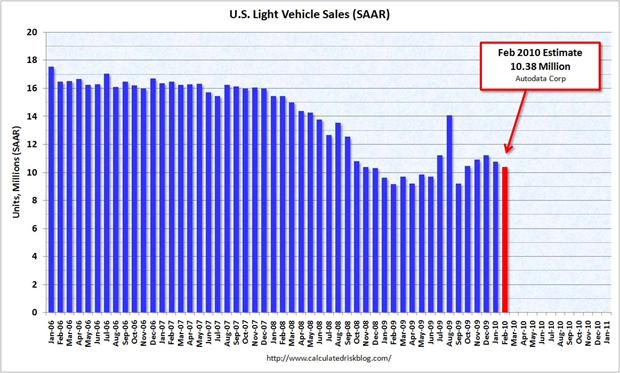

Another month of weakly improving auto sales.

|

February marked the third month in a row that U.S. light vehicle sales exceeded their levels from the year before. But a year ago things were awful, and the improvements have yet to gain much steam. On a seasonally adjusted basis, we’re not making any progress from December.

|

These overall trends hide big differences across individual firms, with the Wall Street Journal reporting that February sales for Ford were up 43% over the previous year, while those for Toyota were down 8.7%. Perhaps the woes of Toyota were a factor depressing the February total, and perhaps weather also played a role.

Whatever the explanation, auto sales so far this year remain 40% below the average seen for January and February over 2005 to 2008.

The problem, of course, is that we really do not know.

There has been a movement in dense inner cities to reduce or eliminate car ownership going back before economic downturn. The motivations are varied but a major one is that for many people it is possible to spend less time and money getting around with a combination of walking, cycling, transit, car sharing/rental, and cabs than owning. The possibility was present for this shift in major cities with adequate transit before the downturn. Is there evidence for a decline in ownership “by choice” in these types of locations versus due to economic necessity? People who make this shift may not return to previous patterns even in a recovery.

The problem, of course, is that the future does not care about statistics.

The average household has more than 2 cars already. We don’t need more cars. Had we let the auto industry fail, these assets could have been reallocated to an industry we actually need, or to people who can actually run a car company profitably. GM and Ford never will be able to compete with the Union Albatross around their necks.

Me thinks the US economy is slowly recovering and improving despite all the teeth gnashing and recriminations.

Emission regulations, dirt-cheap fuel in the late 1990s, early 2000 period and the Greenspan-Bernanke cost of borrowing money have all conspired to produce an enormous fleet of light vehicles on the road or now increasingly parked in the backyard if not exported to foreign countries.

I reckon the USA has vastly overproduced vehicles relative to some longer-term equilibrium. Does anybody have any idea–even a guess–as to how long it will take the USA to move through its mountain of light trucks, SUVs and similar that may be less than suitable for US$60 to US$80/barrel oil?

What’s the big deal. All we need is a little more stimulus. We have been subjected report after report explaining how good stimulus worked with the TARP, so why shouldn’t it work with autos. Look how successful the cash-for-clunkers program was. Let’s do it again! What? Do you doubt Paul Krugman. If we are really in Krugman’s camp perhaps we should create an auto bubble – yes, that’s it!

he objective of the cash for clunkers was to eliminate the large overhang of inventories so the auto firms could start to build cars again with the benefits to income and multipliers this implied.

If this was the objective it was highly successful.

Now the critics are trying to say it had different objectives and criticizing it for not achieving those objectives.

A few points in the finer data are the big stories:

1. Growth in sales at Ford and in GM’s ongoing brands was strongly boosted by resurgent fleet sales. Chrysler apparently did not share in this boom.

2. GM’s growth is almost as strong as Ford’s once discontinued brands are disregarded. GM’s decision to narrow its focus on core brands is clearly working to its advantage.

3. Cars sales are rebounding dramatically, while light truck sales are floundering, despite the fact that we aren’t currently in a period of particularly high oil prices.

I saw the same things Ohwilleke.

I think the world is pricing higher future oil prices into present planning. Hopefully a self-destroying prophesy.

Chrysler looks dead.