language to speak otherwise all is cross-purpose and confusion.”

Bob: Did you even bother to look at the documentation for the Macroeconomic Advisers model I provided a link to? If you had just looked a couple slides in, you wouldn’t have written what you did. In fact, James Kwak and anon (12:20 am) are correct with respect to the model, while and Joe, Adam P. and lilnev make an excellent point with respect to current monetary conditions (we’re at the zero interest rate bound right now).

James Kwak: Thanks for alerting me to the broken link; fixed now.

Alex Tabarrok: Good idea; I was puzzling over how to do that (I don’t have the underlying data for the graphs, so I can’t replicate and overlay the data).

david: Good point – I have clarified which people are “analysts” in quotes, and which ones are analysts without quotes.

Well, as somebody who had to suffer through reading papers on the MPS model in grad school, I think I do have some expertise in sorting through the models. At the same time, I don’t deny the expertise of John Taylor (whose book on applying model-consistent expectations to Keynesian type models was a real trend-setter when it came out). But I think if you are going to criticize my assessment, you need to at least enumerate the reasons why your preferred model (or non-model as the case may be) is superior.

Side observation: don’t we often appeal to expertise? If we don’t, should we fire all the teachers K-12, and in the universities, and all be auto-didacts? Just a question.

On your final point of predictive power, I think your critique can be leveled any model then, Keynesian or non-Keynesian (and who the heck uses Keynesian models now? — it’s almost like people use the term in a derogatory fashion without understanding the meaning). For a technical exposition of the point of counterfactuals, forecasting, and shocks, see this post.

I guess they should be firing that overhyped Christina Romer then. Obama could have saved a few deficit dollars by subscribing to Moody’s.

This is very thoughtful and well-argued post. I only have a minor question on a side-issue.

“So, in order to make their case, critics who argue that the stimulus package passed a year ago had no positive impact on GDP need to either [explain] …(3) why their preferred models are superior to the alternative approaches in this context (demonstrating, along the way, their superior predictive power). Until that occurs, I’ll stick with the mainstream. “

Why is superior predictive ability a criterion for evaluating a counter-factual simulation?

Or to put this in more practical terms, isn’t it at this point in the conversation that some bright but dogmatic colleagues emphasize the logical consistency of their models, make a passing reference to the relative accuracy of Copernican models of planetary orbits, and thereby claim that their (quite different) estimates are not only reasonable, but “mainstream” in the sense that their thesis advisor used models with similar assumptions.

Don the libertarian Demecrat [aka Don Boudreaux] says: “It means that you’re claiming something is true or proven simply because the authority says so”. No, not simply because the authority says so. ‘Simply’ because because these are the best macroeconomists in the country. They are experts at what they do.

And they are certainly more accomplished macroeconomists than those who stand by asinine beliefs such as crowding out during a recession or ‘unseen effects’

Juan Carlos,

haha, I hope they are paying attention. Actually, our fearless macroeconomic leader, Ben, did say he was concerned about fiscal crowding out, just as he announced $1.8 trillion in QE. Solved that problem like nuking a cockroach.

One effect I saw was 2009 banking bonuses were $140 billion (earned without lending demand, we amateur economists would have to assume), and the first year part of the fiscal stimulus was about double that, spread amongst the rest of the country presumably, tho I must have missed the meeting where they handed out my share.

So forgive me for not being in awe of macroeconomic models.

P.S. When are they coming out with the model about tax increases, interest rate increases and the effect on the economy? Wait, I know, Stiglitz says we can’t do that and need another stimulus program! Mistake of ’37. you know. They give out Nobel Prizes for saying stuff like that.

Excellent post, Menzie. I just tweeted a link to this page via twitter @erikbryn so more people can see it.

Amazing that only 6% of Americans think ARRA created any jobs at all (according to a recent poll). There’s a big knowledge gap out there.

To Kwak re “do you really think that these companies have built huge consulting businesses with models that don’t include an elementary macro concept?”

Well, they do seem to have built models that didn’t include elementary micro concepts…like “real estate prices could fall.”

To Chinn: After slogging through all of this, including the links, I’m left thinking “one set of models shows that stimulus was effective, and another set does not (Taylor’s point)… assumptions in, assumptions out. No one has “shown” anything about reality, and it isn’t “evidence.” Is this a fair contention?

I think Robert Bell has it right — an observer will find any of the “empirical” results here only as convincing as s/he finds the model, or the expert, in question.

I think again your “predictions” come from bad assumptions. GIGO. You assume therefore it is true. The effect of the stimulus will prove to be less than 1.0 multiplier. You have to believe CBO multiplier to believe the graphs. The results are proving otherwise. Look at the recent continuing umemployment claims as well as weekly unemployment claims. Unemployment is getting worse. Why? Because stagflation is setting in. Wholesale prices jumped even ex energy (Why you ex I don’t know given we all have to pay for it). The govt spent large sums of money at less than a 1.0 multiplier, kept interest rates low for too long and will cause stagflation. We will not hit 5% growth this year. Overall, less than 3% for the year on a very bad last year number. Not enough to create jobs. If Moody’s is correct and the differential is 1.5%, you have created 210B in GDP for spending 400B (assuming we have spent only 50% of stimulus funds to date). Where are you more than 1.0? Menzie, you will owe me money on our bet.

Arnold Kling weighs in here:

http://econlog.econlib.org/archives/2010/02/macroeconometri_1.html

Shouldn’t the debate be about whether the stimulus projects were appropriate use of the funds? After all, 5 million unemployed people could have been given extended unemployment insurance of $20,000 a year for 3 years for $300 billion… half the cost of the stimulus. Seems to me the distributional issues of the stimulus (rust belt versus Fresno) are more relevant. The “jobs saved” seems like a distraction from an analysis that asks a more fundamental question.

Maybe one of our political leaders could have been brave enough to point out that while our current recession was painful to many, we would be a far better nation if we saved $100 billion of the stimulus money and agreed to rapidly authorize emergency relief and rebuild operations that might be predictable, to help neighbors of ours in far worse shape (Haiti? Honduras?).

Of course, we could also have decided to take a small portion of the stimulus (say that same $100 billion per year) and distributed it to the 10 million people of Afghanistan, in tranches of $2500 per person every six months, for a couple of years, provided nobody killed each other. But maybe that would have increased unemployment as our troops came home? On the other hand, that would have been a freebie, since we save about $70 billion a year by not having the troops there in the first place.

Prof Chinn,

I understand how the government creates jobs. The government gives money to construction companies to repair the highways in the Milwaukee area for an example. Then we also have the multiplier from that money.

The only problem I see is, where did that money originally come from? It had to come from somewhere, as it did not just come out of nowhere. The money had to come from the market economy. Therefore this money also destroyed potential jobs/capital. I really don’t see how it would be possible to calculate this number though, as these jobs were never created in the private sector. Thoughts? Thanks in advanced.

Tax cuts have to come from somewhere, so they can’t possibly create new jobs.

Ditto defense spending.

Ana, you’re very right. Your question is an example of the fundamental question that post-Robbins economists have been trying to answer for a long time with limted results: how to allocate resources efficiently. Unfortunately in macroeconomics expertise in data massaging is what matters.

Stimulus is good for 2% of GDP, which equals $280 bn. How much did this cost? I see ARRA listed at $787 billion.

I don’t think anyone would dispute that the government can provide at least temporary employment by spending $300,000 to create a $100,000 job. But without cost-benefit analysis, you really have nothing, only the tautological assertion that government spending can increase current period GDP. So what?

I can appreciate struggling with turgid papers by economists with poor communication skills. But why not struggle a bit more, and put some numbers into excel and run a few irr’s or npv’s? Why not try to actually answer the question, “Was it worth it?”

When was the last government expenditures put at rest? Is this curve a reflexion of past stimuli?

Government expenditures:

http://research.stlouisfed.org/fred2/series/AFEXPND

Did it drive private investments?

http://research.stlouisfed.org/fred2/series/FPIA

To be fair to the forecasters, the 3 listed here are 3 of the more accurate ones. Macroeconomic Advisers is consistently ranked in the top, both in good and bad times. I think that is relevant to Steele and Bell’s points. If Roubini were on the list, I would understand their worries. While their worries are still valid with these forecasters, they should be less troublesome given their track record.

ebh,

Sure, we couldn’t have anyone doing something useful on the list. Like identifying a housing bubble. Or pointing out that integrated banks and investment banks are robbing us blind. Or a global carry trade bubble (funded thru CB near ZIRP policies worldwide) is distorting all markets and in itself will be a problem to exit. Or a global sovereign debt bubble is growing to dangerous proportions (but you can insure it with CDS. Call your insurance company. err, I mean insolvent, too big to fail bank). Give me a math model showing that $787 Billion in US fiscal stimulus impacted GDP and “saved jobs” anyday.

Anybody who imagines there could be no crowding-out effect from >$1 trillion a year of Treasuries sales is bizarrely deluded.

See the Federal Reserve’s latest report on assets and liabilities of US commercial banks (release H8: http://www.federalreserve.gov/releases/h8/current/default.htm).

The category “commercial and industrial loans”, which is where direct lending to business shows up, shrank from $1.6 trillion at the end of Jan. 2009 to $1.32 trillion at the end of Jan 2010. That’s a drop of nearly 17.7% in the volume of outstanding direct bank loans to US companies, in one year. That’s enormous, and clearly demonstrates drastically reduced access to debt funding for US companies, especially for smaller companies that don’t have the alternative of selling bonds.

In the same period, US commercial banks’ holdings of Treasuries and GSE debt grew from $1.27 trillion to $1.43 trillion. That’s an increase of 12.5%. This was during a period when overall banking assets shrank by 3.8%, so any increase in commercial banks’ holdings of Treasuries could only come at the expense of a disproportionate reduction of some other category (or categories) of bank credit.

If you don’t call that “crowding out”, then you don’t know what the term means.

Simon van Norden: A good point, but I think predictive power should be one (not necessarily the major) criterion for whether a model is useful or not. Certainly it shouldn’t be the key one — if it were, we should always be using VARs.

Cedric Regula: I regret I cannot understand the point of your comment. The model you are referring to sounds like a finance-sector type model, while we are talking about macro models. Finance and macro are related, but have different foci.

Eric Brynjolfsson: Many thanks for the help in getting the word out. Indeed, nihilistic no-nothingness abounds, and we need to do everything possible to get people to think intelligently about the issues.

Charles N. Steele: Not certain you are talking about the macro models, or the pricing and risk assessment models used by the ratings agencies and the investment banks. There is a world of difference.

tim kemper: Implicit in your discussion is (1) a counterfactual path for the GDP, but instead of having a formal model, you pull a given trajectory a priori out of your head; and (2) a belief that I think that the multiplier is greater than unity.

On point (1), that’s certainly your perogative. For me, I’ll stick with models — and that was the entire point of the post. Serious economists have to rely upon some sort of model; with the RBC’ers and other DSGE’ers we have that common point of reference.

Regarding point (2), I believe I have been consistent in stating that not all government measures would necessarily have a multiplier greater than one. In fact, if you take a look through the posts under the multiplier category, you’ll see various tables that elucidate that point.

Greg Ransom: Thanks. Wow. People use “add factors”.

Ana: See this post.

Tom Long: When there is slack in the economy, then reallocating resources can yield increased output. If you rule out slack (perhaps because the price level can adjust with perfect flexibility to set aggregate demand to aggregate supply), then your point has more force.

Steven Kopits: If you look back into the theoretical underpinnings of benefit-cost analyses (the original Little-Mirrlees work), I believe you will find that one needs to determine the shadow price of the inputs. At full employment (no slack in the economy, no distortions), these would equal the market price. However, in the absence of these assumptions, one has to be careful (in many ways — I’d have to dig up my economic development notes to enumerate them all). Particularly relevant to this question is whether there is substantial slack in the economy. Once again, then, reallocating resources when the opportunity cost of their use is low to an activity that yields higher output would lead to a net gain.

By the way, to me, the articles are not particularly turgid, in the same way I suspect physicians reading the latest issue of the New England Journal of Medicine don’t find the articles turgid. So your inability to read through the articles has zero informational content and relevance.

Tom Warner: You can’t be serious. Have you been reading Minnesota Fed working paper 666 over and over again?

Menzie-

As an engineer, I understand the value and the limitations of modeling complex systems. Your efforts to keep us informed of the techniques used to simulate GDP and employment are interesting and informative… Relative to the mainstream forecasters’ prognostications, I find that extrapolated, they predict net job creation to be delayed until sometime between 2011 and 2013 and by extension, we could expect unemployment (U6) to start to be reduced a year later… It’s the destitution and social pathology associated with unemployment that motivates politicians to focus on “job creation” and bubblomics.

Speaking of modeling, the following interview of Benoit Mendelbrot is very thought provoking. Explaining the Wild Things

oh the irony! The NY Times article quotes the IHS Chief Economist, one Mr. Gault. Ayn Rand is rolling over in her grave!!!!!!!

Menzie: “You can’t be serious” isn’t a serious response. If there is a shrinking pool of commercial bank credit, and within that pool one component (holdings of Treasuries) is growing, while another (direct lending to companies) is shrinking disproportionately quickly, then commercial bank holdings of Treasuries are crowding out commercial bank lending. That is what “crowding out” means.

Menzi,

“Finance and macro are related, but have different foci.”

I guess we could call that my point. It’s useful to have a speedometer when driving a car, but you wouldn’t want to ignore the fuel guage.

We know that these models get used by some who are looking for proof that specific policies “worked”, so they tend to be promoted as a holistic cure for what ails us, and that is not the case. The underlying economic driver has been credit expansion of first the private sector and now government sector for this decade, if not for 3 decades. And along with that we have increased the instability of the financial system to make it all possible.

We could say it’s off this topic to say there is anything else to consider but the single econometric model referenced, conclude the policy worked, and now it’s biz as usual. But that seems too simple minded to me, especially when the cost gets charged off elsewhere, and efficacy is not considered (is the activity sustainable and useful) as some have questioned here, and the financial system is on life support.

Tom Warner: The implied NAIRU clearing nominal Fed rate is negative. With a nominal interest rate of zero this means the real interest faced by borrowers is well above the NAIRU clearing rate. In other words, the Treasury is not crowding out private sector demand because there is no private sector demand to crowd out. The normal rules about crowding out do not apply when the implied NAIRU clearing Fed rate is less than zero. It’s a hard concept for folks to understand.

Tom Long: The only problem I see is, where did that money originally come from? It had to come from somewhere, as it did not just come out of nowhere. The money had to come from the market economy.

The economy is awash in savings. Today’s problem is not too much money chasing too few goods; it’s too much money stuffed in a mattress hiding from too many goods. When the private sector won’t soak up savings, then it’s up to the government to step in and do the job.

I’ve noticed that a lot of folks here and at other econ blogs seem to have a hard time distinguishing between recessions caused by aggregate supply shocks and recessions caused by aggregate demand shocks. The lessons of the late 1970s do not apply to today’s problems. Sometimes people overlearn things. Economics is about more than just a supply curve. That’s why I can only scratch my head when I hear people talking about supply side remedies to a demand side problem. It’s as though they were trapped in 1979, complete with wide ties, gold chains and K-C and the Sunshine Band.

Steve Kopits: Stimulus is good for 2% of GDP, which equals $280 bn. How much did this cost? I see ARRA listed at $787 billion.

The govt did not disburse $787 billion. First, the actual stimulus portion of ARRA was only about $710 billion, the rest was just an extension of the AMT adjustment. No one argues with a straight face that extending the AMT stimulated the economy. According to Recovery.gov, the govt awarded $200 billion thru the end of 2009. But that was spread out over 9 months, so the average amount of stimulus in the economy during 2009 was only $100 billion. So basically $100 billion had a cumulative effect of $280 billion, except of course the claim of 2% was not for the entire year’s worth of GDP, but represented a growth rate change based on quarterly GDP data. So it really isn’t $280 billion. A more realistic value would be a cumulative effect of roughly $210 billion over 9 months. That’s still a pretty strong multiplier effect that is consistent with Romer’s expectation. And don’t forget that the stimulus dollars awarded in 2009 will continue to have (diminishing) second order effects through 2010 and 2011.

My question to Dr. Chinn was about macro models only.

So far as I can tell, these exercises in “measuring” the effectiveness of stimulus are demonstrations of what a particular theory or model implies, and not measurement. (This applies equally to proponents and opponents of stimulus.)

This isn’t to say that such exercises have no place, but I think they are being misrepresented as “empirical.” This also helps explain why the “evidence” fails to persuade, without all of us having to accuse each other of dishonesty or idiocy.

The recession was caused the Federal Reserve keeping interest rates too low for too long. This caused mal-investment in some areas, as well as over investment in others (See Ludwig Von Mises work).

The talk of a demand shock recession is wrong. It was not a shock, it was easy to see this coming if you apply Austrian Business Cycle Theory (see FA Hayek’s work that won the Nobel Prize in the 1970’s).

The demand was fake, it was artificial. It was created by the Fed, and it was destined to vanish as soon as they raised rates. If you want to understand the mistakes made, you should look to the group of people who saw this coming as early as 2004 (Austrian Economists).

To Long: Fed interest rate policy surely had an effect, and I think indeed stimulated the housing boom through the sort of Austrian malinvestment mechanism you suggest.

But how can that be the whole story? What about the wave of mortgage fraud that the FBI warned of as early as 2004? What about all the dodgy derivative instruments? Fannie and Freddie creating a market for securitized crap? What about the giants in the shadow banking system (and regular system) gaming the system? William Black’s contention of control fraud? There is more here than the change in the time structure of production of the Mises/Hayek model.

But even more importantly, if you believe in the Austrian view, then why did you ask the earlier question “where does the money come from?” If the Fed can create a stimulus with money and credit from thin air, why can’t Treasury with money and credit from China?

Tom Long: Austrians were also predicting collapses of one sort or another in 1994, 1984, 1974, 1924 and all years in between. A stopped clock is right twice a day. And I would include Austrians in that group of economists who only think in terms of one curve. In any event, the issue in Menzie’s post was the effectiveness of the ARRA stimulus plan…specifically, the effectiveness of ARRA from a mainstream perspective. Austrians mainly like to engage in forensic discussions; they have a lot to say during the autopsy and almost nothing to say in terms of policy prescriptions while the patient is still alive except more purgings, more bleedings and more pain.

Menzie: Okay, so you don’t know what “crowding out” means.

It’s simple, actually. Imagine you’re pouring a heavier, insoluble liquid into a jar full of a lighter liquiod. The lighter liquid gets crowded out.

It’s not really much different with people and markets. In the case we’re discussing, the new “liquid” is Treasuries, which, from the perspective of US commercial banks, currently have a relatively high value/cost ratio. So, US commercial banks are increasing their holdings of Treasuries while reducing their holdings of other kinds of bank credit, especially direct loans to businesses.

Or, analyzed from the side of the company managers, the value/cost ratio of a direct bank loan has been increasing, so their demand for them is reduced. This is happening because banks have other customers who are relatively easier to come to terms with (namely Treasury and the GSEs), reducing banks’ motivation to make more competitive offers on loans to companies. That is how crowding out appears when analyzed from the demand side.

Tom Warner: If I define the investment function for firms to be a simple function of the interest rate, then in a simple two (outside) assets market (bonds, money), then government spending accompanied by a fiscal deficit will under the proper circumstances (a wealth sensitivity of money demand greater than zero) induce portfolio crowding out of investment in addition to the textbook transactions-motivated crowding out. If on the other hand, either (1) the wealth sensitivity of money demand is zero, (2) or monetary policy is sufficiently expansionary, or (3) the interest sensitivity of money demand is sufficiently high (as it might be when at the zero interest rate bound), then portfolio crowding out will not occur. Further, if I make the investment function depend upon income (as it arguably might, as in the standard accelerator model), the a fiscal deficit accompanied by expansionary government spending might actually crowd in investment. For elaboration on points (1)-(3), see this.

By the way, when you wrote regarding Posner’s post on the multiplier and stimulus:

did you mean to defend his mathematical calculations? If so, then I think any intellectual failings I might have are far outweighed by your innumeracy.

Okay, you know of “portfolio crowding out”, which is “higher [government] bond sales, hence higher wealth, and hence higher demand for money which, given the fixed money supply, results in higher interest rates for all income levels” and “transaction crowding out”, which is “higher government spending raises money demand and, given the fixed money supply, higher equilibrium interest rates”.

Those are both subsets of crowding out, neither of which apply to our situation, as we don’t have a fixed money supply.

Crowding out refers to the fact that when government increases bond sales, the extra government demand for credit competes with and crowds out private demand for credit. That has happened.

Tom Warner: That’s your definition. And maybe that’s an interesting definition. What I care about is the impact on the real side of the economy.

Menzie: It has all been laid out with your favorite analysis- compared to baseline. See http://online.wsj.com/article/SB10001424052748704751304575079260144504040.html.

Less than 1.0 multiplier, crowding out and actually negative for GDP.

Bottom line- stimulus was “fool’s money”. Just happens to be that we, the taxpayers,are the fools.

tim kemper: I see you are recycling comments, so let me recycle my riposte. Do you ever read the links I provide? See this post from December of last year, and I’ve commented on this several times since. This is old news. You should definitely read the paper. Ever wonder why the samples used never start after 1953. So I think it’s the right way of thinking about counterfactuals — I just wonder (a lot) about the robustness of the model results. Then I think back to his great error on reading employment data. I still laugh about that each time I think about it.