Econbrowser is pleased to host this guest contribution from UCSD Ph.D. candidate Ben Fissel, who shares a quick estimate of the economic damage from the Gulf oil spill.

How much damage does the market think the oil spill has done?

by Ben Fissel

At this point it’s really

hard to tell how much the sinking of Deepwater Horizon and the

ensuing oil spill will cost BP. There are a

number of factors still in play, such as “when will the spill

be capped?” or “how much of the oil will hit shore?”

If the leak continues to spew oil unabated for three months, the

damage and corresponding cost to BP could be huge. If the winds

shift, minimizing the amount of oil that hits shore, then the costs to

BP won’t be that bad. Until there is some resolution of these

and other questions, there is a large amount of uncertainty regarding

how this will affect BP’s profitability.

What we can assess

with much more confidence is the market’s expectation of the costs.

Stock prices give us a yardstick for the markets perception of a

company’s long run profitability. When an event, such as this

oil spill, impacts a company it will also impact its long run

profitability. The divergence of the stock price from what we would

have expected had the event never happened is a measure of the net

present value of the cost incurred by the oil spill. Event study

analysis gives us a framework to answer just this question.

BP prices since

Jan. 1st have been plotted below in Figures 1 and 2. The

black line gives the real prices and the red line shows the model

estimate of what would have happened if the spill had not occurred.

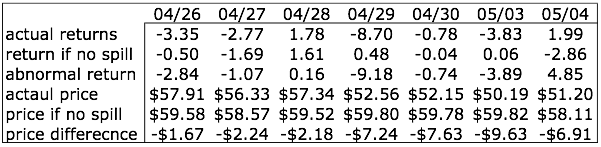

Table 1 lists the prices and returns over the event window for both

the real time series and the estimate. Event studies use other

factors in the market to estimate what BP’s stock price would

have been. A list of these factors can be found on Table 4. The

event window spans 7 trading days April 26th – May 4th

and is centered on April 29th. A 10-day event window

buffer was used to separate the estimated model from the

event window. The 250 trading days prior to the event window and

buffer were used to estimate the model.

The t-statistic of the

cumulative abnormal returns over the event window is -6.33 indicating

that the event clearly had an impact that drove BP’s share price

outside its normal range of variation. The adjusted closing price of

BP on May 4, 2010 was $51.20 whereas had the oil spill not happened

I’ve estimated the price would have been $58.11. This amounts to a

net loss of $6.91 per share. BP has 3.13 billion shares outstanding

amounting to a net loss in $21.62 billion. This loss reflects the

market’s expectation of the net present value of the loss in

profitability of BP as a result of the oil spill, otherwise

interpreted as the cost to BP of the oil spill. This cost may come

from a number of sources besides simply cleanup. For example, the

loss in customers, punitive damages, or possible loss of BP’s ability to profit from this or other potential offshore projects may be other ways the oil spill

will hurt BP.

This high cost estimate is most consistent with the

scenario where BP doesn’t cap the major leakage of oil for a

substantial amount of time. Clearly, not only for the sake of the

environment but also for the sake of BP’s bottom line, they are

going to want to cap this oil spill and clean it up quickly.

Figure 1

Figure 2

Figure 2 Table1

Table1 Table 2

Table 2 Table 3

Table 3 Table 4

Table 4

Note: All the data have been obtained from http://finance.yahoo.com

Add to that $2 bn off the market cap of Cameron and another $6 bn off the cap of TransOcean. With BP, altogether the cost is $30 bn. That’s too much, I think, but it’s hard to tell where impact will be felt exactly.

It looks like the market has over-reacted the event. And I would not be surprized if BP successfully captured most of the leak.

So, buy.

Or, is the cost to these companies correct and other companies will benefit?

Cameron competitors, to take an example, are also down.

FMC (a client) is down 9%, a loss of about $850 million compared to pre-spill.

Dril-Quip (friends), another competitor, is down from $70 to $57, a hit of $0.5 bn to their market cap.

Both of these are fine companies, if you like the sector but don’t want to play the companies involved.

Interesting news stories related to the spill:

Biggest impact could be in the arctic

http://www.rigzone.com/news/article.asp?a_id=92110

Firsthand account of the disaster

http://www.rigzone.com/news/article.asp?a_id=92765

BP plugs first leak

http://www.rigzone.com/news/article.asp?a_id=92795

Excellent stuff Steve. I wish I had cash.

Shouldn’t the rig owner (transocean sedco I think) be liable for damages? Or does the lease contain a clause that releases the rig owner from liability?

I read somewhere that BP self insures but it still seems like they are not at fault if the problem was mechanical and not human error.

Stocks are down also because of the situation in Greece; thus, shares of BP are could be down not only because of the Gulf of Mexico incident [probably the primary reason, but not the only one], but also because of other factors [like Greece and Eurozone generally].

How does one disentangle such effects?

Off topic: Is that green smiley face a trailing indicator? We’ll know next week..

Manfred: That’s why the calculation looks at BP stock relative to the others listed in Table 2.

KevinM: That green face is neutral, not smiling.

Thanks Ben!

I would guess that BP’s market capitalization will suffer a reputation penalty going forward. I haven’t looked but I bet all companies with any leverage to offshore drilling in the USA just took a hit not explained by the swooning oil price. I believe that oil companies exploring off Africa, Asia and South America may benefit in relative terms. The tragedy is generally bullish for oil prices.

My pleasure

I think your probably right, for better or for worse the fate of future offshore drilling in the US has taken a big hit by the spill.

It almost certainly won’t be happening in California now.

http://www.google.com/hostednews/ap/article/ALeqM5g880MQDtXVev91TEWEB3Ps7hI8egD9FGBJE01

Although it was probably never going to be big here.

I think the article posted by Steven Kopits has it right. The biggest impact will be in the arctic.

While applying the loss to total shares outstanding does show the paper loss it does not actually show “market’s expectation of the net present value of the loss in profitability of BP as a result of the oil spill.” Many of those shares never changed hands meaning that the holders exercised faith in BP and have the “expectation” that BP stock will be higher in the future.

I have no problem with your calculation of the loss of $6.91/share, but I do question the total valuation. Perhaps the net of daily gain/loss on trades would be a better number.

The calculation is based on the notion that the price of the asset is equal to the discounted flow of returns to the investor holding the asset. The costs and lost revenue resulting from the oil spill directly impact future profit and hence the investors return. This is true for each share.

If many people felt the price of BP would be higher in the future then people would be buying thereby driving the price up. Some people probably think the price should be higher others think it should be lower. The observed market price represents a meeting of these two parties and in this sense an agreement on the firms future value/profitability.

the spill affects not just the economy but the environment……

A year or so ago, we discussed whether there is/is not sufficient oil in US territory, including offshore, to sustain our present consumption. The answer, of course, is that there is– just not at a price that anyone would care to pay, especially if fully costed.

The oil industry is already heavily subsidized through tax credits. If it had to pay for the damage its products cause, it would be even less competitive.

I remember one of the posters breezily saying that he lived in Florida right by a BP pipeline and had no concerns whatsoever. Here’s hoping that he and all those who are responsible for the dangerous complacency about the environmental damage caused by oil have it wash up on *their* shores, just for the obviously needed lesson.

Drill, baby, drill!

velvetranch: You’re right!

Prof Hamilton: The net present value of the cost in that paper corresponds to the private cost to BP, not the social cost, such as the negative externalities of the environmental impact.

Perhaps, the title of the paper “How much damage does the market think the oil spill has done?” should be changed to “How much damage does the market think the oil spill has done to BP?” (frankly, I care much less about the latter).