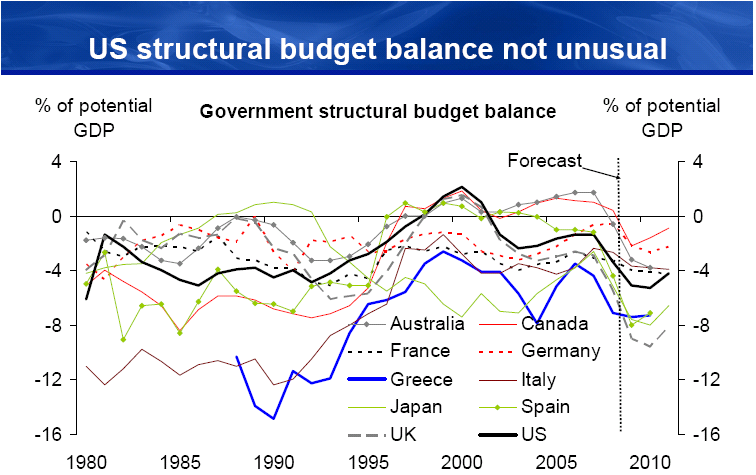

Torsten Slok has a whole set of interesting pictures, two of which are particularly relevant in thinking about the US fiscal situation as compared to other advanced countries.

Gross debt as a share of GDP. Source: personal communication/Torsten Slok, based on IMF WEO data.

Structural budget deficit as a share of GDP. Source: personal communication/Torsten Slok, based on IMF WEO data.

You are leaving out the unfunded social security and medicare liabilities. The ratio looks much worse when you include this.

Menzie, no offense, but you have an affinity for “data” which supports your preconceived notions.

The first graph is downright silly. Not particularly high, because others are higher? That was the hard-nosed reasoning used back in 1999 to explain why dot-com A was fairly valued. You see, dot-coms B and C had even higher valuations!

Two constituencies have made themselves heard over the last couple months on the matter: the people who buy the debt and the people who will ultimately have to pay the debt, the taxpayers.

Neither you nor Krugman, or any number of other bloggers, are going to convince the the buyers to not ask hard questions, nor will you convince taxpayers that the future repayments will be painless. Some people would rather take the pain now, rather than stretch it out over thirty years.

I’m a liberal Democrat, but this “deficit is painless” nonsense is way over-the-top. If you want to make the argument that more stimulus is needed, you had better take a more nuanced approach.

In the movie (and accompanying book) “IOUSA”, David Walker has a great line about such comparisons: “It’s like being the best looking horse at the glue factory.”

I should add (to state what should be obvious) that what really matters is not the current deficits and debt/GDP level, but long-term projections, the drivers thereof, and the risk and cost of delaying the sacrifices needed to shift to a sustainable course.

Bob_in_MA: If you read my posts in this category, you’d see I am quite worried about the long term deficit prospects.

Current position of def/gdp or debt/gdp isn’t really the argument people who are concerned about US fiscal policy would make. It’s the projection to 2020 that seems to concern them. Do we have these data with 10-year projections? I would find that more enlightening.

A feckless effort to soothe us from the Keynsian believers in free lunches.

Observe that all but Australia have an upward trajectory. All are currently paying artificially low interest rates that cannot endure.

The US’s is understated as T-Dub notes. Add the half a trillion that was borrowed off budget this year & next. Also the liabilities of Fannie, Freddie, FDIC, Pension Guaranty, GMAC, etc. that are daily growing.

Reinhardt & Rogoff conclude that when a country’s public debt exceeds 90% of GDP, its economic growth rate slows by 1%. The trajectories in the 1st chart are very likely to steepen. We’ll remember that Menzie assured us it was no big deal.

I’d like to point out to the other commenters that, if you look closely at the first chart, you’ll see that Japan has, for about 12 years already, had a debt-to-GDP ratio that exceeded what the US is projected to have in 2011. Japan has had a lot of pain, but none of it has been the result of excessive public debt (except to the extent that such debt restrained Japan from taking on even more debt, which might have mitigated the pain). Nor have the Japanese government’s creditors suffered major losses.

I’d also like to point out that taxpayers seldom have to repay debt, because, even when the initial debt ratio is quite large, subsequent growth makes it possible to reduce the ratio without reducing the absolute amount of debt.

And I’d also like to point out that some of the largest buyers of US debt are motivated primarily by an intention to keep the dollar strong rather than by an intention to preserve the value of their investment. (Moreover, a reduction in the deficit would weaken the US economy, thereby weakening the dollar, thereby requiring China to buy even more US debt in order to prevent the Renmenbi from appreciating against it.)

When attempting to conduct an analysis of a flawed and broken system one must remember there are only lies, damned lies, and statistics. What we have in America is the classic rate trap that results when one fights the proverbial invisible hand which is code for greedy bankers somewhere.

I strongly caution against drawing conclusions from limited data sets that reek of manipulation. I think the books are cooked.

Japan still has account receivables, a trade surplus, good production & manufacturing capabilities and most importantly, cash on hard.

70% or so of the US economy is based on consumption. The consumer has clearly decided to address debt rather than consuming thus creating a pseudo socialists paradox that by its very nature makes saving good and bad at the same time. The government has broken America with their constant meddling and now seeks complete deindustrialization. Green, hog wash. The fools want green derivatives as if 639 Trillion in derivatives on the books is not enough. A fool is always on the backside of those trades and that shoe has yet to drop and drop it will. America is in managed bankruptcy.

Today a real estate journal indicated that an additional 1.4 trillion in commercial defaults are anticipated. While on the residential side between 3 and 3.4 million foreclosures at an average $180, ooo.oo price point will occur in the coming year. I understand Fanny and Freddie require additional liquidity to the tune of 800 Billion to 1 Trillion dollars. China, Japan, and

Deutschland all are holders of significant treasury issues, another 1.8 to 2.8 Trillion.

Was it not for our complete economic inter-dependence I believe there would be incremental selling today. Then there are the more creative bonds and special instruments, we will not go there as I see nothing that interests me and I do not know what Greenspan was thinking when he unleased this nonsense. I am confident that all agree to some degree that when foreigners are unable to support the house of cards it will fall. How far and how fast, that is as yet indeterminate.

The current leakage of perceived wealth– well, it would frighten even the most useful of the useful idiots. And for the icing on the pie we have the unfunded public and private union liabilities. Who are public unions being protected from I ask, tax payers I suppose? Soon they may require protection as I am witnessing emotions from this country never witnessed by most. I digress.

All programs in America are unsustainable to the point of insanity and I believe them responsible for the current distrust simmering in the backdrop. Young people need to aware and take back their future and stop their sheepish o-baaaaaaa-ma chanting as it reminds one of a very terrible time in history.

I am certain of this. The richest poor people on the planet will be deemed as economically insignificant and therefore expendable for what will be regarded as a greater good. Soon I fear the states wards shall learn what real poverty is. For them, the gravity of the coming hunger and desperate times is inconceivable.

Remember: Deficit spending is nothing more than governmental confiscation and transfer of wealth which in turn retards long term economic prospects and inhibits risk taking by producers and/or builders. It is useful for short durations, not decades.

View America as a giant space ship that is about to crash on a strange and savage land. SHOULD THE VESSELS COMMANDER TRY TO STAY IN SPACE AND REPAIR HIS FATLLY FLAWED CRAFT OR SHALL HE HALT HIS DOOMED VOYAGE IMMEDIATELY, CRASH, SAVE HIS MOST VALUED ASSET; THE PEOPLE, AND BEGIN ANNEW? This I believe is the choice that must be made sooner than later.

The countrys population having decreased by seven percent will and is affecting those states along the southern border, most models clearly dismiss that. I admit to there being some cost savings so it may be a washout.

For me the question is: What would the Austrian school of economic thought and Hayek do?

I think he would want us to take the medicine (yesterday), limit inefficient government spending, cut spending by half and limit circulation. Above all he would encourage us to embrace individualism exceptionalism to unleash the obvious and escape “the road to serfdom” that draws nearer to reality with each passing day . Austrians do cruel math and let real data speak for itself.

I see a severe swing as markets correct and adjust for the coming currency devaluation. I just hope America avoids another war. It is as though human life is but a commodity traded amongst nations usually pretending to share a commonality in interests. History is the key to cheating trends. Guten Nacht: look at 1920 for your answers.

To echo Andy’s point. Interest rates in all of the countries, except Greece are quite low.Mr. market does ot think that the current expected trajectory is worisome.

comparing public debt to GDP is an apples and oranges comparison: public debt is compared to predominantly private production. public+private debt to GDP is a more meaningful comparison, or public debt to tax revenues less government outlays. let’s make another clear distinction here as well: in some countries there are public companies that actually produce and do not simply redistribute tax collections and count this activity towards GDP.

In the micro world,any mature corporation in a mature cycle,with long term debt representing 100 % of its revenues or incomes may likely see its debts rated junks,its bonds prices faliing, its interest rates going very high up.

Derivatives may make wonder until there is no cash available for these instruments and therefore no liquidity. There are no and cannot be, good and bad derivatives in accordance with government trend wishes.

ECB monthly bulletin January 2010 M3 p 27

http://www.ecb.int/pub/pdf/mobu/mb201002en.pdf

Menzie,

The U.S. government is busy hoovering up private credit as fast as it can. Rogoff showed that credit cycles lead to sovereign debt cycles because of that very dynamic. Yet you present government debt to GDP without referencing record, 350%-of-GDP total credit! What has happened since 2007? The U.S. government has all but assumed the debt of the GSE’s and guaranteed about 60% of the short term liabilities of the banking system (TBTF). Neither of these can be found on your public debt to GDP graphs. And if you believe GSE debt is backed by collateral, then you’ve never heard the words “principal forgiveness” or “rent-to-own” uttered by Congressmen.

If you think it is done assuming private credit, you must be very optimistic about the pace of this recovery.

Andy,

-Japan has had a high domestic savings rate. The situation of the U.S. is more similar to countries with chronically low private savings. Needless to say, these can be found in Latin America.

-Total credit to GDP matters because it acts as a brake on growth as consumers and firms (small businesses and financial, in this case) de-lever. The problem with the “hockey stick” approach to debt reduction is that most times times growth materializes to save the day, but some times it doesn’t, and when it doesn’t, the situation is quite dire. So you have a small probability of a very large problem. Most economists deal with this issue by ignoring it, or by proposing that nominal GDP can drag RGDP up with it.

-the motivation to keep the dollar strong stems from a desire to tap into external demand for production surpluses created by too-high investment. If tapping that external demand no longer works, then these countries will face the need to amp-up domestic final demand to maintain employment. The best and easiest way to do that is to revalue the currency. For that, the U.S. would get some export benefit and a great deal of interest rate pain.

T-Dub and kbanaian are right. Let’s add in unfunded pension and medical liabilities and run this forward to 2020. Still think “Don’t worry, be happy,” Menzie?

How many of these other countries have Ponzi schemes instead of actual assets for their national pension plans? I know Canada has real assets in a real fund.

Some people use the term “sovereign debt crisis”, rather than words like “not particularly high”, or “not unusual”. They have more of a view that 9 big bums on a maxed out credit card is “not OK”.

Anyone evaluating credit risk is supposed to look at the entity’s ability to pay, not compare them with other poor credit risks. Or in the case of soveriegns, the ability to inflate away the payments with their printing press powers. With soveriegns, the only other places to get it is personal and corporate tax increases. So total debt load across all levels is what really matters, because they can’t tax it if there is no extra to get.

And the US does NOT EQUAL Japan. Japan is a net exporter of capital, and until recently was a net exporter of products. The US is very much different on these counts.

And if you have been reading the news the past few years, China is of two minds about sending money to the US it may not get back in whole in order to peg the RMB to the dollar. And the US is of two minds about sending China the US economy so that we can borrow the USG to solvency. How many years this can last is anyone’s guess, but I’m pretty sure I’ll live long enough to see it change.

“Mr. Market” has been taken hostage by worldwide massive central bank monetary easing, and if you try to read anything into interest rates about what “Mr. Market” really thinks, you will be off by light years. Not to mention one of our financial innovations from our esteemed investment banks is you can buy insurance against sovereign default (CDS) now, which also helps keep interest rates down. If you believe this situation is somehow different than AIG on steroids.

Add to the liabilities of Fannie, Freddie, FDIC, Pension Guaranty, GMAC, FDIC backed loans to banks (not included in the above USG debt numbers), the USG relaxed mark-to-market rules which make previously insolvent banks look solvent for now. But then everyone knows more RE and CRE defaults are coming, and more bailouts or FDIC closures are on the way.

And if anyone thinks inflation is a painless way out of the debt, I can only assume they were born in the ’90s or later, or maybe have confidence in keeping their government job and its implicit COLA wage contract, backed by the “full faith and credit” of the Fed printing press. But if debt service costs double or triple due to inflation rising, better rethink the safety of the government job.

Menzie, your self-defense at 07:52 PM lends credence to your critics who accuse you of being a partisan Democrat more than an economist.

Your posts in that category are a series of pot shots at George W. Bush, even those posts written long after Bush was out of office.

Like Krugman, you hate deficits when you can pin them on Republicans, but you never criticize Democrat deficits.

Are FHA, Fannie and Freddie included? Negative $trillions, baby, negative $trillions.

Here’s a timely analysis from SocGen, one in the NOT OK crowd, posted at Zero Hedge. At the end of the article he addresses the impact of the “off balance sheet” sovereign liabilities.

http://www.zerohedge.com/article/just-how-ugly-sovereign-default-truth-how-self-delusions-prevent-recognition-reality

OK, I give. Since people have a short memory, take a look at this post on unfunded liabilities. Note the $8.7 trillion item under Medicare Part D. Where were you guys back then?

Menzie,

I have no partisan axe to grind, but regarding your commentary on Medicare Part D, isn’t it the case that what was passed by the Republican-controlled Congress was and signed by the president was LESS costly than what Democrats were seeking (and what candidate Gore had advocated)?

Brooks: I believe there were even lower cost options abounding, including means-testing benefits. My point was that I was highlighting unfunded and contingent liabilities long before it was “fashionable” — at least among this group of commentators. If I may be so presumptuous, let me advertise two academic papers, Chinn, Dooley, Shrestha (1999) and Chinn and Kletzer (2001) (and in a blog context here, in 2007).

You might recall how remarkable the episode was — voting was kept open for hours past regular time, so that Republican leadership could obtain the passing votes.

You’re making my point again, Menzie. You attacked Republican deficits/debt in 2007.

And on Obama’s unprecedented trillion-plus-dollar deficits? Silence.

The point of highlighting the missing liabilities was that these graphs do not provide an apples to apples comparison across countries. The graph is highly misleading in that these liabilities are multiples of the explicit government debt. Many countries have these liabilities either funded or “on the balance sheet” or both. This graph might as well have been a comparison of Enron to other plain vanilla electric utilities.

Menzie,

With all due respect, you didn’t answer my question, so I’ll ask again:

(1) Isn’t it the case that what was passed by the Republican-controlled Congress was and signed by the president was LESS costly than what Democrats were seeking (and what candidate Gore had advocated)?

I ask because Republicans expressing concerns about our medium/long-term fiscal imbalance are often criticized from the left for hypocrisy on the basis that a large, unfunded liability (not even offset in the budget) was created under a Republican-controlled Congress and signed by a Republican president. But it seems that Republicans essentially took a middle course of creating an expensive, unfunded entitlement, largely under political pressure due to Democrats seeking an even more expensive, unfunded entitlement (and thus scoring easy points with the powerful seniors segment and putting themselves in a position to exploit their even less fiscally irresponsible proposal(s) to beat Republicans in subsequent elections with more votes from seniors).

So, while certainly those Republicans can be criticized for the fiscal irresponsibility of that action by those who wanted (or wouldn’t have wanted) a less costly entitlement or no such entitlement at all, it doesn’t seem to make sense for criticism to come from those (Democrats/liberals) who wanted (or would have wanted) an even more costly and even less fiscally responsible version of that entitlement. (2) Do you agree?

As for means testing that entitlement, it seems that Republicans generally supported it, and that, while some Democrats came around to it, there was significant Democratic opposition.

Washington Post, Jun 28, 2003:

the House includes limits on drug subsidies for more affluent Medicare recipients, a change Democrats say would undermine Medicare’s universality and move it toward a welfare approach. The Senate includes no such language, and Kennedy’s filibuster threat on a different means-test issue provided a preview of struggles that are likely to occur over income limits during the House-Senate conference. Both [Bill Frist] and Hastert said yesterday that they want some means testing in the bill’s final version. http://pqasb.pqarchiver.com/washingtonpost/access/352723761.html?FMT=ABS&FMTS=ABS:FT&date=Jun+28%2C+2003&author=Helen+Dewar++and+Amy+Goldstein&pub=The+Washington+Post&edition=&startpage=A.01&desc=Medicare+Expansion+Reaches+Last+Hurdle%3B+House+Vote+Sends+Drug+Benefit+Plan+To+Hill+Negotiators

Also related: http://www.nytimes.com/2003/10/06/us/medicare-plan-raises-the-cost-for-the-affluent.html?scp=1&sq=Medicare+prescription+drug++%22means-test%22&st=nyt

Brooks: I have no partisan axe to grind, but regarding your commentary on Medicare Part D, isn’t it the case that what was passed by the Republican-controlled Congress was and signed by the president was LESS costly than what Democrats were seeking (and what candidate Gore had advocated)?

Absolutely not. The Republican bill took trillions of dollars of government revenues and then passed it through the hands of insurers in the form of subsidies to make sure that they could rake off a portion of the take. This was entirely unnecessary and most inefficient. Medicare already had a very low cost, efficient insurance administration mechanism. Giving the subsidies to private insurers was simply a looting of the treasury for the benefit of insurers. Direct administration by Medicare would have been much cheaper.

Second, the Republican bill forbid by law the government from negotiating with pharmaceutical companies on drug prices. You can’t control costs if you can’t negotiate prices. In this case, the looting was by pharmaceutical companies.

Add to that the fact that the chief architect of the bill was a health industry lobbyist appointed by Bush to be director of the Centers for Medicare and Medicaid Services. Two weeks after the bill passed, Scully was back lobbying for the health care industry, perhaps a record for the revolving door. He was already negotiating for a job with the people benefiting from the bill before the bill even passed.

Scully, under orders from the White House, also illegally threatened to fire the chief actuary for Medicare, Richard Foster, if he disclosed to Congress that cost estimates for the bill greatly exceeded the numbers that the White House was publicly releasing. If the real costs had been disclosed, it is unlikely the bill would have passed.

Medicare Part D without a doubt was one of the most craven, corrupt and expensive pieces of legislation to pass in recent history. Its purpose was to get Bush re-elected in 2004 and the mechanism involved transferring trillions in government revenues to political allies in private insurance and pharmaceuticals. As a two-fer, it was brilliant.

Typo correction: In my 10:29 comment, I meant to say:

“So, while certainly those Republicans can be criticized for the fiscal irresponsibility of that action by those who wanted (or would have wanted) a less costly entitlement…”

Joseph,

You bring up an important point regarding negotiating drug prices and the apparent (unfortunately legal) corruption that seems to have occurred via the revolving door — by the way, you didn’t mention Billy Tauzin, who should be included in that discussion.

That said, the fact (I assume it’s fact) that negotiating drug prices would have brought down costs does not equate to the legislation that Republicans sought and the legislation that was enacted costing as much (let alone more) than what Democrats favored. If you have information to the contrary, please let me know, but I think the Democrats favored a version that would have cost significantly more overall.

The dooooooomers here are surpassing those at Calculated Risk. Keep up the good work guys.

By the way, does anybody recall my post three days prior to this post?

In any case, CR says it better than I do…

And I should add that, were it not for the political pressure from the Democrats seeking such legislation in general (the threat of Democrats’ gaining a large[er] chunk of the senior vote), it’s not at all clear that such legislation would have occurred at all. As I recall, it was something Democrats had pushed for, and Al Gore trumpeted, and Republicans were responding with some lesser benefit at lesser cost to try to avoid getting whacked via the senior vote.

It seems that opposition to means testing was at least mainly from Democrats (see my earlier comment and excerpt from article) and Democrats fought against the “donut hole” in drug coverage (without that coverage gap, cost would obviously be higher). I think those factors (even without others that the Democrats may have favored) probably substantially outweigh the likely savings from drug price negotiation. I searched a bit for dollar figures in articles, CBO’s site, but haven’t gotten anything good (yet). Maybe I’ll search more later. I’d welcome anyone else’s information.

>> By the way, does anybody recall my post three days prior to this post?

Oh, yes, we recall. You managed to say “Bush” twice in the first sentence. And again while focusing on taxes you neglect to even mention spending.

You’re still making my case.

The fiscal situation of the U.S. Government is going from ugly to uglier…

FWIW, my thoughts

http://trueslant.com/michaelpollaro/2010/02/12/u-s-government-on-its-way-to-bankruptcy-part-4/

Menzie and David Pearson et al. The whole discussion here is senseless if you understand the nature of the monetary system. The fact is that debt issuance is voluntary and need not be done at all. US law makes the govt issue debts due to ideological reasons connected to the gold standard. I think you guys should start getting your reserve accounting right and understand bow banking systems and flow of funds work before wasting endless time in writing papers and blogs that “describe” the economy. For starters it will do you good if you start engaging the Modern Monetary theory crowd operation out of the Levy Institute. UMKC and University of New Castle Australia. I seriously wish you can all leave your arrogance out and start from scratch although I have a gut feeling the chances of that happening is close to zilch. Thanks Econrebel 77

Brooks: And I should add that, were it not for the political pressure from the Democrats seeking such legislation in general (the threat of Democrats’ gaining a large[er] chunk of the senior vote), it’s not at all clear that such legislation would have occurred at all.

What! The Democrats made the Republicans pass a corrupt, expensive handout to health insurers and pharmaceutical companies? The Republicans had a majority in congress. Bush announced the plan in July, 2001 when he had been in office less 6 months. All the Democrats voted against it. The White House had to lie to their own delegation about the cost. The Republican speaker of the house had to hold the voting open for an unprecedented three hours because they couldn’t get enough votes to pass. Tom Delay offered a $100,000 bribe on the floor of the House to the campaign fund of one Republican congressman’s son to get the necessary votes. Democrats made them pass the bill?! It’s all their fault? Do you realize how foolish that sounds?

You should also realize that PAYGO rules were in place throughout the 1990s (Clinton administration) and expired in 2002 despite Democratic efforts to renew them. The expiration of the PAYGO rules were what allowed the Republicans to pass the unfunded Medicare bill and the unfunded tax cuts of 2003. Hey, but at least the PAYGO rules were reinstated just in time for the Obama administration.

The idea that conservatives are fiscally responsible has been permanently demolished. Just today the Republicans refused to approve a jobs bill that doesn’t include deficit increasing tax breaks for dead people. One can’t be serious about deficits and at the same time say that the most important issue is tax breaks for dead people. Republicans only pet issue is tax cuts no matter what, and deficits be damned.

Joseph,

The last bunch of Republicans in Congress was not conservative.

That doesn’t mean there are no fiscal conservatives. The Tea Party movement will elect a handful of real fiscal conservatives this November, and a lot of other Congressional Republicans and Democrats will re-discover fiscal conservatism after the massacre they see at the polls.

Viva la revolucion!

I think the argument draws the wrong conclusion.

US debts aren’t bad compared to other western developed countries.

Is like saying my alchol consumption isn’t too much when compared to the drinking habits of my alcholic freinds.

Everyone of those countries is sliding into or is insolvent.

Talk about wrong conclusion. It should be we aren’t on the path to European insovency but we are there!!!

Joseph,

You really should take a deep breath, separate partisan rhetoric from analysis, and engage in the latter rationally.

First, let me be clear that I do not regard either W Bush or Congressional Republicans in those Congresses to be anything anywhere close to fiscally responsible. Same for Democrats. And the same for both today. As is generally the case, Congressional Republicans want to tax too little and spend too much, and Congressional Democrats want to tax a bit more but also spend more, and neither comes anywhere close to addressing our long-term fiscal imbalance despite universal agreement that we are on an unsustainable path. Similarly (perhaps to a lesser degree), most conservatives and most liberals lack seriousness on this issue; they both generally underestimate the necessary total scale of sacrifices and the adverse impact of heavily skewing a “solution” per the extremes of their respective ideologies, and both generally overestimate the political plausibility of their respective ideal, ideologically extreme “solutions” (and I’d include those tea partiers in all of the above, and add that they strike me as populist bunch most of whom combine anger and volume with cluelessness and an ironic sense of superior insight). So I’m not here as either an ideological or party partisan, just trying to make an unbiased, honest assessment.

Now then, with regard to the politics surrounding the creation of Medicare Part D and the particulars, I’m saying that in the years leading up to and including passage, Democrats were essentially on offense and Republicans on defense. For years, Democrats were drivers of the effort to add the prescription drug benefit, and then sought to make that benefit more generous to beneficiaries and more costly overall than Republicans would have liked. Candidate Al Gore pushed the issue, and candidate Bush responded with his own plan in response to that political pressure, and even then Bush’s plan was substantially less expensive. In the 2003 debate, Democrats were the main opposition to means testing and the “doughnut hole” gap in coverage, and wanted a more costly entitlement (and I’d be surprised if savings from drug price negotiation would have offset absence of means testing, avoidance of a coverage gap, and any other areas of additional spending on this benefit favored by Democrats).

You write:

The White House had to lie to their own delegation about the cost…Democrats made them pass the bill?! It’s all their fault? Do you realize how foolish that sounds?

Actually, what sounds foolish is the argument you just presented. You are asserting (1) that Congressional Republicans would have wanted a prescription drug benefit as much as Democrats even if there hadn’t been political pressure created by the Democrats, and that they wanted a higher cost version than the Democrats wanted, and (2) that the only way to get sufficient votes from Congressional Republicans was to dishonestly claim it would cost less than it actually would. Perhaps you should make up your mind between contending that Congressional Republicans wanted to spend more vs. contending that they strongly objected to spending nearly as much as Bush’s plan would cost. I realize you are asserting that Republicans wanted to spend more via absence of drug price negotiation and greater role for private insurers rather than spending more on the benefit, but there still seems to be an inconsistency between your two assertions above regarding their price-sensitivity vis a vis the total cost.

Re: Bush announced the plan in July, 2001 when he had been in office less 6 months. All the Democrats voted against it.

Although I haven’t researched it, hopefully I don’t have to explain to you that Democrats voting against a particular version of legislation for some initiative doesn’t mean they oppose that initiative generally or even that they want to scale it down in scope or cost. If you can provide a link or two to some substantiation of an assertion that they voted against it because it would cost too much, please do. Otherwise, there’s no reason to presume it.

Re: You should also realize that PAYGO rules were in place throughout the 1990s (Clinton administration) and expired in 2002 despite Democratic efforts to renew them. The expiration of the PAYGO rules were what allowed the Republicans to pass the unfunded Medicare bill and the unfunded tax cuts of 2003. Hey, but at least the PAYGO rules were reinstated just in time for the Obama administration.

Sure, PAYGO was recklessly abandoned by the Republican-controlled Congress, and it enabled even more irresponsible spending (and commitments to subsequent spending) than would have otherwise occurred. As for the new PAYGO, hopefully you realize that it exempts policies that contribute enormously to our projected fiscal imbalance (in addition to all discretionary spending, this new version of PAYGO exempts Bush tax cuts, AMT and Medicare “doc fix”). To borrow a phrase from Oldsmobile, “It’s not your father’s PAYGO”.

Re: Republicans only pet issue is tax cuts no matter what, and deficits be damned.

I have long complained that those who want tax cuts anytime, all the time, without sufficient (if any) regard for our fiscal imbalance, have hijacked the label “fiscal conservative”.

As for long term accumulation of public debt, yes, it is true that the US debt/GDP ratio has not yet reached levels that would normally be considered dangerous. However, this is not a normal situation. The US like most developed countries has a severe long-term fiscal problem staring it in the face, stemming from the aging population and the increasing burden of old-age benefits. That’s why it’s grossly irresponsible of the US and other developed country governments to be piling up debt now, just before that “greying population effect” starts to get serious.

What both of these charts miss, and what Menzie seems to always downplay or ignore, are the immediate effects of federal borrowing on the economy. Total Treasury sales to the public (net of Fed purchases and sales) were about $150b in 2006, $270b in 2007, $1.5 trillion in 2008, $1.14 trillion in 2009, and are expected to hit a new record upwards of $1.8 trillion in 2010. (Those are calendar years, not fiscal).

In 2008, it was unusually easily to sell Treasuries as globally investors were cashing out of almost everything else. In 2009, the Fed stimulated demand by creating and lending out more than $1 trillion of long-term money. That can’t be sustained, but this administration keeps coming up with new measures to widen the deficit. As the Fed keeps reiterating that it will stop its rapid money creation after March, the looming prospect of gigantic and growing Treasury borrowing unsupported by monetary stimulus weighs heavily on global financial markets.

The only thing I want to add to the above torrent of views is a defense of Keynes. He said that deficit spending was justified only in times of a recession. Government surpluses were required at all other times – so as to be able to run a deficit when needed.

No economists, regardless of theoretic leanings, can justify piling up governmental debt during “normal” times.

Governmental debt during normal times is created when leaders want to spend money on something that they think is more important than creating a fiscal surplus. I will inject a partisan note here by saying that Ronald Reagan was the first president to break the tradition of stepping back from continous expanding fiscal deficits. The first Bush tried to retrive that noble tradition but he was pillored for his actions. Bill Clinton was no better. He was positively giddy when discussing all the spending he wanted to do with the fiscal surplus that appeared when speculation increased stock market values in the period 1997 – 2000.

Actually, Clinton was by far the best president of recent decades on fiscal balance, but even he never ran a real surplus. His “surpluses” were before debt service.

Econrebel,

“I think you guys should start getting your reserve accounting right and understand bow banking systems and flow of funds work before wasting endless time in writing papers and blogs that “describe” the economy. For starters it will do you good if you start engaging the Modern Monetary theory crowd operation out of the Levy Institute. UMKC and University of New Castle Australia. I seriously wish you can all leave your arrogance out and start from scratch although I have a gut feeling the chances of that happening is close to zilch. Thanks Econrebel 77″

No thanks. I have a counter proposal. You should move out of your parents’ basement, get a job, and open a checking account. You will find out that after a few decades you will learn much about how the economy works. I am also quite certain you will never hear the term “monetary policy” uttered by your employer, or even your bank.

Can’t we all just make the minimum payment and get along?

Folks,

Problem solving requires both policy and politics. Anyone on this thread interested in focusing on both?

OUR BUDGET PROCESS DOESNT WORK;

LETS TRY SOMETHING ELSE

As a non economist, I find the current financial condition of the U.S. very discouraging. Right now, it seems to me we have a real need to bring more discipline to the budgeting process.

Nothing has alarmed me more recently than reading the details of the Obama budget in the New York Times which projects a deficit that will grow to 11 percent of our total economic output in 2011. Additionally, the budget projections suggest deficits will NOT return to sustainable levels over the next ten years, but by 2019 are expected to rise sharply to more than 5 percent of the gross domestic product. This outlook, following the Republican administrations spending spree in the latter years of their term without any efforts to pay for those increases, is a severe indictment of our political leaders.

[edited for length — MDC]

The countrys situation is serious and calls for a fundamental change in the way the government budgets. Without knowledge of the constitutional or legal issues involved, I would like to see a top down budget process where the public takes a one time, binding vote to set the countrys budget number and budget deficit ceiling for 2011. The 2011 budget number could not be less than the 2010 budget.

Economists say budget deficits should not consistently exceed 3 percent. However, the administrations budget projections call for 3.6 percent each year for the next 10 years.

The public vote would bind the administration and congress to reduce the deficit below 3 percent by the end of 2013 and three years after that, reduce it further to 2.5 percent. Thereafter, future administrations would be bound to deficits of no more than 2.5 percent. The only program exempt from the resulting cuts would be National Security which should include NASA.

For example, in 2011 the National Security budget is approximately $782 billion and Iran threatens the Persian Gulf prompting the United States to take action to forestall their aggression at a cost of $100 billion. When the administration prepares the 2012 National Security budget, it would use the $782 billion figure for the 2011 deficit calculation rather than $882 billion.

If the politicians dont have the will to take action and they fail to meet these financial accountability goals, there would be consequences. The voters would become engaged. If the deficit has not been reduced to less than 3 percent by the end of 2013, the Democrats would present a set of budget cutting options, as would the Republicans, and a public vote taken on which plan to adopt. If neither plan receives a majority vote, the parties would submit revised plans. The same process will be used again if the 2.5 percent deficit goal is not achieved by the end of 2016.

…

Terrific post MC. Perspective is needed.

I’m a little concerned by all this partisan bashing. (Shades of polarized Americans bitching at each other, late and post-Vietnam War.) Folks, face the reality. The former regime propelled the USA to the status of foremost terrorist nation-state in the early 21st century and in the process dealt US hegemony a severe blow. The Israelis signaled very clearly in late 2008 with their assault on Gaza that the current US regime is a paper tiger. The security-destroying and wealth-hemorrhaging policies of military occupation continue under President Obama.

Is this a Democrat versus Republican thing? No. Of course not. The Democrats have been just as or more supportive of Israeli violent colonialism–the salient fly in the ointment that drove the Sept. 11th attacks–over the years.

Killing civilians and taking their property worked out great for a number of western powers in the 18th and 19th centuries. In the post-war period, the violent colonialism cost-benefit equation no longer looks so inviting. (Ask the French.) I would urge everybody to look at US colonial entitlement attitudes as a critical but non-partisan problem. That entitlement includes cheap energy, low-density suburbs and detached homes, ideally larger than 3,000 square feet.

To both partisan Democrats and Republicans: Your excise taxes on fossil fuels are the lowest in the rich, OECD program. Get with the program. The US Mid-East energy security program is a multi-trillion dollar failure, and makes you look like monsters in the eyes of much of the globe.

GNP says a lot of correct stuff. T-Dub makes an excellent point – we never had a budget surplus, properly measured. Are unfunded liabilities as high in the other countries? If not, the comparisons are worse than useless, they are misleading. The point is also well taken that a more relevant measure is total debt to GDP, rather than only federal debt to GDP. Which brings to mind another point. U.S. states usually cannot run deficits. Is the same generally true for sub-national jurisdictions abroad? If not, even discounting the issue of unfunded liabilities, we don’t have a good comparison of government debts. Finally, the comparisons should take account of the externally owed part of the debts. It makes a big difference if we owe the debt to ourselves or to others.

I will believe Republicans are serious about the debt when they actually address the explosion in Defense Spending between 2000 and 2008.

But they never do.

In 2000 Defense spending was $294 Billion. IN FY2009 it was $661 Billion. No component of Federal Spending came close to matching the size of the increase in defense spending. In fact, the scale of these increases far exceeds the projected spending on Obama’s Health Care Plan AND the stimulus package COMBINED. On top of the budget for new Jet Fighter (projected to cost 600 Billion alone), and you have to ask why any serious conversation about the budget does not begin with Defense.

But then the GOP has never been serious about the budget, and never will be.